An official website of the United States government

United States Department of Labor

United States Department of Labor

An official website of the United States government

United States Department of Labor

United States Department of Labor

The .gov means it's official.

Federal government websites often end in .gov or .mil. Before sharing sensitive information,

make sure you're on a federal government site.

The site is secure.

The

https:// ensures that you are connecting to the official website and that any

information you provide is encrypted and transmitted securely.

A general slowdown in economic activity, a downturn in the business cycle, a reduction in the amount of goods and services produced and sold—these are all characteristics of a recession. According to the National Bureau of Economic Research (the official arbiter of U.S. recessions), there were 10 recessions between 1948 and 2011. The most recent recession began in December 2007 and ended in June 2009, though many of the statistics that describe the U.S. economy have yet to return to their pre-recession values. In this Spotlight, we present BLS data that compare the recent recession to previous recessions.

Here are some facts about The Recession of 2007–2009:

To learn more, visit www.bls.gov/spotlight/2012/recession/.

A general slowdown in economic activity, a downturn in the business cycle, a reduction in the amount of goods and services produced and sold—these are all characteristics of a recession. According to the National Bureau of Economic Research (the official arbiter of U.S. recessions), there were 10 recessions between 1948 and 2011. The most recent recession began in December 2007 and ended in June 2009, though many of the statistics that describe the U.S. economy have yet to return to their pre-recession values. In this Spotlight, we present BLS data that compare the recent recession to previous recessions.

