An official website of the United States government

United States Department of Labor

United States Department of Labor

Related Articles

Related ArticlesHousehold healthcare spending in 2014

The medical care index is one of eight major groups in the Consumer Price Index (CPI) and is divided into two main components: medical care services and medical care commodities, each containing several item categories. Medical care services, the larger component in terms of weight in the CPI, is organized into three categories: professional services, hospital and related services, and health insurance. Medical care commodities, the other major component, includes medicinal drugs and medical equipment and supplies.

The following topics that are frequently confusing to the public are explained in this factsheet: expenditure methodology, health insurance, medical claims, prescription drugs, professional services, and hospital services.

The CPI measures inflation by tracking retail prices of a good or service of a constant quality and quantity over time. Tracking retail prices allows CPI to capture changes in out-of-pocket household spending over time. Each month, the various item indexes reflect the observed price changes, aggregating up to the all items CPI.

In the aggregation process, each item index is assigned a relative importance, or weight. The weight of each item in the CPI is determined using the Consumer Expenditure Survey (CE) which collects information from the nation's households and families on their buying habits (or expenditures), income, and household characteristics. Goods and services that consumers spend the most on will be the most heavily weighted. Additional information on CE and how weights are calculated and updated can be found in the CPI and the CE sections of the BLS Handbook of Methods.

The CE tracks consumer out-of-pocket spending on medical care, which is used to weight the medical care indexes. CE defines out-of-pocket medical spending as:

Employer paid portions of insurance premiums and fully tax-funded medical care (such as Medicare Part A and Medicaid) are not considered out-of-pocket, and therefore not used in weighting the indexes.

While the weight of each CPI medical care related index is determined by out-of-pocket spending, price change reflected by the indexes measure the total reimbursement to medical care providers. This includes medical care payments made by private insurance companies, Medicare Part B, Medicare Part C (Medicare Advantage) and Medicare Part D on behalf of consumers.

For example, in the physicians’ services index, we consider the price of an office visit to be the patient’s $20 copay, as well as the $80 insurance payment to the physician, for a total of $100. The $100 figure is used when calculating any price change.

The reason for this apparent discrepancy is due to challenges the BLS faces when pricing health insurance; this is described in more detail in the health insurance section. Medicaid and worker's compensation payer types are not eligible for the CPI since consumers do not make out-of-pocket payments to participate in these programs.

Note: Since the relative importance of medical care only includes out-of-pocket expenditures, its share in the CPI is smaller than its share of gross domestic product (GDP) and other national accounts measures. GDP includes reimbursements that are fully paid for by public sources and employers, increasing medical care’s share of GDP.

| Item | Definition | Relative importance (percent) | Percentage of the Medical Care Index |

|---|---|---|---|

|

Medical care |

Medical care commodities and medical care services | 8.423 | 100% |

|

A. Medical care commodities |

Prescription drugs, nonprescription over-the-counter-drugs, and other medical equipment and supplies | 1.489 | 18% |

|

1. Medicinal drugs |

All prescription and over-the-counter drugs | 1.354 | 16% |

|

a. Prescription drugs |

All drugs dispensed by prescription. Mail order outlets are included. Prices reported represent transaction prices between the pharmacy, patient, and third party payer, if applicable. | 0.973 | 12% |

|

b. Nonprescription drugs |

All nonprescription drugs, including topicals | 0.381 | 5% |

|

2. Medical equipment and supplies |

Nonprescription medicines and dressings used externally, contraceptives, and supportive and convalescent medical equipment (e.g., adhesive strips, heating pads, athletic supporters, and wheelchairs) | 0.135 | 2% |

|

B. Medical care services |

Professional medical services, hospital services, nursing home services, adult day care, and health insurance | 6.935 | 82% |

|

1. Professional services |

Physicians, dentists, eye care providers, and other medical professionals | 3.426 | 41% |

|

a. Physicians' services |

Services by medical physicians in private practice, including osteopaths, which are billed by the physician. Includes house, office, clinic, and hospital visits. (Excludes independent lab work and ophthalmologists. See Eyeglasses and eye care.) | 1.684 | 20% |

