An official website of the United States government

United States Department of Labor

United States Department of Labor

About 1 in 4 workers currently covered by a traditional pension plan is in a multiemployer plan, established by a labor union and an industry or trade group to cover workers from two or more related employers. Through collective bargaining, employers agree to fund these plans with contributions to a pension trust fund based on employee hours worked. Multiemployer pension plans were created under the Labor Management Relations Act of 1947, known as the Taft-Hartley Act, and are often established in industries where workers move from job to job, such as construction or trucking.1 According to U.S. Department of Labor data, there were 1,442 multiemployer defined-benefit plans in 2011, covering 4.2 million active employees.2

Traditional pension plans, known as defined-benefit plans, provide periodic (often monthly) payments for life that are determined based on a fixed formula. These plans have been offered less often in recent years; replaced in many cases by defined-contribution plans, such as 401(k) plans, which identify employer and employee contributions but do not guarantee future benefits. This analysis focuses on defined-benefit plans.

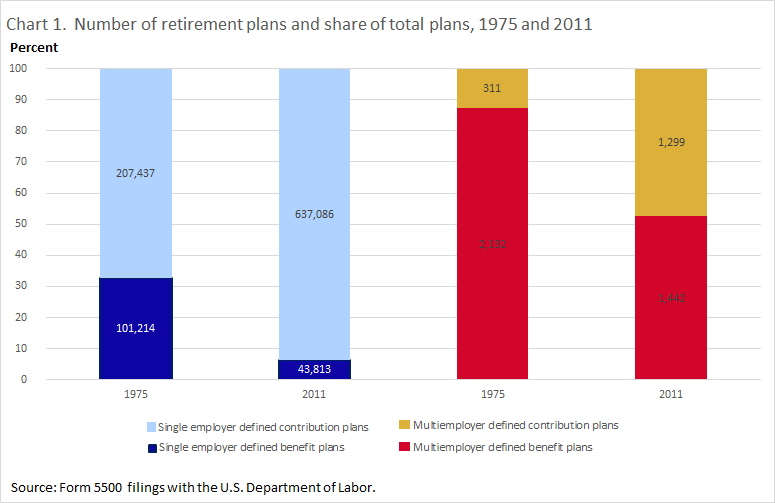

In private industry, retirement plans are generally single employer or multiemployer, with single-employer plans established by one employer specifically for their employees as opposed to multi-employer arrangements. Single-employer plans can be established through collective bargaining and can cover union workers, but they are limited to one employer. Although the number of single-employer plans and participants far outnumber multiemployer plans and participants, the shift from defined-benefit to defined-contribution plans is much more prevalent among single employers. Today, defined-contributions plans are predominant among single employers. The picture for multiemployers is more mixed, with similar numbers of defined-benefit and defined-contribution plans.

The U.S. Department of Labor has two programs that track information about retirement benefits. The Employee Benefits Security Administration (EBSA) tabulates data from the Form 5500 series, an annual mandatory reporting of certain retirement plan details. The Bureau of Labor Statistics (BLS) explores the features of retirement plans through its annual National Compensation Survey (NCS), a voluntary survey of employers yielding information on the coverage, cost, and provisions of various components of compensation, such as wages, health insurance, and retirement plans.3 This issue of Beyond the Numbers uses data from both sources to look at trends in multiemployer defined-benefit plan coverage. This article also focuses on certain plan features, including some of the unique characteristics of defined-benefit plans designed to support employees who have multiple jobs throughout their career.