| Month | Unemployment rate | Long term unemployment rate |

|---|---|---|

Jan 1948 | 3.4 | 0.2 |

Feb 1948 | 3.8 | 0.2 |

Mar 1948 | 4.0 | 0.2 |

Apr 1948 | 3.9 | 0.2 |

May 1948 | 3.5 | 0.2 |

Jun 1948 | 3.6 | 0.2 |

Jul 1948 | 3.6 | 0.2 |

Aug 1948 | 3.9 | 0.2 |

Sep 1948 | 3.8 | 0.2 |

Oct 1948 | 3.7 | 0.2 |

Nov 1948 | 3.8 | 0.2 |

Dec 1948 | 4.0 | 0.2 |

Jan 1949 | 4.3 | 0.2 |

Feb 1949 | 4.7 | 0.2 |

Mar 1949 | 5.0 | 0.2 |

Apr 1949 | 5.3 | 0.3 |

May 1949 | 6.1 | 0.3 |

Jun 1949 | 6.2 | 0.4 |

Jul 1949 | 6.7 | 0.5 |

Aug 1949 | 6.8 | 0.6 |

Sep 1949 | 6.6 | 0.6 |

Oct 1949 | 7.9 | 0.6 |

Nov 1949 | 6.4 | 0.7 |

Dec 1949 | 6.6 | 0.7 |

Jan 1950 | 6.5 | 0.6 |

Feb 1950 | 6.4 | 0.7 |

Mar 1950 | 6.3 | 0.7 |

Apr 1950 | 5.8 | 0.8 |

May 1950 | 5.5 | 0.7 |

Jun 1950 | 5.4 | 0.7 |

Jul 1950 | 5.0 | 0.5 |

Aug 1950 | 4.5 | 0.5 |

Sep 1950 | 4.4 | 0.5 |

Oct 1950 | 4.2 | 0.4 |

Nov 1950 | 4.2 | 0.4 |

Dec 1950 | 4.3 | 0.3 |

Jan 1951 | 3.7 | 0.3 |

Feb 1951 | 3.4 | 0.3 |

Mar 1951 | 3.4 | 0.2 |

Apr 1951 | 3.1 | 0.2 |

May 1951 | 3.0 | 0.2 |

Jun 1951 | 3.2 | 0.2 |

Jul 1951 | 3.1 | 0.2 |

Aug 1951 | 3.1 | 0.2 |

Sep 1951 | 3.3 | 0.2 |

Oct 1951 | 3.5 | 0.2 |

Nov 1951 | 3.5 | 0.2 |

Dec 1951 | 3.1 | 0.2 |

Jan 1952 | 3.2 | 0.2 |

Feb 1952 | 3.1 | 0.1 |

Mar 1952 | 2.9 | 0.1 |

Apr 1952 | 2.9 | 0.2 |

May 1952 | 3.0 | 0.1 |

Jun 1952 | 3.0 | 0.1 |

Jul 1952 | 3.2 | 0.1 |

Aug 1952 | 3.4 | 0.1 |

Sep 1952 | 3.1 | 0.1 |

Oct 1952 | 3.0 | 0.1 |

Nov 1952 | 2.8 | 0.1 |

Dec 1952 | 2.7 | 0.2 |

Jan 1953 | 2.9 | 0.1 |

Feb 1953 | 2.6 | 0.1 |

Mar 1953 | 2.6 | 0.1 |

Apr 1953 | 2.7 | 0.1 |

May 1953 | 2.5 | 0.1 |

Jun 1953 | 2.5 | 0.1 |

Jul 1953 | 2.6 | 0.1 |

Aug 1953 | 2.7 | 0.1 |

Sep 1953 | 2.9 | 0.1 |

Oct 1953 | 3.1 | 0.1 |

Nov 1953 | 3.5 | 0.2 |

Dec 1953 | 4.5 | 0.2 |

Jan 1954 | 4.9 | 0.2 |

Feb 1954 | 5.2 | 0.2 |

Mar 1954 | 5.7 | 0.4 |

Apr 1954 | 5.9 | 0.4 |

May 1954 | 5.9 | 0.5 |

Jun 1954 | 5.6 | 0.5 |

Jul 1954 | 5.8 | 0.5 |

Aug 1954 | 6.0 | 0.7 |

Sep 1954 | 6.1 | 0.7 |

Oct 1954 | 5.7 | 0.7 |

Nov 1954 | 5.3 | 0.7 |

Dec 1954 | 5.0 | 0.6 |

Jan 1955 | 4.9 | 0.7 |

Feb 1955 | 4.7 | 0.7 |

Mar 1955 | 4.6 | 0.6 |

Apr 1955 | 4.7 | 0.6 |

May 1955 | 4.3 | 0.5 |

Jun 1955 | 4.2 | 0.5 |

Jul 1955 | 4.0 | 0.5 |

Aug 1955 | 4.2 | 0.4 |

Sep 1955 | 4.1 | 0.4 |

Oct 1955 | 4.3 | 0.4 |

Nov 1955 | 4.2 | 0.4 |

Dec 1955 | 4.2 | 0.4 |

Jan 1956 | 4.0 | 0.4 |

Feb 1956 | 3.9 | 0.4 |

Mar 1956 | 4.2 | 0.4 |

Apr 1956 | 4.0 | 0.3 |

May 1956 | 4.3 | 0.3 |

Jun 1956 | 4.3 | 0.3 |

Jul 1956 | 4.4 | 0.3 |

Aug 1956 | 4.1 | 0.4 |

Sep 1956 | 3.9 | 0.4 |

Oct 1956 | 3.9 | 0.4 |

Nov 1956 | 4.3 | 0.4 |

Dec 1956 | 4.2 | 0.4 |

Jan 1957 | 4.2 | 0.3 |

Feb 1957 | 3.9 | 0.3 |

Mar 1957 | 3.7 | 0.3 |

Apr 1957 | 3.9 | 0.3 |

May 1957 | 4.1 | 0.4 |

Jun 1957 | 4.3 | 0.4 |

Jul 1957 | 4.2 | 0.4 |

Aug 1957 | 4.1 | 0.3 |

Sep 1957 | 4.4 | 0.3 |

Oct 1957 | 4.5 | 0.4 |

Nov 1957 | 5.1 | 0.4 |

Dec 1957 | 5.2 | 0.4 |

Jan 1958 | 5.8 | 0.4 |

Feb 1958 | 6.4 | 0.5 |

Mar 1958 | 6.7 | 0.5 |

Apr 1958 | 7.4 | 0.8 |

May 1958 | 7.4 | 0.8 |

Jun 1958 | 7.3 | 1.0 |

Jul 1958 | 7.5 | 1.2 |

Aug 1958 | 7.4 | 1.4 |

Sep 1958 | 7.1 | 1.5 |

Oct 1958 | 6.7 | 1.4 |

Nov 1958 | 6.2 | 1.2 |

Dec 1958 | 6.2 | 1.2 |

Jan 1959 | 6.0 | 1.2 |

Feb 1959 | 5.9 | 1.1 |

Mar 1959 | 5.6 | 1.0 |

Apr 1959 | 5.2 | 0.9 |

May 1959 | 5.1 | 0.8 |

Jun 1959 | 5.0 | 0.8 |

Jul 1959 | 5.1 | 0.7 |

Aug 1959 | 5.2 | 0.7 |

Sep 1959 | 5.5 | 0.7 |

Oct 1959 | 5.7 | 0.6 |

Nov 1959 | 5.8 | 0.7 |

Dec 1959 | 5.3 | 0.7 |

Jan 1960 | 5.2 | 0.7 |

Feb 1960 | 4.8 | 0.6 |

Mar 1960 | 5.4 | 0.6 |

Apr 1960 | 5.2 | 0.6 |

May 1960 | 5.1 | 0.6 |

Jun 1960 | 5.4 | 0.6 |

Jul 1960 | 5.5 | 0.6 |

Aug 1960 | 5.6 | 0.6 |

Sep 1960 | 5.5 | 0.7 |

Oct 1960 | 6.1 | 0.8 |

Nov 1960 | 6.1 | 0.8 |

Dec 1960 | 6.6 | 0.8 |

Jan 1961 | 6.6 | 0.9 |

Feb 1961 | 6.9 | 0.9 |

Mar 1961 | 6.9 | 1.0 |

Apr 1961 | 7.0 | 1.1 |

May 1961 | 7.1 | 1.2 |

Jun 1961 | 6.9 | 1.3 |

Jul 1961 | 7.0 | 1.4 |

Aug 1961 | 6.6 | 1.3 |

Sep 1961 | 6.7 | 1.2 |

Oct 1961 | 6.5 | 1.2 |

Nov 1961 | 6.1 | 1.1 |

Dec 1961 | 6.0 | 1.1 |

Jan 1962 | 5.8 | 1.0 |

Feb 1962 | 5.5 | 1.0 |

Mar 1962 | 5.6 | 0.9 |

Apr 1962 | 5.6 | 0.9 |

May 1962 | 5.5 | 0.9 |

Jun 1962 | 5.5 | 0.8 |

Jul 1962 | 5.4 | 0.8 |

Aug 1962 | 5.7 | 0.8 |

Sep 1962 | 5.6 | 0.7 |

Oct 1962 | 5.4 | 0.7 |

Nov 1962 | 5.7 | 0.6 |

Dec 1962 | 5.5 | 0.7 |

Jan 1963 | 5.7 | 0.8 |

Feb 1963 | 5.9 | 0.8 |

Mar 1963 | 5.7 | 0.8 |

Apr 1963 | 5.7 | 0.8 |

May 1963 | 5.9 | 0.8 |

Jun 1963 | 5.6 | 0.7 |

Jul 1963 | 5.6 | 0.8 |

Aug 1963 | 5.4 | 0.7 |

Sep 1963 | 5.5 | 0.8 |

Oct 1963 | 5.5 | 0.7 |

Nov 1963 | 5.7 | 0.7 |

Dec 1963 | 5.5 | 0.7 |

Jan 1964 | 5.6 | 0.7 |

Feb 1964 | 5.4 | 0.7 |

Mar 1964 | 5.4 | 0.7 |

Apr 1964 | 5.3 | 0.6 |

May 1964 | 5.1 | 0.7 |

Jun 1964 | 5.2 | 0.7 |

Jul 1964 | 4.9 | 0.7 |

Aug 1964 | 5.0 | 0.7 |

Sep 1964 | 5.1 | 0.6 |

Oct 1964 | 5.1 | 0.6 |

Nov 1964 | 4.8 | 0.6 |

Dec 1964 | 5.0 | 0.6 |

Jan 1965 | 4.9 | 0.5 |

Feb 1965 | 5.1 | 0.6 |

Mar 1965 | 4.7 | 0.5 |

Apr 1965 | 4.8 | 0.5 |

May 1965 | 4.6 | 0.5 |

Jun 1965 | 4.6 | 0.5 |

Jul 1965 | 4.4 | 0.4 |

Aug 1965 | 4.4 | 0.4 |

Sep 1965 | 4.3 | 0.5 |

Oct 1965 | 4.2 | 0.4 |

Nov 1965 | 4.1 | 0.4 |

Dec 1965 | 4.0 | 0.4 |

Jan 1966 | 4.0 | 0.4 |

Feb 1966 | 3.8 | 0.4 |

Mar 1966 | 3.8 | 0.4 |

Apr 1966 | 3.8 | 0.3 |

May 1966 | 3.9 | 0.4 |

Jun 1966 | 3.8 | 0.3 |

Jul 1966 | 3.8 | 0.3 |

Aug 1966 | 3.8 | 0.3 |

Sep 1966 | 3.7 | 0.3 |

Oct 1966 | 3.7 | 0.3 |

Nov 1966 | 3.6 | 0.3 |

Dec 1966 | 3.8 | 0.3 |

Jan 1967 | 3.9 | 0.3 |

Feb 1967 | 3.8 | 0.3 |

Mar 1967 | 3.8 | 0.2 |

Apr 1967 | 3.8 | 0.2 |

May 1967 | 3.8 | 0.2 |

Jun 1967 | 3.9 | 0.2 |

Jul 1967 | 3.8 | 0.2 |

Aug 1967 | 3.8 | 0.3 |

Sep 1967 | 3.8 | 0.2 |

Oct 1967 | 4.0 | 0.2 |

Nov 1967 | 3.9 | 0.2 |

Dec 1967 | 3.8 | 0.2 |

Jan 1968 | 3.7 | 0.2 |

Feb 1968 | 3.8 | 0.2 |

Mar 1968 | 3.7 | 0.2 |

Apr 1968 | 3.5 | 0.2 |

May 1968 | 3.5 | 0.2 |

Jun 1968 | 3.7 | 0.2 |

Jul 1968 | 3.7 | 0.2 |

Aug 1968 | 3.5 | 0.2 |

Sep 1968 | 3.4 | 0.2 |

Oct 1968 | 3.4 | 0.2 |

Nov 1968 | 3.4 | 0.2 |

Dec 1968 | 3.4 | 0.2 |

Jan 1969 | 3.4 | 0.2 |

Feb 1969 | 3.4 | 0.1 |

Mar 1969 | 3.4 | 0.1 |

Apr 1969 | 3.4 | 0.2 |

May 1969 | 3.4 | 0.2 |

Jun 1969 | 3.5 | 0.2 |

Jul 1969 | 3.5 | 0.2 |

Aug 1969 | 3.5 | 0.2 |

Sep 1969 | 3.7 | 0.2 |

Oct 1969 | 3.7 | 0.2 |

Nov 1969 | 3.5 | 0.2 |

Dec 1969 | 3.5 | 0.2 |

Jan 1970 | 3.9 | 0.2 |

Feb 1970 | 4.2 | 0.2 |

Mar 1970 | 4.4 | 0.2 |

Apr 1970 | 4.6 | 0.2 |

May 1970 | 4.8 | 0.3 |

Jun 1970 | 4.9 | 0.3 |

Jul 1970 | 5.0 | 0.3 |

Aug 1970 | 5.1 | 0.3 |

Sep 1970 | 5.4 | 0.3 |

Oct 1970 | 5.5 | 0.3 |

Nov 1970 | 5.9 | 0.4 |

Dec 1970 | 6.1 | 0.5 |

Jan 1971 | 5.9 | 0.5 |

Feb 1971 | 5.9 | 0.5 |

Mar 1971 | 6.0 | 0.5 |

Apr 1971 | 5.9 | 0.5 |

May 1971 | 5.9 | 0.6 |

Jun 1971 | 5.9 | 0.6 |

Jul 1971 | 6.0 | 0.7 |

Aug 1971 | 6.1 | 0.6 |

Sep 1971 | 6.0 | 0.7 |

Oct 1971 | 5.8 | 0.7 |

Nov 1971 | 6.0 | 0.7 |

Dec 1971 | 6.0 | 0.7 |

Jan 1972 | 5.8 | 0.7 |

Feb 1972 | 5.7 | 0.8 |

Mar 1972 | 5.8 | 0.7 |

Apr 1972 | 5.7 | 0.8 |

May 1972 | 5.7 | 0.7 |

Jun 1972 | 5.7 | 0.6 |

Jul 1972 | 5.6 | 0.6 |

Aug 1972 | 5.6 | 0.6 |

Sep 1972 | 5.5 | 0.6 |

Oct 1972 | 5.6 | 0.6 |

Nov 1972 | 5.3 | 0.5 |

Dec 1972 | 5.2 | 0.5 |

Jan 1973 | 4.9 | 0.5 |

Feb 1973 | 5.0 | 0.4 |

Mar 1973 | 4.9 | 0.4 |

Apr 1973 | 5.0 | 0.4 |

May 1973 | 4.9 | 0.4 |

Jun 1973 | 4.9 | 0.4 |

Jul 1973 | 4.8 | 0.3 |

Aug 1973 | 4.8 | 0.4 |

Sep 1973 | 4.8 | 0.3 |

Oct 1973 | 4.6 | 0.4 |

Nov 1973 | 4.8 | 0.4 |

Dec 1973 | 4.9 | 0.4 |

Jan 1974 | 5.1 | 0.4 |

Feb 1974 | 5.2 | 0.4 |

Mar 1974 | 5.1 | 0.4 |

Apr 1974 | 5.1 | 0.4 |

May 1974 | 5.1 | 0.4 |

Jun 1974 | 5.4 | 0.4 |

Jul 1974 | 5.5 | 0.4 |

Aug 1974 | 5.5 | 0.4 |

Sep 1974 | 5.9 | 0.4 |

Oct 1974 | 6.0 | 0.4 |

Nov 1974 | 6.6 | 0.5 |

Dec 1974 | 7.2 | 0.6 |

Jan 1975 | 8.1 | 0.7 |

Feb 1975 | 8.1 | 0.8 |

Mar 1975 | 8.6 | 0.8 |

Apr 1975 | 8.8 | 1.0 |

May 1975 | 9.0 | 1.2 |

Jun 1975 | 8.8 | 1.4 |

Jul 1975 | 8.6 | 1.5 |

Aug 1975 | 8.4 | 1.6 |

Sep 1975 | 8.4 | 1.7 |

Oct 1975 | 8.4 | 1.5 |

Nov 1975 | 8.3 | 1.7 |

Dec 1975 | 8.2 | 1.7 |

Jan 1976 | 7.9 | 1.7 |

Feb 1976 | 7.7 | 1.6 |

Mar 1976 | 7.6 | 1.5 |

Apr 1976 | 7.7 | 1.5 |

May 1976 | 7.4 | 1.3 |

Jun 1976 | 7.6 | 1.4 |

Jul 1976 | 7.8 | 1.3 |

Aug 1976 | 7.8 | 1.3 |

Sep 1976 | 7.6 | 1.2 |

Oct 1976 | 7.7 | 1.3 |

Nov 1976 | 7.8 | 1.3 |

Dec 1976 | 7.8 | 1.4 |

Jan 1977 | 7.5 | 1.2 |

Feb 1977 | 7.6 | 1.2 |

Mar 1977 | 7.4 | 1.2 |

Apr 1977 | 7.2 | 1.1 |

May 1977 | 7.0 | 1.1 |

Jun 1977 | 7.2 | 1.0 |

Jul 1977 | 6.9 | 1.0 |

Aug 1977 | 7.0 | 0.9 |

Sep 1977 | 6.8 | 0.9 |

Oct 1977 | 6.8 | 0.9 |

Nov 1977 | 6.8 | 0.9 |

Dec 1977 | 6.4 | 0.9 |

Jan 1978 | 6.4 | 0.8 |

Feb 1978 | 6.3 | 0.7 |

Mar 1978 | 6.3 | 0.7 |

Apr 1978 | 6.1 | 0.7 |

May 1978 | 6.0 | 0.7 |

Jun 1978 | 5.9 | 0.6 |

Jul 1978 | 6.2 | 0.6 |

Aug 1978 | 5.9 | 0.6 |

Sep 1978 | 6.0 | 0.6 |

Oct 1978 | 5.8 | 0.6 |

Nov 1978 | 5.9 | 0.5 |

Dec 1978 | 6.0 | 0.5 |

Jan 1979 | 5.9 | 0.5 |

Feb 1979 | 5.9 | 0.5 |

Mar 1979 | 5.8 | 0.6 |

Apr 1979 | 5.8 | 0.5 |

May 1979 | 5.6 | 0.5 |

Jun 1979 | 5.7 | 0.5 |

Jul 1979 | 5.7 | 0.4 |

Aug 1979 | 6.0 | 0.5 |

Sep 1979 | 5.9 | 0.5 |

Oct 1979 | 6.0 | 0.5 |

Nov 1979 | 5.9 | 0.5 |

Dec 1979 | 6.0 | 0.5 |

Jan 1980 | 6.3 | 0.5 |

Feb 1980 | 6.3 | 0.5 |

Mar 1980 | 6.3 | 0.6 |

Apr 1980 | 6.9 | 0.6 |

May 1980 | 7.5 | 0.7 |

Jun 1980 | 7.6 | 0.7 |

Jul 1980 | 7.8 | 0.8 |

Aug 1980 | 7.7 | 0.9 |

Sep 1980 | 7.5 | 0.9 |

Oct 1980 | 7.5 | 1.0 |

Nov 1980 | 7.5 | 1.1 |

Dec 1980 | 7.2 | 1.1 |

Jan 1981 | 7.5 | 1.2 |

Feb 1981 | 7.4 | 1.2 |

Mar 1981 | 7.4 | 1.1 |

Apr 1981 | 7.2 | 1.0 |

May 1981 | 7.5 | 1.1 |

Jun 1981 | 7.5 | 1.0 |

Jul 1981 | 7.2 | 1.0 |

Aug 1981 | 7.4 | 1.1 |

Sep 1981 | 7.6 | 1.0 |

Oct 1981 | 7.9 | 1.0 |

Nov 1981 | 8.3 | 1.0 |

Dec 1981 | 8.5 | 1.1 |

Jan 1982 | 8.6 | 1.1 |

Feb 1982 | 8.9 | 1.2 |

Mar 1982 | 9.0 | 1.2 |