|

b. Dental services |

Services performed by dentists, oral or maxillofacial surgeons, orthodontists, periodontists, or other dental specialists in group or individual practice. Treatment may be provided in the office or hospital. | 0.904 | 11% |

|

c. Eyeglasses and eye care |

Services and goods provided by opticians, optometrists, and ophthalmologists. Includes eye exams, dispensing of eyeglasses and contact lenses, office visits, and surgical procedures in the office or hospital. | 0.327 | 4% |

|

d. Services by other medical professionals |

Services performed by other professionals such as psychologists, chiropractors, physical therapists, podiatrists, social workers, and nurse practitioners in or out of the office. Also, includes independent lab work and imaging services. | 0.511 | 6% |

|

2. Hospital and related services |

Services provided to inpatients and outpatients. Includes emergency room visits, nursing home care and adult day care. | 2.618 | 31% |

|

a. Hospital services |

Services provided to patients during visits to hospitals, ambulatory surgical centers, or other similar settings. | 2.167 | 26% |

|

i. Inpatient hospital services (1) |

Services for inpatients. Includes a mixture of itemized services, Diagnosis Related Group -based services, per diems, packages, or other bundled services. | N/A | |

|

ii. Outpatient hospital services (1) |

Services provided to patients classified as outpatients in hospitals, free standing services facilities, ambulatory surgery, and urgent care centers. | N/A | |

|

b. Nursing home and adult day care services |

Charges for residential care at nursing homes, nursing home units of retirement homes, and convalescent or rest homes. Also includes non-residential adult day care. | 0.221 | 3% |

|

c. Care of invalids and elderly at home |

Fees paid to individuals or agencies for the personal care of invalids, elderly or convalescents in the home including food preparation, bathing, light house cleaning, and other services | 0.230 | 3% |

|

3. Health Insurance |

Indirect approach based on retained earnings method. See Health Insurance section. | 0.890 | 11% |

|

Footnotes: (1) Substratum index: a special index published below the typical item level. Relative importance is not available for these indexes. (2) CPI pricing and weighting excludes institutionalized populations such as those living in nursing homes. |

|||

Even though insurance premiums are an important part of consumers’ medical spending, the BLS does not directly price health insurance policies. In a direct approach, we would track the movement of insurance premiums, holding constant the quality of insurance, and use these price relatives to build the Health Insurance index. However, the BLS has been unable to consistently control for changes in quality such as policy benefits and risk factors. Price change between health plans of varying quality cannot be compared, and any quality adjustment methods to facilitate price comparison would be difficult and subjective. As a result, we developed an indirect approach called the retained earnings method.

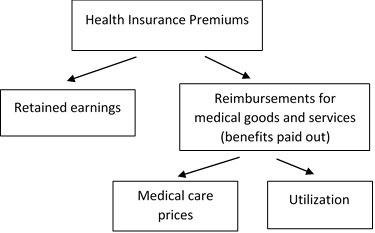

This section offers a general overview of the retained earnings methodology; the specifics of each step are detailed in later sections. This method begins by decomposing health insurance premiums into two categories based on how they are used by the insurance company: earnings retained by the insurance company and the benefits paid out on behalf of customers.

The earnings retained by the company can be thought of as leftover premiums income after paying out benefits and rebates1. These earnings retained by the insurance company are used to cover administrative costs or kept as profit. The BLS classifies this value as the cost of administering insurance services, such as paying out claims, and refers to it as the retained earnings. Benefits paid out — or reimbursements to providers for medical goods and services — can be broken down as the average price of medical service claims multiplied by the number of claims filed, also referred to as medical care utilization.

Deconstructing health insurance premiums in this way shows that premiums are a function of retained earnings, utilization, and the price of medical care.

Figure A. Breakdown of Health Insurance Premium Components.

Once premiums are defined, the BLS makes an important assumption: that the quality of a health insurance policy can be held constant through the ratio of retained earnings to benefits paid out. For example, if retained earnings rise as a result of increased premiums while benefits paid out stays constant, then the quality of insurance has decreased relative to its cost. This monthly relative of the retained earnings to benefits ratio is how the BLS tracks premium prices without having to adjust for quality changes in each insurance policy, such as services covered.

