An official website of the United States government

United States Department of Labor

United States Department of Labor

| August 2016

A career in business is versatile. Some occupations, such as human resources managers, involve working with people; others, including logisticians, focus on products. No matter your interest, there’s likely a business angle to it that you could pursue.

And depending on your career choice, you might be paid a lot, too. Data from the U.S. Bureau of Labor Statistics (BLS) show that wages for many business-related occupations were higher than those for all workers. But workers in some of the higher paying occupations may also log more than the average number of hours on the job.

Keep reading to learn more about some of the highest paying business occupations and how you can prepare for these careers.

BLS data show that many business occupations have high wages. But you’ll also want to consider job outlook when making a career choice. BLS has a stat for that, too.

As with most fields, business occupations may not pay a lot when you’re first starting out. Rather, wages typically increase as you gain experience. A number of other factors might affect wages, too, such as where you work (both geographic location and employer) and what your specific job tasks are.

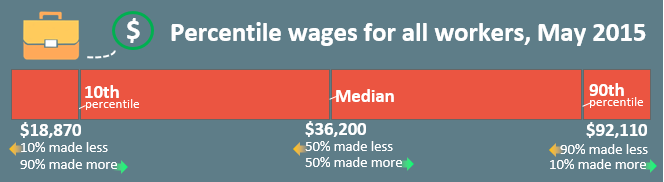

In the tables that follow, percentiles show how wages were distributed within an occupation.

The 10th percentile wage for an occupation is the point at which 10 percent of workers in that occupation earned less than that amount, and 90 percent earned more; these wages may be closer to what workers made at the entry level. The 50th percentile (median) wage—half made less, half made more—may approximate what mid-career workers earned. And the 90th percentile wage, where 90 percent earned less and 10 percent more, are more likely to be what highly experienced workers made. (BLS also publishes wage estimates at the 25th and 75th percentiles.)

The illustration shows percentile wages for all workers in May 2015, according to BLS: $18,870 (10th percentile), $36,200 (median), and $92,110 (90th percentile). Compare these with percentile wages in the tables for business occupations.

Wages in this article represent pay before taxes and payroll deductions. Some types of incentive pay, such as commissions, production bonuses, and tips, are included. Premium pay, such as overtime, and certain other types of bonuses, such as profit-sharing payments, are not included. Self-employed workers’ wages also are not included.

It’s important to consider more than your potential paycheck when choosing a career. Also think about whether a particular occupation is a good fit for your interests and skills.

Once you have an idea of what will be a good fit, you’ll want to know whether you’ll be able to find employment in your career of choice. To help you gauge current and projected job prospects for the occupations highlighted in this article, the tables also show BLS data for the number of jobs in 2014 and projected job openings between 2014 and 2024. Occupations with many jobs and those projected to have many job openings might offer more opportunity.

The sections that follow highlight selected high-paying occupations in five groups:

Information about wages, employment, and job outlook is specific to the occupations in each group, so the details provided vary. This article also highlights occupations in which workers put in more than the average hours for all full-time workers (about 42 hours per week in 2015, according to BLS).

Workers in this occupation group help with the day-to-day activities of running a business, such as coordinating employee benefits or purchasing supplies. Table 1 shows selected high-paying occupations for business operations specialists.

| Occupation | Annual wages, May 2015(1) | |||||

|---|---|---|---|---|---|---|

| 10th percentile | Median | 90th percentile | Employment, 2014 | Job openings, projected 2014–24 | Average hours worked(2), 2015 | |

|

Claims adjusters, appraisers, examiners, and investigators |

$38,150 | $63,060 | $94,140 | 315,300 | 87,900 | 41 |

|

Compensation, benefits, and job analysis specialists |

38,370 | 60,850 | 98,860 | 84,700 | 24,000 | 41 |

|

Compliance officers |

37,390 | 65,640 | 102,940 | 260,300 | 45,300 | 42 |

|

Logisticians |

45,830 | 74,260 | 115,960 | 130,400 | 20,600 | 42 |

|

Management analysts |

45,970 | 81,320 | 150,220 | 758,000 | 208,500 | 44 |

|

Market research analysts and marketing specialists |

33,530 | 62,150 | 120,460 | 495,500 | 151,400 | 43 |

|

Purchasing agents, except wholesale, retail, and farm products |

37,850 | 62,220 | 99,960 | 300,800 | 82,700 | 41 |

|

Footnotes: |

||||||

Wages. At all three percentiles, management analysts had the highest wage of the occupations in table 1 in May 2015. These analysts were also among those who worked the longest each week (44 hours, on average) of the occupations shown.

Market research analysts and marketing specialists earned the lowest wage at the 10th percentile. At the 90th percentile, however, their wage was second highest of the occupations in the table. The large spread in wages for this occupation may be due, in part, to the diverse nature of these jobs.

