The pandemic that has gripped the world for over a year has resulted in many challenges for BLS, notably in collecting key economic data from employers and households. It has also brought about innovation, as we were forced to find new ways to do things. We’ve gotten rid of many paper forms; we’ve learned to “sign” documents electronically; and we’ve done our best to remember to unmute in video meetings. Data collection is now almost entirely paperless. It involves more email and web-based interactions, and the latest BLS innovation—the video data collection interview.

Pretend with me that you are peeking in on a recent video interview. BLS Philadelphia Region Field Economist Joseph Wright is the star of this video show. His mission today is to interview a representative from a business for the Producer Price Index (PPI). The PPI measures the average change over time in the selling prices received by domestic producers for their output. To do that, Joe and his colleagues talk to domestic producers (businesses) to identify products and track selling prices.

Earlier, Joe contacted this business and got permission for video collection. As the scene opens, both Joe and the official at this company (we call these individuals “respondents”) are working from home. Joe has done video collection several times before, and that experience is evident. After he shows his credentials to verify he is legit, he shares his screen to point to information about BLS confidentiality protections and to highlight some PPI data.

Thinking about this process, it seems like sharing a few highlights on a screen is much easier than shuffling a bunch of papers while meeting with the respondent in person. Advantage—video.

Next, Joe starts the actual data collection process. He begins with some questions and examples designed to verify the firm’s industry classification. Then the conversation pivots to information about the products produced, where Joe and the respondent clarify things like new formulations, quantities in metric tons, and shipping lingo such as free-on-board. Fortunately, Joe and the respondent speak the same language. In fact, one of the hallmarks of BLS data collection is familiarity with detailed industries, occupations, work processes, and more. We are talking to experts, so it’s best to know our stuff. And Joe clearly does.

The goal of an initial PPI interview like this one is to select a sample of products sold by the business. We also want to get a detailed description of the products so we can follow the correct selling price. Finally, we want to set up the process for the business to easily report updated selling prices each month. From information provided by the respondent, Joe did some quick math and identified a random selection of products to follow, based on sales volume. He confirmed product descriptions, which will be provided back to the respondent when it’s time to update the selling prices. Clearly Joe is a pro, as he made quick work of the entire process.

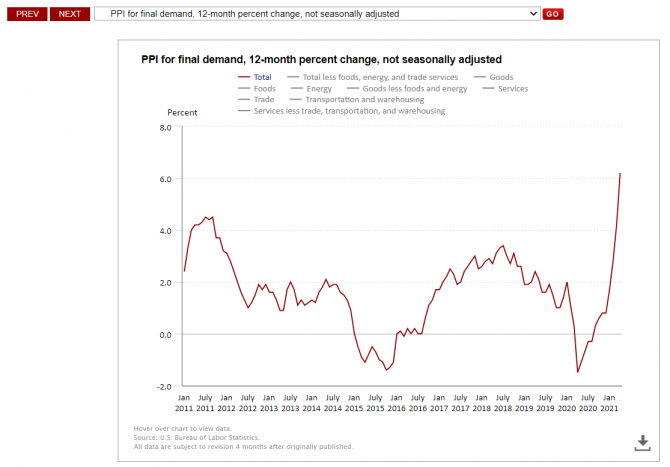

This respondent’s data will eventually be part of the monthly PPI release, which provides considerable detail on changes in selling prices for a wide range of industries and products. Here’s a look at 12-month changes in the PPI over the past decade. More charts and more details are available on the BLS website.

Data collection is a tough job. This particular respondent was comfortable with the video process and willing to provide information. It helps that the respondent said more than once that “we use these [BLS data] in our contracts” and that he was “glad to be part of this [since we] use a lot of these indexes.” While many respondents are indeed cooperative, and familiar with BLS data, others are not. Fortunately, BLS field economists are equipped with a marketing toolbox, which includes training in how to work with small and large companies; factsheets and related material that highlight how businesses can use BLS data, for example, in contract escalation; and details on BLS procedures to protect the confidentiality of respondent data. The video data collection interview is the latest tool.

BLS confidentiality procedures deserve extra emphasis. While our goal is to give respondents various data collection options, to make the process as convenient as possible, we never introduce a new collection option without a thorough confidentiality vetting. In the case of video collection, that vetting led to the development of strict standards and detailed procedures. These efforts are designed to ensure respondents of the value of their participation, and the care with which BLS handles their data. Enough said.

At BLS, we see the value in building relationships with respondents, and thus in-person data collection will continue to be part of our toolbox. But we also want to limit respondent burden and be good stewards of the taxpayer’s money. As Joe’s example demonstrates, the video data collection interview is an effective option to limit burden and expense while obtaining quality information to support key economic indicators. Even in a post-pandemic world, BLS video data collection is here to stay.

United States Department of Labor

United States Department of Labor