An official website of the United States government

United States Department of Labor

United States Department of Labor

Each year thousands of people write contracts with escalation clauses that are tied to the Consumer Price Index (CPI). Escalation contracts call for an increase in some type of payment in the event of an increase in prices. These contracts are used in a wide variety of ways, from adjusting rent prices to adding cost-of-living adjustments to alimony payments and wage contracts. Unfortunately, many escalation contracts tied to the CPI are vague. For example, a contract may stipulate that “the Consumer Price Index (CPI)” be used to escalate an apartment rent, but the Bureau of Labor Statistics (BLS) publishes thousands of CPIs each month, so a more carefully worded contract could minimize ambiguity and the likelihood of future disputes. This issue of Beyond the Numbers can help those who use the CPI to write escalation clauses to create a more comprehensive contract.

BLS publishes different CPIs for different population groups, different geographic areas, different item categories, and different reference bases. For many indexes, BLS publishes both seasonally adjusted data and data that are not seasonally adjusted. A well-written escalation contract should specify each of the following parameters.

Determine which CPI population group to use in the contract. The CPI publishes price changes for two population groups. The Consumer Price Index for All Urban Consumers (CPI-U), as the name implies, measures price change for urban consumers. The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) measures price change for a narrower population of Americans. An escalation contract should specify whether the CPI-U or CPI-W is to be used. The CPI-U covers a significantly broader segment of Americans and represents the broadest measure of consumer inflation that BLS produces, therefore it is typically subject to less sampling error than the CPI-W.1

Determine which CPI item category to use in the contract. CPIs are published for hundreds of item categories. There are separate indexes for bananas, medical care, and televisions, for example. But the broadest item category is the all items category, which includes everything that a consumer buys out of pocket, including food, energy, and all items other than food and energy. An escalation contract should specify which CPI item category is to be used in the escalation. Generally, users are encouraged to specify a broad item category, such as the all items index, when writing an escalation contract because broader item categories have larger sample sizes and are typically subject to smaller sampling error.

Determine which geographic area to use in the contract.CPIs are published for a wide variety of geographic areas. For example, BLS publishes indexes at the U.S. City Average (or national) level, the regional level (for example, the South region), and even for some local metropolitan areas (for example, Atlanta, GA). An escalation contract should specify which CPI geographic area is to be used in the escalation. An advantage of specifying the broader (U.S. City Average) geography in the contract is that U.S. City Average indexes have larger sample sizes than smaller geographic areas do and therefore are subject to smaller sampling error.

Determine which reference base to use and how to handle potential changes in the reference base. A reference base specifies which time period is set to 100 for an index. Defining a reference base of 100 allows users to more easily calculate percent changes over time. For each CPI index series, BLS publishes a current (or “standard” reference base). For example, the standard reference base for the CPI-U all items index is 1982–1984=100. Some index series, though, have different reference bases. For clarity, an escalation contract should specify the reference base to be used.

The contract could also specify how to handle a change in the reference base. For example, before 1988, the all items index was published on a standard reference base of 1967=100. In 1988, the reference base of 1982–1984=100 became the standard reference base. Percent changes between periods are not affected by changes in the reference base (except for rounding). As such, an escalation contract could state that the standard reference base be used.

Use indexes that are not seasonally adjusted. BLS publishes some indexes that are seasonally adjusted and some that are not seasonally adjusted. In an escalation contract, the parties should generally use an index that is not seasonally adjusted, and they should specify this in the contract. Seasonally adjusted indexes are subject to revision each year, so they add an unneeded level of complexity to most escalation contracts.

Specify a unique CPI index series. In summary, the CPI population, item category, and reference base should all be explicitly stated in an escalation contract in order to spell out which CPI is tied to the contract. In addition, parties should note they are using indexes that are not seasonally adjusted. For example, if the parties wanted a contract to use the broadest measure of consumer inflation, they would write the contract to specify the precise index being used, as follows:

The Consumer Price Index for All Urban Consumers (CPI-U); U.S. City Average; All items, not seasonally adjusted, 1982–1984=100 reference base.

Specify the base dollar amount. The two parties that are writing the escalation contract using the CPI should specify the base amount to be escalated. For example, the base dollar amount for rent on an apartment or home might be set at $1,000, the initial rent paid by the renter.

