An official website of the United States government

United States Department of Labor

United States Department of Labor

Every year, many employers conduct an open season to let employees select or change their medical plans. Several factors may affect their selection, including choice of care provider and shared cost. Employees can sort out some of these distinctions by identifying the type of plan, but some plan names are unclear, such as “standard medical,” “basic medical,” and “traditional medical plan.” Can employees guess plan types based on such names? Even more specific names like “preferred plan” and “point-of-service plan” might not tell how the plan works.

Plan names may reveal some, but not complete, information. If it’s an indemnity plan, what kind? Is that HMO traditional, or open-access? With many plan names so vague, how can we figure out their type? Since the Bureau of Labor Statistics (BLS) began reporting on medical plans over 30 years ago, it has identified them by type. Of course, plans have changed quite a bit in 30 years. Today, BLS classifies medical plans into six types:

Fee-for-service plan. A plan that gives participants the same reimbursement no matter what hospital or care provider they choose.

Preferred provider organization. A plan that contracts with medical providers, such as hospitals and doctors, to create a network. Patients pay less if they use providers who belong to the network, or they can use providers outside the network for a higher cost.

Exclusive provider organization. A plan comprising groups of hospitals and doctors that contract to provide comprehensive medical services. Patients receive coverage only for services from those providers (except in an emergency).

Point-of-service plan. Such plans typically have differing coverage levels, based on where service occurs. For example, the plan pays more for service performed by a limited set of providers, less for services in a broad network of providers, and even less for services outside the network.

Health maintenance organization. A plan that provides prepaid comprehensive medical care. HMOs both insure and deliver services, and patients usually live within a limited area and must get their nonemergency services within the network (except in an emergency).

Open-access HMO. An HMO that covers nonemergency care outside its network for an extra cost.

This issue of Beyond the Numbers explores how the BLS National Compensation Survey (NCS) uses plan features to identify these six medical plan types.

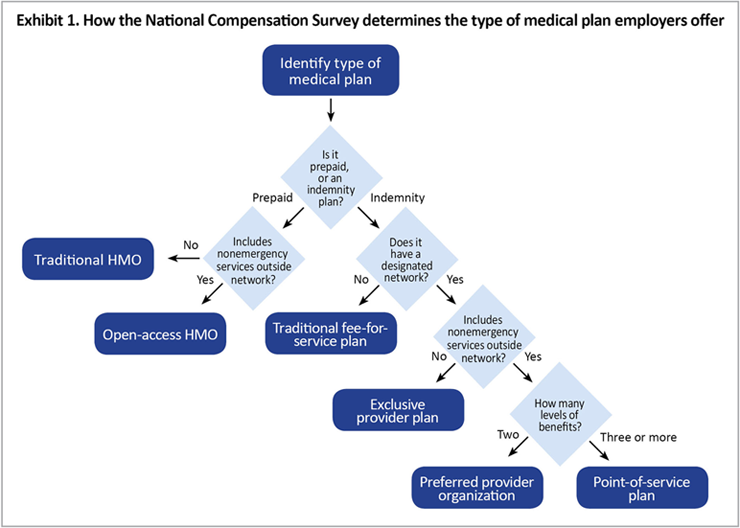

The NCS reports on several medical plan features, which often differ by plan type. For example, some types specify a coinsurance level, such as 80 percent, as the share of costs paid by the plan, with the patient paying the rest. In the NCS, plan type is used to differentiate additional plan features. If the plan type is incorrect, plan features may be misrepresented. Rather than relying strictly on plan names, the NCS identifies four features of each plan to determine the type. These features, as shown in exhibit 1, consider administrative details, consumer choice, and how consumers pay for services. The responses to the questions in the flowchart peel back, layer by layer, the main features of a specific plan type.

Is the plan an indemnity or prepaid plan? 1 Indemnity plans reimburse the patient or the provider as medical expenses occur or afterward. Prepaid plans pay medical service providers a fixed amount based on the number of people enrolled, regardless of services received.