Jobs and outlook. There were more than 750,000 management analyst jobs in 2014, making it the largest of the occupations in table 1. Many of these analysts were employed in consulting firms, where they help find ways to make businesses more profitable and efficient. The District of Columbia, Virginia, and Maryland had the highest concentrations of management analysts. And BLS projects over 200,000 job openings for this occupation over the 2014–24 decade.

If you like keeping track of money, a financial specialist career might be a good option. Workers in the occupations shown in table 2 might do tasks such as balancing business accounts and helping people make investment decisions. Because of their expertise, many of these workers earn wages that are higher than those for all workers.

| Occupation | Annual wages, May 2015[1] | Employment, 2014 | Job openings, projected 2014–24 |

Average hours worked, 2015[2] | ||

|---|---|---|---|---|---|---|

| 10th percentile | Median | 90th percentile[3] | ||||

|

Accountants and auditors |

$41,400 | $67,190 | $118,930 | 1,332,700 | 498,000 | 42 |

|

Budget analysts |

47,550 | 71,590 | 108,600 | 60,800 | 16,700 | 39 |

|

Credit analysts |

40,250 | 69,680 | 134,080 | 69,400 | 34,300 | 40 |

|

Financial analysts |

49,450 | 80,310 | 160,760 | 277,600 | 89,400 | 43 |

|

Financial examiners |

45,540 | 78,010 | 149,390 | 38,200 | 13,100 | 40 |

|

Insurance underwriters |

38,960 | 65,040 | 116,600 | 103,400 | 19,500 | 41 |

|

Personal financial advisors |

39,300 | 89,160 | ≥187,200 | 249,400 | 136,400 | 43 |

|

[1] Estimates do not include wages of self-employed workers. |

||||||

Wages. Financial analysts had the highest 10th percentile wage of the occupations shown in table 2, nearly $50,000 a year. At higher percentiles, their wages may be double or even triple that amount.

Personal financial advisors had one of the lowest 10th percentile wages of these occupations, but their median and 90th percentile wages were the highest of the occupations in table 2. They and financial analysts worked, on average, the most hours on the job (43 hours a week) of the occupations shown in the table.

Jobs and outlook. Accountants and auditors held more than 1.3 million jobs in 2014, the most of the occupations in table 2. Many of these jobs were in accounting firms. Accountants and auditors work in every state, but they were most concentrated in the District of Columbia, Colorado, and Delaware. And this occupation is projected to have nearly half a million job openings between 2014 and 2024.

Managers oversee an array of business-related activities. That’s why these workers typically need experience in a related occupation even at the entry level. Table 3 shows selected management occupations with high pay.

| Occupation | Annual wages, May 2015[1] | Employment, 2014 | Job openings, projected 2014–24 | Average hours worked, 2015[2] |

||

|---|---|---|---|---|---|---|

| 10th percentile | Median | 90th percentile[3] | ||||

|

Chief executives |

$68,600 | $175,110 | ≥$187,200 | 343,400 | 58,400 | 48 |

|

Computer and information systems managers |

80,160 | 131,600 | ≥187,200 | 348,500 | 94,800 | 44 |

|

Financial managers |

63,020 | 117,990 | ≥187,200 | 555,900 | 169,300 | 43 |

|

Human resources managers |

61,300 | 104,440 | ≥187,200 | 122,500 | 46,600 | 43 |

|

Marketing and sales managers |

57,480 | 119,280 | ≥187,200 | 570,600 | 172,200 | 46 |

|

Medical and health services managers |

56,230 | 94,500 | 165,380 | 333,000 | 140,500 | 44 |

|

Purchasing managers |

60,830 | 108,120 | 172,950 | 73,000 | 17,900 | 42 |

|

[1] Estimates do not include wages of self-employed workers. |

||||||

Wages. Managers had some of the highest wages of the occupations in this article. And computer and information systems managers had the highest 10th percentile wage in the table, $80,160. Chief executives had the highest median annual wage, $175,110—nearly 5 times the median wage for all occupations. These workers often get perks, such as profit-sharing payments and stock bonuses, in addition to their wages. And most of the occupations in table 3 had a 90th percentile wage equal to or above the top value published by BLS, $187,200.

But high pay could also mean many hours: All of the occupations in table 3 had average weekly hours that were higher than the average for all workers.

Jobs and outlook. Marketing and sales managers held more than a half million jobs in 2014. About one-third of these jobs were for marketing managers, who may be likely to work at companies’ corporate offices, computer systems design firms, and consulting firms. Massachusetts, Connecticut, and New Jersey had some of the highest concentrations of marketing managers. BLS projects about 172,200 job openings between 2014 and 2024 for marketing and sales managers, the most out of the occupations shown in table 3.

