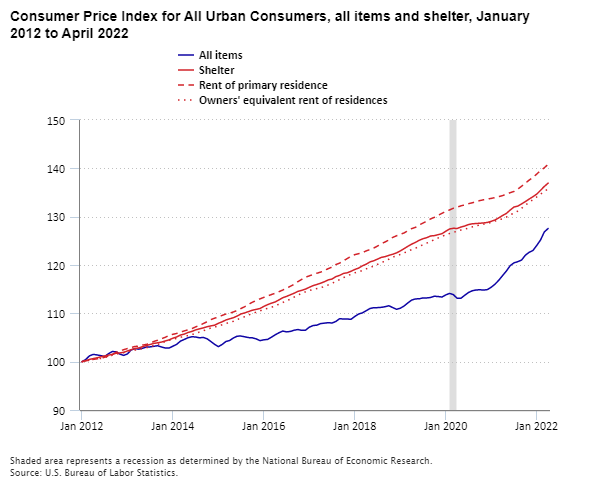

Shelter costs are the largest regular expense for most households. That makes them a topic of considerable interest to users of Consumer Price Index (CPI) data. The U.S. city average for shelter increased 5.1 percent from April 2021 to April 2022. Its two main components, owners’ equivalent rent of residences and rent of primary residence, each increased 4.8 over the year. (Lodging away from home is the other component of shelter, and lodging prices rose 19.7 percent from April 2021 to April 2022.)

Editor’s note: Data for this chart are available in the table below.

Because of their large weight in the CPI market basket—nearly a third—the indexes for owners’ equivalent rent and rent can have a large impact on the overall inflation estimate. There is also a lot of misunderstanding about these shelter indexes, and so it is worth taking a few minutes to get a clear understanding of what they measure.

Owners’ equivalent rent is the larger of these two components, at nearly one quarter of the consumer market basket, or weight, in the CPI. It represents the implicit amount an owner of a housing unit would have to pay in rent to live in the unit, assuming it was leased instead of owned. The expenditure weight for owners’ equivalent rent in the CPI is based on a question in the Consumer Expenditure Survey. That question asks homeowners, “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?” The role of this question can be easily misunderstood by even sophisticated users of BLS data. That has contributed to a common misconception: the mistaken belief that the price observations used for owners’ equivalent rent in the CPI are also from homeowner estimates of their home’s rental value. In fact, the sample of prices used in the owners’ equivalent rent index comes from observations of rent collected in our monthly survey of housing prices, but with utilities and other similar charges removed.

Why don’t we just measure changes in home values in the CPI? It’s because a home isn’t just a consumption item for the owner. It is also an investment, often the largest investment many people will make in their lives. The concept in the CPI—and in the economic statistics programs of most other nations—is to treat owned housing as a capital or investment good, distinct from the shelter service it provides. We treat spending to buy and improve houses and other housing units as investment and not consumption in the CPI. Mortgage interest costs, property taxes, real estate fees, most maintenance, and all improvement costs are part of the cost of the capital good and are also not treated as consumption items. These nonconsumption costs of owned housing are out of scope for the CPI under the cost-of-living framework that guides the index.

Some people have noted that the CPI index for rent (which represents just over 7 percent of the weight of the CPI) is not rising as fast as some other measures, notably those published by firms in the real estate industry. One reason for this is that over 80 percent of rental units in the CPI sample each period have tenants who continue to rent the same unit. Landlords often raise rents when a unit is vacated by a prior tenant and a new tenant moves in. In some cases, the rent paid by tenants with multi-year leases increases periodically—and automatically, by the CPI itself—through an escalation clause in the lease agreement that cites the CPI for this purpose.

Because rents for existing tenants change in line with the terms of leases and rental agreements, and many leases are for 12 months, existing tenants typically do not face price change within the 12-month period of the lease. This is called a “sticky” price. Because of this, the process used to calculate the indexes for rent and owners’ equivalent rent differs from the process used to calculate the rest of the CPI. Most prices are collected either monthly or every 2 months, but rent prices are collected every 6 months. In effect, this means price increases for shelter can sometimes take longer to appear in the CPI than in some other data sources.

We are always working to improve the accuracy of the CPI, and that includes our shelter indexes. We asked for expert opinion from the National Academy of Sciences, Committee on National Statistics, on better ways to measure price change for these important items. The committee recently published their report, “Modernizing the Consumer Price Index for the 21st Century.” The report endorsed the use of owners’ equivalent rent in the CPI and recommended that, “BLS should continue using rental equivalence as the primary approach to estimating the price of housing services for owner-occupied units.”

I will say more about the report from the Committee on National Statistics soon. In the meantime, we will consider all the recommendations of this distinguished group as we plan future improvements to the CPI.