Specify the timing and frequency of the escalation. The index reference month (or other time period) to be used in the contract should be clearly stated. The CPI for a given month is published about 2 weeks after the reference month, so a contract could not be escalated until the data are released. For example, if the two parties to a contract want to escalate a $1,000 rent each year using the December CPI each year, they should note in the contract that they are using the December index, published in mid-January.

In addition, many national indexes, such as the U.S. City Average, are published monthly, but most local area data are published less frequently. Some indexes are published bimonthly or semiannually. Therefore, the national (U.S. City Average) indexes have the advantages of smaller sampling error and more frequent publication.

Include a provision on price “floors” and “ceilings.” Prices for most broad categories of items, such as the all items index, tend to increase over long periods of time. But prices can fall as well. The contract should include a provision on what to do if the index series used in the escalation clause decreases. For example, if the index specified in the contract decreases 5 percent, should the amount being escalated fall 5 percent as well, or should there be no change in the amount paid? This concept is sometimes called a “floor.”

Similarly, prices might increase more than either party expected. As such, the parties involved in the escalation contract may want to consider adding a “ceiling” to each price increase. For example, parties who do not want increases to exceed 10 percent a year should state this in the contract.

The Bureau of Labor Statistics neither encourages nor discourages the use of price adjustment measures in contractual agreements. Also, although BLS can provide technical and statistical assistance to parties developing escalation agreements, BLS can neither develop specific wording for contracts nor mediate legal or interpretive disputes that might arise between the parties to the agreement.

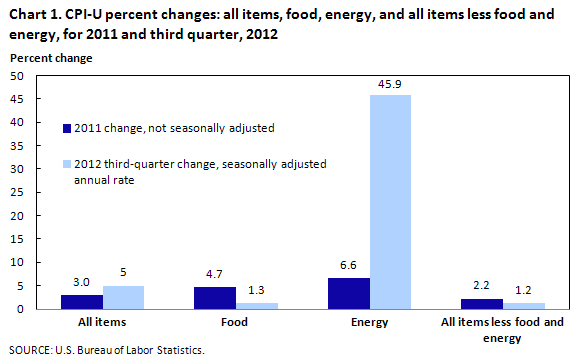

The U.S. all items Consumer Price Index for All Urban Consumers (CPI-U) increased at a 5.0-percent seasonally adjusted annual rate (SAAR) during the third quarter of 2012. (See chart 1.) This follows an increase of 3.7 percent and a decline of 0.8 percent in the first and second quarters, respectively. For the first 9 months of 2012, the index has increased at a 2.6-percent SAAR. This compares with a rise of 3.0 percent in 2011.

| Category | 2011 change, not seasonally adjusted | 2012 third-quarter change, seasonally adjusted annual rate |

|---|---|---|

All items | 3.0 | 5 |

Food | 4.7 | 1.3 |

Energy | 6.6 | 45.9 |

All items less food and energy | 2.2 | 1.2 |

A turnaround in the energy index, which rose 45.9 percent in the third quarter, was the primary source of the change in the all items index. While contributing to the change in all items from June to September, the food index and the index for all items less food and energy grew at much slower rates (up 1.3 and 1.2 percent, respectively) than the third-quarter energy index.

The energy index maintained its pattern of alternating between increasing in one quarter, then decreasing the next quarter. The third quarter’s 45.9-percent rise was preceded by a second-quarter decline of 26.2 percent and a first-quarter climb of 18.3 percent. With the inclusion of data from the fourth quarter of 2011, the energy index increased modestly, a 2.3-percent increase over the last 12 months. The year-to-date annual growth rate for energy paints a different picture. It is up 8.4 percent, consistent with the somewhat large increases of the previous 2 years. Energy was up 6.6 percent in 2011 and 7.7 percent in 2010. The average annual rate of change from September 2007 to September 2012 was a more moderate 4.1 percent.

Household energy and motor fuel, the major components of the energy index, both increased during the third quarter. Household energy increased 2.5 percent, led by fuel oil and other fuels rising 18.2 percent, and energy services rose 1.3 percent. Household energy had fallen the two previous quarters: decreasing 7.3 percent during the second quarter and 5.8 percent during the first quarter. Household energy is down 3.6 percent on a 12-month basis. The motor fuel index jumped 86.0 percent during the third quarter. The gasoline index was up 86.8 percent. The other motor fuels index rose 60.0 percent. This gasoline increase followed a 37.3-percent decline in the second quarter and a 39.9-percent increase in the first quarter. Motor fuel increased 6.8 percent in the last 12 months.