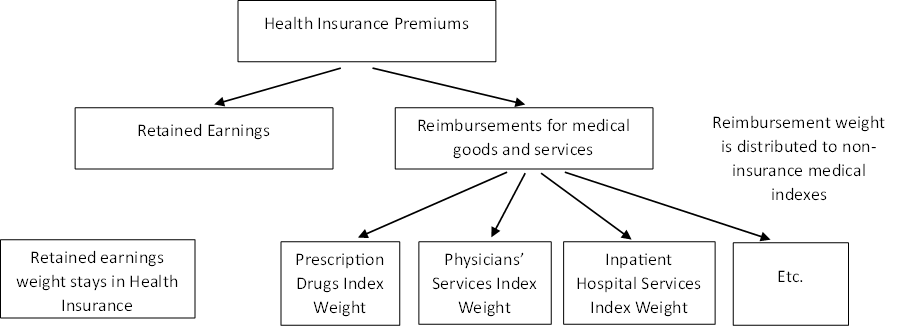

Since BLS only wants to track change in retained earnings in the health insurance index, BLS must reallocate the health insurance weight representing benefits paid out. This weight is reassigned proportionally to the non-insurance medical care indexes.

After this weight is reallocated, the monthly relative of the retained earnings to benefits ratio is multiplied by the monthly change in each non-insurance medical care index. This is done to account for the effect that changing medical prices has on premiums, and thus retained earnings.

We separate the process of reassigning weight and calculating the health insurance index into four steps which are discussed in greater detail below.

The first step of the retained earnings method is to determine the appropriate weighting. The method we use reassigns part of the health insurance weight to the other medical care indexes. This is done by breaking down health insurance premiums, and thus the health insurance index weight, into the two ways premium payments are disbursed: insurance reimbursements for medical goods and services, and the administrative costs and profits of insurance companies (retained earnings).

Once separated, the weight corresponding to medical care reimbursements will be reallocated to the other non-insurance medical care indexes. The method for this reallocation is described in the reassigning health insurance weight section below. The weight corresponding to retained earnings remains in the health insurance index.

Figure B. Health Insurance Weight Redistribution.

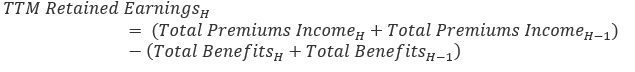

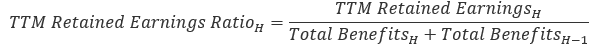

The second step in the retained earnings method is to calculate the retained earnings ratio and its monthly relative. The retained earnings ratio is calculated using premium income and benefit payment data obtained from industry sources. Total premiums and benefits are sourced twice a year from the U.S. Health Insurance Industry Analysis Report (for the October adjustment) and Mid-Year Industry Analysis Report (for the April adjustment) published by the National Association of Insurance Commissioners (NAIC) and annually from the California Department of Managed Health Care (DMHC) for commercial insurance. Since this information is not available in real time, the retained earnings ratio is lagged by approximately 10 months.

The health insurance retained earnings relative is calculated using data that is published in annual and mid-year reports. The numbers for the second half of the year are created by subtracting the mid-year totals from the annual totals. Where mid-year data is not available, we impute it using annual data. Note that the health insurance retained earnings relative for Medicare part D is smoothed over two years but is currently only updated once a year.

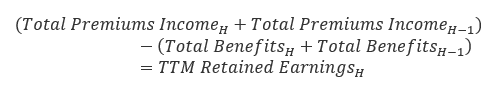

The retained earnings ratio is calculated as:

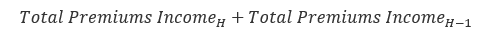

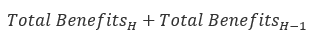

The total benefits paid out by the insurer are subtracted from its total premiums income to get the trailing 12 month retained earnings by half year, H.