Does the plan have a network? A network is a specific group of doctors, hospitals, suppliers, and clinics who have contracted to provide services for an agreed rate.

Does the plan allow people to receive nonemergency care outside the network? This question identifies how restrictive the plan is regarding choice of medical providers.

Does the plan have more than two levels of coverage? This question determines if the plan is a point-of-service plan, which typically has several reimbursement levels depending on where enrollees receive services.

In Exhibit 2, side-by-side comparisons of the six types of healthcare plans show the differences determined by answers to the four questions about the plans' features. For instance, point-of-service is the only plan type that has more than two levels of benefits, and fee-for-service is the only type that does not use a network.

Type of plan | Is the plan indemnity or prepaid? | Does the plan have a network? | Does the plan cover nonemergency care outside the network? | Does the plan have more than two levels of benefits? |

|---|---|---|---|---|

Fee-for-service plan | Indemnity | No | Yes | No |

Preferred provider organization (PPO) | Indemnity | Yes | Yes | No |

Exclusive provider organization (EPO) | Indemnity | Yes | No | No |

Point-of-service plan | Indemnity | Yes | Yes | Yes |

Health maintenance organization (HMO) | Prepaid | Yes | No | No |

Open-access health maintenance organization | Prepaid | Yes | Yes | No |

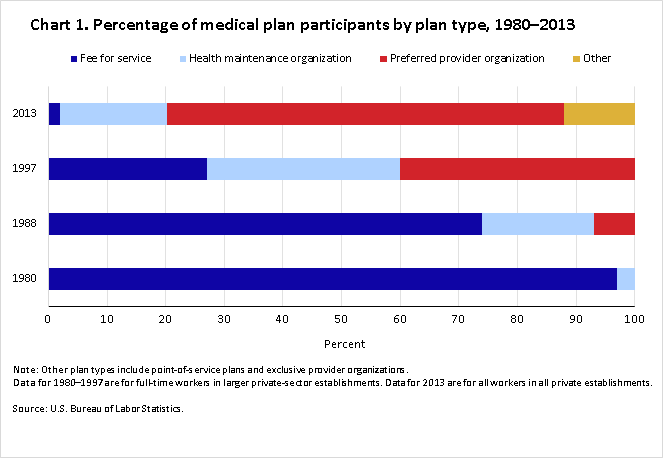

While BLS has been studying medical benefits for over 30 years, the survey has changed several times, making it difficult to draw direct comparisons over time. Nonetheless, a snapshot for selected years helps to illuminate changes. The 1980 survey, limited to full-time workers in larger private establishments, showed nearly all covered workers as having a traditional fee-for-service plan. These plans typically had basic coverage (paying the full amount for services up to a specified level) and major medical coverage (sharing additional costs between the plan and the employee). Few HMOs showed up in the 1980 survey, accounting for about 2–3 percent of covered workers.

By 1988, alternative plans began to emerge. BLS data for that year show that 74 percent of covered workers were in fee-for-service plans, 19 percent in HMOs, and 7 percent in PPOs. By 1997, PPOs were the most prevalent, covering 40 percent of participants. HMOs covered 33 percent, while participation in fee-for-service plans dropped to 27 percent. The trend away from traditional fee-for-service plans continues. BLS 2013 estimates show 67 percent in PPOs, 18 percent in HMOs, and 2 percent in fee-for-service plans. The remaining participants are in exclusive provider organizations and point-of-service plans.2 (See chart 1.)