The 18.2-percent increase in the fuel oil and other fuels index was driven by a 38.0-percent upward move in the fuel oil index. Fuel oil, consistent with other oil derivatives, suffered a large decline in the second quarter (down 38.5 percent) after a large first-quarter increase (31.2 percent). The propane, kerosene, and firewood index fell 13.7 percent, and has fallen four quarters in a row. Fuel oil has increased 4.0 percent over the last 12 months, but the 12.1-percent decline in propane, kerosene, and firewood during the last year has pulled fuel oil and other fuels down 1.3 percent over the last 12 months.

Energy services rose 1.3 percent after three consecutive quarterly declines. The 20.0-percent increase in natural gas snapped a string of three consecutive quarterly double-digit declines and more than offset the 3.7-percent fall in electricity. The decline in electricity was its third consecutive quarterly decrease. The energy services index, consistent with the natural gas index that has driven it the last few quarters, snapped a string of three consecutive single-digit quarterly declines. However, the 12-month percent change ending September 2012 remained negative (down 3.8 percent) and has been negative every month of 2012 except January.

Although changes in gasoline tend to have a large impact on 1-month changes in the CPI, the significant increases and decreases of gasoline over the last four quarters have dampened the longer term impact of gasoline prices on overall inflation. Gasoline prices were up 6.8 percent over the last 12 months, whereas the 12-month change for all items and all items less food and energy were both 2.0 percent.

Food prices increased at a slower rate in the third quarter of 2012, after rising 1.7 percent in the second quarter and 1.5 percent in the first quarter. Consistent with its slow quarterly rates of growth, the food index has moderated considerably in 2012, increasing 1.5 percent for the year to date, after climbing 4.7 percent in 2011, and rising at a 2.7-percent annualized rate from September 2007 to September 2012. Grocery store food prices reflected the deceleration, increasing 0.2 percent in the third quarter, after 0.8-percent and 0.5-percent increases in the second and first quarters, respectively. Fruits and vegetables suffered the largest decline, falling 0.8 percent. It was a calm quarter for price changes for food at home; no grocery store food group moved even 1.0 percent, annualized, in the third quarter. However, certain individual food indexes did see double-digit changes. Bacon and breakfast sausage increased 10.9 percent in the third quarter, partially undoing the 16.1-percent decline of the second quarter. Apples have increased 20.9 and 23.5 percent in the second and third quarters of this year, respectively. In the third quarter, oranges fell 12.8 percent and potatoes fell 26.4 percent. Unlike potatoes, which also fell significantly (12.8 percent) in the second quarter, oranges rose slightly (0.7 percent) in the second quarter. Lettuce, which fell 23.0 percent in the first quarter of 2012, rose 10.4 percent and 11.9 percent in the second and third quarters, respectively, leaving it down 1.6 percent for the year to date.

Food away from home price growth has remained remarkably consistent throughout 2012. The food away from home index increased 2.8 percent, 3.0 percent, and 2.9 percent in the first, second, and third quarters of 2012, respectively. The 12-month increase was 2.8 percent while the year-to-date increase was 2.9 percent. In 2011, food away from home rose 2.9 percent. Food at employee sites and schools increased 6.8 percent in the third quarter after a 1.3-percent decline in the second quarter. Food at employee sites and schools posted a decline in the second quarter, the only quarterly fall for any of the components of food away from home this year. Food from vending machines and mobile vendors had the smallest third-quarter increase (0.3 percent). The third-quarter increases for full service meals, limited service meals, and other food away from home were 2.1 percent, 2.5 percent, and 2.0 percent, respectively.