The TTM retained earnings is then divided by trailing 12-month total benefits to get a ratio of retained earnings to benefits:

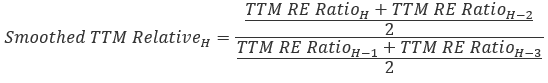

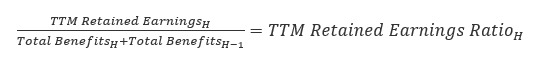

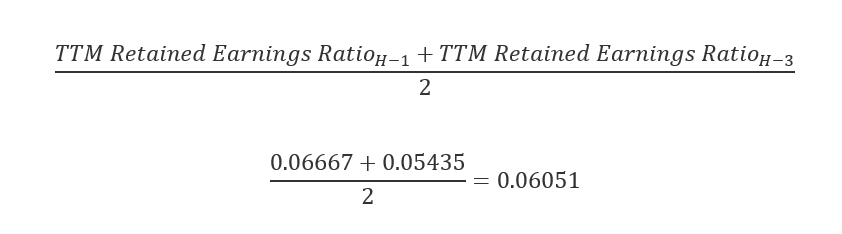

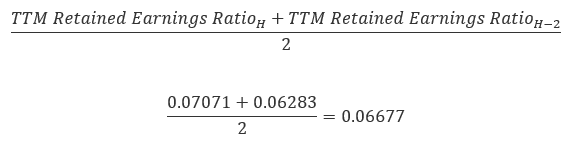

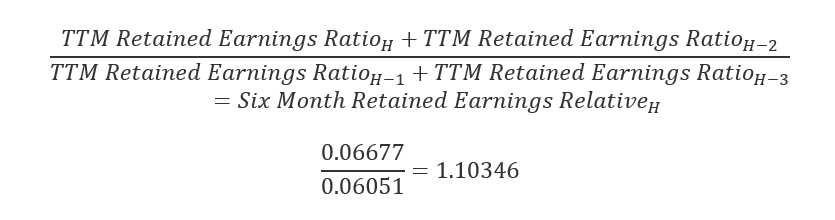

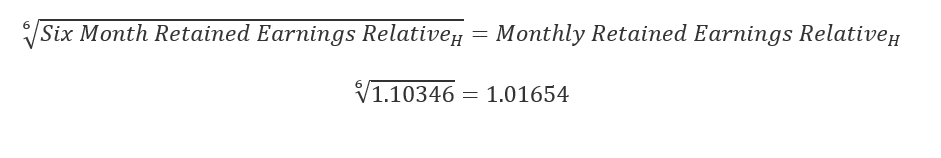

The smoothed biannual relative change between ratios of retained earnings to benefits (the retained earnings ratio) is calculated by dividing the 2-year average from the most recent half by the 2-year average from one half before.

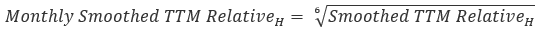

The half-year retained earnings ratio is then converted to a monthly relative by taking its sixth root.

Below is a hypothetical calculation of the change in retained earnings for commercial carriers. The numbers in the table below are for example purposes only and do not reflect the actual data from the periods listed.

| Date Range of Data (Example) | Period Name (in equations) | Total Premiums Income | Total Benefits |

|---|---|---|---|

|

Half 1 of year T |

H | $107,000.00 | $100,000.00 |

|

Half 2 of year T-1 |

H-1 | $105,000.00 | $98,000.00 |

|

Half 1 of year T-1 |

H-2 | $103,000.00 | $97,000.00 |

|

Half 2 of year T-2 |

H-3 | $100,000.00 | $94,000.00 |

|

Half 1 of Year T-2 |

H-4 | $94,000.00 | $90,000.00 |

| Period | Equation (Step 1c) | Result (TTM Retained Earnings) |

|---|---|---|

|

H |

(107,000+105,000)-(100,000+98,000) | 14,000 |

|

H-1 |

(105,000+103,000)-(98,000+97,000) | 13,000 |

|

H-2 |

(103,000+100,000)-(97,000+94,000) | 12,000 |

|

H-3 |

(100,000+94,000)-(94,000+90,000) | 10,000 |

Calculate the TTM retained earnings ratio for each half by dividing the TTM retained earnings (calculated in 1c) by the benefits (calculated in 1b). Repeat step 1 for the most recent four half-year periods (H, H-1, H-2, H-3) to get the retained earnings ratio for each period.

