An official website of the United States government

United States Department of Labor

United States Department of Labor

CPI Vehicle classifications from Environmental Protection Agency (EPA) are used to assign each unique vehicle to either the new cars or new trucks index. The new cars index is composed of subcompact, compact or sporty, intermediate, full, and luxury cars. The new trucks index is composed of pickup trucks, vans, and specialty vehicles; specialty vehicles include sport and cross utility vehicles. In this factsheet, we examine the cost-based dollar amounts used in the quality adjustment of price data for new vehicles.

The new vehicles index is estimated using a transactions dataset purchased from J.D. Power that includes observed transaction-level prices and detailed vehicle information. Each observation includes a transaction price as well as a set of 40 variables including rebate values and vehicle characteristics. Sales tax rates are applied by BLS for index calculation.

The size of the J.D. Power new vehicle data set depends on the transaction volume and number of participating dealers at any given time, but we typically receive data on 250,000 transactions per month, reported by participating dealers across the country. The majority of nameplates purchased across the country are represented in the dataset. All transactions reported in the dataset are used in the new vehicle index except for vehicles specifically referenced as fleet vehicles, police vehicles, work trucks, or cargo vehicles.

The J.D. Power data are grouped into “Designated Market Areas” that correspond to all the major cities in the current CPI sample and a large pool of small and mid-sized cities. These Designated Market Areas are mapped to the 32 index areas that represent the CPI geography.

To maintain a constant quality index, the CPI applies quality adjustments during model year changeovers using data received by BLS from automobile manufacturers. Quality adjustments are based on costs provided by manufacturers in categories such as reliability, durability, safety, fuel economy, maneuverability, speed, acceleration/deceleration, carrying capacity, and comfort or convenience. Adjustments are also made when equipment is added or deleted from the tracked model.

BLS receives new vehicle cost data from participating manufacturers in early September each year. For purposes of the CPI, model year changeovers occur when sales for a new model year vehicle exceed the sales of the prior year model.

The CPI adjusts for structural and engineering quality changes such as:

Changes that affect the safety of occupants of the vehicle as mandated by legislated federal or state standards. Changes in safety features not required by legislated standards will be evaluated on a case-by-case basis.

Changes in mechanical or electrical features that affect the overall operation or efficiency of the vehicle, or the ability of a component to perform its function, such as changes affecting steering, braking, stability, engine horsepower, traction control, transmission, battery life, and fuel systems and/or electrical systems.

Changes in design or materials that affect the length of service, durability, need for repairs, or strength or performance of the item, such as stronger bumpers, HID headlamps, or flexible body panels.

Changes that affect comfort or convenience, if supported by evidence of a functional or software improvement, such as navigation and communication systems, driver-assistance systems, backup cameras, sensors, or changes in storage capacity.

The CPI does not quality adjust for cosmetic modifications to new vehicles such as:

Style or changes in appearance designed solely to make the product seem new or different, such as trim, wheel design, colored bumpers, etc.

Physical changes in separate components or parts that do not affect functionality or the performance of the component, such as simplification of components for assembly purposes or serviceability.

Changes made solely to meet air pollution standards on models introduced in January 1999 or later and that do not otherwise provide direct value to the consumer. Price increases associated with such modifications are treated as increases in the index.

The important difference between this cost-based quality adjustment method versus a hedonic quality adjustment method is the use of actual cost data provided directly from manufacturers, and not estimated consumer values derived from a regression model.

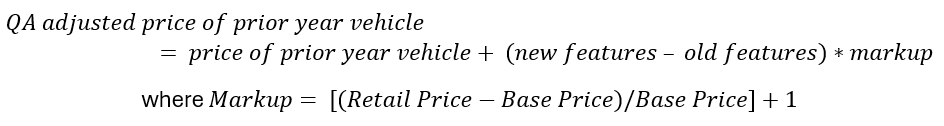

Quality adjustments are applied to the prior year vehicle price, and the adjustment amount includes the markup value, which is a ratio of the transaction price and the dealer cost of the newer vehicle. The markup value has a floor of 1 (i.e., any calculated markup less than 1 is set to 1).

Adjustments are calculated as:

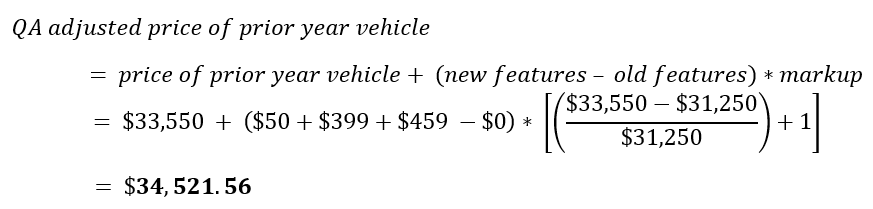

The following example is provided to illustrate how CPI analysts apply cost-based quality adjustments during model year changeovers for new vehicles.

In the instance provided below, a 2020 model is undergoing a model changeover. The 2021 model has three characteristics/improvements that were not available in the 2020 model. To keep the quality constant in the new vehicles index, a cost-based quality adjustment will be applied to the price of the 2020 model before calculating the price change between the two models.

| Type of Change | 2020 Model | 2021 Model | Reported Value of Characteristic |

|---|---|---|---|

|

Retail Price |

$33,550 | $34,750 | -- |

|

Base Price |

$31,250 | $32,150 | -- |

|

Interior |

Not standard | Smartphone integration | $50 |

|

Transmission |

6 speed transmission (standard) | 9 speed transmission | $399 |

|

Remote/ keyless entry |

No | Yes (Auto Start/Stop) | $459 |

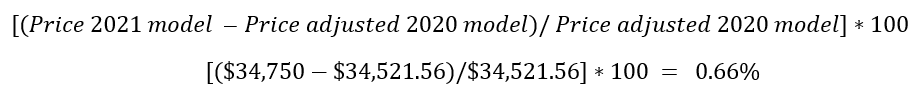

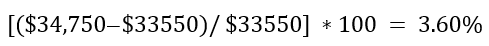

Measuring price change with cost-based quality adjustments is considered more accurate than directly comparing the prices. If the CPI did not use this method the price change in this example would be:

Last Modified Date: April 9, 2025