An official website of the United States government

United States Department of Labor

United States Department of Labor

BLS will implement changes to the Consumer Price Index (CPI) health insurance methodology starting with the calculation of October 2023 indexes. The pre-October 2023 method is based on an annual calculation using aggregated health insurance premium and benefit data. Two concerns with the pre-October 2023 methodology are the volatility in the annual data and the lag involved in incorporating the health insurance financial data. To address these concerns, we are introducing smoothing to the index to reduce the volatility. We will also incorporate semiannual financial data, which reduces the lag in the index.

After providing an overview of the health insurance data and pre-October 2023 methodology, we discuss the recommendations that led to the changes in the methodology. Then, we discuss the new methodology that uses a smoothed semiannual index instead of an unsmoothed annual index. Finally, there are issues relating to the transition which require adjustments to correct.

The CPI measures health insurance inflation using an indirect method.[1] The indirect method views health insurance as a composite good. Total premiums pay for insurance services (risk protection, claim processing, etc.) and medical goods and services through the insurer reimbursements to providers. Rather than pricing the full premium of health insurance plans, the CPI prices the services provided by the health insurer measured by the portion of the total premium that isn’t used to indirectly purchase medical goods and services. The premiums minus benefits spending is known as the retained earnings.

Then, the measured prices of medical goods and non-insurance services (e.g., physicians, hospitals, etc.) are defined to be the total reimbursed amount and include any payments from insurers. The associated out of pocket expenditure weights are reassigned from premiums to the medical goods and non-insurance services categories. So, the only weight remaining to the health insurance index reflects the retained earnings.[2] Since the insurance spending on medical benefits is included in the non-insurance medical indexes, the insurance services price should not include the impact of benefit inflation on total premiums. Instead, BLS defines the price of these insurance services as the ratio of retained earnings (premiums minus benefits) and real benefits (benefits adjusted for medical inflation).

Prior to October 2023, the health insurance premium and benefits data used in the calculation of the health insurance price relative are annual. The CPI health insurance monthly relative is the twelfth root of the year over year change in the retained earnings to benefit ratio times medical benefits inflation. There are two retained earnings relatives. The first covers most health plans and reflects most of the weight of the index. The second covers plans not included in the first calculation, specifically long-term care (LTC) insurance and Medicare Part D.

Despite some practical advantages of the indirect method, there are some limitations. First, the retained earnings ratio can be volatile, which can cause the retained earnings relative to fluctuate substantially from one year to the next. The reason for this volatility is that insurance plans cover a full year, so premiums are only updated once a year, and utilization within the year can be unpredictable. If utilization is unexpectedly high in a given year, the retained earnings to benefits ratio will fall. The next year, insurers will raise premiums to rebuild their reserves, and the retained earnings to benefits ratio will rise.

Another limitation is that the data are lagged. The health insurance index does not reflect contemporaneous retained earnings information since there is a lag in the availability of the retained earnings data to the CPI. The primary data source for the retained earnings relative in the CPI health insurance index is the U.S. Health Insurance Industry Analysis Report published by the National Association of Insurance Commissioners (NAIC) on an annual basis. The main health insurance relative combines this data with data from California as managed care plans in California report to a different regulator. The second retained earnings relative that covers long term care (LTC) and Medicare part D uses data from the NAIC Accident and Health Policy Experience Report.

The BLS recently asked the National Academies of Science, Engineering, and Medicine, Committee on National Statistics (CNSTAT) for recommendations on improving the CPI, including recommendations on pricing health insurance. The final CNSTAT report was released in 2022.[3] CNSTAT recommended that the BLS continue to use the indirect method for pricing health insurance (recommendation 5.1) but made several recommendations for how the indirect method could be improved.

One issue with the pre-October 2023 method is there can be a lot of volatility in the retained earnings data from one year to the next. There is a question as to whether smoothing the retained earnings data using a moving average is desirable when calculating the relative. This section discusses the arguments for and against smoothing the annual retained earnings data.

The argument against smoothing is that the volatility represents real price changes that should be reflected in the index. If consumers on average have unexpectedly high utilization in a given year, they are receiving a benefit from having their premium locked in for the year. In terms of the insurance services, they are paying less for them (lower retained earnings) and getting more out of them (assuming the quantity of insurance services is proportional to utilization), which means that the price of insurance services has fallen. If this is considered a real price change, then it is irrelevant that it will likely be reversed in the following year. It can be viewed analogously to a sale, with consumers benefitting from prices that are lowered temporarily.