Apr 1982 | 9.3 | 1.4 |

May 1982 | 9.4 | 1.5 |

Jun 1982 | 9.6 | 1.6 |

Jul 1982 | 9.8 | 1.6 |

Aug 1982 | 9.8 | 1.7 |

Sep 1982 | 10.1 | 1.8 |

Oct 1982 | 10.4 | 2.0 |

Nov 1982 | 10.8 | 2.1 |

Dec 1982 | 10.8 | 2.3 |

Jan 1983 | 10.4 | 2.4 |

Feb 1983 | 10.4 | 2.5 |

Mar 1983 | 10.3 | 2.5 |

Apr 1983 | 10.2 | 2.4 |

May 1983 | 10.1 | 2.5 |

Jun 1983 | 10.1 | 2.6 |

Jul 1983 | 9.4 | 2.3 |

Aug 1983 | 9.5 | 2.3 |

Sep 1983 | 9.2 | 2.2 |

Oct 1983 | 8.8 | 2.0 |

Nov 1983 | 8.5 | 1.9 |

Dec 1983 | 8.3 | 1.8 |

Jan 1984 | 8.0 | 1.8 |

Feb 1984 | 7.8 | 1.6 |

Mar 1984 | 7.8 | 1.6 |

Apr 1984 | 7.7 | 1.6 |

May 1984 | 7.4 | 1.5 |

Jun 1984 | 7.2 | 1.4 |

Jul 1984 | 7.5 | 1.4 |

Aug 1984 | 7.5 | 1.3 |

Sep 1984 | 7.3 | 1.3 |

Oct 1984 | 7.4 | 1.3 |

Nov 1984 | 7.2 | 1.2 |

Dec 1984 | 7.3 | 1.2 |

Jan 1985 | 7.3 | 1.1 |

Feb 1985 | 7.2 | 1.2 |

Mar 1985 | 7.2 | 1.2 |

Apr 1985 | 7.3 | 1.2 |

May 1985 | 7.2 | 1.1 |

Jun 1985 | 7.4 | 1.1 |

Jul 1985 | 7.4 | 1.1 |

Aug 1985 | 7.1 | 1.1 |

Sep 1985 | 7.1 | 1.1 |

Oct 1985 | 7.1 | 1.0 |

Nov 1985 | 7.0 | 1.1 |

Dec 1985 | 7.0 | 1.0 |

Jan 1986 | 6.7 | 0.9 |

Feb 1986 | 7.2 | 1.0 |

Mar 1986 | 7.2 | 1.0 |

Apr 1986 | 7.1 | 1.0 |

May 1986 | 7.2 | 1.0 |

Jun 1986 | 7.2 | 1.1 |

Jul 1986 | 7.0 | 1.0 |

Aug 1986 | 6.9 | 1.0 |

Sep 1986 | 7.0 | 1.0 |

Oct 1986 | 7.0 | 1.0 |

Nov 1986 | 6.9 | 1.0 |

Dec 1986 | 6.6 | 1.0 |

Jan 1987 | 6.6 | 1.0 |

Feb 1987 | 6.6 | 0.9 |

Mar 1987 | 6.6 | 0.9 |

Apr 1987 | 6.3 | 0.9 |

May 1987 | 6.3 | 0.9 |

Jun 1987 | 6.2 | 0.9 |

Jul 1987 | 6.1 | 0.8 |

Aug 1987 | 6.0 | 0.9 |

Sep 1987 | 5.9 | 0.8 |

Oct 1987 | 6.0 | 0.8 |

Nov 1987 | 5.8 | 0.8 |

Dec 1987 | 5.7 | 0.7 |

Jan 1988 | 5.7 | 0.7 |

Feb 1988 | 5.7 | 0.7 |

Mar 1988 | 5.7 | 0.7 |

Apr 1988 | 5.4 | 0.7 |

May 1988 | 5.6 | 0.7 |

Jun 1988 | 5.4 | 0.7 |

Jul 1988 | 5.4 | 0.7 |

Aug 1988 | 5.6 | 0.7 |

Sep 1988 | 5.4 | 0.7 |

Oct 1988 | 5.4 | 0.6 |

Nov 1988 | 5.3 | 0.6 |

Dec 1988 | 5.3 | 0.6 |

Jan 1989 | 5.4 | 0.6 |

Feb 1989 | 5.2 | 0.5 |

Mar 1989 | 5.0 | 0.5 |

Apr 1989 | 5.2 | 0.6 |

May 1989 | 5.2 | 0.5 |

Jun 1989 | 5.3 | 0.5 |

Jul 1989 | 5.2 | 0.5 |

Aug 1989 | 5.2 | 0.5 |

Sep 1989 | 5.3 | 0.5 |

Oct 1989 | 5.3 | 0.5 |

Nov 1989 | 5.4 | 0.5 |

Dec 1989 | 5.4 | 0.5 |

Jan 1990 | 5.4 | 0.5 |

Feb 1990 | 5.3 | 0.5 |

Mar 1990 | 5.2 | 0.5 |

Apr 1990 | 5.4 | 0.5 |

May 1990 | 5.4 | 0.5 |

Jun 1990 | 5.2 | 0.5 |

Jul 1990 | 5.5 | 0.5 |

Aug 1990 | 5.7 | 0.6 |

Sep 1990 | 5.9 | 0.6 |

Oct 1990 | 5.9 | 0.6 |

Nov 1990 | 6.2 | 0.7 |

Dec 1990 | 6.3 | 0.7 |

Jan 1991 | 6.4 | 0.7 |

Feb 1991 | 6.6 | 0.7 |

Mar 1991 | 6.8 | 0.8 |

Apr 1991 | 6.7 | 0.8 |

May 1991 | 6.9 | 0.8 |

Jun 1991 | 6.9 | 0.9 |

Jul 1991 | 6.8 | 0.9 |

Aug 1991 | 6.9 | 0.9 |

Sep 1991 | 6.9 | 0.9 |

Oct 1991 | 7.0 | 1.0 |

Nov 1991 | 7.0 | 1.1 |

Dec 1991 | 7.3 | 1.2 |

Jan 1992 | 7.3 | 1.3 |

Feb 1992 | 7.4 | 1.3 |

Mar 1992 | 7.4 | 1.4 |

Apr 1992 | 7.4 | 1.4 |

May 1992 | 7.6 | 1.5 |

Jun 1992 | 7.8 | 1.7 |

Jul 1992 | 7.7 | 1.7 |

Aug 1992 | 7.6 | 1.6 |

Sep 1992 | 7.6 | 1.6 |

Oct 1992 | 7.3 | 1.7 |

Nov 1992 | 7.4 | 1.6 |

Dec 1992 | 7.4 | 1.6 |

Jan 1993 | 7.3 | 1.5 |

Feb 1993 | 7.1 | 1.5 |

Mar 1993 | 7.0 | 1.4 |

Apr 1993 | 7.1 | 1.3 |

May 1993 | 7.1 | 1.4 |

Jun 1993 | 7.0 | 1.4 |

Jul 1993 | 6.9 | 1.4 |

Aug 1993 | 6.8 | 1.4 |

Sep 1993 | 6.7 | 1.4 |

Oct 1993 | 6.8 | 1.4 |

Nov 1993 | 6.6 | 1.4 |

Dec 1993 | 6.5 | 1.4 |

Jan 1994 | 6.6 | 1.3 |

Feb 1994 | 6.6 | 1.3 |

Mar 1994 | 6.5 | 1.4 |

Apr 1994 | 6.4 | 1.3 |

May 1994 | 6.1 | 1.3 |

Jun 1994 | 6.1 | 1.2 |

Jul 1994 | 6.1 | 1.2 |

Aug 1994 | 6.0 | 1.2 |

Sep 1994 | 5.9 | 1.2 |

Oct 1994 | 5.8 | 1.2 |

Nov 1994 | 5.6 | 1.1 |

Dec 1994 | 5.5 | 1.0 |

Jan 1995 | 5.6 | 1.0 |

Feb 1995 | 5.4 | 0.9 |

Mar 1995 | 5.4 | 1.0 |

Apr 1995 | 5.8 | 1.1 |

May 1995 | 5.6 | 1.0 |

Jun 1995 | 5.6 | 0.9 |

Jul 1995 | 5.7 | 0.9 |

Aug 1995 | 5.7 | 0.9 |

Sep 1995 | 5.6 | 1.0 |

Oct 1995 | 5.5 | 0.9 |

Nov 1995 | 5.6 | 0.9 |

Dec 1995 | 5.6 | 0.9 |

Jan 1996 | 5.6 | 0.9 |

Feb 1996 | 5.5 | 0.9 |

Mar 1996 | 5.5 | 1.0 |

Apr 1996 | 5.6 | 1.0 |

May 1996 | 5.6 | 1.0 |

Jun 1996 | 5.3 | 1.0 |

Jul 1996 | 5.5 | 1.0 |

Aug 1996 | 5.1 | 0.9 |

Sep 1996 | 5.2 | 0.9 |

Oct 1996 | 5.2 | 0.9 |

Nov 1996 | 5.4 | 0.8 |

Dec 1996 | 5.4 | 0.9 |

Jan 1997 | 5.3 | 0.8 |

Feb 1997 | 5.2 | 0.8 |

Mar 1997 | 5.2 | 0.8 |

Apr 1997 | 5.1 | 0.8 |

May 1997 | 4.9 | 0.8 |

Jun 1997 | 5.0 | 0.8 |

Jul 1997 | 4.9 | 0.8 |

Aug 1997 | 4.8 | 0.8 |

Sep 1997 | 4.9 | 0.8 |

Oct 1997 | 4.7 | 0.8 |

Nov 1997 | 4.6 | 0.7 |

Dec 1997 | 4.7 | 0.7 |

Jan 1998 | 4.6 | 0.7 |

Feb 1998 | 4.6 | 0.7 |

Mar 1998 | 4.7 | 0.7 |

Apr 1998 | 4.3 | 0.6 |

May 1998 | 4.4 | 0.6 |

Jun 1998 | 4.5 | 0.6 |

Jul 1998 | 4.5 | 0.6 |

Aug 1998 | 4.5 | 0.6 |

Sep 1998 | 4.6 | 0.7 |

Oct 1998 | 4.5 | 0.6 |

Nov 1998 | 4.4 | 0.6 |

Dec 1998 | 4.4 | 0.6 |

Jan 1999 | 4.3 | 0.5 |

Feb 1999 | 4.4 | 0.6 |

Mar 1999 | 4.2 | 0.5 |

Apr 1999 | 4.3 | 0.5 |

May 1999 | 4.2 | 0.5 |

Jun 1999 | 4.3 | 0.6 |

Jul 1999 | 4.3 | 0.5 |

Aug 1999 | 4.2 | 0.5 |

Sep 1999 | 4.2 | 0.5 |

Oct 1999 | 4.1 | 0.5 |

Nov 1999 | 4.1 | 0.5 |

Dec 1999 | 4.0 | 0.5 |

Jan 2000 | 4.0 | 0.5 |

Feb 2000 | 4.1 | 0.4 |

Mar 2000 | 4.0 | 0.5 |

Apr 2000 | 3.8 | 0.4 |

May 2000 | 4.0 | 0.5 |

Jun 2000 | 4.0 | 0.4 |

Jul 2000 | 4.0 | 0.5 |

Aug 2000 | 4.1 | 0.5 |

Sep 2000 | 3.9 | 0.5 |

Oct 2000 | 3.9 | 0.4 |

Nov 2000 | 3.9 | 0.4 |

Dec 2000 | 3.9 | 0.4 |

Jan 2001 | 4.2 | 0.5 |

Feb 2001 | 4.2 | 0.5 |

Mar 2001 | 4.3 | 0.5 |

Apr 2001 | 4.4 | 0.5 |

May 2001 | 4.3 | 0.4 |

Jun 2001 | 4.5 | 0.5 |

Jul 2001 | 4.6 | 0.5 |

Aug 2001 | 4.9 | 0.6 |

Sep 2001 | 5.0 | 0.6 |

Oct 2001 | 5.3 | 0.6 |

Nov 2001 | 5.5 | 0.8 |

Dec 2001 | 5.7 | 0.8 |

Jan 2002 | 5.7 | 0.8 |

Feb 2002 | 5.7 | 0.8 |

Mar 2002 | 5.7 | 0.9 |

Apr 2002 | 5.9 | 1.0 |

May 2002 | 5.8 | 1.1 |

Jun 2002 | 5.8 | 1.1 |

Jul 2002 | 5.8 | 1.1 |

Aug 2002 | 5.7 | 1.1 |

Sep 2002 | 5.7 | 1.1 |

Oct 2002 | 5.7 | 1.1 |

Nov 2002 | 5.9 | 1.2 |

Dec 2002 | 6.0 | 1.3 |

Jan 2003 | 5.8 | 1.2 |

Feb 2003 | 5.9 | 1.3 |

Mar 2003 | 5.9 | 1.2 |

Apr 2003 | 6.0 | 1.3 |

May 2003 | 6.1 | 1.3 |

Jun 2003 | 6.3 | 1.4 |

Jul 2003 | 6.2 | 1.3 |

Aug 2003 | 6.1 | 1.4 |

Sep 2003 | 6.1 | 1.4 |

Oct 2003 | 6.0 | 1.3 |

Nov 2003 | 5.8 | 1.4 |

Dec 2003 | 5.7 | 1.3 |

Jan 2004 | 5.7 | 1.3 |

Feb 2004 | 5.6 | 1.3 |

Mar 2004 | 5.8 | 1.3 |

Apr 2004 | 5.6 | 1.2 |

May 2004 | 5.6 | 1.2 |

Jun 2004 | 5.6 | 1.3 |

Jul 2004 | 5.5 | 1.1 |

Aug 2004 | 5.4 | 1.1 |

Sep 2004 | 5.4 | 1.2 |

Oct 2004 | 5.5 | 1.2 |

Nov 2004 | 5.4 | 1.1 |

Dec 2004 | 5.4 | 1.1 |

Jan 2005 | 5.3 | 1.1 |

Feb 2005 | 5.4 | 1.1 |

Mar 2005 | 5.2 | 1.1 |

Apr 2005 | 5.2 | 1.1 |

May 2005 | 5.1 | 1.0 |

Jun 2005 | 5.0 | 0.9 |

Jul 2005 | 5.0 | 0.9 |

Aug 2005 | 4.9 | 0.9 |

Sep 2005 | 5.0 | 1.0 |

Oct 2005 | 5.0 | 0.9 |

Nov 2005 | 5.0 | 0.9 |

Dec 2005 | 4.9 | 0.9 |

Jan 2006 | 4.7 | 0.8 |

Feb 2006 | 4.8 | 0.9 |

Mar 2006 | 4.7 | 0.9 |

Apr 2006 | 4.7 | 0.9 |

May 2006 | 4.6 | 0.9 |

Jun 2006 | 4.6 | 0.8 |

Jul 2006 | 4.7 | 0.9 |

Aug 2006 | 4.7 | 0.9 |

Sep 2006 | 4.5 | 0.8 |

Oct 2006 | 4.4 | 0.7 |

Nov 2006 | 4.5 | 0.7 |

Dec 2006 | 4.4 | 0.7 |

Jan 2007 | 4.6 | 0.7 |

Feb 2007 | 4.5 | 0.8 |

Mar 2007 | 4.4 | 0.8 |

Apr 2007 | 4.5 | 0.8 |

May 2007 | 4.4 | 0.7 |

Jun 2007 | 4.6 | 0.7 |

Jul 2007 | 4.7 | 0.8 |

Aug 2007 | 4.6 | 0.8 |

Sep 2007 | 4.7 | 0.8 |

Oct 2007 | 4.7 | 0.8 |

Nov 2007 | 4.7 | 0.9 |

Dec 2007 | 5.0 | 0.9 |

Jan 2008 | 5.0 | 0.9 |

Feb 2008 | 4.9 | 0.9 |

Mar 2008 | 5.1 | 0.9 |

Apr 2008 | 5.0 | 0.9 |

May 2008 | 5.4 | 1.0 |

Jun 2008 | 5.6 | 1.0 |

Jul 2008 | 5.8 | 1.1 |

Aug 2008 | 6.1 | 1.2 |

Sep 2008 | 6.1 | 1.3 |

Oct 2008 | 6.5 | 1.5 |

Nov 2008 | 6.8 | 1.4 |

Dec 2008 | 7.3 | 1.7 |

Jan 2009 | 7.8 | 1.7 |

Feb 2009 | 8.3 | 1.9 |

Mar 2009 | 8.7 | 2.1 |

Apr 2009 | 8.9 | 2.4 |

May 2009 | 9.4 | 2.6 |

Jun 2009 | 9.5 | 2.8 |

Jul 2009 | 9.5 | 3.2 |

Aug 2009 | 9.6 | 3.3 |

Sep 2009 | 9.8 | 3.5 |

Oct 2009 | 10.0 | 3.7 |

Nov 2009 | 9.9 | 3.8 |

Dec 2009 | 9.9 | 4.0 |

Jan 2010 | 9.7 | 4.1 |

Feb 2010 | 9.8 | 4.0 |

Mar 2010 | 9.8 | 4.3 |

Apr 2010 | 9.9 | 4.4 |

May 2010 | 9.6 | 4.3 |

Jun 2010 | 9.4 | 4.3 |

Jul 2010 | 9.5 | 4.2 |

Aug 2010 | 9.6 | 4.1 |

Sep 2010 | 9.5 | 4.0 |

Oct 2010 | 9.5 | 4.0 |

Nov 2010 | 9.8 | 4.1 |

Dec 2010 | 9.4 | 4.2 |

Jan 2011 | 9.1 | 4.0 |

Feb 2011 | 9.0 | 3.9 |

Mar 2011 | 8.9 | 4.0 |

Apr 2011 | 9.0 | 3.8 |

May 2011 | 9.0 | 4.0 |

Jun 2011 | 9.1 | 4.1 |

Jul 2011 | 9.1 | 4.0 |

Aug 2011 | 9.1 | 3.9 |

Sep 2011 | 9.0 | 4.0 |

Oct 2011 | 8.9 | 3.8 |

Nov 2011 | 8.7 | 3.7 |

Dec 2011 | 8.5 | 3.6 |

Source: Current Population Survey | Chart

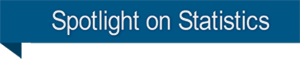

One of the most widely recognized indicators of a recession is higher unemployment rates. In December 2007, the national unemployment rate was 5.0 percent, and it had been at or below that rate for the previous 30 months. At the end of the recession, in June 2009, it was 9.5 percent. In the months after the recession, the unemployment rate peaked at 10.0 percent (in October 2009). Before this, the most recent months with unemployment rates over 10.0 percent were September 1982 through June 1983, during which time the unemployment rate peaked at 10.8 percent.

Compared with previous recessions, the higher proportion of long-term unemployed (those unemployed for 27 weeks or longer) in the recent recession and its post-recession period is notable.

NOTE: People are classified as unemployed if they do not have a job, have actively looked for work in the prior 4 weeks, and are currently available for work. The unemployment rate is the number of unemployed persons as a percent of the labor force. (The labor force is the total number of employed and unemployed persons.) The long-term unemployment rate is the number of persons unemployed for 27 weeks or longer as a percent of the labor force. To learn more, see How the Government Measures Unemployment.