| Type of plan | 1980 | 1988 | 1997 | 2013 |

|---|---|---|---|---|

| Fee for service | 97 | 74 | 27 | 2 |

| Health maintenance organization | 3 | 19 | 33 | 18 |

| Preferred provider organization | 0 | 7 | 40 | 67 |

| Other | 0 | 0 | 0 | 12 |

BLS designs its employee benefits reports to help both employees and employers understand what benefits are available and how they work. BLS keeps abreast of changes in laws and practices and adjusts its survey methods and definitions to ensure data are up to date. BLS also regularly reviews data from other sources.3 For example, the Kaiser/HRET Survey of Employer-Sponsored Medical Benefits reports trends similar to BLS findings. In the Kaiser survey, traditional fee-for-service plans, referred to as “conventional plans,” had an enrollment share of 73 percent in 1988. That share declined drastically to 27 percent in 1996, and stood at less than 1 percent in 2013. The Kaiser survey also reflects the sharp rise in PPO plans, which became the most prevalent plan in 1999, with 39 percent, rising to 57 percent in 2013.4

Similarly, data from Mercer’s National Survey of Employer Sponsored Medical Plans, although only covering 2005–2012, reveals findings in line with BLS data. This 2012 survey shows 65 percent of covered workers enrolled in PPO plans.5

The Kaiser and Mercer data both include plan types not included in the BLS classification. For example, Mercer has data on consumer-driven plans. Kaiser makes reference to high-deductible plans, and its data connect these types of plans to a “savings option,” an account available to workers to pay certain medical expenses.

BLS has also found plans that are identified as consumer driven or are associated with accounts such as a flexible spending account (FSA), a health savings account (HSA), or a health reimbursement account (HRA). In addition, BLS has identified plans called high-deductible plans that may have some type of accounts. The NCS has not added plan types to account for these but has classified them into existing plan types. As before, the plan name alone might not identify a unique and consistent set of features. NCS does tabulate information on some of these unique plan characteristics, however. For example, in 2013, 30 percent of medical plan participants in private industry were in plans with high deductibles, and of those workers, 42 percent had access to a health savings account.6

Implementation of the Affordable Care Act may result in changes to employment-based medical plans. As the NCS continues to capture data from employers and report the findings, new plan names may arise and new plan features may be identified. BLS will update its methods as needed to monitor this changing landscape.

This Beyond the Numbers article was prepared by Bonita Briscoe, economist in the Office of Compensation and Working Conditions, email: Briscoe.Bonita@bls.gov, telephone:(202) 691-5763.

Information in this article will be made available to sensory-impaired individuals upon request. Voice phone: (202) 691-5200. Federal Relay Service: 1-800-877-8339. This article is in the public domain and may be reproduced without permission.

Bonita Briscoe, “Understanding health plan types: What’s in a name? ,” Beyond the Numbers: Pay & Benefits, vol. 4 / no. 2 (U.S. Bureau of Labor Statistics, January 2015), https://www.bls.gov/opub/btn/volume-4/understanding_health_plan_types.htm

1 Additional details and definitions of medical plans are available at https://www.bls.gov/ncs/ebs/sp/healthterms.pdf.

2 The most recent data on medical plan type from the BLS National Compensation Survey are available at https://www.bls.gov/ncs/ebs/detailedprovisions/2013/ownership/private/basic_health.htm#medical_care. Data from previous surveys are available at https://www.bls.gov/ncs/ncspubs.htm.

3 For a similar discussion, see http://www.kaiserhealthnews.org/Stories/2014/August/19/Hows-A-Consumer-To-Know-What-Health-Plan-Is-Best.aspx?utm_campaign=KHN%3A+Daily+Health+Policy+Report&utm_source=hs_email&utm_medium=email&utm_content=13839846&_hsenc=p2ANqtz-89I_8krC47D3Q1eDIAZ_1vKzls5tYz2vKCsdUeJsdLmIbsscUw9l9YD4em4uQ4mHe4HrHvaJlPUShO-HgIagHcTj6N2A&_hsmi=13839846

4 Information on the Kaiser survey is available at http://kff.org/report-section/ehbs-2013-section-5/.

5 Information on the Mercer survey is available at http://benefitcommunications.com/upload/downloads/Mercer_Survey_2013.pdf

6 BLS data on high-deductible plans and health savings accounts are available at https://www.bls.gov/ncs/ebs/detailedprovisions/2013/ownership/private/basic_health.htm#high_deductible.

Publish Date: Friday, January 16, 2015