| Period | Equation | Result (TTM Retained Earnings Ratio) |

|---|---|---|

|

H |

14,000/(100,000+98,000) | 0.07071 |

|

H-1 |

13,000/(98,000+97,000) | 0.06667 |

|

H-2 |

12,000/(97,000+94,000) | 0.06283 |

|

H-3 |

10,000/(94,000+90,000) | 0.05435 |

Calculate the annual smoothed retained earnings ratio for the current half-year period. We must use the method in step 2 instead of taking a simple average of all four periods in order to avoid double counting the previous period data.

Calculate the monthly relative by taking the 6th root of the result from step 3c:

The third step in the retained earnings method is to multiply the monthly retained earnings relative by the index relatives of the other nine non-insurance medical indexes. This allows the BLS to account for the effect medical price change has on health insurance premiums. These nine indexes are: physicians' services, dental services, eye care, other professional services, hospital services, nursing homes, home health care, prescription drugs, and medical equipment.

This results in nine health insurance index products, each factoring in medical care price changes. The weight of the health insurance index, which reflects retained earnings, is distributed to these nine health insurance index products based on their share of benefits. The overall Health Insurance index is calculated by aggregating these nine index products by their corresponding weights.

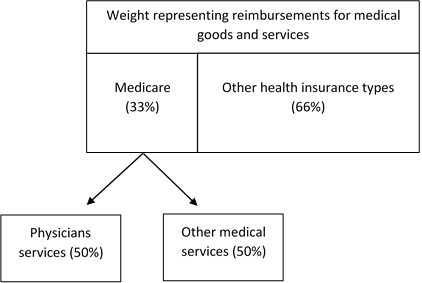

The fourth and final step of the retained earnings method is to reassign the previously separated Health Insurance index weight to the other nine non-insurance indexes. Remember that the health insurance weight is split between medical care reimbursement and retained earnings. The weight representing medical care reimbursement is what gets reassigned to the other indexes. This weight is further split by health insurance type (commercial insurance and Medicare) and then redistributed to each medical non-insurance index in proportion with how much each health insurance type pays for that medical good or service.

For example, let’s say Medicare is responsible for one-third of the reimbursement weight in the health insurance index and half of Medicare spending is used to pay for physicians’ services. This would mean one-half of one-third of the health insurance index weight would be transferred to the physicians’ services index.

Figure C. Reassigning Health Insurance Weight.

This process occurs for each health insurance type and each of the non-insurance medical indexes until all of the weight representing reimbursements is redistributed. Industry data is used to determine the percentage each health insurance type pays for each medical item.

After the reallocation of expenditure on benefits, non-insurance medical care indexes carry the weight of both out-of-pocket payments and the insurance reimbursements for medical care. Therefore, each of these non-insurance indexes must track the price relatives of the total reimbursement (insurance reimbursements as well as the out-of-pocket patient copays). Continuing the example above, if the BLS is tracking the cost of an annual physical paid for by Medicare, we would track both the patient co-pay as well as how much Medicare pays.

Prior to September 2018, commercial insurance data was sourced from A.M. Best’s Insurance rather than NAIC and DMHC.

In October 2020, the retained earnings calculation began including premium and benefit expenditures for Medicare Advantage. Previously, these Medicare Advantage expenditures were not included.

Prior to April 2021, part of the retained earnings calculation included premiums and benefits data from a national nonprofit health insurance carrier. This data was replaced by National Association of Insurance Commissioners (NAIC).

In October 2022, the retained earnings calculation began including premium and benefit expenditures for Medicare Part D. Previously, these Medicare Part D expenditures were not included.

