An official website of the United States government

United States Department of Labor

United States Department of Labor

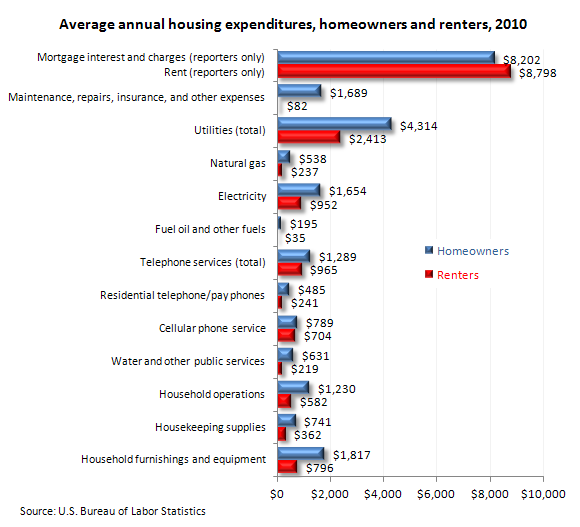

In 2010, people who rented their residences paid more, on average, in annual rent ($8,798) than homeowners reported paying in mortgage interest and charges ($8,202). In the last 25 years, this has only happened twice: in 2010 and in 2004.

For nearly all subcategories of housing, homeowners spent much more on average than renters in 2010. Homeowners ($1,689) paid 20 times more for maintenance, repairs, and insurance than renters ($82), reflecting the direct payment of renters' maintenance costs by many landlords. Homeowners ($4,314) spent almost twice as much as renters ($2,413) on utilities.

| Expenditure | Homeowners | Renters |

|---|---|---|

Mortgage interest and charges (reporters only) | $8,202 | N/A |

Rent (reporters only) | N/A | $8,798 |

Maintenance, repairs, insurance, and other expenses | 1,689 | 82 |

Utilities (total) | 4,314 | 2,413 |

Natural gas | 538 | 237 |

Electricity | 1,654 | 952 |

Fuel oil and other fuels | 195 | 35 |

Telephone services (total) | 1,289 | 965 |

Residential telephone/pay phones | 485 | 241 |

Cellular phone service | 789 | 704 |

Water and other public services | 631 | 219 |

Household operations | 1,230 | 582 |

Housekeeping supplies | 741 | 362 |

Household furnishings and equipment | 1,817 | 796 |

These data are featured in the TED article, Consumer expenditures by homeowners and renters, 2010.

In 2010, homeowners and renters reported different total expenditures, on average, on telephone services ($1,289 and $952, respectively). However, there were some similarities within the telephone services category—homeowners spent $789, on average, on cellular phone service, and renters averaged $704 for the year.

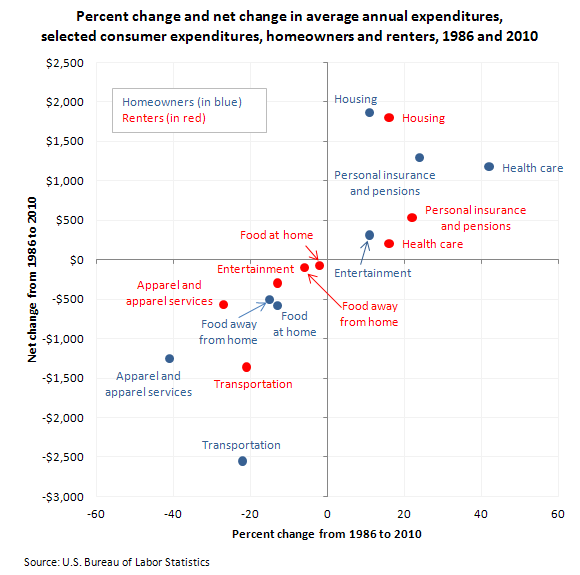

When 1986 dollars are converted to 2010 dollars, there is a negligible difference in overall expenditures for both homeowners and renters in the last 25 years. However, though overall spending has changed very little, the manner in which consumers are choosing to spend their money has changed dramatically. Since 1986, both owners and renters have shifted their spending habits away from transportation, food, and apparel and apparel services and spent more on housing, personal insurance and pensions, and healthcare.

| Expenditure | Percent change | Net change |

|---|---|---|

Homeowners | ||

Food at home | -13 | -$580 |

Food away from home | -15 | -507 |

Housing | 11 | 1,866 |

Apparel and apparel services | -41 | -1249 |

Transportation | -22 | -2553 |

Health care | 42 | 1,179 |

Entertainment | 11 | 313 |

Personal insurance and pensions | 24 | 1,297 |

Renters | ||

Food at home | -2 | -70 |

Food away from home | -13 | -296 |

Housing | 16 | 1,805 |

Apparel and apparel services | -27 | -567 |

Transportation | -21 | -1,362 |

Health care | 16 | 205 |

Personal insurance and pensions | 22 | 533 |

These data are featured in the TED article, Consumer expenditures by homeowners and renters, 2010.

From 1986 to 2010, homeowners decreased their spending on food at home (−$580, or −13 percent), food away from home (−$507, or −15 percent), apparel and apparel services (−$1,249, or −41 percent), and transportation (−$2,553, or −22 percent). These decreases were offset by increases in expenditures on housing ($1,866, or 11 percent), healthcare ($1,179, or 42 percent), entertainment ($313, or 11 percent), and personal insurance and pensions ($1,297, or 24 percent).

Renters had similar, though less volatile, changes in expenditures between 1986 and 2010. Renters spent less money on food at home (−$70, or −2 percent), food away from home ($−296, or −13 percent), apparel and apparel services (−$567, or −27 percent), transportation (−$1,362, or −21 percent), and entertainment (−$96, or −6 percent). Renters increased their spending on housing ($1,805, or 16 percent), healthcare ($205, or 16 percent), and personal insurance and pensions ($533, or 22 percent).

These data come from the Consumer Expenditure Survey. To learn more, see "A comparison of 25 years of consumer expenditures by homeowners and renters" (HTML) (PDF), by Adam Reichenberger in Beyond the Numbers, volume 1, number 15, October 2012. Consumer units include families, single persons living alone or sharing a household with others but who are financially independent, or two or more persons living together who share expenses.

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Consumer expenditures by homeowners and renters, 2010 at https://www.bls.gov/opub/ted/2012/ted_20121025.htm (visited February 20, 2026).