An official website of the United States government

United States Department of Labor

United States Department of Labor

The leased cars and trucks index, a component of the new and used motor vehicles index, is included in the transportation group of the Consumer Price Index (CPI). This index is only published at the national level.

The weight of leased cars and trucks in the CPI consists of consumer spending on new leased cars and leased trucks. The index covers leases on all classes of new consumer vehicles, including subcompact cars, compact or sporty cars, intermediate cars, full-sized cars, luxury or status cars, pickup trucks, vans, and specialty vehicles, including sport/cross utility vehicles.

The relative importance of an item category is its percent of the CPI weight as of December of the most recent year.

| Item | Relative importance |

|---|---|

|

Transportation |

16.316 |

|

Private transportation |

14.832 |

|

New and used motor vehicles |

7.204 |

|

New vehicles |

3.838 |

|

Used cars and trucks |

2.759 |

|

Leased cars and trucks |

0.394 |

|

Car and truck rental |

0.138 |

|

Unsampled new and used motor vehicles |

0.076 |

The leased cars and trucks index is estimated using a transactions dataset that includes observed, transaction-level prices and detailed vehicle information. Each observation includes a taxed monthly payment price as well as variables including rebate values, vehicle characteristics, and component price variables specific to leasing transactions like residual value, annual percentage rate (APR), a finance charge or money factor, and amount financed. Leased vehicle taxes are reported as part of the total monthly payment variable.

The size of the dataset depends on the transaction volume and number of participating dealers at any given time, but we typically receive around 70,000 eligible leasing transactions per month. All transactions reported in the dataset are used in the leased cars and trucks index except for vehicles specifically referenced as fleet vehicles (a car or truck owned or leased by a company, organization, or government agency, rather than an individual), police vehicles, work trucks, or cargo vehicles.

The data are grouped into Designated Market Areas (DMA) and mapped to the 23 self-representing major cities in the current CPI sample. The remaining DMAs are mapped to a large pool of small and midsized cities that make up 9 non-self-representing areas. As a result, price data from anywhere within the United States are eligible for this index, whereas only price data from sampled geographic areas are included in the survey-based components of the CPI.

The leased cars and trucks index calculation method is an adaptation of the new vehicles index method. However, calculating a transaction price for leased cars and trucks differs greatly when compared to new vehicles. The price used in the leased cars and trucks index is a geometric average transaction price for each combination of a specific vehicle type and a specific term length within each index area.

To start with, the monthly lease price is calculated for each transaction using component price variables provided in the transaction dataset.

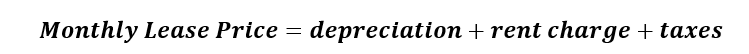

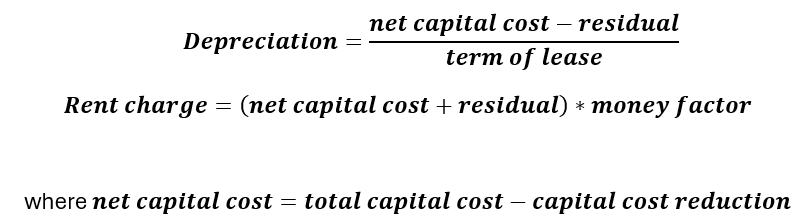

Formula for monthly lease price:

Depreciation captures the decline in the value of the vehicle over the course of the lease, while the rent charge (also known as a finance charge or money factor) compensates the owner of the vehicle (the lessor or dealership) for the opportunity cost of capital.

Formulas for the components of monthly payment:

Before taxes are applied, a downpayment adjustment is made to account for the impact of both cash down payments and trade-in allowances on net capitalized cost. Quality adjustments are integrated into the net capitalized cost and residual value component prices (learn about the leased cars and trucks quality adjustment method in the next section). Finally, taxes are applied to this adjusted monthly payment price to estimate a final, taxed leased price for each transaction.

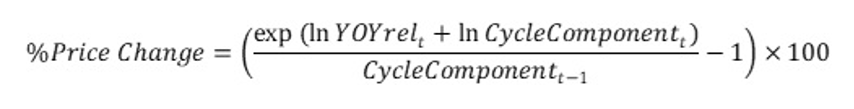

Like new vehicles, the leased cars and trucks index uses a combination of year-over-year (YoY) comparisons and a cyclical component. Monthly vehicle prices tend to decline over the model year, which can bias the trend in a price index. The YoY relatives provide an unbiased estimate of the trend but no information on short-run changes in the new vehicle market. We combine the YoY measure with a statistical component of the monthly index detrended with a statistical time series filter. The combination of trend and fluctuations provides a measure that is both accurate in the long run and informative in the short run.