There are many ways to count retirement plans, and to analyze change to those plans over time. Data from the Form 5500 series contain the number of plans, the total number of participants (including active participants, annuitants, those vested but not yet receiving benefits, and those receiving survivor benefits), and, separately, the number of active participants.4

In 2011, there were nearly 44,000 single-employer defined-benefit plans, less than half the total in 1975, when data were first available. In contrast, the number of multiemployer defined-benefit plans dropped by about one-third over the same time period, from 2,132 to 1,442. As evidence of the shift away from defined-benefit plans, such plans represented about 33 percent of all single-employer plans in 1975 but only 6 percent of all plans in 2011. Defined benefit plans dominated the multiemployer landscape in 1975, making up 87 percent of all multiemployer retirement plans. Since 2002, the number of multiemployer defined-benefit and defined-contribution plans has been roughly evenly split. (See chart 1.)

| Date | Single employer defined benefit plans | Single employer defined contribution plans | Multiemployer defined benefit plans | Multiemployer defined contribution plans |

|---|---|---|---|---|

| 1975 | 101,214 | 207,437 | 2,132 | 311 |

| 2011 | 43,813 | 637,086 | 1,442 | 1,299 |

| Single-employer plans | 1975 | 2011 |

|---|---|---|

| Total participants (1) | 24,514 | 30,443 |

| Active participants | 20,129 | 12,327 |

| Active participants as percent of total | 82.1 | 40.5 |

| Multiemployer plans | ||

| Total participants (1) | 8,490 | 10,433 |

| Active participants | 7,086 | 4,180 |

| Active participants as percent of total | 83.5 | 40.1 |

| Footnotes: Source: Form 5500 filings with the U.S. Department of Labor. | ||

In addition, the distribution of defined-benefit plan participants by sponsor in 2011 is similar to what it was in the mid-1970s. In 2011, about 1 in 4 defined-benefit participants were in multiemployer plans and about 1 in 4 active defined-benefit participants were in multiemployer plans. Although these shares were lower during the 1990s, they are similar to those identified in 1975, the first year in which data were available. (See chart 2.)

| Year | All participants | Active participants |

|---|---|---|

| 1975 | 25.7 | 26.0 |

| 1976 | 24.2 | 24.7 |

| 1977 | 23.6 | 23.7 |

| 1978 | 23.1 | 22.7 |

| 1979 | 23.2 | 22.7 |

| 1980 | 22.2 | 21.4 |

| 1981 | 22.0 | 21.2 |

| 1982 | 21.6 | 20.6 |

| 1983 | 21.5 | 20.4 |

| 1984 | 21.1 | 19.5 |

| 1985 | 20.8 | 19.2 |

| 1986 | 20.8 | 18.9 |

| 1987 | 20.8 | 18.5 |

| 1988 | 20.5 | 18.6 |

| 1989 | 21.8 | 19.9 |

| 1990 | 21.4 | 18.9 |

| 1991 | 21.4 | 19.2 |

| 1992 | 20.6 | 18.2 |

| 1993 | 20.2 | 17.8 |

| 1994 | 20.2 | 18.0 |

| 1995 | 21.1 | 19.3 |

| 1996 | 21.0 | 19.8 |

| 1997 | 21.6 | 20.5 |

| 1998 | 21.5 | 20.6 |

| 1999 | 21.6 | 20.6 |

| 2000 | 22.8 | 22.1 |

| 2001 | 22.9 | 22.6 |

| 2002 | 22.1 | 21.7 |

| 2003 | 22.4 | 22.0 |

| 2004 | 22.7 | 22.3 |

| 2005 | 22.9 | 22.6 |

| 2006 | 23.0 | 23.2 |

| 2007 | 23.4 | 23.8 |

| 2008 | 23.7 | 24.5 |

| 2009 | 24.2 | 24.4 |

| 2010 | 25.6 | 25.4 |

| 2011 | 25.5 | 25.3 |

Participation in a multiemployer defined-benefit plan is established through a collective bargaining agreement. Employers “cover” employees by agreeing to contribute toward the cost of the plan, with contributions often based on hours worked. Some examples of how this might be specified include:

Some plans require employees to work for some length of time, often specified in hours over a 1-year period, before they are allowed to join the plan. For example:

BLS data from 2012 indicate that just over 60 percent of employees participating in multiemployer defined-benefit plans open to new employees had to meet an age or service requirement, or both. Among all plans, close to 80 percent of participants in plans open to new employees imposed such eligibility requirements. When multiemployer plans did impose an eligibility requirement, the median age requirement was 21 years and the median service requirement was 12 months. These requirements were similar to those found in single-employer plans.