| Month | White | Black or African American | Hispanic or Latino | Men | Women |

|---|---|---|---|---|---|

Jan 1948 | — | — | — | 3.4 | 3.3 |

Feb 1948 | — | — | — | 3.6 | 4.5 |

Mar 1948 | — | — | — | 3.8 | 4.4 |

Apr 1948 | — | — | — | 3.8 | 4.3 |

May 1948 | — | — | — | 3.5 | 3.7 |

Jun 1948 | — | — | — | 3.3 | 4.3 |

Jul 1948 | — | — | — | 3.4 | 4.2 |

Aug 1948 | — | — | — | 3.6 | 4.4 |

Sep 1948 | — | — | — | 3.7 | 4.1 |

Oct 1948 | — | — | — | 3.6 | 4.0 |

Nov 1948 | — | — | — | 3.7 | 3.9 |

Dec 1948 | — | — | — | 3.9 | 4.2 |

Jan 1949 | — | — | — | 4.2 | 4.4 |

Feb 1949 | — | — | — | 4.6 | 4.8 |

Mar 1949 | — | — | — | 5.1 | 4.6 |

Apr 1949 | — | — | — | 5.3 | 5.5 |

May 1949 | — | — | — | 6.1 | 6.0 |

Jun 1949 | — | — | — | 6.2 | 6.2 |

Jul 1949 | — | — | — | 6.7 | 6.8 |

Aug 1949 | — | — | — | 6.8 | 6.8 |

Sep 1949 | — | — | — | 6.5 | 6.8 |

Oct 1949 | — | — | — | 8.4 | 6.8 |

Nov 1949 | — | — | — | 6.5 | 6.3 |

Dec 1949 | — | — | — | 6.5 | 6.8 |

Jan 1950 | — | — | — | 6.4 | 6.9 |

Feb 1950 | — | — | — | 6.2 | 6.8 |

Mar 1950 | — | — | — | 6.1 | 6.7 |

Apr 1950 | — | — | — | 5.9 | 5.4 |

May 1950 | — | — | — | 5.4 | 5.8 |

Jun 1950 | — | — | — | 5.1 | 6.1 |

Jul 1950 | — | — | — | 4.8 | 5.6 |

Aug 1950 | — | — | — | 4.3 | 4.8 |

Sep 1950 | — | — | — | 4.2 | 5.1 |

Oct 1950 | — | — | — | 3.9 | 4.8 |

Nov 1950 | — | — | — | 3.7 | 5.2 |

Dec 1950 | — | — | — | 3.8 | 5.2 |

Jan 1951 | — | — | — | 3.3 | 4.6 |

Feb 1951 | — | — | — | 3.0 | 4.5 |

Mar 1951 | — | — | — | 2.7 | 4.9 |

Apr 1951 | — | — | — | 2.5 | 4.4 |

May 1951 | — | — | — | 2.5 | 4.2 |

Jun 1951 | — | — | — | 2.8 | 4.3 |

Jul 1951 | — | — | — | 2.7 | 4.0 |

Aug 1951 | — | — | — | 2.8 | 3.9 |

Sep 1951 | — | — | — | 2.8 | 4.6 |

Oct 1951 | — | — | — | 3.1 | 4.5 |

Nov 1951 | — | — | — | 3.1 | 4.5 |

Dec 1951 | — | — | — | 2.7 | 4.2 |

Jan 1952 | — | — | — | 2.8 | 3.9 |

Feb 1952 | — | — | — | 2.8 | 3.8 |

Mar 1952 | — | — | — | 2.7 | 3.5 |

Apr 1952 | — | — | — | 2.7 | 3.5 |

May 1952 | — | — | — | 2.6 | 3.9 |

Jun 1952 | — | — | — | 2.8 | 3.5 |

Jul 1952 | — | — | — | 3.0 | 3.7 |

Aug 1952 | — | — | — | 3.2 | 3.8 |

Sep 1952 | — | — | — | 3.0 | 3.3 |

Oct 1952 | — | — | — | 2.6 | 3.8 |

Nov 1952 | — | — | — | 2.5 | 3.4 |

Dec 1952 | — | — | — | 2.5 | 3.1 |

Jan 1953 | — | — | — | 2.8 | 3.1 |

Feb 1953 | — | — | — | 2.4 | 2.9 |

Mar 1953 | — | — | — | 2.3 | 3.2 |

Apr 1953 | — | — | — | 2.6 | 3.0 |

May 1953 | — | — | — | 2.5 | 2.7 |

Jun 1953 | — | — | — | 2.4 | 2.8 |

Jul 1953 | — | — | — | 2.5 | 2.9 |

Aug 1953 | — | — | — | 2.5 | 3.0 |

Sep 1953 | — | — | — | 2.7 | 3.4 |

Oct 1953 | — | — | — | 2.9 | 3.6 |

Nov 1953 | — | — | — | 3.4 | 3.7 |

Dec 1953 | — | — | — | 4.2 | 5.1 |

Jan 1954 | 4.5 | — | — | 4.4 | 5.9 |

Feb 1954 | 4.9 | — | — | 4.9 | 5.9 |

Mar 1954 | 5.0 | — | — | 5.3 | 6.4 |

Apr 1954 | 5.5 | — | — | 5.6 | 6.4 |

May 1954 | 5.3 | — | — | 5.7 | 6.3 |

Jun 1954 | 5.0 | — | — | 5.3 | 6.2 |

Jul 1954 | 5.3 | — | — | 5.6 | 6.3 |

Aug 1954 | 5.6 | — | — | 6.0 | 6.2 |

Sep 1954 | 5.9 | — | — | 6.0 | 6.4 |

Oct 1954 | 5.1 | — | — | 5.7 | 5.8 |

Nov 1954 | 4.7 | — | — | 5.2 | 5.6 |

Dec 1954 | 4.4 | — | — | 5.0 | 5.2 |

Jan 1955 | 4.5 | — | — | 4.8 | 5.3 |

Feb 1955 | 4.1 | — | — | 4.5 | 5.0 |

Mar 1955 | 4.0 | — | — | 4.5 | 4.8 |

Apr 1955 | 4.3 | — | — | 4.7 | 4.7 |

May 1955 | 3.8 | — | — | 4.0 | 4.7 |

Jun 1955 | 3.7 | — | — | 3.9 | 4.7 |

Jul 1955 | 3.6 | — | — | 3.8 | 4.6 |

Aug 1955 | 3.6 | — | — | 3.9 | 4.9 |

Sep 1955 | 3.6 | — | — | 3.7 | 5.0 |

Oct 1955 | 3.7 | — | — | 3.9 | 5.1 |

Nov 1955 | 3.6 | — | — | 3.9 | 4.9 |

Dec 1955 | 3.7 | — | — | 3.8 | 4.9 |

Jan 1956 | 3.5 | — | — | 3.8 | 4.5 |

Feb 1956 | 3.6 | — | — | 3.8 | 4.3 |

Mar 1956 | 3.7 | — | — | 3.8 | 5.1 |

Apr 1956 | 3.6 | — | — | 3.6 | 4.8 |

May 1956 | 3.8 | — | — | 3.9 | 5.0 |

Jun 1956 | 3.7 | — | — | 4.0 | 5.1 |

Jul 1956 | 3.8 | — | — | 3.8 | 5.7 |

Aug 1956 | 3.4 | — | — | 3.7 | 4.8 |

Sep 1956 | 3.5 | — | — | 3.6 | 4.6 |

Oct 1956 | 3.4 | — | — | 3.5 | 4.7 |

Nov 1956 | 3.8 | — | — | 4.0 | 4.9 |

Dec 1956 | 3.8 | — | — | 3.9 | 4.7 |

Jan 1957 | 3.8 | — | — | 3.9 | 4.8 |

Feb 1957 | 3.6 | — | — | 3.6 | 4.5 |

Mar 1957 | 3.4 | — | — | 3.5 | 4.3 |

Apr 1957 | 3.5 | — | — | 3.8 | 4.2 |

May 1957 | 3.6 | — | — | 3.8 | 4.7 |

Jun 1957 | 3.7 | — | — | 4.0 | 4.8 |

Jul 1957 | 3.7 | — | — | 3.8 | 4.8 |

Aug 1957 | 3.7 | — | — | 3.9 | 4.7 |

Sep 1957 | 3.9 | — | — | 4.3 | 4.6 |

Oct 1957 | 4.0 | — | — | 4.4 | 4.6 |

Nov 1957 | 4.6 | — | — | 5.2 | 5.1 |

Dec 1957 | 4.7 | — | — | 5.2 | 5.1 |

Jan 1958 | 5.2 | — | — | 5.7 | 5.9 |

Feb 1958 | 5.7 | — | — | 6.3 | 6.6 |

Mar 1958 | 5.9 | — | — | 6.7 | 6.6 |

Apr 1958 | 6.7 | — | — | 7.3 | 7.6 |

May 1958 | 6.7 | — | — | 7.5 | 7.3 |

Jun 1958 | 6.6 | — | — | 7.4 | 7.1 |

Jul 1958 | 6.8 | — | — | 7.6 | 7.3 |

Aug 1958 | 6.7 | — | — | 7.5 | 7.2 |

Sep 1958 | 6.4 | — | — | 7.1 | 7.0 |

Oct 1958 | 6.0 | — | — | 6.7 | 6.7 |

Nov 1958 | 5.5 | — | — | 6.3 | 6.0 |

Dec 1958 | 5.5 | — | — | 6.2 | 6.2 |

Jan 1959 | 5.3 | — | — | 5.9 | 6.2 |

Feb 1959 | 5.2 | — | — | 5.8 | 6.0 |

Mar 1959 | 4.9 | — | — | 5.3 | 6.2 |

Apr 1959 | 4.7 | — | — | 4.8 | 6.1 |

May 1959 | 4.5 | — | — | 4.8 | 5.8 |

Jun 1959 | 4.4 | — | — | 4.7 | 5.6 |

Jul 1959 | 4.5 | — | — | 4.9 | 5.7 |

Aug 1959 | 4.6 | — | — | 5.1 | 5.6 |

Sep 1959 | 4.9 | — | — | 5.5 | 5.6 |

Oct 1959 | 5.0 | — | — | 5.5 | 6.1 |

Nov 1959 | 5.3 | — | — | 5.9 | 5.8 |

Dec 1959 | 4.7 | — | — | 5.0 | 5.8 |

Jan 1960 | 4.6 | — | — | 5.0 | 5.7 |

Feb 1960 | 4.3 | — | — | 4.6 | 5.4 |

Mar 1960 | 4.8 | — | — | 5.3 | 5.8 |

Apr 1960 | 4.6 | — | — | 5.0 | 5.5 |

May 1960 | 4.6 | — | — | 5.0 | 5.5 |

Jun 1960 | 4.8 | — | — | 5.2 | 5.7 |

Jul 1960 | 4.9 | — | — | 5.3 | 5.8 |

Aug 1960 | 5.1 | — | — | 5.6 | 5.8 |

Sep 1960 | 5.1 | — | — | 5.5 | 5.7 |

Oct 1960 | 5.5 | — | — | 5.9 | 6.4 |

Nov 1960 | 5.5 | — | — | 6.0 | 6.5 |

Dec 1960 | 5.9 | — | — | 6.3 | 7.0 |

Jan 1961 | 5.9 | — | — | 6.5 | 6.9 |

Feb 1961 | 6.2 | — | — | 6.6 | 7.3 |

Mar 1961 | 6.2 | — | — | 6.6 | 7.4 |

Apr 1961 | 6.2 | — | — | 6.8 | 7.4 |

May 1961 | 6.3 | — | — | 6.9 | 7.4 |

Jun 1961 | 6.2 | — | — | 6.5 | 7.6 |

Jul 1961 | 6.3 | — | — | 6.6 | 7.7 |

Aug 1961 | 5.9 | — | — | 6.4 | 7.0 |

Sep 1961 | 5.9 | — | — | 6.3 | 7.3 |

Oct 1961 | 5.7 | — | — | 6.1 | 7.2 |

Nov 1961 | 5.4 | — | — | 5.8 | 6.6 |

Dec 1961 | 5.3 | — | — | 5.7 | 6.4 |

Jan 1962 | 5.1 | — | — | 5.4 | 6.7 |

Feb 1962 | 4.8 | — | — | 5.2 | 6.2 |

Mar 1962 | 4.8 | — | — | 5.2 | 6.3 |

Apr 1962 | 4.7 | — | — | 5.2 | 6.2 |

May 1962 | 4.8 | — | — | 5.2 | 6.0 |

Jun 1962 | 4.8 | — | — | 5.3 | 5.8 |

Jul 1962 | 4.8 | — | — | 5.1 | 6.1 |

Aug 1962 | 5.0 | — | — | 5.3 | 6.4 |

Sep 1962 | 5.0 | — | — | 5.2 | 6.3 |

Oct 1962 | 4.8 | — | — | 5.0 | 6.1 |

Nov 1962 | 5.0 | — | — | 5.3 | 6.3 |

Dec 1962 | 4.8 | — | — | 5.1 | 6.2 |

Jan 1963 | 5.0 | — | — | 5.4 | 6.4 |

Feb 1963 | 5.3 | — | — | 5.7 | 6.5 |

Mar 1963 | 5.0 | — | — | 5.4 | 6.2 |

Apr 1963 | 5.1 | — | — | 5.4 | 6.2 |

May 1963 | 5.2 | — | — | 5.4 | 6.7 |

Jun 1963 | 4.9 | — | — | 5.1 | 6.4 |

Jul 1963 | 5.1 | — | — | 5.1 | 6.6 |

Aug 1963 | 4.8 | — | — | 4.9 | 6.3 |

Sep 1963 | 4.8 | — | — | 4.9 | 6.6 |

Oct 1963 | 4.8 | — | — | 5.0 | 6.6 |

Nov 1963 | 5.0 | — | — | 5.3 | 6.6 |

Dec 1963 | 5.0 | — | — | 5.0 | 6.4 |

Jan 1964 | 5.0 | — | — | 5.0 | 6.6 |

Feb 1964 | 4.9 | — | — | 4.8 | 6.5 |

Mar 1964 | 4.9 | — | — | 4.8 | 6.6 |

Apr 1964 | 4.8 | — | — | 4.8 | 6.4 |

May 1964 | 4.5 | — | — | 4.5 | 6.3 |

Jun 1964 | 4.7 | — | — | 4.7 | 6.2 |

Jul 1964 | 4.3 | — | — | 4.4 | 6.0 |

Aug 1964 | 4.4 | — | — | 4.5 | 5.9 |

Sep 1964 | 4.5 | — | — | 4.6 | 6.0 |

Oct 1964 | 4.6 | — | — | 4.5 | 6.1 |

Nov 1964 | 4.3 | — | — | 4.3 | 5.9 |

Dec 1964 | 4.5 | — | — | 4.3 | 6.2 |

Jan 1965 | 4.3 | — | — | 4.3 | 5.9 |

Feb 1965 | 4.5 | — | — | 4.3 | 6.4 |

Mar 1965 | 4.3 | — | — | 4.1 | 5.9 |

Apr 1965 | 4.4 | — | — | 4.3 | 5.9 |

May 1965 | 4.2 | — | — | 4.1 | 5.5 |

Jun 1965 | 4.2 | — | — | 3.9 | 5.7 |

Jul 1965 | 3.9 | — | — | 3.9 | 5.3 |

Aug 1965 | 4.0 | — | — | 3.9 | 5.2 |

Sep 1965 | 3.8 | — | — | 3.7 | 5.4 |

