An official website of the United States government

United States Department of Labor

United States Department of Labor

During economic booms, recessions, and recovery periods, consumers’ purchasing behavior changes. For instance, they may be more likely to purchase a car during an expansion period, rather than during a recession. The relative importances of items in the Consumer Price Index (CPI) are based on surveys of consumers’ purchasing behavior and they tell us how consumer purchases have changed over time.1 Comparing historical relative importances to more recent ones illustrates long-term trends, such as the declining relative importance of landline phones and the increased relative importance of college tuition and prescription drugs.

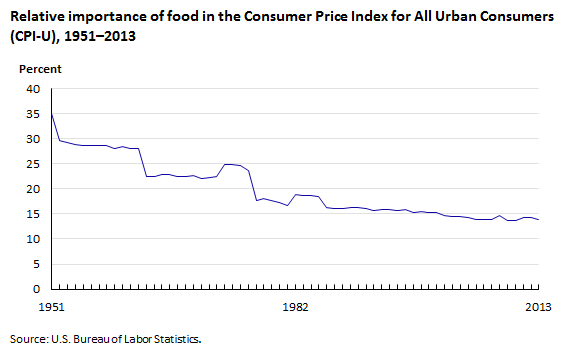

The relative importance of food is its expenditure or value weight expressed as a percentage of all items within an area.2 In this article, relative importance is for the U.S. city average. As chart 1 shows, the most durable and pronounced trend in the Consumer Price Index for All Urban Consumers (CPI-U) is the long-term decline of the relative importance of food.

| Year | Percent |

|---|---|

1951 | 35.070 |

1952 | 29.600 |

1953 | 29.230 |

1954 | 28.880 |

1955 | 28.550 |

1956 | 28.700 |

1957 | 28.600 |

1958 | 28.700 |

1959 | 28.000 |

1960 | 28.500 |

1961 | 28.100 |

1962 | 28.100 |

1963 | 22.430 |

1964 | 22.490 |

1965 | 22.830 |

1966 | 22.940 |

1967 | 22.540 |

1968 | 22.460 |

1969 | 22.680 |

1970 | 21.990 |

1971 | 22.190 |

1972 | 22.492 |

1973 | 24.810 |

1974 | 24.785 |

1975 | 24.675 |

1976 | 23.667 |

1977 | 17.718 |

1978 | 18.161 |

1979 | 17.655 |

1980 | 17.322 |

1981 | 16.577 |

1982 | 18.963 |

1983 | 18.737 |

1984 | 18.711 |

1985 | 18.513 |

1986 | 16.190 |

1987 | 16.055 |

1988 | 16.171 |

1989 | 16.318 |

1990 | 16.188 |

1991 | 16.007 |

1992 | 15.777 |

1993 | 15.799 |

1994 | 15.838 |

1995 | 15.766 |

1996 | 15.913 |

1997 | 15.326 |

1998 | 15.422 |

1999 | 15.315 |

2000 | 15.217 |

2001 | 14.688 |

2002 | 14.554 |

2003 | 14.383 |

2004 | 14.295 |

2005 | 13.942 |

2006 | 13.885 |

2007 | 13.833 |

2008 | 14.629 |

2009 | 13.738 |

2010 | 13.742 |

2011 | 14.308 |

2012 | 14.312 |

2013 | 13.891 |

We can also see meaningful changes in consumer behavior over the short run. CPI relative importances are now updated based on new consumer expenditure data every 2 years. (Relative importances may change slightly from month to month as relative prices change, but these monthly changes are not based on changes in consumer behavior.)

This Beyond the Numbers article compares relative importances based on data collected during three periods that can be characterized roughly as boom, recession, and recovery. The “recovery” era is represented by the current CPI relative importances, which are based on surveys conducted in 2011–2012. These relative importances replaced figures that were based on data collected during 2009–2010, and represent the “recession” period. (While the economy was recovering at least during the latter part of this period, it seems reasonable to expect consumer behavior to reflect recession conditions.) Because the 2007–2008 period was one of transition from boom to recession, we will examine the weights based on 2005–2006 data, as representing spending during a booming economy.

It should be kept in mind that relative importance comes from expenditure data, and so relative importances can vary because of changes in both price and quantity. A higher relative importance might not mean consumers are purchasing more of something; it might mean its relative price has increased.