A notable difference between single-employer and multiemployer plans involves plans that are closed to new employees, a practice known as a frozen plan. Although BLS data have shown an increase in frozen defined-benefit plans in recent years, this practice was rare among multiemployer plans.

Employer contributions, as specified in the collective bargaining agreement, may be defined over various time periods, including hourly, daily, weekly, or monthly amount. For example, the agreement may specify that the employer contribute $2.25 per hour worked or $8 for each paid working day. Plans may identify maximum hours for which contributions may be made, such as 184 hours per month or 2,080 hours per year, and may specifically include or exclude overtime hours. The agreement may identify the hours for which contributions are made, such as certain paid nonwork periods including holidays, vacation, sick leave, and other absences, and may specify a maximum dollar amount of contribution per year.

Some agreements require covered employees to contribute toward the pension fund, although this is rare. One example is for workers contracted for certain school activities, such as transportation. Employee contributions are deducted by the employer and provided to the pension fund along with any employer contributions. Many multiemployer pension plans do not allow employee contributions.

Defined-benefit pension plans specify a formula for determining benefits. In single-employer plans, that formula typically takes employee earnings into account. In contrast, multiemployer plan formulas are typically based on service or related to plan contributions. In 2012, the two most frequently observed formulas among multiemployer plans were dollar amount times years of service (52 percent of participants) and the percentage of employer contribution (35 percent of participants).

Plans with dollars times years of service, formulas may specify a single dollar amount (for example, a pension of $75 per month for each year of service) or may vary the dollar amount. For example, a plan might provide a benefit equal to $110 times years of service for up to 20 years and $125 times years of service over 20 years. Such plans might also vary benefits by job category, for example:

Another method of varying dollar amounts is based on employer contribution. In such cases, BLS distinguishes between plans based on the relationship of the benefit and the employer contribution. The following plan would be classified as a dollar amount plan, because there is no apparent relationship between the contribution and the benefit:

Employer contribution per hour Dollar amount times years of service benefit

The other predominant benefit formula in multiemployer plans is based on a percentage of employer contributions. This can be straightforward—monthly pension equal to 1 percent of employer’s lifetime contributions—or can be specified in an indirect manner, such as:

Monthly benefit equals $1.55 times total pension credits; employee receives one pension credit for every $90 of employer contribution.

In that case, the formula appears to specify a dollar amount but in fact, that dollar amount is based on the employer’s contribution.

Plans may specify that employees must work a minimum number of hours per year to receive credit toward their retirement benefits for that year. For example, employees earn a year of service when they work at least 300 hours in a year. Alternatively, a plan may include partial credits, such as a half-year credit for working 1,000 to 1,499 hours per year and a full credit for working 1,500 hours or more per year. Plans may also account for varying contribution levels. In one case, if employees worked for different contributing employers during the year, or if the employer’s hourly contribution rate changes during the year, the monthly retirement benefit for that year will be calculated based on the rate at which employees worked the most hours during the year.

This Beyond the Numbers article was prepared by William J. Wiatrowski, economist in the Office of Compensation and Working Conditions, U.S. Bureau of Labor Statistics. Email: wiatrowski.william@bls.gov, telephone: (202) 691-6300.

Information in this article will be made available upon request to individuals with sensory impairments. Voice phone: (202) 691-5200. Federal Relay Service: 1-800-877-8339. This article is in the public domain and may be reproduced without permission

William J. Wiatrowski, “An analysis of multiemployer pension plans ,” Beyond the Numbers: Pay & Benefits, vol. 3 / no. 22 (U.S. Bureau of Labor Statistics, October 2014), https://www.bls.gov/opub/btn/volume-3/an-analysis-of-multiemployer-pension-plans.htm

Publish Date: Wednesday, October 15, 2014