Oct 1965 | 3.8 | — | — | 3.7 | 5.1 |

Nov 1965 | 3.7 | — | — | 3.4 | 5.4 |

Dec 1965 | 3.6 | — | — | 3.4 | 5.1 |

Jan 1966 | 3.5 | — | — | 3.4 | 5.0 |

Feb 1966 | 3.4 | — | — | 3.3 | 4.7 |

Mar 1966 | 3.4 | — | — | 3.3 | 4.8 |

Apr 1966 | 3.3 | — | — | 3.1 | 4.8 |

May 1966 | 3.5 | — | — | 3.2 | 5.2 |

Jun 1966 | 3.4 | — | — | 3.2 | 4.9 |

Jul 1966 | 3.3 | — | — | 3.2 | 4.8 |

Aug 1966 | 3.3 | — | — | 3.2 | 4.9 |

Sep 1966 | 3.2 | — | — | 3.1 | 4.7 |

Oct 1966 | 3.3 | — | — | 3.0 | 4.9 |

Nov 1966 | 3.2 | — | — | 3.1 | 4.6 |

Dec 1966 | 3.3 | — | — | 3.2 | 4.8 |

Jan 1967 | 3.4 | — | — | 3.0 | 5.4 |

Feb 1967 | 3.3 | — | — | 3.0 | 5.2 |

Mar 1967 | 3.3 | — | — | 3.0 | 5.1 |

Apr 1967 | 3.4 | — | — | 3.1 | 4.9 |

May 1967 | 3.3 | — | — | 3.2 | 5.0 |

Jun 1967 | 3.5 | — | — | 3.2 | 5.1 |

Jul 1967 | 3.3 | — | — | 3.0 | 5.1 |

Aug 1967 | 3.4 | — | — | 3.1 | 4.9 |

Sep 1967 | 3.3 | — | — | 2.9 | 5.3 |

Oct 1967 | 3.5 | — | — | 3.1 | 5.6 |

Nov 1967 | 3.5 | — | — | 3.1 | 5.2 |

Dec 1967 | 3.4 | — | — | 3.1 | 5.1 |

Jan 1968 | 3.3 | — | — | 3.0 | 5.0 |

Feb 1968 | 3.4 | — | — | 3.1 | 5.1 |

Mar 1968 | 3.2 | — | — | 3.0 | 4.8 |

Apr 1968 | 3.1 | — | — | 2.8 | 4.7 |

May 1968 | 3.1 | — | — | 2.7 | 4.7 |

Jun 1968 | 3.4 | — | — | 3.0 | 4.9 |

Jul 1968 | 3.2 | — | — | 2.9 | 5.0 |

Aug 1968 | 3.2 | — | — | 2.8 | 4.7 |

Sep 1968 | 3.1 | — | — | 2.7 | 4.5 |

Oct 1968 | 3.0 | — | — | 2.7 | 4.5 |

Nov 1968 | 3.0 | — | — | 2.7 | 4.6 |

Dec 1968 | 3.0 | — | — | 2.7 | 4.6 |

Jan 1969 | 3.0 | — | — | 2.7 | 4.6 |

Feb 1969 | 3.0 | — | — | 2.6 | 4.6 |

Mar 1969 | 3.0 | — | — | 2.7 | 4.6 |

Apr 1969 | 3.0 | — | — | 2.6 | 4.7 |

May 1969 | 3.0 | — | — | 2.6 | 4.6 |

Jun 1969 | 3.1 | — | — | 2.7 | 4.8 |

Jul 1969 | 3.2 | — | — | 2.9 | 4.6 |

Aug 1969 | 3.1 | — | — | 2.8 | 4.8 |

Sep 1969 | 3.4 | — | — | 3.1 | 4.9 |

Oct 1969 | 3.4 | — | — | 3.0 | 5.0 |

Nov 1969 | 3.2 | — | — | 2.9 | 4.5 |

Dec 1969 | 3.3 | — | — | 3.0 | 4.5 |

Jan 1970 | 3.6 | — | — | 3.3 | 4.9 |

Feb 1970 | 3.8 | — | — | 3.6 | 5.1 |

Mar 1970 | 4.0 | — | — | 3.7 | 5.6 |

Apr 1970 | 4.1 | — | — | 4.0 | 5.5 |

May 1970 | 4.4 | — | — | 4.2 | 5.7 |

Jun 1970 | 4.5 | — | — | 4.5 | 5.7 |

Jul 1970 | 4.6 | — | — | 4.6 | 5.8 |

Aug 1970 | 4.7 | — | — | 4.6 | 6.0 |

Sep 1970 | 5.0 | — | — | 4.8 | 6.3 |

Oct 1970 | 5.2 | — | — | 5.0 | 6.4 |

Nov 1970 | 5.4 | — | — | 5.2 | 6.9 |

Dec 1970 | 5.6 | — | — | 5.6 | 6.9 |

Jan 1971 | 5.5 | — | — | 5.4 | 6.8 |

Feb 1971 | 5.3 | — | — | 5.3 | 6.8 |

Mar 1971 | 5.5 | — | — | 5.3 | 7.1 |

Apr 1971 | 5.4 | — | — | 5.2 | 7.0 |

May 1971 | 5.4 | — | — | 5.3 | 6.9 |

Jun 1971 | 5.5 | — | — | 5.3 | 6.9 |

Jul 1971 | 5.5 | — | — | 5.4 | 7.0 |

Aug 1971 | 5.6 | — | — | 5.5 | 7.0 |

Sep 1971 | 5.4 | — | — | 5.4 | 6.9 |

Oct 1971 | 5.4 | — | — | 5.2 | 6.8 |

Nov 1971 | 5.6 | — | — | 5.4 | 7.0 |

Dec 1971 | 5.4 | — | — | 5.5 | 6.8 |

Jan 1972 | 5.2 | 11.2 | — | 5.3 | 6.7 |

Feb 1972 | 5.1 | 11.2 | — | 5.3 | 6.4 |

Mar 1972 | 5.2 | 10.7 | — | 5.3 | 6.7 |

Apr 1972 | 5.3 | 9.8 | — | 5.1 | 6.7 |

May 1972 | 5.1 | 10.2 | — | 5.1 | 6.6 |

Jun 1972 | 5.1 | 10.2 | — | 4.9 | 6.8 |

Jul 1972 | 5.1 | 10.5 | — | 4.8 | 7.0 |

Aug 1972 | 5.1 | 10.6 | — | 4.9 | 6.9 |

Sep 1972 | 5.0 | 10.4 | — | 4.8 | 6.7 |

Oct 1972 | 5.1 | 10.6 | — | 4.8 | 6.8 |

Nov 1972 | 4.7 | 10.0 | — | 4.6 | 6.2 |

Dec 1972 | 4.6 | 9.4 | — | 4.5 | 6.2 |

Jan 1973 | 4.5 | 9.1 | — | 4.2 | 6.1 |

Feb 1973 | 4.5 | 9.5 | — | 4.3 | 6.2 |

Mar 1973 | 4.4 | 9.4 | 7.3 | 4.3 | 6.0 |

Apr 1973 | 4.5 | 9.9 | 7.9 | 4.3 | 6.1 |

May 1973 | 4.3 | 9.6 | 8.1 | 4.3 | 5.7 |

Jun 1973 | 4.3 | 9.8 | 7.9 | 4.1 | 6.0 |

Jul 1973 | 4.2 | 9.8 | 7.2 | 4.0 | 6.0 |

Aug 1973 | 4.3 | 9.2 | 7.4 | 4.1 | 6.0 |

Sep 1973 | 4.3 | 9.7 | 7.7 | 4.0 | 6.1 |

Oct 1973 | 4.1 | 8.8 | 8.0 | 3.9 | 5.7 |

Nov 1973 | 4.3 | 9.3 | 8.1 | 4.1 | 6.0 |

Dec 1973 | 4.4 | 9.0 | 7.6 | 4.2 | 6.1 |

Jan 1974 | 4.6 | 9.5 | 7.6 | 4.4 | 6.2 |

Feb 1974 | 4.6 | 9.8 | 7.8 | 4.5 | 6.2 |

Mar 1974 | 4.5 | 9.8 | 7.6 | 4.4 | 6.1 |

Apr 1974 | 4.5 | 9.5 | 7.0 | 4.5 | 6.0 |

May 1974 | 4.6 | 9.7 | 7.3 | 4.4 | 6.3 |

Jun 1974 | 4.8 | 10.1 | 8.6 | 4.6 | 6.5 |

Jul 1974 | 4.9 | 10.4 | 8.8 | 4.7 | 6.8 |

Aug 1974 | 5.0 | 9.9 | 8.1 | 4.8 | 6.5 |

Sep 1974 | 5.4 | 10.8 | 8.1 | 5.0 | 7.1 |

Oct 1974 | 5.4 | 11.5 | 8.2 | 5.3 | 7.1 |

Nov 1974 | 6.0 | 12.4 | 8.6 | 5.8 | 7.9 |

Dec 1974 | 6.4 | 13.1 | 9.1 | 6.4 | 8.3 |

Jan 1975 | 7.4 | 14.1 | 10.7 | 7.3 | 9.2 |

Feb 1975 | 7.4 | 14.4 | 11.2 | 7.4 | 9.1 |

Mar 1975 | 7.8 | 15.1 | 12.1 | 7.9 | 9.6 |

Apr 1975 | 8.0 | 15.3 | 12.4 | 8.2 | 9.6 |

May 1975 | 8.4 | 15.1 | 14.3 | 8.4 | 9.8 |

Jun 1975 | 8.1 | 15.0 | 11.7 | 8.3 | 9.4 |

Jul 1975 | 8.0 | 14.1 | 11.6 | 8.2 | 9.3 |

Aug 1975 | 7.7 | 15.2 | 12.1 | 7.9 | 9.2 |

Sep 1975 | 7.7 | 15.4 | 12.7 | 8.0 | 9.0 |

Oct 1975 | 7.7 | 14.9 | 13.0 | 7.8 | 9.2 |

Nov 1975 | 7.6 | 14.6 | 12.4 | 7.8 | 9.0 |

Dec 1975 | 7.4 | 14.5 | 12.1 | 7.6 | 9.1 |

Jan 1976 | 7.2 | 14.3 | 11.4 | 7.3 | 8.9 |

Feb 1976 | 6.9 | 14.4 | 10.7 | 7.0 | 8.8 |

Mar 1976 | 6.9 | 13.5 | 11.0 | 6.9 | 8.6 |

Apr 1976 | 6.9 | 13.8 | 11.7 | 7.0 | 8.6 |

May 1976 | 6.7 | 13.2 | 10.5 | 6.9 | 8.1 |

Jun 1976 | 6.9 | 14.3 | 11.1 | 7.1 | 8.4 |

Jul 1976 | 7.1 | 13.9 | 11.7 | 7.1 | 8.8 |

Aug 1976 | 7.1 | 14.3 | 12.4 | 6.9 | 9.0 |

Sep 1976 | 7.0 | 13.7 | 11.8 | 7.0 | 8.7 |

Oct 1976 | 7.0 | 13.9 | 11.6 | 7.0 | 8.7 |

Nov 1976 | 7.1 | 14.0 | 11.7 | 7.3 | 8.7 |

Dec 1976 | 7.0 | 14.1 | 11.7 | 7.2 | 8.5 |

Jan 1977 | 6.8 | 13.8 | 11.2 | 6.8 | 8.5 |

Feb 1977 | 6.9 | 14.2 | 11.4 | 7.0 | 8.6 |

Mar 1977 | 6.7 | 13.9 | 11.2 | 6.6 | 8.6 |

Apr 1977 | 6.4 | 12.8 | 9.6 | 6.4 | 8.4 |

May 1977 | 6.3 | 13.5 | 9.9 | 6.4 | 7.9 |

Jun 1977 | 6.4 | 13.9 | 10.1 | 6.4 | 8.4 |

Jul 1977 | 6.0 | 13.9 | 9.5 | 6.1 | 8.0 |

Aug 1977 | 6.0 | 15.1 | 9.4 | 6.2 | 8.1 |

Sep 1977 | 6.0 | 14.5 | 9.7 | 5.8 | 8.1 |

Oct 1977 | 5.9 | 14.5 | 9.4 | 6.0 | 7.9 |

Nov 1977 | 5.8 | 14.7 | 9.3 | 5.8 | 8.1 |

Dec 1977 | 5.5 | 13.6 | 8.8 | 5.5 | 7.5 |

Jan 1978 | 5.5 | 13.9 | 9.3 | 5.6 | 7.6 |

Feb 1978 | 5.5 | 13.1 | 9.9 | 5.6 | 7.2 |

Mar 1978 | 5.4 | 13.1 | 9.5 | 5.6 | 7.2 |

Apr 1978 | 5.3 | 12.9 | 8.5 | 5.3 | 7.1 |

May 1978 | 5.2 | 13.0 | 9.6 | 5.2 | 7.2 |

Jun 1978 | 5.0 | 12.8 | 9.1 | 4.9 | 7.2 |

Jul 1978 | 5.3 | 13.0 | 9.5 | 5.1 | 7.6 |

Aug 1978 | 5.1 | 12.3 | 9.1 | 5.0 | 7.2 |

Sep 1978 | 5.2 | 11.9 | 8.9 | 5.1 | 7.2 |

Oct 1978 | 5.0 | 11.8 | 8.5 | 5.1 | 6.7 |

Nov 1978 | 5.0 | 12.7 | 8.4 | 5.0 | 7.0 |

Dec 1978 | 5.2 | 12.4 | 8.7 | 5.3 | 7.0 |

Jan 1979 | 5.1 | 12.4 | 8.2 | 5.1 | 6.9 |

Feb 1979 | 5.1 | 13.1 | 7.7 | 5.2 | 6.9 |

Mar 1979 | 5.1 | 12.5 | 7.9 | 5.1 | 6.8 |

Apr 1979 | 5.0 | 12.9 | 8.2 | 5.1 | 6.8 |

May 1979 | 4.8 | 12.4 | 7.9 | 4.8 | 6.7 |

Jun 1979 | 4.9 | 12.2 | 8.4 | 4.9 | 6.8 |

Jul 1979 | 4.9 | 12.1 | 8.1 | 5.1 | 6.6 |

Aug 1979 | 5.3 | 12.4 | 8.7 | 5.2 | 7.1 |

Sep 1979 | 5.2 | 11.7 | 7.6 | 5.2 | 6.7 |

Oct 1979 | 5.2 | 12.3 | 8.7 | 5.3 | 6.9 |

Nov 1979 | 5.2 | 11.9 | 9.2 | 5.3 | 6.7 |

Dec 1979 | 5.2 | 12.2 | 9.1 | 5.3 | 6.8 |

Jan 1980 | 5.5 | 13.0 | 8.7 | 5.8 | 6.9 |

Feb 1980 | 5.5 | 12.9 | 8.9 | 5.8 | 7.0 |

Mar 1980 | 5.6 | 12.9 | 9.2 | 5.9 | 6.9 |

Apr 1980 | 6.1 | 13.8 | 10.4 | 6.7 | 7.2 |

May 1980 | 6.6 | 14.4 | 10.1 | 7.4 | 7.5 |

Jun 1980 | 6.7 | 14.6 | 10.1 | 7.6 | 7.6 |

Jul 1980 | 6.9 | 15.3 | 10.8 | 7.8 | 7.8 |

Aug 1980 | 6.9 | 14.6 | 10.8 | 7.7 | 7.8 |

Sep 1980 | 6.6 | 14.8 | 11.4 | 7.6 | 7.3 |

Oct 1980 | 6.6 | 15.1 | 10.6 | 7.4 | 7.7 |

Nov 1980 | 6.5 | 15.1 | 9.9 | 7.3 | 7.6 |

Dec 1980 | 6.3 | 15.0 | 10.3 | 6.9 | 7.6 |

Jan 1981 | 6.7 | 14.6 | 10.6 | 7.2 | 7.8 |

Feb 1981 | 6.6 | 14.7 | 11.3 | 7.3 | 7.7 |

Mar 1981 | 6.5 | 15.1 | 10.2 | 7.1 | 7.7 |

Apr 1981 | 6.4 | 14.7 | 9.5 | 6.9 | 7.6 |

May 1981 | 6.6 | 14.8 | 10.0 | 7.3 | 7.8 |

Jun 1981 | 6.5 | 15.7 | 10.3 | 7.3 | 7.8 |

Jul 1981 | 6.3 | 15.0 | 10.0 | 6.9 | 7.7 |

Aug 1981 | 6.3 | 16.3 | 10.0 | 7.2 | 7.7 |

Sep 1981 | 6.6 | 15.9 | 9.6 | 7.2 | 8.1 |

Oct 1981 | 6.9 | 16.7 | 10.7 | 7.7 | 8.3 |

Nov 1981 | 7.3 | 16.8 | 11.2 | 8.1 | 8.4 |

Dec 1981 | 7.5 | 17.2 | 11.7 | 8.5 | 8.5 |

Jan 1982 | 7.6 | 17.3 | 11.7 | 8.7 | 8.5 |

