I’m delighted to announce that we now have new research data on job gains and losses by firm age and size across industries and states.

For many years, policymakers, economists, and others have debated whether small or large firms create more jobs. Our Business Employment Dynamics program, which measures gross job gains and losses to help us understand net employment changes, informs that debate with data on firm size. A related question is whether startups or older establishments create more jobs. Again, BLS has a stat for that. We have data on employment and business survival rates by the age of the establishment.

While it’s useful to know the age of an establishment—that is, a single location of a business—for some questions, we need to know the age of the firm. A firm may include several or even many establishments. To understand entrepreneurship in particular, we want to know how both the age and size of firms affect job gains, job losses, and employment growth.

With these new data we can answer many interesting questions, including:

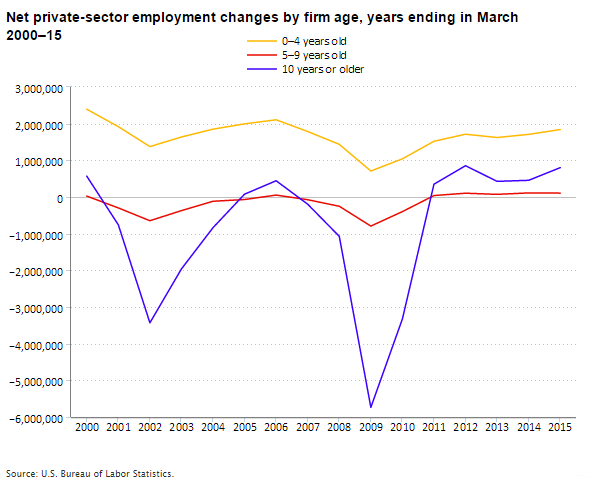

- How much do older firms contribute to job growth? Firms 10 years or older created 800,000 jobs, or 29 percent of the total 2.7 million net employment gain in the year ending March 2015. See the chart below.

- How much do startup firms contribute to job growth? In the year ending March 2015, startup firms—firms less than 1 year old—created 1.7 million jobs or 60 percent of total employment growth. More than half these jobs were from firms with fewer than 10 employees.

- How does the age or size of the firm affect the rate of business closures? In 2015, 788,000 establishments closed. Of these, 55 percent were from firms 10 years or older; 16 percent were from firms 5 to 9 years old; and 28 percent were from firms less than 4 years old. Of the establishments that closed from March 2014 to March 2015, 91,000 of them, or 12 percent of the total, had 500 or more employees.

- Which firm-age group accounted for most job losses during the last two recessions? Firms 10 years or older lost the most jobs during both recessions. Again, see the chart below.

The new research data measure annual gross job gains and gross job losses by firm age and size from March of one year to March of the next. We get the data on firms from the Quarterly Census of Employment and Wages by linking individual establishments over time. Besides firm age and size, we also measure establishment age and size. We have two methods to examine size. One method compares the current size of firms or establishments with the size at the beginning of the year (the base-sizing method). The other method compares the current size with the average size over the year (the average-sizing method).

I really want to know how you like these new data and what we can do to make them more useful. I invite you to explore the data and share your comments. Your feedback will help us develop the dataset and possibly move it into our regular production. Please write your comments below, or you can email the Business Employment Dynamics staff.

United States Department of Labor

United States Department of Labor