There are certain expectations that many economists have about consumer spending in a recession, compared with a boom or recovery. Let’s take a look at the relative importance changes in food, vehicles, travel-related categories, durable goods, and shelter categories, to see if they match what may be expected intuitively.

The relative importance of food has been on a long-term decline that goes back to when the CPI was developed. Food dominated the early CPI and constituted around one-fourth of the CPI, as late as the 1970s. Recently the relative importance of food is less than one-seventh of the average consumer’s total expenditures. This generally follows Engel’s law; as Americans have become wealthier, the proportion of income spent on food has declined. We would expect, then, that during a recession, the relative importance of food would go up. We also may hypothesize that a higher proportion of food expenditures would be on food at home versus food away from home. In addition, within the food-away-from-home component, we may expect that expenditures will shift towards limited-service restaurants—away from full service—as consumers find ways to stretch their spending dollars. The table that follows shows the relative importance for selected food categories in the 2007 boom and the subsequent recession and recovery periods, and selected ratios of these relative importances.

| Category | Relative importances (RI) of the food component | ||

|---|---|---|---|

| Dec. 2007 | Dec. 2011 | Dec. 2013 | |

| (boom) | (recession) | (recovery) | |

| Food | 13.833 | 14.308 | 13.891 |

| Food at home | 7.66 | 8.638 | 8.187 |

| Food away from home | 6.173 | 5.669 | 5.704 |

| Full service | 3.027 | 2.691 | 2.759 |

| Limited service | 2.429 | 2.277 | 2.356 |

| Ratio of food at home RI to food away from home RI | 1.241 | 1.524 | 1.435 |

| Ratio of RI of full-service restaurant food to Limited-service restaurant food | 1.246 | 1.182 | 1.171 |

As expected, the relative importance of food increases during the recession period and has dropped back again during the recovery. Also as expected, the increase is in food at home—the relative importance of food away from home declines, and the ratio of food-at-home expenditures to food away from home goes up sharply. In addition, the ratio of expenditures in full service restaurants to limited service drops during the recession. In other words, in the tougher economic conditions, consumers ate out less and ate at cheaper places when they did eat out. The recovery period, though, has seen only a slight gain in the relative importance for food away from home. As mentioned earlier, the relative importance of food away from home and its ratio to food at home remained closer to the levels seen during the recession than in the boom period. Within the food-away-from-home component, as expected, the ratio of full-to-limited service expenditures fell during the recession. However, the ratio has not recovered; it has actually continued to decline during the recovery.

We may hypothesize that during a recession, to save money, consumers likely would limit their new car expenditures by buying used cars relative to new cars.

| Category | Relative importances of the vehicle components | ||

|---|---|---|---|

| Dec. 2007 | Dec. 2011 | Dec. 2013 | |

| (boom) | (recession) | (recovery) | |

| New vehicles | 4.632 | 3.195 | 3.559 |

| Used cars and trucks | 1.773 | 1.913 | 1.673 |

| Ratio of new to used vehicles | 2.613 | 1.67 | 2.127 |

Indeed, the relative importance of new vehicles dropped dramatically during the recession, falling by about a third. The relative importance of used cars and trucks rose modestly. The ratio of expenditures on new vehicles to used falls from about 2.6 to 1.6. The recovery period shows that the relative importance of new vehicles is substantially higher than the ratio during the recession but still well below the boom level. The used cars and trucks relative importance fell below the boom level during the recovery period. The ratio of new-to-used expenditures during the recovery period (2013) is about 2.1, halfway between the boom and recession levels. The total relative importance on new and used vehicles fell by about one-quarter during the recession and has recovered only slightly.

We would expect consumers to hold off purchases of durable goods during leaner times, and so we expect the relative importance of durable goods to fall. Vehicles are a major component of durable goods in the CPI, so the results for the vehicle components foreshadow those of durable goods, but the relative importance of durable goods dropped notably during the recession:

| Category | Relative importances of durable goods | ||

|---|---|---|---|

| Dec. 2007 | Dec. 2011 | Dec. 2013 | |

| (boom) | (recession) | (recovery) | |

| Durables | 10.837 | 8.968 | 9.201 |

| New and used motor vehicles | 7.191 | 5.651 | 5.815 |

| Furniture and bedding | 1.036 | 0.729 | 0.787 |

| Appliances | 0.357 | 0.285 | 0.288 |

The relative importance of durables dropped nearly 20 percent from the boom to the recession. Much of the decline is from vehicles, but the relative importance of furniture dropped about 25 percent, and that of appliances also fell. All the categories show a higher relative importance in recovery than recession but are still below their earlier levels.