You can read more about shelter in our factsheet for rent and owners’ equivalent rent. We also have more technical details in the Handbook of Methods.

| Month | All items | Shelter | Rent of primary residence | Owners’ equivalent rent of residences |

|---|---|---|---|---|

Jan 2012 | 100.000 | 100.000 | 100.000 | 100.000 |

Feb 2012 | 100.440 | 100.205 | 100.182 | 100.102 |

Mar 2012 | 101.203 | 100.472 | 100.332 | 100.295 |

Apr 2012 | 101.509 | 100.638 | 100.469 | 100.465 |

May 2012 | 101.390 | 100.799 | 100.589 | 100.560 |

Jun 2012 | 101.241 | 100.999 | 100.657 | 100.660 |

Jul 2012 | 101.076 | 101.179 | 100.929 | 100.837 |

Aug 2012 | 101.639 | 101.350 | 101.150 | 101.097 |

Sep 2012 | 102.092 | 101.511 | 101.438 | 101.322 |

Oct 2012 | 102.052 | 101.737 | 101.937 | 101.538 |

Nov 2012 | 101.569 | 101.804 | 102.193 | 101.735 |

Dec 2012 | 101.295 | 101.922 | 102.477 | 101.880 |

Jan 2013 | 101.595 | 102.213 | 102.711 | 102.077 |

Feb 2013 | 102.427 | 102.481 | 102.926 | 102.249 |

Mar 2013 | 102.695 | 102.720 | 103.146 | 102.384 |

Apr 2013 | 102.588 | 102.848 | 103.209 | 102.542 |

May 2013 | 102.771 | 103.097 | 103.432 | 102.701 |

Jun 2013 | 103.017 | 103.340 | 103.566 | 102.888 |

Jul 2013 | 103.058 | 103.554 | 103.790 | 103.045 |

Aug 2013 | 103.182 | 103.779 | 104.187 | 103.355 |

Sep 2013 | 103.302 | 103.905 | 104.432 | 103.570 |

Oct 2013 | 103.036 | 104.053 | 104.752 | 103.839 |

Nov 2013 | 102.825 | 104.285 | 105.038 | 104.149 |

Dec 2013 | 102.816 | 104.509 | 105.422 | 104.415 |

Jan 2014 | 103.199 | 104.852 | 105.666 | 104.646 |

Feb 2014 | 103.581 | 105.113 | 105.828 | 104.815 |

Mar 2014 | 104.248 | 105.512 | 106.120 | 105.056 |

Apr 2014 | 104.591 | 105.696 | 106.358 | 105.227 |

May 2014 | 104.957 | 106.036 | 106.595 | 105.411 |

Jun 2014 | 105.152 | 106.252 | 106.832 | 105.604 |

Jul 2014 | 105.111 | 106.567 | 107.192 | 105.844 |

Aug 2014 | 104.935 | 106.787 | 107.502 | 106.124 |

Sep 2014 | 105.014 | 106.979 | 107.871 | 106.380 |

Oct 2014 | 104.751 | 107.224 | 108.254 | 106.667 |

Nov 2014 | 104.185 | 107.399 | 108.695 | 106.969 |

Dec 2014 | 103.594 | 107.543 | 108.987 | 107.140 |

Jan 2015 | 103.107 | 107.932 | 109.258 | 107.403 |

Feb 2015 | 103.555 | 108.247 | 109.575 | 107.632 |

Mar 2015 | 104.171 | 108.628 | 109.862 | 107.885 |

Apr 2015 | 104.383 | 108.871 | 110.044 | 108.142 |

May 2015 | 104.915 | 109.101 | 110.295 | 108.353 |

Jun 2015 | 105.282 | 109.454 | 110.600 | 108.720 |

Jul 2015 | 105.289 | 109.886 | 111.011 | 109.018 |

Aug 2015 | 105.140 | 110.096 | 111.390 | 109.325 |

Sep 2015 | 104.977 | 110.379 | 111.871 | 109.664 |

Oct 2015 | 104.929 | 110.648 | 112.306 | 109.963 |

Nov 2015 | 104.708 | 110.818 | 112.653 | 110.260 |

Dec 2015 | 104.350 | 111.000 | 112.995 | 110.509 |

Jan 2016 | 104.523 | 111.434 | 113.305 | 110.795 |

Feb 2016 | 104.609 | 111.802 | 113.605 | 111.031 |

Mar 2016 | 105.059 | 112.101 | 113.882 | 111.250 |

Apr 2016 | 105.557 | 112.353 | 114.148 | 111.546 |

May 2016 | 105.984 | 112.781 | 114.482 | 111.890 |

Jun 2016 | 106.332 | 113.231 | 114.818 | 112.249 |

Jul 2016 | 106.160 | 113.510 | 115.190 | 112.574 |

Aug 2016 | 106.258 | 113.834 | 115.599 | 112.942 |

Sep 2016 | 106.513 | 114.165 | 116.005 | 113.367 |

Oct 2016 | 106.646 | 114.543 | 116.563 | 113.751 |

Nov 2016 | 106.480 | 114.757 | 117.024 | 114.167 |

Dec 2016 | 106.515 | 115.016 | 117.469 | 114.458 |