For many businesses, sales are at the core of profitability. Certain types of sales workers, but not all, have high pay. Selected high-paying sales occupations are shown in table 4.

| Occupation | Annual wages, May 2015[1] | Employment, 2014 | Job openings, projected 2014–24 |

Average hours worked, 2015[2] | ||

|---|---|---|---|---|---|---|

| 10th percentile | Median | 90th percentile[3] | ||||

|

First-line supervisors of non-retail sales workers |

$36,870 | $72,300 | $149,290 | 430,700 | 69,900 | 45 |

|

Insurance sales agents |

26,330 | 48,200 | 122,590 | 466,100 | 165,800 | 42 |

|

Real estate brokers |

23,400 | 56,860 | 166,940 | 83,900 | 7,300 | 44[4] |

|

Sales engineers |

55,280 | 97,650 | 165,250 | 69,900 | 23,000 | 46 |

|

Sales representatives, services, all other |

24,720 | 51,700 | 113,570 | 853,500 | 252,400 | 44 |

|

Sales representatives, wholesale and manufacturing |

28,240 | 59,080 | 126,160 | 1,800,900 | 487,700 | 44 |

|

Securities, commodities, and financial services sales agents |

32,680 | 71,550 | ≥187,200 | 341,500 | 91,400 | 44 |

|

[1] Estimates do not include wages of self-employed workers. |

||||||

With some sales careers, workers are paid on commission. These payments reward workers who sell a lot with higher earnings. But the risks work the same way, with workers who don’t do well seeing their pay suffer—or even losing their job.

Wages. More than half of the occupations in table 4 had wages of less than $30,000 at the 10th percentile. At the 90th percentile, however, all earned over $100,000 a year.

Sales engineers had the highest 10th percentile wage of the occupations in the table, $55,280. This occupation also had the highest median wage, and the highest average hours worked per week, of the occupations in table 4. But securities, commodities, and financial services sales agents had the highest 90th percentile wage, $187,200 or more.

High-paying sales jobs also might require long hours. The only occupation in table 4 with average hours less than those for all workers was insurance sales agents.

Jobs and outlook. Wholesale and manufacturing sales representatives had the most jobs of any occupation in this article, more than 1.8 million. Many of these sales representatives worked in wholesale electronic markets and agents and brokers, an industry in which this occupation’s employment is projected to grow. Total job openings for wholesale and manufacturing sales representatives are expected to be numerous, with almost a half million openings projected over the 2014–24 decade.

Sales representatives who sell scientific and technical products had higher pay in 2014 than those who sell other types of products, but they also had fewer jobs. Jobs for scientific and technical products sales representatives were concentrated in New Hampshire, Massachusetts, and Ohio; those for workers who sell other types of products had high concentrations of jobs in Wisconsin, Michigan, and Georgia.

A variety of other occupations that are related to business also have high pay. (See table 5.)

| Occupation | Annual wages, May 2015[1] | Employment, 2014 | Job openings, projected 2014–24 |

Average hours worked, 2015[2] |

||

|---|---|---|---|---|---|---|

| 10th percentile | Median | 90th percentile | ||||

|

Actuaries |

$58,290 | $97,070 | $180,500 | 24,600 | 11,700 | 44 |

|

Economists |

52,540 | 99,180 | 176,960 | 21,500 | 7,000 | 40 |

|

Industrial-organizational psychologists |

52,270 | 77,350 | 158,990 | 2,000 | 800 | 41[3] |

|

Operations research analysts |

43,520 | 78,630 | 132,500 | 91,300 | 43,900 | 41 |

|

Postsecondary business teachers |

35,370 | 75,370 | 170,640 | 106,800 | 28,300 | 43[4] |

|

Public relations specialists |

31,690 | 56,770 | 110,080 | 240,700 | 43,600 | 43 |

|

Statisticians |

44,900 | 80,110 | 130,630 | 30,000 | 15,400 | 41 |

|

[1] Estimates do not include wages of self-employed workers. |

||||||

Wages. In this table, actuaries had the highest wage at both the 10th and 90th percentiles: $58,290 and $180,500, respectively. For median wages, economists’ wage of $99,180 was highest. Almost every occupation in the table, however, had a median wage that was at least twice that for all occupations.

Jobs and outlook. Employment for the occupations shown in table 5 was relatively small, with several of them having 30,000 or fewer jobs. The largest of these occupations in 2014 was public relations specialist (about 240,700 jobs). The highest concentrations of jobs for workers in this occupation were in the District of Columbia, New York, and Vermont.