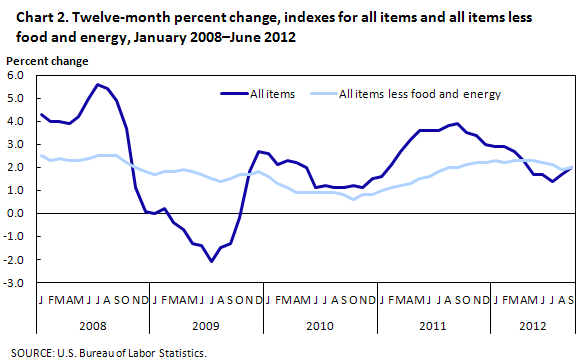

The index for all items less food and energy rose at a 1.2-percent seasonally adjusted annual rate (SAAR) in the third quarter of 2012, a significant deceleration from the 2.6-percent rate of increase recorded in the second quarter. The all items less food and energy index increased 2.2 percent in the first quarter. Both the 12-month percent change and the year-to-date annualized rate were 2.0 percent. (See chart 2.) The shelter index increased 2.4 percent in the third quarter, following increases of 1.8 percent and 2.2 percent during the second and first quarters of 2012, respectively. Shelter increased 2.2 percent for both the latest 12 months as well as the 2012 annualized rate of change. Within the shelter index, owners’ equivalent rent (2.7 percent) rose more slowly than rent of primary residence (3.2 percent) in the third quarter. The rent of primary residence index also rose more quickly than the owners’ equivalent rent index in the second quarter (2.1 percent versus 1.5 percent) and first quarter (2.2 percent versus 2.1 percent). Similarly, the 12-month percent change for rent of primary residence (2.7 percent) exceeds the corresponding figure (2.1 percent) for owners’ equivalent rent. Lodging away from home declined 9.4 percent in the third quarter, partially undoing 9.2- and 9.9-percent increases in the second and first quarters, respectively. Even with the third-quarter decline, the lodging away from home index had a positive 12-month percent change (1.5 percent). Other lodging away from home including hotels and motels made a significant contribution to the lodging away from home decrease, falling 12.3 percent in the third quarter, after increasing 10.4 percent in the second quarter and 11.0 percent in the first quarter.