Feb 1982 | 7.8 | 17.7 | 12.1 | 8.8 | 8.9 |

Mar 1982 | 8.0 | 18.1 | 12.2 | 9.1 | 8.9 |

Apr 1982 | 8.3 | 18.2 | 12.9 | 9.4 | 9.3 |

May 1982 | 8.2 | 18.5 | 13.9 | 9.4 | 9.3 |

Jun 1982 | 8.5 | 18.5 | 13.8 | 9.8 | 9.2 |

Jul 1982 | 8.7 | 18.8 | 14.2 | 10.0 | 9.6 |

Aug 1982 | 8.7 | 18.9 | 14.8 | 10.2 | 9.4 |

Sep 1982 | 9.0 | 19.7 | 14.4 | 10.6 | 9.5 |

Oct 1982 | 9.2 | 20.1 | 15.0 | 10.9 | 9.8 |

Nov 1982 | 9.6 | 20.2 | 15.2 | 11.1 | 10.2 |

Dec 1982 | 9.7 | 20.9 | 15.7 | 11.2 | 10.4 |

Jan 1983 | 9.1 | 21.2 | 15.3 | 10.7 | 10.1 |

Feb 1983 | 9.3 | 19.9 | 15.5 | 10.9 | 9.9 |

Mar 1983 | 9.1 | 20.1 | 15.6 | 10.7 | 9.8 |

Apr 1983 | 8.9 | 20.4 | 14.8 | 10.7 | 9.5 |

May 1983 | 8.8 | 20.3 | 14.0 | 10.5 | 9.5 |

Jun 1983 | 8.7 | 20.7 | 14.3 | 10.1 | 9.9 |

Jul 1983 | 8.2 | 19.4 | 12.4 | 9.8 | 9.0 |

Aug 1983 | 8.2 | 19.7 | 13.0 | 9.8 | 9.0 |

Sep 1983 | 8.0 | 18.8 | 12.9 | 9.5 | 8.7 |

Oct 1983 | 7.7 | 18.2 | 12.1 | 9.1 | 8.5 |

Nov 1983 | 7.4 | 17.5 | 12.3 | 8.6 | 8.2 |

Dec 1983 | 7.1 | 17.8 | 11.6 | 8.3 | 8.3 |

Jan 1984 | 6.9 | 17.3 | 11.4 | 8.1 | 7.9 |

Feb 1984 | 6.8 | 16.2 | 10.4 | 7.8 | 7.8 |

Mar 1984 | 6.7 | 16.6 | 11.5 | 7.7 | 7.8 |

Apr 1984 | 6.7 | 16.5 | 11.6 | 7.7 | 7.8 |

May 1984 | 6.4 | 15.7 | 10.6 | 7.3 | 7.6 |

Jun 1984 | 6.2 | 15.6 | 10.3 | 7.1 | 7.4 |

Jul 1984 | 6.3 | 16.7 | 10.4 | 7.4 | 7.6 |

Aug 1984 | 6.4 | 16.0 | 10.7 | 7.3 | 7.8 |

Sep 1984 | 6.4 | 15.0 | 10.5 | 7.3 | 7.4 |

Oct 1984 | 6.3 | 15.3 | 10.8 | 7.1 | 7.7 |

Nov 1984 | 6.2 | 15.0 | 10.2 | 7.0 | 7.4 |

Dec 1984 | 6.3 | 15.2 | 10.4 | 7.2 | 7.4 |

Jan 1985 | 6.3 | 15.2 | 10.5 | 7.1 | 7.6 |

Feb 1985 | 6.2 | 15.8 | 9.8 | 7.1 | 7.4 |

Mar 1985 | 6.2 | 15.1 | 10.5 | 7.0 | 7.5 |

Apr 1985 | 6.3 | 15.1 | 10.4 | 7.1 | 7.5 |

May 1985 | 6.2 | 15.2 | 10.6 | 6.9 | 7.6 |

Jun 1985 | 6.5 | 14.4 | 10.7 | 7.2 | 7.5 |

Jul 1985 | 6.4 | 15.2 | 11.2 | 7.2 | 7.6 |

Aug 1985 | 6.2 | 14.3 | 10.4 | 6.9 | 7.3 |

Sep 1985 | 6.1 | 15.2 | 10.4 | 6.9 | 7.4 |

Oct 1985 | 6.1 | 15.0 | 11.1 | 7.1 | 7.3 |

Nov 1985 | 5.9 | 15.6 | 10.6 | 6.9 | 7.2 |

Dec 1985 | 6.0 | 15.0 | 10.5 | 6.8 | 7.2 |

Jan 1986 | 5.7 | 14.5 | 10.2 | 6.5 | 6.9 |

Feb 1986 | 6.3 | 14.4 | 11.9 | 7.0 | 7.4 |

Mar 1986 | 6.2 | 14.6 | 10.7 | 7.0 | 7.4 |

Apr 1986 | 6.1 | 14.8 | 10.3 | 6.9 | 7.4 |

May 1986 | 6.2 | 14.6 | 10.8 | 7.1 | 7.3 |

Jun 1986 | 6.2 | 15.1 | 10.6 | 7.1 | 7.3 |

Jul 1986 | 6.1 | 14.4 | 10.7 | 7.1 | 7.0 |

Aug 1986 | 5.9 | 14.8 | 10.9 | 6.9 | 6.9 |

Sep 1986 | 6.0 | 14.9 | 11.1 | 7.1 | 6.9 |

Oct 1986 | 6.0 | 14.6 | 10.4 | 7.0 | 6.9 |

Nov 1986 | 6.0 | 14.3 | 9.3 | 6.9 | 6.9 |

Dec 1986 | 5.8 | 13.7 | 10.5 | 6.7 | 6.5 |

Jan 1987 | 5.7 | 14.0 | 10.6 | 6.7 | 6.6 |

Feb 1987 | 5.7 | 13.8 | 9.8 | 6.6 | 6.6 |

Mar 1987 | 5.7 | 13.8 | 9.3 | 6.5 | 6.7 |

Apr 1987 | 5.4 | 12.9 | 8.9 | 6.3 | 6.3 |

May 1987 | 5.4 | 13.6 | 8.6 | 6.4 | 6.2 |

Jun 1987 | 5.4 | 12.9 | 8.5 | 6.3 | 6.0 |

Jul 1987 | 5.2 | 12.9 | 8.1 | 6.1 | 6.0 |

Aug 1987 | 5.1 | 12.6 | 7.9 | 6.1 | 6.0 |

Sep 1987 | 5.1 | 12.6 | 8.3 | 5.8 | 6.0 |

Oct 1987 | 5.2 | 12.3 | 8.4 | 5.9 | 6.1 |

Nov 1987 | 5.0 | 12.1 | 8.8 | 5.7 | 6.0 |

Dec 1987 | 4.9 | 12.1 | 8.1 | 5.7 | 5.8 |

Jan 1988 | 5.0 | 12.0 | 7.6 | 5.7 | 5.8 |

Feb 1988 | 4.9 | 12.4 | 8.5 | 5.6 | 5.9 |

Mar 1988 | 4.8 | 12.7 | 8.4 | 5.7 | 5.7 |

Apr 1988 | 4.6 | 12.2 | 8.8 | 5.3 | 5.6 |

May 1988 | 4.7 | 12.3 | 8.8 | 5.6 | 5.6 |

Jun 1988 | 4.6 | 11.5 | 8.8 | 5.4 | 5.4 |

Jul 1988 | 4.7 | 11.6 | 7.9 | 5.3 | 5.5 |

Aug 1988 | 4.8 | 11.4 | 8.1 | 5.6 | 5.6 |

Sep 1988 | 4.8 | 11.0 | 7.4 | 5.3 | 5.5 |

Oct 1988 | 4.7 | 11.1 | 7.8 | 5.4 | 5.4 |

Nov 1988 | 4.6 | 11.0 | 7.9 | 5.3 | 5.3 |

Dec 1988 | 4.6 | 11.3 | 7.6 | 5.3 | 5.3 |

Jan 1989 | 4.6 | 11.8 | 8.6 | 5.4 | 5.4 |

Feb 1989 | 4.3 | 11.9 | 7.0 | 5.2 | 5.1 |

Mar 1989 | 4.2 | 11.1 | 6.6 | 4.9 | 5.2 |

Apr 1989 | 4.5 | 11.1 | 8.1 | 5.2 | 5.3 |

May 1989 | 4.4 | 11.2 | 7.9 | 5.0 | 5.4 |

Jun 1989 | 4.5 | 11.7 | 8.2 | 5.1 | 5.6 |

Jul 1989 | 4.5 | 11.0 | 8.8 | 5.0 | 5.6 |

Aug 1989 | 4.5 | 11.1 | 8.8 | 5.1 | 5.4 |

Sep 1989 | 4.5 | 11.7 | 8.1 | 5.4 | 5.2 |

Oct 1989 | 4.5 | 11.7 | 8.0 | 5.3 | 5.4 |

Nov 1989 | 4.6 | 11.7 | 7.9 | 5.4 | 5.4 |

Dec 1989 | 4.6 | 11.6 | 8.3 | 5.3 | 5.4 |

Jan 1990 | 4.6 | 11.1 | 7.3 | 5.4 | 5.3 |

Feb 1990 | 4.6 | 11.0 | 7.5 | 5.2 | 5.4 |

Mar 1990 | 4.5 | 10.9 | 7.4 | 5.2 | 5.3 |

Apr 1990 | 4.7 | 10.7 | 8.5 | 5.4 | 5.4 |

May 1990 | 4.6 | 10.6 | 7.9 | 5.3 | 5.4 |

Jun 1990 | 4.5 | 10.5 | 7.7 | 5.3 | 5.2 |

Jul 1990 | 4.7 | 11.4 | 8.0 | 5.6 | 5.4 |

Aug 1990 | 4.9 | 11.7 | 8.3 | 5.8 | 5.6 |

Sep 1990 | 5.0 | 12.1 | 8.3 | 5.9 | 5.8 |

Oct 1990 | 5.1 | 12.1 | 8.5 | 6.1 | 5.7 |

Nov 1990 | 5.3 | 12.4 | 8.9 | 6.4 | 5.9 |

Dec 1990 | 5.4 | 12.4 | 9.9 | 6.5 | 5.9 |

Jan 1991 | 5.6 | 11.9 | 9.1 | 6.5 | 6.2 |

Feb 1991 | 5.8 | 12.2 | 9.2 | 6.9 | 6.1 |

Mar 1991 | 6.0 | 12.5 | 9.8 | 7.2 | 6.3 |

Apr 1991 | 5.9 | 12.7 | 9.8 | 7.1 | 6.2 |

May 1991 | 6.1 | 12.8 | 10.0 | 7.2 | 6.6 |

Jun 1991 | 6.2 | 12.5 | 10.1 | 7.2 | 6.5 |

Jul 1991 | 6.2 | 11.9 | 9.6 | 7.2 | 6.3 |

Aug 1991 | 6.2 | 12.4 | 10.5 | 7.2 | 6.5 |

Sep 1991 | 6.2 | 12.3 | 10.9 | 7.3 | 6.4 |

Oct 1991 | 6.2 | 13.3 | 10.7 | 7.3 | 6.6 |

Nov 1991 | 6.3 | 12.5 | 10.4 | 7.4 | 6.7 |

Dec 1991 | 6.5 | 12.9 | 10.2 | 7.6 | 6.9 |

Jan 1992 | 6.4 | 13.5 | 11.0 | 7.8 | 6.7 |

Feb 1992 | 6.5 | 14.2 | 11.3 | 7.9 | 6.9 |

Mar 1992 | 6.5 | 14.1 | 11.2 | 7.9 | 6.9 |

Apr 1992 | 6.5 | 14.1 | 11.0 | 7.7 | 6.9 |

May 1992 | 6.6 | 14.7 | 11.7 | 8.1 | 7.1 |

Jun 1992 | 6.9 | 14.6 | 12.1 | 8.3 | 7.3 |

Jul 1992 | 6.7 | 14.4 | 11.7 | 8.0 | 7.3 |

Aug 1992 | 6.7 | 14.2 | 11.7 | 8.0 | 7.2 |

Sep 1992 | 6.7 | 13.9 | 11.8 | 8.0 | 7.2 |

Oct 1992 | 6.5 | 14.3 | 11.8 | 7.8 | 6.8 |

Nov 1992 | 6.5 | 14.1 | 12.0 | 7.8 | 7.0 |

Dec 1992 | 6.5 | 14.3 | 11.5 | 7.6 | 7.2 |

Jan 1993 | 6.3 | 14.1 | 11.3 | 7.4 | 7.0 |

Feb 1993 | 6.2 | 13.5 | 11.5 | 7.4 | 6.9 |

Mar 1993 | 6.1 | 13.7 | 11.3 | 7.5 | 6.5 |

Apr 1993 | 6.1 | 14.0 | 11.0 | 7.4 | 6.7 |

May 1993 | 6.2 | 13.1 | 10.2 | 7.3 | 6.8 |

Jun 1993 | 6.2 | 13.4 | 10.4 | 7.4 | 6.7 |

Jul 1993 | 6.1 | 12.7 | 10.7 | 7.2 | 6.5 |

Aug 1993 | 6.0 | 12.3 | 9.8 | 7.1 | 6.4 |

Sep 1993 | 5.9 | 12.5 | 10.0 | 7.0 | 6.4 |

Oct 1993 | 6.2 | 11.8 | 11.4 | 6.9 | 6.5 |

Nov 1993 | 5.7 | 12.6 | 10.5 | 6.7 | 6.5 |

Dec 1993 | 5.8 | 11.7 | 10.6 | 6.6 | 6.4 |

Jan 1994 | 5.7 | 13.1 | 10.5 | 6.8 | 6.4 |

Feb 1994 | 5.7 | 12.8 | 10.1 | 6.7 | 6.4 |

Mar 1994 | 5.7 | 12.4 | 9.9 | 6.5 | 6.5 |

Apr 1994 | 5.6 | 11.9 | 10.8 | 6.4 | 6.3 |

May 1994 | 5.2 | 11.7 | 9.6 | 6.1 | 6.0 |

Jun 1994 | 5.3 | 11.3 | 10.3 | 6.1 | 6.1 |

Jul 1994 | 5.3 | 10.9 | 10.1 | 6.3 | 5.9 |

Aug 1994 | 5.2 | 11.2 | 9.8 | 6.1 | 6.0 |

Sep 1994 | 5.1 | 10.6 | 10.1 | 5.8 | 5.9 |

Oct 1994 | 5.0 | 11.3 | 9.5 | 5.8 | 5.7 |

Nov 1994 | 4.8 | 10.8 | 8.9 | 5.6 | 5.6 |

Dec 1994 | 4.8 | 9.9 | 9.3 | 5.5 | 5.5 |

Jan 1995 | 4.8 | 10.3 | 10.2 | 5.6 | 5.6 |

Feb 1995 | 4.7 | 10.1 | 9.0 | 5.4 | 5.5 |

Mar 1995 | 4.7 | 9.7 | 8.9 | 5.3 | 5.5 |

Apr 1995 | 5.0 | 10.7 | 8.9 | 5.6 | 5.9 |

May 1995 | 5.0 | 10.0 | 9.8 | 5.8 | 5.5 |

Jun 1995 | 4.9 | 10.7 | 9.1 | 5.6 | 5.7 |

Jul 1995 | 4.9 | 10.9 | 8.8 | 5.6 | 5.8 |

Aug 1995 | 4.9 | 11.1 | 9.6 | 5.7 | 5.6 |

Sep 1995 | 4.9 | 11.1 | 9.1 | 5.6 | 5.7 |

Oct 1995 | 4.9 | 10.0 | 9.4 | 5.4 | 5.7 |

Nov 1995 | 5.0 | 9.7 | 9.5 | 5.7 | 5.5 |

Dec 1995 | 4.9 | 10.2 | 9.3 | 5.7 | 5.5 |

Jan 1996 | 4.9 | 10.6 | 9.4 | 5.6 | 5.8 |

Feb 1996 | 4.8 | 10.0 | 9.6 | 5.6 | 5.4 |

Mar 1996 | 4.8 | 10.6 | 9.6 | 5.6 | 5.3 |

Apr 1996 | 4.8 | 10.7 | 9.6 | 5.6 | 5.5 |

May 1996 | 4.9 | 10.2 | 9.6 | 5.6 | 5.5 |

Jun 1996 | 4.6 | 10.4 | 8.8 | 5.3 | 5.3 |

Jul 1996 | 4.7 | 10.6 | 8.8 | 5.5 | 5.4 |

Aug 1996 | 4.4 | 10.6 | 8.8 | 5.0 | 5.3 |

Sep 1996 | 4.5 | 10.6 | 8.2 | 5.2 | 5.2 |

Oct 1996 | 4.5 | 10.7 | 8.0 | 5.1 | 5.4 |

Nov 1996 | 4.6 | 10.6 | 8.5 | 5.3 | 5.4 |

Dec 1996 | 4.6 | 10.5 | 7.4 | 5.0 | 5.7 |

Jan 1997 | 4.5 | 10.8 | 8.4 | 5.3 | 5.3 |

Feb 1997 | 4.5 | 10.7 | 8.2 | 5.1 | 5.4 |

Mar 1997 | 4.4 | 10.5 | 8.3 | 5.1 | 5.2 |

Apr 1997 | 4.3 | 10.2 | 8.2 | 5.1 | 5.0 |

May 1997 | 4.1 | 10.3 | 7.7 | 4.6 | 5.2 |