The argument for smoothing is that the relevant price when considering insurance is the ex-ante price.[4] Any ex-post deviations from expected utilization should not be considered real price changes. Individuals can be viewed as facing a fixed price schedule with uncertain utilization. The actual realized retained earnings to benefits ratio will depend on utilization and can show a change in price even if the price schedule is fixed. In similar situations where the price depends on total utilization, the CPI will hold utilization constant when pricing (for example, in the pricing of electricity). CNSTAT argued that the ex-ante price is the relevant price and suggested we consider smoothing (recommendation 5.3). We agree with CNSTAT that the ex-ante price is the more appropriate measure, so a relative calculated from smoothed retained earnings data will be a more accurate measure of price change. A limitation of smoothing is that if the retained earnings to benefit ratio changes for ex-ante reasons (reflecting a real ex-ante price change), smoothing will delay the impact of this change on the price index.

Pre-October 2023, the annual retained earnings data is incorporated into the CPI starting in October after the calendar year for the retained earnings data. For example, in October 2022, retained earnings data was first incorporated into the index reflecting the change in the retained earnings to benefits ratio from 2020 to 2021. This annual change is smoothed over 12 months, so the 2021 retained earnings data will not be fully reflected in the index until September 2023.

Exploring the use of quarterly data to improve the timeliness of the index was another recommendation of the CNSTAT panel (recommendation 5.6).

After conducting extensive research on these recommendations, we determined that the health insurance index could be improved by smoothing the retained earnings data and by using more timely, higher frequency data. In this section, we summarize how we plan to implement these changes to the methodology.

Following the recommendation to smooth the retained earnings data, we investigated different window lengths for the moving average and considered simple versus exponential moving averages. Ultimately, we chose to smooth using a 2-year simple moving average of the retained earnings ratio. Unusual deviations in the retained earnings are generally reversed the following year, so a 2-year average is sufficient for smoothing. Using additional years has less of an impact on smoothing and introduces unnecessary lag. We also favor using a simple moving average versus an exponential moving average as the exponential moving average will retain more of these 1-year deviations. The smoothing will be applied to both retained earnings calculations.

Overall, semiannual and quarterly updates are feasible and improve the timeliness of the index (by six months for semiannual updates and nine months for quarterly updates). A limitation of the quarterly updates is that the data is not provided at the level of detail that allows us to exclude out-of-scope plans. So out-of-scope plans are included in the calculation to impute quarterly changes in the in-scope retained earnings. The quarterly updating can increase volatility, and there is no way to know whether this volatility is driven by in-scope plans (reflecting a true price change that we would want to show in the index) or out-of-scope plans.

Updating twice a year is a clear improvement over the annual method and improves the timeliness of the index by six months compared to the annual updates. The additional benefit of improved timeliness (3 months) of updating quarterly is offset by an increase in volatility. At this time, we decided to switch to semiannual updates as it is not clear the added timeliness of updating quarterly is worth the increase in volatility. However, we will continue to research quarterly data and may incorporate it in the indexes at some point in the future. The semiannual updates will apply to the main retained earnings calculation. The second retained earnings calculation, covering LTC and Medicare part D, will continue to update annually in October, though we will continue to explore options for imputing the semiannual changes for this data.

In terms of implementing the semiannual updates, the mid-year report includes data through June 30, and the final report includes the full year data. To calculate the 2nd half data, we subtract the mid-year report values from the full year data. Once we have the data by half, there are several options for creating semiannual relatives. The formula we chose to incorporate the semiannual updates is a sequential trailing 12 month relative of the retained earnings to benefit ratio. One issue is that the NAIC data are not complete and must be supplemented with data from managed care plans in California that report to a different regulator. The California data are not available at the necessary level of detail semiannually, so we impute the first half of California data using changes in the NAIC data.