| Month | All items | All items less food and energy |

|---|---|---|

Jan 2008 | 4.3 | 2.5 |

Feb 2008 | 4.0 | 2.3 |

Mar 2008 | 4.0 | 2.4 |

Apr 2008 | 3.9 | 2.3 |

May 2008 | 4.2 | 2.3 |

Jun 2008 | 5.0 | 2.4 |

Jul 2008 | 5.6 | 2.5 |

Aug 2008 | 5.4 | 2.5 |

Sep 2008 | 4.9 | 2.5 |

Oct 2008 | 3.7 | 2.2 |

Nov 2008 | 1.1 | 2.0 |

Dec 2008 | 0.1 | 1.8 |

Jan 2009 | 0.0 | 1.7 |

Feb 2009 | 0.2 | 1.8 |

Mar 2009 | -0.4 | 1.8 |

Apr 2009 | -0.7 | 1.9 |

May 2009 | -1.3 | 1.8 |

Jun 2009 | -1.4 | 1.7 |

Jul 2009 | -2.1 | 1.5 |

Aug 2009 | -1.5 | 1.4 |

Sep 2009 | -1.3 | 1.5 |

Oct 2009 | -0.2 | 1.7 |

Nov 2009 | 1.8 | 1.7 |

Dec 2009 | 2.7 | 1.8 |

Jan 2010 | 2.6 | 1.6 |

Feb 2010 | 2.1 | 1.3 |

Mar 2010 | 2.3 | 1.1 |

Apr 2010 | 2.2 | 0.9 |

May 2010 | 2.0 | 0.9 |

Jun 2010 | 1.1 | 0.9 |

Jul 2010 | 1.2 | 0.9 |

Aug 2010 | 1.1 | 0.9 |

Sep 2010 | 1.1 | 0.8 |

Oct 2010 | 1.2 | 0.6 |

Nov 2010 | 1.1 | 0.8 |

Dec 2010 | 1.5 | 0.8 |

Jan 2011 | 1.6 | 1.0 |

Feb 2011 | 2.1 | 1.1 |

Mar 2011 | 2.7 | 1.2 |

Apr 2011 | 3.2 | 1.3 |

May 2011 | 3.6 | 1.5 |

Jun 2011 | 3.6 | 1.6 |

Jul 2011 | 3.6 | 1.8 |

Aug 2011 | 3.8 | 2.0 |

Sep 2011 | 3.9 | 2.0 |

Oct 2011 | 3.5 | 2.1 |

Nov 2011 | 3.4 | 2.2 |

Dec 2011 | 3.0 | 2.2 |

Jan 2012 | 2.9 | 2.3 |

Feb 2012 | 2.9 | 2.2 |

Mar 2012 | 2.7 | 2.3 |

Apr 2012 | 2.3 | 2.3 |

May 2012 | 1.7 | 2.3 |

Jun 2012 | 1.7 | 2.2 |

Jul 2012 | 1.4 | 2.1 |

Aug 2012 | 1.7 | 1.9 |

Sep 2012 | 2.0 | 2.0 |

New and used motor vehicles fell 4.6 percent in the third quarter of 2012, after 5.2- and 1.5-percent increases in the second and first quarters, leaving a year-to-date annualized change of 0.6 percent. The 12-month change was down 0.4 percent. The used cars and trucks index was the source of the fall in the new and used motor vehicles index. Used cars and trucks fell 10.9 percent in the third quarter. New vehicle prices fell 0.3 percent. Airline fares dropped 10.1 percent during the third quarter, after a 2.2-percent increase and a 2.5-percent decline in the second and first quarters, respectively. Airline fares were down 2.6 percent on a 12-month basis and down at a seasonally adjusted annual rate (SAAR) of 10.1 percent

Medical care (up 3.4 percent), education (3.0 percent), other goods and services (2.5 percent), and apparel (0.1 percent) had modest price growth in the third quarter. Recreation was flat during this time period, after modest growth in the second quarter (1.3 percent) and first quarter (2.9 percent). Communication fell 4.5 percent in the third quarter, after growing 0.8 and 1.6 percent in the second and first quarters, respectively. As a result of its third-quarter performance, the communication index has a negative 12-month percent change (down 0.6 percent) and year-to-date annualized rate (down 0.7 percent).

Among the more important of the smaller indexes, household furnishings and operations declined 0.8 percent in the third quarter of 2012, after little change in the first two quarters. Prescription drug prices rose 4.9 percent in the third quarter, after 1.4-percent and 4.7-percent increases in the second and first quarters, respectively. Medical care services increased 3.5 percent from July to September, after 6.9-percent and 2-percent increases in the first two quarters of the year, respectively. Physicians’ services (up 4.7 percent), dental services (3.5 percent), and hospital and related services (2.1 percent) contributed to a positive increase, while eyeglasses and eye care (down 5.1 percent) reduced medical care services’ rate of price growth. Tobacco and smoking products (up 4.8 percent) drove the third-quarter increase in other goods and services (2.5 percent). The 1.8-percent increase in the personal care index in the third quarter slowed the acceleration rate of goods and services in that quarter.

Prices for recreational books were flat for the third quarter, after small declines in the first two quarters of 2012. Educational books and supplies were up 12.3 percent in the third quarter, after increases of 6.5 and 6.0 percent in the second and first quarters of 2012. Recreational books were down 0.8 percent over the last 12 months, with a year-to-date drop of 1.9 percent. Educational books and supplies grew 7.2 percent during the last 12 months and the index is growing at a 8.3-percent annualized rate in 2012. The divergence of recreational books with educational books is consistent with the price behavior of recreation and education. The education index has a 12-month percent change of 3.9 percent, three times as fast as the 1.3-percent change in the recreation index.

In conclusion, the indexes for all items, all items less food and energy, food, and energy are all increasing at approximately a 2-percent rate of growth on a 12-month basis. Although the quarterly indexes for energy remain extremely volatile, shelter is consistently running around 2 percent and food just below 2 percent. n

Price movements described in this article reflect data released on October 16, 2012. All percent changes of 12 months or greater reflect data that are not seasonally adjusted. Data are annualized if the period covered is greater than a year. Percent changes covering less than a year are based on seasonally adjusted annual rates, unless otherwise noted. CPI seasonally adjusted indexes and percent changes are subject to annual revision.

This Beyond the Numbers summary was prepared by Malik Crawford and Kenneth J. Stewart, economists in the Office of Prices and Living Conditions, U.S. Bureau of Labor Statistics. Email: crawford.malik@bls.gov. Telephone: (202) 691-5375.

Information in this article will be made available to sensory-impaired individuals upon request. Voice phone: (202) 691-5200. Federal Relay Service: 1-800-877-8339. This article is in the public domain and may be reproduced without permission.

Malik Crawford and Kenneth J. Stewart, Consumer Price Index program, “Writing an escalation contract using the Consumer Price Index ,” Beyond the Numbers: Prices & Spending, vol. 1 / no. 19 (U.S. Bureau of Labor Statistics, November 2012), https://www.bls.gov/opub/btn/volume-1/writing-an-escalation-contract-using-the-consumer-price-index.htm

Publish Date: Wednesday, November 14, 2012