In October 2023, following recommendations from the National Academies of Science, Engineering, and Medicine’s Committee on National Statistics (CNSTAT), the BLS improved the retained earnings calculation by updating retained earnings every six months using half-year data and calculating a two-year moving average to smooth the changes in retained earnings. The publication of October 2023 data involved a 6-month transition using annual data that has been averaged (smoothed) over two years. With April 2024 data, we began to incorporate half-year, rather than annual, retained earnings. The retained earnings are now updated every six months with April and October data. This change in methodology reduced the time lag associated with the health insurance index by six months.

In October 2025, the BLS removed long-term care (LTC) insurance from the health insurance index. Changes in the market for LTC insurance have made it out of scope and ineligible for pricing.

Starting with the release of October 2024 indexes, in November 2024, the BLS uses secondary source medical claims data from a national health insurance aggregator to measure price change for services covered by private insurance for physicians’ services and outpatient hospital services. These data are collected from medical claims records submitted by healthcare providers to a patient’s insurance and include information like diagnostic codes, procedure codes, and the cost of the services, along with other data. These data only replace data for services covered by private insurance; services paid for by cash (self-pay), Medicare part B, and all inpatient hospital services are still collected via the Commodity & Services survey and are combined with the claims data to calculate the final indexes. A detailed explanation of the methodology for using medical claims can be found at https://www.bls.gov/cpi/additional-resources/use-of-medical-claims-data-physicians-and-hospital-services.htm.

Secondary source medical claims data provide significantly more observations and capture more types of services than the traditional methodology. These data also address existing difficulties with collecting data from hospitals and doctor’s offices, which is especially relevant for private insurance prices. Additionally, the claims data allow CPI to capture changes in the market much faster than traditional methods. The claims data are only available with a three-month lag, but the CPI program determined that the claims data performs better than the traditionally collected data regardless of the lag. The medical claims sample is fully rotated every two years, with 25 percent of PSUs rotating every 6 months. The samples rotate in April and October every year (using data for services provided in January and July, respectively). This rotation is more frequent than the four-year sample rotation used for most CPI items. This is beneficial for medical data because it will pick up new or changing procedure codes more quickly. For more information on the research behind the inclusion of medical claims data in the CPI, see the article “Incorporating medical claims data in the Consumer Price Index” from the Monthly Labor Review in February 2023.

The prescription drugs index measures price change of drugs purchased with a prescription at a retail, mail order, or internet pharmacy. The tracked price is the total reimbursement to the retailer from the patient and all eligible payers for a single prescription. Payers are any entities who reimburse health care providers for the cost of medical services and/or goods. Eligible payer types for prescription drugs are: patient self-pay (cash), commercial or private insurance, and Medicare Part D.

Prescription drugs that are primarily consumed and paid for as part of hospital visits are included in the hospital services index. A deeper examination of BLS methodology for handling prescription drugs can be found here.

The prescription drugs index employs a streamlined sampling method; the pricing unit, or quote, is a specific prescription for a particular drug. When sampling drugs to price at a pharmacy, we obtain a list of the last 20 prescriptions dispensed and each prescription is assigned a percentage representing its likelihood to be sampled. The assigned percentage is equal to each prescription’s price divided by the total price of all 20 prescriptions. Using these probabilities, a prescription is selected; this process is known as sampling by probability proportional to size (PPS).

In this case, the “size” refers to the total reimbursement (patient payment and payer reimbursement) to the pharmacy for the prescription. The more expensive or more popular a drug is, the higher its sales numbers will be, and the more likely it is to be selected. This item selection process is the desired procedure and is attempted at every pharmacy selected for pricing. We work with respondents who cannot provide the necessary information to determine a workable sampling process, which may include selecting a drug via equal probability or other simplified methods.

When a brand-name drug in the sample loses its patent protection, consumers will often switch to the cheaper generic drugs that have entered the market. To accurately reflect the market, the BLS will resample all previous instances where the brand was selected because no generic existed at the time. We then resample between brand and generic versions of the originally sampled drug using corresponding probabilities proportional to the share of prescriptions sold at the pharmacy in the past 3 months.

To give enough time for the market to fully adjust to the new generics, the BLS waits approximately six months after patent expiration before implementing the resampling procedure. Resampling occurs only once. If a generic is selected, we treat any difference in price from the brand as a price change and the price difference is reflected in the index in the month when the resampling was performed. If the brand is selected again, we simply continue to price the brand.