Jun 1997 | 4.2 | 10.8 | 7.5 | 5.0 | 5.0 |

Jul 1997 | 4.2 | 9.5 | 7.9 | 4.8 | 5.0 |

Aug 1997 | 4.2 | 9.4 | 7.2 | 4.8 | 4.9 |

Sep 1997 | 4.2 | 9.5 | 7.4 | 4.7 | 5.0 |

Oct 1997 | 4.1 | 9.5 | 7.8 | 4.7 | 4.7 |

Nov 1997 | 3.9 | 9.5 | 7.0 | 4.6 | 4.7 |

Dec 1997 | 3.9 | 10.0 | 7.3 | 4.7 | 4.8 |

Jan 1998 | 4.0 | 9.4 | 7.1 | 4.5 | 4.8 |

Feb 1998 | 3.9 | 9.3 | 6.9 | 4.5 | 4.8 |

Mar 1998 | 4.0 | 9.2 | 6.9 | 4.6 | 4.8 |

Apr 1998 | 3.7 | 9.1 | 6.7 | 4.1 | 4.6 |

May 1998 | 3.8 | 8.9 | 6.9 | 4.3 | 4.5 |

Jun 1998 | 3.9 | 8.8 | 7.4 | 4.4 | 4.6 |

Jul 1998 | 3.8 | 9.5 | 7.3 | 4.6 | 4.5 |

Aug 1998 | 3.9 | 8.8 | 7.4 | 4.4 | 4.6 |

Sep 1998 | 3.9 | 9.1 | 7.3 | 4.6 | 4.6 |

Oct 1998 | 3.9 | 8.6 | 7.2 | 4.4 | 4.7 |

Nov 1998 | 3.8 | 8.6 | 7.1 | 4.3 | 4.6 |

Dec 1998 | 3.8 | 7.7 | 7.7 | 4.3 | 4.4 |

Jan 1999 | 3.8 | 7.8 | 6.7 | 4.2 | 4.4 |

Feb 1999 | 3.8 | 8.2 | 6.7 | 4.3 | 4.5 |

Mar 1999 | 3.6 | 8.0 | 5.8 | 3.9 | 4.4 |

Apr 1999 | 3.8 | 7.8 | 7.0 | 4.1 | 4.6 |

May 1999 | 3.7 | 7.4 | 6.7 | 4.2 | 4.2 |

Jun 1999 | 3.8 | 7.7 | 6.6 | 4.2 | 4.4 |

Jul 1999 | 3.7 | 8.7 | 6.5 | 4.2 | 4.5 |

Aug 1999 | 3.7 | 7.7 | 6.5 | 4.1 | 4.3 |

Sep 1999 | 3.6 | 8.5 | 6.7 | 4.1 | 4.4 |

Oct 1999 | 3.5 | 8.4 | 6.4 | 4.1 | 4.1 |

Nov 1999 | 3.5 | 8.0 | 6.0 | 4.0 | 4.2 |

Dec 1999 | 3.5 | 7.8 | 5.8 | 4.0 | 4.1 |

Jan 2000 | 3.4 | 8.2 | 5.6 | 3.9 | 4.1 |

Feb 2000 | 3.6 | 8.1 | 5.7 | 4.1 | 4.1 |

Mar 2000 | 3.5 | 7.4 | 6.1 | 3.8 | 4.3 |

Apr 2000 | 3.4 | 7.0 | 5.5 | 3.7 | 4.0 |

May 2000 | 3.5 | 7.7 | 5.8 | 3.9 | 4.2 |

Jun 2000 | 3.4 | 7.8 | 5.6 | 3.8 | 4.1 |

Jul 2000 | 3.5 | 7.7 | 5.8 | 3.9 | 4.2 |

Aug 2000 | 3.6 | 7.9 | 5.9 | 3.9 | 4.3 |

Sep 2000 | 3.5 | 7.3 | 5.8 | 3.9 | 4.0 |

Oct 2000 | 3.4 | 7.3 | 5.1 | 3.9 | 3.9 |

Nov 2000 | 3.5 | 7.3 | 6.0 | 3.9 | 4.0 |

Dec 2000 | 3.5 | 7.4 | 5.7 | 4.0 | 3.8 |

Jan 2001 | 3.6 | 8.2 | 5.8 | 4.2 | 4.1 |

Feb 2001 | 3.7 | 7.7 | 6.1 | 4.3 | 4.2 |

Mar 2001 | 3.7 | 8.3 | 6.2 | 4.3 | 4.2 |

Apr 2001 | 3.9 | 8.0 | 6.4 | 4.5 | 4.3 |

May 2001 | 3.8 | 7.9 | 6.3 | 4.4 | 4.2 |

Jun 2001 | 4.0 | 8.3 | 6.6 | 4.6 | 4.4 |

Jul 2001 | 4.0 | 8.0 | 6.2 | 4.6 | 4.5 |

Aug 2001 | 4.3 | 9.1 | 6.5 | 5.0 | 4.8 |

Sep 2001 | 4.3 | 8.9 | 6.7 | 4.9 | 5.0 |

Oct 2001 | 4.7 | 9.5 | 7.1 | 5.4 | 5.2 |

Nov 2001 | 4.9 | 9.8 | 7.3 | 5.7 | 5.4 |

Dec 2001 | 5.1 | 10.1 | 7.7 | 5.8 | 5.7 |

Jan 2002 | 5.1 | 10.0 | 7.8 | 5.8 | 5.5 |

Feb 2002 | 5.0 | 9.9 | 7.0 | 5.8 | 5.5 |

Mar 2002 | 5.0 | 10.5 | 7.5 | 5.9 | 5.6 |

Apr 2002 | 5.2 | 10.7 | 8.0 | 6.0 | 5.9 |

May 2002 | 5.1 | 10.2 | 7.1 | 5.8 | 5.7 |

Jun 2002 | 5.1 | 10.5 | 7.4 | 6.0 | 5.6 |

Jul 2002 | 5.2 | 9.8 | 7.4 | 5.9 | 5.7 |

Aug 2002 | 5.1 | 9.8 | 7.5 | 5.9 | 5.5 |

Sep 2002 | 5.1 | 9.7 | 7.4 | 5.9 | 5.5 |

Oct 2002 | 5.1 | 9.8 | 7.9 | 5.8 | 5.6 |

Nov 2002 | 5.1 | 10.7 | 7.8 | 6.1 | 5.6 |

Dec 2002 | 5.1 | 11.3 | 7.9 | 6.2 | 5.7 |

Jan 2003 | 5.2 | 10.5 | 7.9 | 6.2 | 5.4 |

Feb 2003 | 5.1 | 10.7 | 7.6 | 6.1 | 5.6 |

Mar 2003 | 5.1 | 10.3 | 7.8 | 6.1 | 5.7 |

Apr 2003 | 5.3 | 10.9 | 7.6 | 6.4 | 5.7 |

May 2003 | 5.4 | 10.9 | 8.1 | 6.4 | 5.7 |

Jun 2003 | 5.5 | 11.5 | 8.4 | 6.7 | 5.9 |

Jul 2003 | 5.4 | 10.9 | 8.1 | 6.6 | 5.7 |

Aug 2003 | 5.4 | 10.9 | 7.7 | 6.3 | 5.8 |

Sep 2003 | 5.3 | 11.1 | 7.3 | 6.4 | 5.8 |

Oct 2003 | 5.1 | 11.4 | 7.4 | 6.2 | 5.7 |

Nov 2003 | 5.2 | 10.2 | 7.5 | 6.2 | 5.4 |

Dec 2003 | 5.0 | 10.1 | 6.6 | 5.8 | 5.6 |

Jan 2004 | 5.0 | 10.4 | 7.4 | 5.7 | 5.7 |

Feb 2004 | 4.9 | 9.7 | 7.4 | 5.6 | 5.5 |

Mar 2004 | 5.1 | 10.3 | 7.5 | 5.8 | 5.8 |

Apr 2004 | 5.0 | 9.8 | 7.1 | 5.7 | 5.4 |

May 2004 | 4.9 | 10.1 | 7.0 | 5.8 | 5.4 |

Jun 2004 | 5.0 | 10.2 | 6.6 | 5.7 | 5.6 |

Jul 2004 | 4.7 | 11.0 | 6.9 | 5.5 | 5.5 |

Aug 2004 | 4.7 | 10.5 | 6.8 | 5.6 | 5.2 |

Sep 2004 | 4.6 | 10.3 | 6.9 | 5.6 | 5.2 |

Oct 2004 | 4.6 | 10.8 | 6.7 | 5.6 | 5.3 |

Nov 2004 | 4.6 | 10.7 | 6.7 | 5.5 | 5.2 |

Dec 2004 | 4.5 | 10.7 | 6.5 | 5.5 | 5.1 |

Jan 2005 | 4.5 | 10.6 | 6.2 | 5.4 | 5.1 |

Feb 2005 | 4.6 | 10.9 | 6.4 | 5.5 | 5.3 |

Mar 2005 | 4.5 | 10.5 | 5.8 | 5.3 | 5.1 |

Apr 2005 | 4.4 | 10.3 | 6.4 | 5.1 | 5.2 |

May 2005 | 4.4 | 10.1 | 5.9 | 5.0 | 5.2 |

Jun 2005 | 4.3 | 10.2 | 5.7 | 5.0 | 5.1 |

Jul 2005 | 4.2 | 9.2 | 5.5 | 4.9 | 5.1 |

Aug 2005 | 4.2 | 9.7 | 5.8 | 4.9 | 4.9 |

Sep 2005 | 4.4 | 9.4 | 6.5 | 5.0 | 5.1 |

Oct 2005 | 4.4 | 9.1 | 5.9 | 4.8 | 5.1 |

Nov 2005 | 4.3 | 10.6 | 6.2 | 5.0 | 5.1 |

Dec 2005 | 4.2 | 9.2 | 6.1 | 4.8 | 4.9 |

Jan 2006 | 4.1 | 8.9 | 5.7 | 4.6 | 4.8 |

Feb 2006 | 4.1 | 9.5 | 5.5 | 4.8 | 4.8 |

Mar 2006 | 4.0 | 9.5 | 5.2 | 4.7 | 4.7 |

Apr 2006 | 4.1 | 9.4 | 5.3 | 4.7 | 4.7 |

May 2006 | 4.1 | 8.7 | 4.9 | 4.7 | 4.5 |

Jun 2006 | 4.1 | 8.9 | 5.2 | 4.6 | 4.6 |

Jul 2006 | 4.1 | 9.5 | 5.3 | 4.7 | 4.7 |

Aug 2006 | 4.1 | 8.8 | 5.3 | 4.7 | 4.6 |

Sep 2006 | 3.9 | 9.0 | 5.5 | 4.4 | 4.7 |

Oct 2006 | 3.9 | 8.4 | 4.7 | 4.4 | 4.4 |

Nov 2006 | 4.0 | 8.5 | 5.1 | 4.5 | 4.5 |

Dec 2006 | 3.9 | 8.3 | 5.0 | 4.5 | 4.4 |

Jan 2007 | 4.2 | 7.9 | 5.8 | 4.7 | 4.5 |

Feb 2007 | 4.1 | 8.0 | 5.3 | 4.7 | 4.3 |

Mar 2007 | 3.8 | 8.4 | 5.1 | 4.5 | 4.3 |

Apr 2007 | 4.0 | 8.3 | 5.5 | 4.6 | 4.4 |

May 2007 | 3.9 | 8.3 | 5.7 | 4.6 | 4.3 |

Jun 2007 | 4.1 | 8.5 | 5.6 | 4.7 | 4.4 |

Jul 2007 | 4.2 | 8.1 | 5.9 | 4.7 | 4.6 |

Aug 2007 | 4.2 | 7.6 | 5.5 | 4.7 | 4.6 |

Sep 2007 | 4.2 | 8.0 | 5.8 | 4.8 | 4.5 |

Oct 2007 | 4.1 | 8.5 | 5.6 | 4.8 | 4.6 |

Nov 2007 | 4.2 | 8.5 | 5.8 | 4.8 | 4.6 |

Dec 2007 | 4.4 | 9.0 | 6.3 | 5.1 | 4.9 |

Jan 2008 | 4.4 | 9.1 | 6.5 | 5.2 | 4.8 |

Feb 2008 | 4.4 | 8.4 | 6.3 | 5.0 | 4.7 |

Mar 2008 | 4.5 | 9.2 | 6.9 | 5.2 | 5.0 |

Apr 2008 | 4.4 | 8.6 | 6.9 | 5.1 | 4.8 |

May 2008 | 4.8 | 9.6 | 6.9 | 5.6 | 5.2 |

Jun 2008 | 5.0 | 9.4 | 7.7 | 5.8 | 5.3 |

Jul 2008 | 5.2 | 10.0 | 7.6 | 6.2 | 5.3 |

Aug 2008 | 5.5 | 10.6 | 8.1 | 6.3 | 5.9 |

Sep 2008 | 5.4 | 11.3 | 8.0 | 6.7 | 5.5 |

Oct 2008 | 5.9 | 11.4 | 8.8 | 7.1 | 5.9 |

Nov 2008 | 6.2 | 11.6 | 8.7 | 7.4 | 6.2 |

Dec 2008 | 6.7 | 12.1 | 9.4 | 8.0 | 6.5 |

Jan 2009 | 7.1 | 12.7 | 10.0 | 8.6 | 7.0 |

Feb 2009 | 7.5 | 13.7 | 11.1 | 9.2 | 7.3 |

Mar 2009 | 8.0 | 13.6 | 11.6 | 9.7 | 7.6 |

Apr 2009 | 8.1 | 14.9 | 11.4 | 10.1 | 7.6 |

May 2009 | 8.6 | 14.9 | 12.6 | 10.6 | 8.0 |

Jun 2009 | 8.7 | 14.8 | 12.2 | 10.6 | 8.3 |

Jul 2009 | 8.7 | 14.8 | 12.5 | 10.5 | 8.3 |

Aug 2009 | 8.9 | 14.9 | 13.1 | 10.8 | 8.3 |

Sep 2009 | 9.0 | 15.4 | 12.7 | 10.9 | 8.4 |

Oct 2009 | 9.3 | 16.0 | 13.0 | 11.2 | 8.7 |

Nov 2009 | 9.2 | 15.8 | 12.6 | 11.1 | 8.6 |

Dec 2009 | 9.0 | 16.2 | 12.8 | 10.9 | 8.7 |

Jan 2010 | 8.7 | 16.5 | 12.6 | 10.9 | 8.4 |

Feb 2010 | 8.9 | 16.0 | 12.4 | 10.8 | 8.6 |

Mar 2010 | 8.8 | 16.7 | 12.6 | 10.9 | 8.6 |

Apr 2010 | 9.0 | 16.4 | 12.4 | 10.8 | 8.8 |

May 2010 | 8.8 | 15.4 | 12.3 | 10.4 | 8.8 |

Jun 2010 | 8.6 | 15.2 | 12.4 | 10.4 | 8.3 |

Jul 2010 | 8.6 | 15.7 | 12.2 | 10.4 | 8.5 |

Aug 2010 | 8.7 | 16.1 | 12.1 | 10.4 | 8.6 |

Sep 2010 | 8.6 | 16.0 | 12.4 | 10.3 | 8.5 |

Oct 2010 | 8.6 | 15.9 | 12.5 | 10.2 | 8.8 |

Nov 2010 | 8.9 | 16.1 | 13.1 | 10.5 | 9.0 |

Dec 2010 | 8.5 | 15.8 | 12.9 | 10.0 | 8.6 |

Jan 2011 | 8.1 | 15.7 | 12.0 | 9.6 | 8.5 |

Feb 2011 | 8.0 | 15.4 | 11.6 | 9.4 | 8.5 |

Mar 2011 | 7.9 | 15.6 | 11.3 | 9.4 | 8.3 |

Apr 2011 | 8.1 | 16.2 | 11.8 | 9.5 | 8.4 |

May 2011 | 8.0 | 16.2 | 11.8 | 9.5 | 8.5 |

Jun 2011 | 8.1 | 16.2 | 11.6 | 9.7 | 8.5 |

Jul 2011 | 8.1 | 15.9 | 11.3 | 9.6 | 8.5 |

Aug 2011 | 7.9 | 16.7 | 11.3 | 9.5 | 8.5 |

Sep 2011 | 7.9 | 15.9 | 11.3 | 9.4 | 8.6 |

Oct 2011 | 8.0 | 15.0 | 11.4 | 9.4 | 8.4 |

Nov 2011 | 7.6 | 15.5 | 11.4 | 8.9 | 8.3 |

Dec 2011 | 7.5 | 15.8 | 11.0 | 8.7 | 8.3 |

Note: Persons whose ethnicity is identified as Hispanic or Latino may be of any race. | |||||

Source: Current Population Survey | Chart

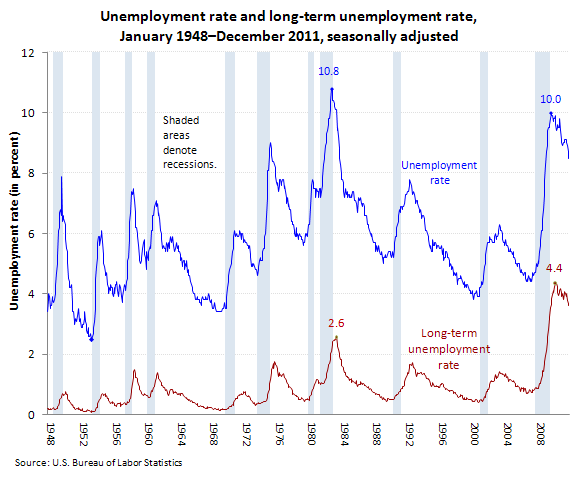

Unemployment rates of Blacks or African Americans and Hispanics or Latinos historically have been higher than the rate for Whites. In the months during and after the recent recession, unemployment rates for Blacks or African Americans and Hispanics or Latinos remained below the peaks they reached in 1982 and 1983, while the unemployment rate of Whites was very comparable to that of 1983.