One may hypothesize that consumers in a recession environment would travel less, cutting back purchases of airfare and hotel rooms.

Here, the evidence isn’t compelling. The relative importance for hotels and motels has modestly risen from the recession to the recovery period. The airline fare index does not fit the expected pattern, rising in the recession and falling since.

| Category | Relative importances of travel | ||

|---|---|---|---|

| Dec. 2007 | Dec. 2011 | Dec. 2013 | |

| (boom) | (recession) | (recovery) | |

| Hotels and motels | (1) | 0.594 | 0.626 |

| Airline fare | 0.721 | 0.768 | 0.742 |

| Footnotes: (1) Prior to 2009, the weight of vacation homes was included in the other lodging away from home including hotels and motels category. Any comparison of relative importance before and after the change would be misleading. | |||

The recession hit the housing sector of the economy hard. We might expect homeownership to drop during the recession and that more people were renting, compared to owning.

| Category | Relative importances of housing | ||

|---|---|---|---|

| Dec. 2007 | Dec. 2011 | Dec. 2013 | |

| (boom) | (recession) | (recovery) | |

| Rent | 5.765 | 6.485 | 6.977 |

| Owners’ equivalent rent of primary residence | 23.942 | 22.543 | 22.505 |

| Ratio of Rent to Owners’ equivalent rent | 0.241 | 0.288 | 0.31 |

As expected, the relative importance of owners’ equivalent rent dropped during the recession, and the relative importance of rent increased. Rather than reversing during the recovery, however, the trend has continued. Although the ratio of the relative importance of rent to that of owners' equivalent rent is not a perfect indicator of the mix between renters and owners, the nearly 30-percent increase in the ratio suggests that the housing sector has been slow to recover from the recession.

The relative importances in the CPI present a snapshot of consumer behavior during the period in which the data for them is collected. Comparing snapshots of different periods, we see that the relative importances for the selected CPI categories presented in this article generally move as we would intuitively expect. The relative importance based on data from the recession show reduced spending on food away from home, new cars, and durable goods, in general, with more spending on food at home and used cars. Rent of housing increases in importance to homeownership. Not all movements are as expected, as consumers’ relative expenditure for airfare increased during the recession. But in general, CPI relative importances seem to reflect the sorts of adjustments we may expect from consumers, as the economy goes through a recession and recovers.

This Beyond the Numbers summary was prepared by Steve Reed and Malik Crawford, economists in the Office of Prices and Living Conditions, U.S. Bureau of Labor Statistics. Email: crawford.malik@bls.gov. Telephone: (202) 691-5377.

Information in this article will be made available to sensory-impaired individuals upon request. Voice phone: (202) 691-5200. Federal Relay Service: 1 (800) 877-8339. This article is in the public domain and may be reproduced without permission.

Steve Reed and Malik Crawford, “How does consumer spending change during boom, recession, and recovery? ,” Beyond the Numbers: Prices & Spending, vol. 3 / no. 15 (U.S. Bureau of Labor Statistics, June 2014), https://www.bls.gov/opub/btn/volume-3/how-does-consumer-spending-change-during-boom-recession-and-recovery.htm

1 This analysis uses the CPI-based relative importances to illustrate how the weights used in the CPI change as economic reality changes.

CPI relative importance data comes from the Consumer Expenditure Survey (CE). The CE contains a wealth of detailed information consumer expenditure behavior. Readers interested in studying consumer behavior more extensively may wish to use CE data directly rather than CPI relative importance data. CE data can be accessed at www.bls.gov/cex.

2 When the value weights are collected—most recently during the 2011–2012 Consumer Expenditure Survey—they represent average annual expenditures, and their relative importance ratios show approximately how the index population distributes expenditures among the components. Relative importances represent an estimate of how consumers would distribute their expenditures as prices change over time.

Relative importances cannot be used as estimates of current spending patterns or as indicators of changing consumer expenditures in the intervals between weight revisions because consumption patterns are influenced by factors other than price change. These factors include income, variations in climate, family size, and availability of new and different kinds of goods and services.

For more information on relative importances in the CPI, go to https://www.bls.gov/cpi/tables/relative-importance/home.htm.

Publish Date: Thursday, June 26, 2014