Jan 2017 | 107.136 | 115.389 | 117.753 | 114.717 |

Feb 2017 | 107.473 | 115.736 | 118.042 | 114.947 |

Mar 2017 | 107.560 | 115.972 | 118.297 | 115.127 |

Apr 2017 | 107.879 | 116.233 | 118.533 | 115.321 |

May 2017 | 107.971 | 116.546 | 118.883 | 115.529 |

Jun 2017 | 108.069 | 116.916 | 119.246 | 115.874 |

Jul 2017 | 107.995 | 117.102 | 119.579 | 116.186 |

Aug 2017 | 108.318 | 117.589 | 120.086 | 116.629 |

Sep 2017 | 108.892 | 117.859 | 120.392 | 116.974 |

Oct 2017 | 108.823 | 118.253 | 120.871 | 117.386 |

Nov 2017 | 108.825 | 118.386 | 121.324 | 117.733 |

Dec 2017 | 108.761 | 118.701 | 121.803 | 118.092 |

Jan 2018 | 109.354 | 119.071 | 122.146 | 118.391 |

Feb 2018 | 109.850 | 119.356 | 122.336 | 118.563 |

Mar 2018 | 110.098 | 119.826 | 122.571 | 118.878 |

Apr 2018 | 110.536 | 120.167 | 122.913 | 119.194 |

May 2018 | 110.996 | 120.638 | 123.195 | 119.468 |

Jun 2018 | 111.172 | 120.877 | 123.516 | 119.779 |

Jul 2018 | 111.180 | 121.219 | 123.917 | 120.129 |

Aug 2018 | 111.242 | 121.574 | 124.421 | 120.514 |

Sep 2018 | 111.371 | 121.734 | 124.763 | 120.799 |

Oct 2018 | 111.568 | 122.001 | 125.188 | 121.205 |

Nov 2018 | 111.194 | 122.224 | 125.708 | 121.633 |

Dec 2018 | 110.839 | 122.500 | 126.037 | 121.899 |

Jan 2019 | 111.050 | 122.911 | 126.340 | 122.185 |

Feb 2019 | 111.520 | 123.376 | 126.633 | 122.505 |

Mar 2019 | 112.149 | 123.869 | 127.084 | 122.830 |

Apr 2019 | 112.743 | 124.313 | 127.536 | 123.190 |

May 2019 | 112.983 | 124.676 | 127.790 | 123.463 |

Jun 2019 | 113.005 | 125.113 | 128.300 | 123.861 |

Jul 2019 | 113.194 | 125.442 | 128.672 | 124.179 |

Aug 2019 | 113.188 | 125.656 | 129.073 | 124.542 |

Sep 2019 | 113.277 | 126.005 | 129.537 | 124.906 |

Oct 2019 | 113.536 | 126.081 | 129.865 | 125.222 |

Nov 2019 | 113.475 | 126.280 | 130.307 | 125.597 |

Dec 2019 | 113.372 | 126.476 | 130.683 | 125.894 |

Jan 2020 | 113.812 | 126.982 | 131.085 | 126.273 |

Feb 2020 | 114.123 | 127.454 | 131.392 | 126.523 |

Mar 2020 | 113.875 | 127.596 | 131.743 | 126.785 |

Apr 2020 | 113.114 | 127.559 | 131.982 | 126.973 |

May 2020 | 113.116 | 127.851 | 132.244 | 127.237 |

Jun 2020 | 113.735 | 128.067 | 132.431 | 127.379 |

Jul 2020 | 114.310 | 128.368 | 132.686 | 127.653 |

Aug 2020 | 114.671 | 128.532 | 132.878 | 127.889 |

Sep 2020 | 114.830 | 128.579 | 133.058 | 128.015 |

Oct 2020 | 114.878 | 128.640 | 133.332 | 128.347 |

Nov 2020 | 114.808 | 128.704 | 133.496 | 128.454 |

Dec 2020 | 114.916 | 128.809 | 133.658 | 128.625 |

Jan 2021 | 115.405 | 129.037 | 133.775 | 128.810 |

Feb 2021 | 116.036 | 129.321 | 133.963 | 129.090 |

Mar 2021 | 116.858 | 129.760 | 134.148 | 129.337 |

Apr 2021 | 117.819 | 130.245 | 134.361 | 129.564 |

May 2021 | 118.763 | 130.677 | 134.652 | 129.920 |

Jun 2021 | 119.867 | 131.372 | 134.969 | 130.363 |

Jul 2021 | 120.443 | 131.997 | 135.215 | 130.757 |

Aug 2021 | 120.692 | 132.182 | 135.697 | 131.151 |

Sep 2021 | 121.020 | 132.641 | 136.296 | 131.721 |

Oct 2021 | 122.025 | 133.121 | 136.932 | 132.368 |

Nov 2021 | 122.625 | 133.642 | 137.566 | 132.989 |

Dec 2021 | 123.002 | 134.131 | 138.111 | 133.505 |

Jan 2022 | 124.037 | 134.667 | 138.812 | 134.075 |

Feb 2022 | 125.170 | 135.454 | 139.545 | 134.649 |

Mar 2022 | 126.841 | 136.244 | 140.110 | 135.204 |

Apr 2022 | 127.549 | 136.941 | 140.835 | 135.764 |

United States Department of Labor

United States Department of Labor