| Month | White | Black or African American | Hispanic or Latino | Men | Women |

|---|---|---|---|---|---|

Jan 1948 | — | — | — | 3.4 | 3.3 |

Feb 1948 | — | — | — | 3.6 | 4.5 |

Mar 1948 | — | — | — | 3.8 | 4.4 |

Apr 1948 | — | — | — | 3.8 | 4.3 |

May 1948 | — | — | — | 3.5 | 3.7 |

Jun 1948 | — | — | — | 3.3 | 4.3 |

Jul 1948 | — | — | — | 3.4 | 4.2 |

Aug 1948 | — | — | — | 3.6 | 4.4 |

Sep 1948 | — | — | — | 3.7 | 4.1 |

Oct 1948 | — | — | — | 3.6 | 4.0 |

Nov 1948 | — | — | — | 3.7 | 3.9 |

Dec 1948 | — | — | — | 3.9 | 4.2 |

Jan 1949 | — | — | — | 4.2 | 4.4 |

Feb 1949 | — | — | — | 4.6 | 4.8 |

Mar 1949 | — | — | — | 5.1 | 4.6 |

Apr 1949 | — | — | — | 5.3 | 5.5 |

May 1949 | — | — | — | 6.1 | 6.0 |

Jun 1949 | — | — | — | 6.2 | 6.2 |

Jul 1949 | — | — | — | 6.7 | 6.8 |

Aug 1949 | — | — | — | 6.8 | 6.8 |

Sep 1949 | — | — | — | 6.5 | 6.8 |

Oct 1949 | — | — | — | 8.4 | 6.8 |

Nov 1949 | — | — | — | 6.5 | 6.3 |

Dec 1949 | — | — | — | 6.5 | 6.8 |

Jan 1950 | — | — | — | 6.4 | 6.9 |

Feb 1950 | — | — | — | 6.2 | 6.8 |

Mar 1950 | — | — | — | 6.1 | 6.7 |

Apr 1950 | — | — | — | 5.9 | 5.4 |

May 1950 | — | — | — | 5.4 | 5.8 |

Jun 1950 | — | — | — | 5.1 | 6.1 |

Jul 1950 | — | — | — | 4.8 | 5.6 |

Aug 1950 | — | — | — | 4.3 | 4.8 |

Sep 1950 | — | — | — | 4.2 | 5.1 |

Oct 1950 | — | — | — | 3.9 | 4.8 |

Nov 1950 | — | — | — | 3.7 | 5.2 |

Dec 1950 | — | — | — | 3.8 | 5.2 |

Jan 1951 | — | — | — | 3.3 | 4.6 |

Feb 1951 | — | — | — | 3.0 | 4.5 |

Mar 1951 | — | — | — | 2.7 | 4.9 |

Apr 1951 | — | — | — | 2.5 | 4.4 |

May 1951 | — | — | — | 2.5 | 4.2 |

Jun 1951 | — | — | — | 2.8 | 4.3 |

Jul 1951 | — | — | — | 2.7 | 4.0 |

Aug 1951 | — | — | — | 2.8 | 3.9 |

Sep 1951 | — | — | — | 2.8 | 4.6 |

Oct 1951 | — | — | — | 3.1 | 4.5 |

Nov 1951 | — | — | — | 3.1 | 4.5 |

Dec 1951 | — | — | — | 2.7 | 4.2 |

Jan 1952 | — | — | — | 2.8 | 3.9 |

Feb 1952 | — | — | — | 2.8 | 3.8 |

Mar 1952 | — | — | — | 2.7 | 3.5 |

Apr 1952 | — | — | — | 2.7 | 3.5 |

May 1952 | — | — | — | 2.6 | 3.9 |

Jun 1952 | — | — | — | 2.8 | 3.5 |

Jul 1952 | — | — | — | 3.0 | 3.7 |

Aug 1952 | — | — | — | 3.2 | 3.8 |

Sep 1952 | — | — | — | 3.0 | 3.3 |

Oct 1952 | — | — | — | 2.6 | 3.8 |

Nov 1952 | — | — | — | 2.5 | 3.4 |

Dec 1952 | — | — | — | 2.5 | 3.1 |

Jan 1953 | — | — | — | 2.8 | 3.1 |

Feb 1953 | — | — | — | 2.4 | 2.9 |

Mar 1953 | — | — | — | 2.3 | 3.2 |

Apr 1953 | — | — | — | 2.6 | 3.0 |

May 1953 | — | — | — | 2.5 | 2.7 |

Jun 1953 | — | — | — | 2.4 | 2.8 |

Jul 1953 | — | — | — | 2.5 | 2.9 |

Aug 1953 | — | — | — | 2.5 | 3.0 |

Sep 1953 | — | — | — | 2.7 | 3.4 |

Oct 1953 | — | — | — | 2.9 | 3.6 |

Nov 1953 | — | — | — | 3.4 | 3.7 |

Dec 1953 | — | — | — | 4.2 | 5.1 |

Jan 1954 | 4.5 | — | — | 4.4 | 5.9 |

Feb 1954 | 4.9 | — | — | 4.9 | 5.9 |

Mar 1954 | 5.0 | — | — | 5.3 | 6.4 |

Apr 1954 | 5.5 | — | — | 5.6 | 6.4 |

May 1954 | 5.3 | — | — | 5.7 | 6.3 |

Jun 1954 | 5.0 | — | — | 5.3 | 6.2 |

Jul 1954 | 5.3 | — | — | 5.6 | 6.3 |

Aug 1954 | 5.6 | — | — | 6.0 | 6.2 |

Sep 1954 | 5.9 | — | — | 6.0 | 6.4 |

Oct 1954 | 5.1 | — | — | 5.7 | 5.8 |

Nov 1954 | 4.7 | — | — | 5.2 | 5.6 |

Dec 1954 | 4.4 | — | — | 5.0 | 5.2 |

Jan 1955 | 4.5 | — | — | 4.8 | 5.3 |

Feb 1955 | 4.1 | — | — | 4.5 | 5.0 |

Mar 1955 | 4.0 | — | — | 4.5 | 4.8 |

Apr 1955 | 4.3 | — | — | 4.7 | 4.7 |

May 1955 | 3.8 | — | — | 4.0 | 4.7 |

Jun 1955 | 3.7 | — | — | 3.9 | 4.7 |

Jul 1955 | 3.6 | — | — | 3.8 | 4.6 |

Aug 1955 | 3.6 | — | — | 3.9 | 4.9 |

Sep 1955 | 3.6 | — | — | 3.7 | 5.0 |

Oct 1955 | 3.7 | — | — | 3.9 | 5.1 |

Nov 1955 | 3.6 | — | — | 3.9 | 4.9 |

Dec 1955 | 3.7 | — | — | 3.8 | 4.9 |

Jan 1956 | 3.5 | — | — | 3.8 | 4.5 |

Feb 1956 | 3.6 | — | — | 3.8 | 4.3 |

Mar 1956 | 3.7 | — | — | 3.8 | 5.1 |

Apr 1956 | 3.6 | — | — | 3.6 | 4.8 |

May 1956 | 3.8 | — | — | 3.9 | 5.0 |

Jun 1956 | 3.7 | — | — | 4.0 | 5.1 |

Jul 1956 | 3.8 | — | — | 3.8 | 5.7 |

Aug 1956 | 3.4 | — | — | 3.7 | 4.8 |

Sep 1956 | 3.5 | — | — | 3.6 | 4.6 |

Oct 1956 | 3.4 | — | — | 3.5 | 4.7 |

Nov 1956 | 3.8 | — | — | 4.0 | 4.9 |

Dec 1956 | 3.8 | — | — | 3.9 | 4.7 |

Jan 1957 | 3.8 | — | — | 3.9 | 4.8 |

Feb 1957 | 3.6 | — | — | 3.6 | 4.5 |

Mar 1957 | 3.4 | — | — | 3.5 | 4.3 |

Apr 1957 | 3.5 | — | — | 3.8 | 4.2 |

May 1957 | 3.6 | — | — | 3.8 | 4.7 |

Jun 1957 | 3.7 | — | — | 4.0 | 4.8 |

Jul 1957 | 3.7 | — | — | 3.8 | 4.8 |

Aug 1957 | 3.7 | — | — | 3.9 | 4.7 |

Sep 1957 | 3.9 | — | — | 4.3 | 4.6 |

Oct 1957 | 4.0 | — | — | 4.4 | 4.6 |

Nov 1957 | 4.6 | — | — | 5.2 | 5.1 |

Dec 1957 | 4.7 | — | — | 5.2 | 5.1 |

Jan 1958 | 5.2 | — | — | 5.7 | 5.9 |

Feb 1958 | 5.7 | — | — | 6.3 | 6.6 |

Mar 1958 | 5.9 | — | — | 6.7 | 6.6 |

Apr 1958 | 6.7 | — | — | 7.3 | 7.6 |

May 1958 | 6.7 | — | — | 7.5 | 7.3 |

Jun 1958 | 6.6 | — | — | 7.4 | 7.1 |

Jul 1958 | 6.8 | — | — | 7.6 | 7.3 |

Aug 1958 | 6.7 | — | — | 7.5 | 7.2 |

Sep 1958 | 6.4 | — | — | 7.1 | 7.0 |

Oct 1958 | 6.0 | — | — | 6.7 | 6.7 |

Nov 1958 | 5.5 | — | — | 6.3 | 6.0 |

Dec 1958 | 5.5 | — | — | 6.2 | 6.2 |

Jan 1959 | 5.3 | — | — | 5.9 | 6.2 |

Feb 1959 | 5.2 | — | — | 5.8 | 6.0 |

Mar 1959 | 4.9 | — | — | 5.3 | 6.2 |

Apr 1959 | 4.7 | — | — | 4.8 | 6.1 |

May 1959 | 4.5 | — | — | 4.8 | 5.8 |

Jun 1959 | 4.4 | — | — | 4.7 | 5.6 |

Jul 1959 | 4.5 | — | — | 4.9 | 5.7 |

Aug 1959 | 4.6 | — | — | 5.1 | 5.6 |

Sep 1959 | 4.9 | — | — | 5.5 | 5.6 |

Oct 1959 | 5.0 | — | — | 5.5 | 6.1 |

Nov 1959 | 5.3 | — | — | 5.9 | 5.8 |

Dec 1959 | 4.7 | — | — | 5.0 | 5.8 |

Jan 1960 | 4.6 | — | — | 5.0 | 5.7 |

Feb 1960 | 4.3 | — | — | 4.6 | 5.4 |

Mar 1960 | 4.8 | — | — | 5.3 | 5.8 |

Apr 1960 | 4.6 | — | — | 5.0 | 5.5 |

May 1960 | 4.6 | — | — | 5.0 | 5.5 |

Jun 1960 | 4.8 | — | — | 5.2 | 5.7 |

Jul 1960 | 4.9 | — | — | 5.3 | 5.8 |

Aug 1960 | 5.1 | — | — | 5.6 | 5.8 |

Sep 1960 | 5.1 | — | — | 5.5 | 5.7 |

Oct 1960 | 5.5 | — | — | 5.9 | 6.4 |

Nov 1960 | 5.5 | — | — | 6.0 | 6.5 |

Dec 1960 | 5.9 | — | — | 6.3 | 7.0 |

Jan 1961 | 5.9 | — | — | 6.5 | 6.9 |

Feb 1961 | 6.2 | — | — | 6.6 | 7.3 |

Mar 1961 | 6.2 | — | — | 6.6 | 7.4 |

Apr 1961 | 6.2 | — | — | 6.8 | 7.4 |

May 1961 | 6.3 | — | — | 6.9 | 7.4 |

Jun 1961 | 6.2 | — | — | 6.5 | 7.6 |

Jul 1961 | 6.3 | — | — | 6.6 | 7.7 |

Aug 1961 | 5.9 | — | — | 6.4 | 7.0 |

Sep 1961 | 5.9 | — | — | 6.3 | 7.3 |

Oct 1961 | 5.7 | — | — | 6.1 | 7.2 |

Nov 1961 | 5.4 | — | — | 5.8 | 6.6 |

Dec 1961 | 5.3 | — | — | 5.7 | 6.4 |

Jan 1962 | 5.1 | — | — | 5.4 | 6.7 |

Feb 1962 | 4.8 | — | — | 5.2 | 6.2 |

Mar 1962 | 4.8 | — | — | 5.2 | 6.3 |

Apr 1962 | 4.7 | — | — | 5.2 | 6.2 |

May 1962 | 4.8 | — | — | 5.2 | 6.0 |

Jun 1962 | 4.8 | — | — | 5.3 | 5.8 |

Jul 1962 | 4.8 | — | — | 5.1 | 6.1 |

Aug 1962 | 5.0 | — | — | 5.3 | 6.4 |

Sep 1962 | 5.0 | — | — | 5.2 | 6.3 |

Oct 1962 | 4.8 | — | — | 5.0 | 6.1 |

Nov 1962 | 5.0 | — | — | 5.3 | 6.3 |

Dec 1962 | 4.8 | — | — | 5.1 | 6.2 |

Jan 1963 | 5.0 | — | — | 5.4 | 6.4 |

Feb 1963 | 5.3 | — | — | 5.7 | 6.5 |

Mar 1963 | 5.0 | — | — | 5.4 | 6.2 |

Apr 1963 | 5.1 | — | — | 5.4 | 6.2 |

May 1963 | 5.2 | — | — | 5.4 | 6.7 |

Jun 1963 | 4.9 | — | — | 5.1 | 6.4 |

Jul 1963 | 5.1 | — | — | 5.1 | 6.6 |

Aug 1963 | 4.8 | — | — | 4.9 | 6.3 |

Sep 1963 | 4.8 | — | — | 4.9 | 6.6 |

Oct 1963 | 4.8 | — | — | 5.0 | 6.6 |

Nov 1963 | 5.0 | — | — | 5.3 | 6.6 |

Dec 1963 | 5.0 | — | — | 5.0 | 6.4 |

Jan 1964 | 5.0 | — | — | 5.0 | 6.6 |

Feb 1964 | 4.9 | — | — | 4.8 | 6.5 |

Mar 1964 | 4.9 | — | — | 4.8 | 6.6 |

Apr 1964 | 4.8 | — | — | 4.8 | 6.4 |

May 1964 | 4.5 | — | — | 4.5 | 6.3 |

Jun 1964 | 4.7 | — | — | 4.7 | 6.2 |

Jul 1964 | 4.3 | — | — | 4.4 | 6.0 |

Aug 1964 | 4.4 | — | — | 4.5 | 5.9 |

Sep 1964 | 4.5 | — | — | 4.6 | 6.0 |

Oct 1964 | 4.6 | — | — | 4.5 | 6.1 |

Nov 1964 | 4.3 | — | — | 4.3 | 5.9 |

Dec 1964 | 4.5 | — | — | 4.3 | 6.2 |

Jan 1965 | 4.3 | — | — | 4.3 | 5.9 |

Feb 1965 | 4.5 | — | — | 4.3 | 6.4 |

Mar 1965 | 4.3 | — | — | 4.1 | 5.9 |

Apr 1965 | 4.4 | — | — | 4.3 | 5.9 |

May 1965 | 4.2 | — | — | 4.1 | 5.5 |

Jun 1965 | 4.2 | — | — | 3.9 | 5.7 |

Jul 1965 | 3.9 | — | — | 3.9 | 5.3 |

Aug 1965 | 4.0 | — | — | 3.9 | 5.2 |

Sep 1965 | 3.8 | — | — | 3.7 | 5.4 |

Oct 1965 | 3.8 | — | — | 3.7 | 5.1 |

Nov 1965 | 3.7 | — | — | 3.4 | 5.4 |

Dec 1965 | 3.6 | — | — | 3.4 | 5.1 |

Jan 1966 | 3.5 | — | — | 3.4 | 5.0 |

Feb 1966 | 3.4 | — | — | 3.3 | 4.7 |

Mar 1966 | 3.4 | — | — | 3.3 | 4.8 |

Apr 1966 | 3.3 | — | — | 3.1 | 4.8 |

May 1966 | 3.5 | — | — | 3.2 | 5.2 |

Jun 1966 | 3.4 | — | — | 3.2 | 4.9 |

Jul 1966 | 3.3 | — | — | 3.2 | 4.8 |

Aug 1966 | 3.3 | — | — | 3.2 | 4.9 |

Sep 1966 | 3.2 | — | — | 3.1 | 4.7 |

Oct 1966 | 3.3 | — | — | 3.0 | 4.9 |

Nov 1966 | 3.2 | — | — | 3.1 | 4.6 |

Dec 1966 | 3.3 | — | — | 3.2 | 4.8 |

Jan 1967 | 3.4 | — | — | 3.0 | 5.4 |

Feb 1967 | 3.3 | — | — | 3.0 | 5.2 |

Mar 1967 | 3.3 | — | — | 3.0 | 5.1 |

Apr 1967 | 3.4 | — | — | 3.1 | 4.9 |

May 1967 | 3.3 | — | — | 3.2 | 5.0 |

Jun 1967 | 3.5 | — | — | 3.2 | 5.1 |

Jul 1967 | 3.3 | — | — | 3.0 | 5.1 |

Aug 1967 | 3.4 | — | — | 3.1 | 4.9 |

Sep 1967 | 3.3 | — | — | 2.9 | 5.3 |

Oct 1967 | 3.5 | — | — | 3.1 | 5.6 |

Nov 1967 | 3.5 | — | — | 3.1 | 5.2 |

Dec 1967 | 3.4 | — | — | 3.1 | 5.1 |

Jan 1968 | 3.3 | — | — | 3.0 | 5.0 |

Feb 1968 | 3.4 | — | — | 3.1 | 5.1 |

Mar 1968 | 3.2 | — | — | 3.0 | 4.8 |

Apr 1968 | 3.1 | — | — | 2.8 | 4.7 |

May 1968 | 3.1 | — | — | 2.7 | 4.7 |

Jun 1968 | 3.4 | — | — | 3.0 | 4.9 |

Jul 1968 | 3.2 | — | — | 2.9 | 5.0 |

Aug 1968 | 3.2 | — | — | 2.8 | 4.7 |

Sep 1968 | 3.1 | — | — | 2.7 | 4.5 |

Oct 1968 | 3.0 | — | — | 2.7 | 4.5 |

Nov 1968 | 3.0 | — | — | 2.7 | 4.6 |

Dec 1968 | 3.0 | — | — | 2.7 | 4.6 |

Jan 1969 | 3.0 | — | — | 2.7 | 4.6 |

Feb 1969 | 3.0 | — | — | 2.6 | 4.6 |

Mar 1969 | 3.0 | — | — | 2.7 | 4.6 |

Apr 1969 | 3.0 | — | — | 2.6 | 4.7 |

May 1969 | 3.0 | — | — | 2.6 | 4.6 |

Jun 1969 | 3.1 | — | — | 2.7 | 4.8 |

Jul 1969 | 3.2 | — | — | 2.9 | 4.6 |

Aug 1969 | 3.1 | — | — | 2.8 | 4.8 |

Sep 1969 | 3.4 | — | — | 3.1 | 4.9 |

Oct 1969 | 3.4 | — | — | 3.0 | 5.0 |

Nov 1969 | 3.2 | — | — | 2.9 | 4.5 |

Dec 1969 | 3.3 | — | — | 3.0 | 4.5 |

Jan 1970 | 3.6 | — | — | 3.3 | 4.9 |

Feb 1970 | 3.8 | — | — | 3.6 | 5.1 |

Mar 1970 | 4.0 | — | — | 3.7 | 5.6 |

Apr 1970 | 4.1 | — | — | 4.0 | 5.5 |

May 1970 | 4.4 | — | — | 4.2 | 5.7 |

Jun 1970 | 4.5 | — | — | 4.5 | 5.7 |

Jul 1970 | 4.6 | — | — | 4.6 | 5.8 |

Aug 1970 | 4.7 | — | — | 4.6 | 6.0 |

Sep 1970 | 5.0 | — | — | 4.8 | 6.3 |

Oct 1970 | 5.2 | — | — | 5.0 | 6.4 |

Nov 1970 | 5.4 | — | — | 5.2 | 6.9 |

Dec 1970 | 5.6 | — | — | 5.6 | 6.9 |

Jan 1971 | 5.5 | — | — | 5.4 | 6.8 |

Feb 1971 | 5.3 | — | — | 5.3 | 6.8 |

Mar 1971 | 5.5 | — | — | 5.3 | 7.1 |

Apr 1971 | 5.4 | — | — | 5.2 | 7.0 |

May 1971 | 5.4 | — | — | 5.3 | 6.9 |

Jun 1971 | 5.5 | — | — | 5.3 | 6.9 |

Jul 1971 | 5.5 | — | — | 5.4 | 7.0 |

Aug 1971 | 5.6 | — | — | 5.5 | 7.0 |

Sep 1971 | 5.4 | — | — | 5.4 | 6.9 |

Oct 1971 | 5.4 | — | — | 5.2 | 6.8 |

Nov 1971 | 5.6 | — | — | 5.4 | 7.0 |

Dec 1971 | 5.4 | — | — | 5.5 | 6.8 |

Jan 1972 | 5.2 | 11.2 | — | 5.3 | 6.7 |

Feb 1972 | 5.1 | 11.2 | — | 5.3 | 6.4 |

Mar 1972 | 5.2 | 10.7 | — | 5.3 | 6.7 |

Apr 1972 | 5.3 | 9.8 | — | 5.1 | 6.7 |

May 1972 | 5.1 | 10.2 | — | 5.1 | 6.6 |

Jun 1972 | 5.1 | 10.2 | — | 4.9 | 6.8 |

Jul 1972 | 5.1 | 10.5 | — | 4.8 | 7.0 |

Aug 1972 | 5.1 | 10.6 | — | 4.9 | 6.9 |

Sep 1972 | 5.0 | 10.4 | — | 4.8 | 6.7 |

Oct 1972 | 5.1 | 10.6 | — | 4.8 | 6.8 |

Nov 1972 | 4.7 | 10.0 | — | 4.6 | 6.2 |

Dec 1972 | 4.6 | 9.4 | — | 4.5 | 6.2 |

Jan 1973 | 4.5 | 9.1 | — | 4.2 | 6.1 |

Feb 1973 | 4.5 | 9.5 | — | 4.3 | 6.2 |

Mar 1973 | 4.4 | 9.4 | 7.3 | 4.3 | 6.0 |

Apr 1973 | 4.5 | 9.9 | 7.9 | 4.3 | 6.1 |

May 1973 | 4.3 | 9.6 | 8.1 | 4.3 | 5.7 |

Jun 1973 | 4.3 | 9.8 | 7.9 | 4.1 | 6.0 |

Jul 1973 | 4.2 | 9.8 | 7.2 | 4.0 | 6.0 |

Aug 1973 | 4.3 | 9.2 | 7.4 | 4.1 | 6.0 |

Sep 1973 | 4.3 | 9.7 | 7.7 | 4.0 | 6.1 |

Oct 1973 | 4.1 | 8.8 | 8.0 | 3.9 | 5.7 |

Nov 1973 | 4.3 | 9.3 | 8.1 | 4.1 | 6.0 |

Dec 1973 | 4.4 | 9.0 | 7.6 | 4.2 | 6.1 |

Jan 1974 | 4.6 | 9.5 | 7.6 | 4.4 | 6.2 |

Feb 1974 | 4.6 | 9.8 | 7.8 | 4.5 | 6.2 |

Mar 1974 | 4.5 | 9.8 | 7.6 | 4.4 | 6.1 |

Apr 1974 | 4.5 | 9.5 | 7.0 | 4.5 | 6.0 |

May 1974 | 4.6 | 9.7 | 7.3 | 4.4 | 6.3 |

Jun 1974 | 4.8 | 10.1 | 8.6 | 4.6 | 6.5 |

Jul 1974 | 4.9 | 10.4 | 8.8 | 4.7 | 6.8 |

Aug 1974 | 5.0 | 9.9 | 8.1 | 4.8 | 6.5 |

Sep 1974 | 5.4 | 10.8 | 8.1 | 5.0 | 7.1 |

Oct 1974 | 5.4 | 11.5 | 8.2 | 5.3 | 7.1 |

Nov 1974 | 6.0 | 12.4 | 8.6 | 5.8 | 7.9 |

Dec 1974 | 6.4 | 13.1 | 9.1 | 6.4 | 8.3 |

Jan 1975 | 7.4 | 14.1 | 10.7 | 7.3 | 9.2 |

Feb 1975 | 7.4 | 14.4 | 11.2 | 7.4 | 9.1 |

Mar 1975 | 7.8 | 15.1 | 12.1 | 7.9 | 9.6 |

Apr 1975 | 8.0 | 15.3 | 12.4 | 8.2 | 9.6 |

May 1975 | 8.4 | 15.1 | 14.3 | 8.4 | 9.8 |

Jun 1975 | 8.1 | 15.0 | 11.7 | 8.3 | 9.4 |

Jul 1975 | 8.0 | 14.1 | 11.6 | 8.2 | 9.3 |

Aug 1975 | 7.7 | 15.2 | 12.1 | 7.9 | 9.2 |

Sep 1975 | 7.7 | 15.4 | 12.7 | 8.0 | 9.0 |

Oct 1975 | 7.7 | 14.9 | 13.0 | 7.8 | 9.2 |

Nov 1975 | 7.6 | 14.6 | 12.4 | 7.8 | 9.0 |

Dec 1975 | 7.4 | 14.5 | 12.1 | 7.6 | 9.1 |

Jan 1976 | 7.2 | 14.3 | 11.4 | 7.3 | 8.9 |

Feb 1976 | 6.9 | 14.4 | 10.7 | 7.0 | 8.8 |

Mar 1976 | 6.9 | 13.5 | 11.0 | 6.9 | 8.6 |

Apr 1976 | 6.9 | 13.8 | 11.7 | 7.0 | 8.6 |

May 1976 | 6.7 | 13.2 | 10.5 | 6.9 | 8.1 |

Jun 1976 | 6.9 | 14.3 | 11.1 | 7.1 | 8.4 |

Jul 1976 | 7.1 | 13.9 | 11.7 | 7.1 | 8.8 |

Aug 1976 | 7.1 | 14.3 | 12.4 | 6.9 | 9.0 |

Sep 1976 | 7.0 | 13.7 | 11.8 | 7.0 | 8.7 |

Oct 1976 | 7.0 | 13.9 | 11.6 | 7.0 | 8.7 |

Nov 1976 | 7.1 | 14.0 | 11.7 | 7.3 | 8.7 |

Dec 1976 | 7.0 | 14.1 | 11.7 | 7.2 | 8.5 |

Jan 1977 | 6.8 | 13.8 | 11.2 | 6.8 | 8.5 |

Feb 1977 | 6.9 | 14.2 | 11.4 | 7.0 | 8.6 |

Mar 1977 | 6.7 | 13.9 | 11.2 | 6.6 | 8.6 |

Apr 1977 | 6.4 | 12.8 | 9.6 | 6.4 | 8.4 |

May 1977 | 6.3 | 13.5 | 9.9 | 6.4 | 7.9 |

Jun 1977 | 6.4 | 13.9 | 10.1 | 6.4 | 8.4 |

Jul 1977 | 6.0 | 13.9 | 9.5 | 6.1 | 8.0 |

Aug 1977 | 6.0 | 15.1 | 9.4 | 6.2 | 8.1 |

Sep 1977 | 6.0 | 14.5 | 9.7 | 5.8 | 8.1 |

Oct 1977 | 5.9 | 14.5 | 9.4 | 6.0 | 7.9 |

Nov 1977 | 5.8 | 14.7 | 9.3 | 5.8 | 8.1 |

Dec 1977 | 5.5 | 13.6 | 8.8 | 5.5 | 7.5 |

Jan 1978 | 5.5 | 13.9 | 9.3 | 5.6 | 7.6 |

Feb 1978 | 5.5 | 13.1 | 9.9 | 5.6 | 7.2 |

Mar 1978 | 5.4 | 13.1 | 9.5 | 5.6 | 7.2 |

Apr 1978 | 5.3 | 12.9 | 8.5 | 5.3 | 7.1 |

May 1978 | 5.2 | 13.0 | 9.6 | 5.2 | 7.2 |

Jun 1978 | 5.0 | 12.8 | 9.1 | 4.9 | 7.2 |

Jul 1978 | 5.3 | 13.0 | 9.5 | 5.1 | 7.6 |

Aug 1978 | 5.1 | 12.3 | 9.1 | 5.0 | 7.2 |

Sep 1978 | 5.2 | 11.9 | 8.9 | 5.1 | 7.2 |

Oct 1978 | 5.0 | 11.8 | 8.5 | 5.1 | 6.7 |

Nov 1978 | 5.0 | 12.7 | 8.4 | 5.0 | 7.0 |

Dec 1978 | 5.2 | 12.4 | 8.7 | 5.3 | 7.0 |

Jan 1979 | 5.1 | 12.4 | 8.2 | 5.1 | 6.9 |

Feb 1979 | 5.1 | 13.1 | 7.7 | 5.2 | 6.9 |

Mar 1979 | 5.1 | 12.5 | 7.9 | 5.1 | 6.8 |

Apr 1979 | 5.0 | 12.9 | 8.2 | 5.1 | 6.8 |

May 1979 | 4.8 | 12.4 | 7.9 | 4.8 | 6.7 |

Jun 1979 | 4.9 | 12.2 | 8.4 | 4.9 | 6.8 |

Jul 1979 | 4.9 | 12.1 | 8.1 | 5.1 | 6.6 |

Aug 1979 | 5.3 | 12.4 | 8.7 | 5.2 | 7.1 |

Sep 1979 | 5.2 | 11.7 | 7.6 | 5.2 | 6.7 |

Oct 1979 | 5.2 | 12.3 | 8.7 | 5.3 | 6.9 |

Nov 1979 | 5.2 | 11.9 | 9.2 | 5.3 | 6.7 |

Dec 1979 | 5.2 | 12.2 | 9.1 | 5.3 | 6.8 |

Jan 1980 | 5.5 | 13.0 | 8.7 | 5.8 | 6.9 |

Feb 1980 | 5.5 | 12.9 | 8.9 | 5.8 | 7.0 |

Mar 1980 | 5.6 | 12.9 | 9.2 | 5.9 | 6.9 |

Apr 1980 | 6.1 | 13.8 | 10.4 | 6.7 | 7.2 |

May 1980 | 6.6 | 14.4 | 10.1 | 7.4 | 7.5 |

Jun 1980 | 6.7 | 14.6 | 10.1 | 7.6 | 7.6 |

Jul 1980 | 6.9 | 15.3 | 10.8 | 7.8 | 7.8 |

Aug 1980 | 6.9 | 14.6 | 10.8 | 7.7 | 7.8 |

Sep 1980 | 6.6 | 14.8 | 11.4 | 7.6 | 7.3 |