If a specific prescription drug becomes available over-the-counter (OTC), the BLS will continue to price any quotes of the drug in the prescription drug index until it rotates out under normal rotation procedures (a complete rotation occurs once every 4 years with one-eighth rotating every 6 months). During this time, the quote remains in the prescription drug sample and any price change is reflected in the prescription drug index. Any quotes for that drug are not immediately transferred to the non-prescription drugs index, but once the drug becomes available OTC, it is eligible for selection in the non-prescription drugs index.

In 2016, the prescription drugs index changed its estimation formula from a geometric means formula to a Laspeyres formula. This was done following BLS research finding that the substitution effect for prescription drugs is overstated when using a geometric means formula.

The professional services index covers services that are performed and billed by private-practice medical doctors, dentists, eye care providers, and other medical providers. Physicians' services and dental services indexes have most of the weight for this category. The professional services index collects prices on three different payer types: patient self-pay (cash), commercial or private insurance, and Medicare Part B.

Sub-indexes are calculated at the payer type level for the Physicians’ Services Index. The BLS uses the Medical Expenditure Panel Survey (MEPS) to weight the associated payer type indexes within a geographical area. The BLS then aggregates these area payer-type sub-indexes to calculate the U.S. level indexes. This method is used to improve the index representativeness of the various payer types by increasing the share of payments covered by private insurance relative to payments made by uninsured people and payments covered by Medicare Part B. This change was implemented in April 2019. See the Improving the CPI physicians’ services index article for more information on this change.

Since Medicare Part B does not cover most dental services, the dental services index does not accept Medicare Part B payments but does accept patient self-pay and private insurance.

The methodology for initiating all professional services is the same. The pricing unit is a doctor’s visit, defined by a specific medical service. At the initial visit, we establish the practitioner's specialty; if it is a group practice, one practitioner is sampled. Then a medical service is sampled via PPS. Here, “size” refers to the total reimbursement of each service over the previous year. For Physicians’ Services, Current Procedural Terminology (CPT) codes are collected to help describe the item accurately. Like most other CPI items, samples for professional services are rotated once every 4 years with one-eighth of the sample rotating every 6 months.

The BLS uses a carry forward process for some prices in the physicians’ services index in order to reduce the time burden on CPI survey respondents. Many physicians make limited adjustments to their prices each year, usually only changing prices when renegotiating their annual contract with insurance companies. This means physicians’ offices are eligible to have prices collected less frequently. For non-pricing months, the last collected price for each quote is carried forward for use in the current month index. Most offices that are approved for carry forward are priced between 2 and 4 months per year. The selected pricing months are those where price changes are most likely to occur. This change was made in June 2017.

In September 2014, the BLS began pricing services at Health Maintenance Organizations (HMOs); previously HMOs were not eligible.

In October 2024, the BLS began incorporating medical claims data from a national health insurance aggregator in the physicians’ services index in the calculation of price change for services covered by private insurance. This change is further explained in the Medical Claims section of the fact sheet.

The hospital services index tracks the price of services performed and billed by a hospital. It includes both inpatient and outpatient medical services, as well as room and board, lab work, and other services provided by the hospital. It includes services performed by physicians if they are employed by the hospital. However, it excludes services performed by physicians who do not work for the hospital, even if they are using hospital facilities. Those services are captured in the professional services index. Eligible payers for the hospital services index are: patient self-pay (cash), commercial or private insurance, and Medicare Part B.

The pricing unit is a hospital visit, defined by a specific medical service and a specific diagnosis or medical condition. At the initial visit, we work with the respondent to select a medical service using PPS. Here, “size” is referring to total reimbursement to the hospital. We then document the medical service and specific procedures of the hospital visit.

Reimbursements to hospitals can be categorized as either an itemized list or a lump sum payment. Reimbursement through an itemized list, usually called fee-for-service or fee schedule, results in a separate price for each individual good and service provided. Lump sum reimbursements, such as Diagnosis-Related Group (DRG) charges, result in a flat fee for all goods and services rendered based on the diagnosis or the type of procedure performed.