Operations research analysts had about 91,300 jobs in 2014. However, this occupation is projected to have the most job openings of those in the table: about 43,900 between 2014 and 2024. Nearly as many job openings are projected for public relations specialists (43,600).

Entry requirements for business occupations vary, but people in these careers often need good interpersonal, written and oral communication, and analytical skills. Traits that are important in many occupations, such as humility and patience, may also be valuable in business. And being hardworking and eager to help are good ways to prove yourself.

In addition, aspiring business workers may need to meet the education, experience, or training requirements of these occupations to be hired for entry-level jobs.

Business has been one of the most popular college majors for years, with rates of growth for degrees awarded in this field outpacing those for degrees awarded overall. From 1970–71 to 2013–14, for example, the number of business degrees awarded tripled at the bachelor’s degree level and increased sevenfold at the master’s degree level, according to data from the National Center for Education Statistics. (See chart 1.) By comparison, the number of bachelor's degrees doubled overall and master's degrees tripled overall during the same period.

You’ll need at least a bachelor’s degree to enter most of the high-paying occupations mentioned in this article. A few exceptions include real estate brokers; insurance sales agents; and claims adjusters, examiners, and investigators. In those occupations, you may qualify for entry-level jobs with a high school diploma.

Choosing a major. In some occupations, it’s helpful for jobseekers have a bachelor’s degree in a specific subject or major; in other occupations, it’s required. Accountants, for example, usually need at least a bachelor’s degree in accounting or a related field. And advertising managers may have an easier time finding a job if their degree is in advertising or journalism.

In fact, according to the National Association of Colleges and Employers, business majors were projected to be the most sought-after graduates for the Class of 2016. Bachelor’s degree recipients who studied accounting, finance, and business administration and management were in greatest demand.

Broadening your education. You may not need a degree in business to have a business career. Some employers value the broad perspectives that people with other types of academic backgrounds bring. For example, American Community Survey data show that more than half of management, business, and financial operations workers majored in a subject other than business, such as social sciences or communications.

No matter what your major, it’s important to study a range of nonbusiness subjects, such as English or history. Diversifying your education also may boost your pay. For example, occupations in which workers have knowledge of computer science and engineering often command some of the highest wages of those shown in the tables.

Some occupations typically require education beyond a bachelor’s degree. These include statisticians, economists, and industrial-organizational psychologists, who usually need a master’s degree; and postsecondary business teachers, who usually need a doctoral degree.

Workers still might benefit from earning a master’s degree in business administration (MBA) or similar degree even if advanced education isn’t usually required in a particular business occupation. Getting this credential might improve your job prospects or help you to qualify for higher paying jobs.

Work experience is helpful or even required for getting an entry-level business job, depending on the occupation. You can begin building your résumé while you’re in school. But when you start your career, understand that you may have to work several years to gain the experience you need for the job you want.

Student opportunities. Students interested in a business career can begin preparing as early as high school. For example, you can demonstrate leadership skills by getting involved in student government. Or you might pursue small entrepreneurship endeavors, such as starting a small lawnmowing business.

Networking is essential. One way to start making professional contacts is to join clubs or student chapters of national business organizations, such as DECA or the Future Business Leaders of America.

Another way to set yourself up for success is by doing one or more internships while in school. For some jobs, this might be the best way to get hired at the entry level because employers may prefer to extend offers to their interns upon graduation. In college, you may even be able to get academic credit for completing an internship related to your major.

Work in a related occupation. To qualify for entry-level positions in some occupations, especially management, you first must work a number of years in a related occupation. For example, computer and information systems managers usually need 5 or more years of experience in an information technology occupation that relates to the work they will manage.

After they’re hired, workers in some business-related occupations need on-the-job training to become fully qualified. Depending on the occupation, they may need a lot of training. For example, actuaries might work for years as trainees, learning from experienced workers while also taking a series of tests that will lead to certification.

Training periods are somewhat shorter for other occupations, such as wholesale and manufacturing sales representatives, but some training periods may last for up to a year. For example, sales representatives might participate in formal company training programs and then shadow experienced representatives to learn how the job is done.

Although details vary by state, some occupations require a license specific to the work you do. For example, workers who sell financial products usually need licenses for the types of products they sell. Employers typically sponsor these workers and may allow time or provide training to prepare for the necessary exams.

To start planning for a career, visit the Occupational Outlook Handbook (OOH). OOH profiles describe most of the occupations in this article, as well as hundreds of others. For each occupation, you’ll learn about what workers do, its job outlook, specific entry requirements, and more.

Career Outlook articles related to business occupations include

Many articles in Career Outlook highlight workers’ pay. Two that focus on this topic are

And for articles related to career planning and paying for college, see

Elka Torpey, "Business careers with high pay," Career Outlook, U.S. Bureau of Labor Statistics, August 2016.