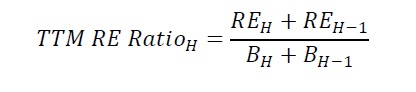

The trailing 12 month (TTM) index pools two halves of data and calculates the sequential relative. Once the second half of the year data is incorporated, the TTM and full year indexes will be identical. This is a desirable property of the TTM index as it will equal the full year index once each index incorporates the same data. For this reason, the TTM index is our preferred method as it will automatically correct any errors in the first half data, whether due to data reporting issues or imputation error relating to the California data. The main advantage of the semiannual index is that it will incorporate this change six months sooner than the annual index. The TTM retained earnings to benefit ratio in half H is:

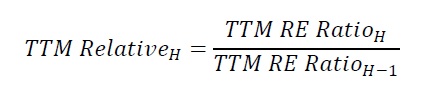

The TTM sequential relative is:

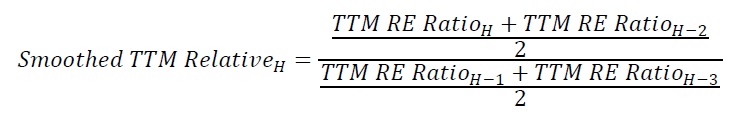

Incorporating both changes, the TTM smoothed relative in half H is:

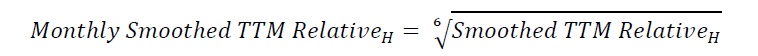

This is a semiannual relative, so the monthly retained earnings relative is calculated by taking the sixth root. The monthly retained earnings relative is:

The monthly retained earnings relative is multiplied by the relatives for medical benefits to form the health insurance relative. This is the calculation for the semiannual updates starting in April 2024 that will incorporate the first half of 2023 data. To switch from an unsmoothed annual index to a smoothed semiannual index, adjustments must be made to the October 2023 update that incorporates the 2022 annual data. We discuss the adjustments for this transition period in the next section.

Both methodological changes (smoothing retained earnings and incorporating retained earnings data sooner) introduce issues with the transition from pre-October 2023 methods. The first issue relates to the timing of the semiannual and annual indexes. Since, the semiannual index is six months ahead of the annual index, switching from annual to semiannual requires speeding up the next annual update. Instead of spreading the 2022 annual update over 12 months, it would be spread over six months by taking the sixth root instead of the twelfth root. Then, in April 2024, we would be able to update the indexes with 2023 first half retained earnings data since the 2022 data will be fully reflected in the index.

The second issue is that, unless a correction term is applied, switching from an unsmoothed to a smoothed relative will create a permanent distortion in the index. See the technical appendix on smoothing retained earnings for an example that illustrates how this distortion arises and how we derive the corrected relative.

Following recommendations from CNSTAT, starting in April 2024, we will switch the retained earnings calculation from an annual relative updated in October to a two year moving average using semiannual data and will update in April and October.[5] The next annual update in October 2023 will involve a six month transition to account for issues relating to changing in methodology. Table 1 provides a summary of the update timing moving forward.

| Index Month | Summary of update |

|---|---|

|

October 2023 |

Incorporate 2022 annual retained earnings data as an adjusted smoothed relative. For the main RE calculation, this update will be spread over six months. For the LTC/Part D calculation, it will be spread over a year. See the technical appendix for the derivation of the adjustment term. |

|

April 2024 |

Update the main RE calculation to incorporate the first half data for 2023. The update will be the semiannual sequential smoothed relative and smoothed over six months. The contribution of California managed care plans to the first half of 2023 retained earnings and benefits will be imputed from changes in the NAIC data. |

|

October 2024 |

Annual update to incorporate full year 2023 data. Second half of 2023 values are calculated by subtracting the first half totals (or first half imputed values for CA managed care plans). For the main RE calculation, the second half data is incorporated as the semiannual sequential TTM smoothed relative and smoothed over the following six months. For the LTC/part D retained earnings calculation, full year 2023 values are incorporated as a smoothed annual relative which is spread over the following 12 months. |

|

April/October |

In future years, the April/October update process will continue. First half data will be incorporated in April and the full year update will occur in October. |

|

Note: This is the tentative schedule for the proposed methodology changes. BLS may amend this schedule in the future as we learn from experience. |

|

Details regarding the transition to this new methodology are provided in: Technical Appendix to Improvements to the CPI Health Insurance Index: Transitioning from an unsmoothed to a smoothed relative

Last Modified Date: October 18, 2024

[1] For more detail on the CPI health insurance methodology see the CPI medical care factsheet.

[2] An alternative to the indirect method would be to price total premiums. Then, the prices and weights of medical goods and non-insurance services would only include out of pocket payments.

[3] The final report can be found here. Chapter 5 focuses on improvements to the medical indexes, with particular emphasis on the pricing of health insurance.

[4] The ex-ante price refers to the insurers setting premiums before knowing what the utilization will be during year. The premium is set based on expected utilization. The benefits spending we observe is based on actual utilization (ex-post), which may differ from what the insurance company expected when setting the premium.

[5] Part of the index will still use annual data but will also switch to using a two year moving average.