To calculate the short-run component, monthly price relatives are constructed by comparing monthly leased vehicle payments in current (t) and previous (t-1) months. Price comparisons are made for all eligible vehicles, including recently introduced models. Price comparisons are aggregated with an expenditure-weighted Tornqvist formula to form area-level indexes. These indexes are used as inputs for the high-frequency time series component that serves as an estimate of short-run price fluctuations. This component is then combined with a YoY relative, which is described next.

The YoY relative is calculated to measure long-term price trends in the vehicle market. To calculate a YoY price comparison for a single observation, BLS economists map each vehicle involved in a leasing transaction in the current month to its previous model year equivalent. We then compare the monthly lease price of each vehicle in the current month (t) to the monthly lease price of its previous model year equivalent in the same calendar month of the previous year (t-12). Vehicles that cannot be mapped to a previous model year equivalent (such as models in their first year of existence) and vehicles that have been redesigned are not included in YoY calculations until 12 months after the vehicle’s introduction. Vehicle-level YoY relatives are aggregated to form area-level YoY relatives using the Tornqvist price index formula with expenditure share weights. The 12th root of each YoY relative is taken to scale the price change down to a monthly frequency. This method allows BLS to estimate the price change across model years for vehicles of similar age. The resulting YoY price indexes are then adjusted using the time series filter to model the latest cyclical trend (the high-frequency component described above).

Price change for each geographic area in the CPI for leased cars and trucks is calculated as:

In the leased cars and trucks index, vehicle configurations are not subjected to replacement where a new iteration of a vehicle configuration replaces the old version. Therefore, monthly price relatives for all eligible leased cars and trucks are used in both the year-over-year and monthly components. In contrast, the new vehicle monthly index uses model year sample rotation to mimic the methodology that had been used for the index based on surveyed vehicle prices. Using the simpler approach of including all versions of a vehicle sold had little effect on the estimation of cyclical relatives and allowed for more observations to be incorporated into the index.

The leased cars and trucks index uses the same quality adjustment values used for the new vehicles index. This includes a review of model year comparability and quality-adjustment when necessary, using data received by BLS from automobile manufacturers.

Quality adjustments are based on costs provided by manufacturers in categories such as reliability, durability, safety, fuel economy, maneuverability, speed, acceleration/deceleration, carrying capacity, and comfort or convenience. Adjustments are also made when equipment is added or deleted from the tracked model.

While the leased cars and trucks index uses the same nominal dollar-value quality adjustments as the new vehicles index, the application of these values to the monthly leasing price is different than the application of these values to the new vehicle price. Dollar-value adjustments can be directly applied to new vehicle prices. For leased cars and trucks, we must adjust both the initial vehicle price and the residual value of the vehicle at the end of the leasing agreement. To adjust the initial vehicle price, the quality adjustment value (multiplied by a markup) is subtracted from the new initial vehicle price directly. To adjust the residual value, we assume that the value of the quality adjustment will depreciate at the same rate as the rest of the vehicle. This depreciated quality adjustment value is subtracted from the residual value. These quality adjusted component prices are used to calculate the transaction-level leased vehicle price discussed in the previous selection. Additional information is available in the Quality Adjustment in the CPI: New, Used, and Leased Motor Vehicles document.

To meet publication deadlines, the CPI program receives an initial data delivery on the 25th of the month and begins initial analysis of newly introduced vehicle configurations. On the last day of the reference month, the final version of the dataset is delivered and used for price index calculation. Due to lags in reporting, even this final dataset omits some transactions from the reference month. Internal research shows approximately nine percent of transactions are truncated but that this data truncation does not have a statistically significant impact on item-level relative calculation.

Access data for leased cars and trucks in our online database.

Information on trends in leased cars and truck prices can be obtained from several other sources including Ward’s Automotive, Kelley Blue Book, and Edmunds.com. The mention of these sources does not constitute or imply endorsement, recommendation, or favoring by the U.S. Bureau of Labor Statistics.

BLS also publishes an annual report on quality changes to new models from the Producer Price Index (PPI) program. The report provides for the average model year changes in invoice price and a retail equivalent price, as well as the estimated value of quality changes. These reports are available on the PPI Archived Reports on Quality Changes for Motor Vehicles webpage.

Additional information may be obtained from the Consumer Price Index Information Office by email or calling 202-691-7000. Information on the CPI's overall methodology can be found in the CPI section of the BLS Handbook of Methods.

Last Modified Date: February 13, 2026