For hospital services data that is collected via the Commodities & Services survey, outlets are sampled from a dataset produced by the American Hospital Association. The sample of outlets for hospital services rotates less frequently than other items in the CPI. Outlets are priced for 8 years instead of the standard 4 years. The sample is static for 4 of the 8 years, after which the sample will undergo routine semi-annual rotation over the following 4 years. For example, the sample for this item will rotate during the August 2023 through the February 2027 samples and then will not rotate again until August 2031.

The BLS uses a carry forward process for some prices in the hospital services index in order to reduce the time burden on CPI survey respondents. Many hospitals make limited adjustments to their prices each year, usually only changing prices when renegotiating their annual contract with insurance companies. This means hospitals are eligible to have prices collected less frequently. For non-pricing months, the last collected price for each quote is carried forward for use in the current month index. Most hospitals that are approved for carry forward are priced between 2 and 4 months per year. The selected pricing months are those where price changes are most likely to occur. This change was made in June 2017.

In October 2024, the BLS began incorporating medical claims data from a national health insurance aggregator in the outpatient hospital services index in the calculation of price change for services covered by private insurance. This change is further explained in the Medical Claims section of the fact sheet.

Access data for medical care in our online database.

We often receive questions about where potentially ambiguous items are categorized; table E contains a list of these items along with their expenditure category.

| Item/Outlet | Expenditure Category |

|---|---|

|

Anti-Aging Cream |

Personal Care Products |

|

Appetite Suppressant |

Medicinal Drugs |

|

Asthma Inhaler |

Medical Equipment and Supplies |

|

Back Brace |

Medical Equipment and Supplies |

|

Breast Pumps |

Miscellaneous Personal Goods |

|

Chair for the Shower |

Medical Equipment and Supplies |

|

Compression Socks |

Medical Equipment and Supplies |

|

Dietary Supplements |

Medicinal Drugs |

|

Douche |

Personal Care Products |

|

Drug and/or Rehabilitation Centers |

Hospital and Related Services |

|

Exfoliate |

Personal Care Products |

|

Eye Drops |

Medicinal Drugs |

|

Feminine Hygiene |

Personal Care Products |

|

Glucose Test Urine Strip |

Medical Equipment and Supplies |

|

Hair Loss Treatment |

Personal Care Products |

|

Independent Medical Laboratories |

Professional Services |

|

Intermediate Care Facilities for Individuals with Intellectual Disabilities |

Hospital and Related Services |

|

Latex Gloves |

Medical Equipment and Supplies |

|

Lip Balm |

Personal Care Products |

|

Lotion |

Personal Care Products |

|

Massage Therapist |

Professional Services |

|

Masseuse |

Personal Care Services |

|

Medical Acne Treatment |

Medicinal Drugs |

|

Nasal Spray |

Medicinal Drugs |

|

Nasal Wash |

Medical Equipment and Supplies |

|

Needles for Injecting Medicine |

Medical Equipment and Supplies |

|

Nicotine Gum |

Medicinal Drugs |

|

Ovulation Kits |

Medical Equipment and Supplies |

|

Performance Supplement |

Medicinal Drugs |

|

Pregnancy Tests |

Medical Equipment and Supplies |

|

Probiotics |

Medicinal Drugs |

|

Protein Shakes |

Other Foods |

|

Shoe Orthotics |

Personal Care Products |

|

Snoring Treatment Strips |

Medical Equipment and Supplies |

|

Steam Inhaler |

Medical Equipment and Supplies |

|

Vitamins |

Medicinal Drugs |

|

Wander Alarm |

Medical Equipment and Supplies |

Experimental disease-based price indexes created by the BLS are available on the Price and Index Number Research page.

Additional information may be obtained from the Consumer Price Index Information Office by email or calling 202-691-7000. Information on the CPI's overall methodology can be found in the CPI section of the BLS Handbook of Methods.

Note:

1 Rebates are removed from the premium income data prior to BLS receiving the data.

Last Modified Date: February 13, 2026