An official website of the United States government

United States Department of Labor

United States Department of Labor

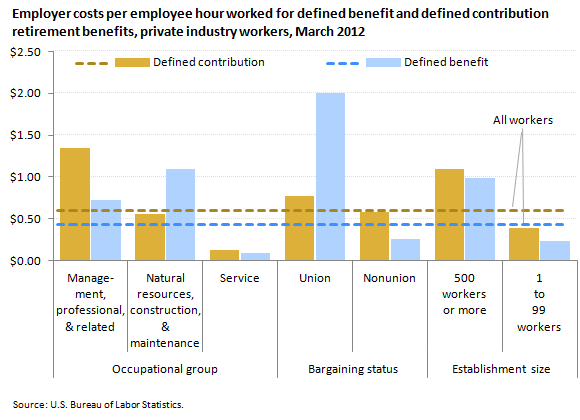

Private industry employers now spend more per employee hour worked for defined contribution retirement plans (retirement plans that specify the level of employer contributions and place those contributions into individual employee accounts) than for defined benefit retirement plans (plans that provide employees with guaranteed retirement benefits that are based on a benefit formula). March 2012 private industry employer costs for defined contribution plans were 60 cents per employee hour worker, compared to 43 cents for defined benefit plans.

| Characteristics | Employer costs per employee hour worked | |

|---|---|---|

| Defined benefit | Defined contribution | |

All workers | $ 0.43 | $ 0.60 |

Occupational group | ||

Management, professional, and related | 0.72 | 1.35 |

Sales and office | 0.22 | 0.43 |

Service | 0.09 | 0.13 |

Natural resources, construction, and maintenance | 1.10 | 0.56 |

Production, transportation, and material moving | 0.44 | 0.37 |

Bargaining status | ||

Union | 2.00 | 0.77 |

Nonunion | 0.26 | 0.58 |

Establishment size | ||

1 to 99 workers | 0.23 | 0.39 |

100 to 499 workers | 0.42 | 0.65 |

500 workers or more | 0.99 | 1.10 |

Employer costs for defined benefit plans were higher for natural resource, construction, and maintenance employees ($1.10) than for workers in other major occupational categories.

Employer cost of defined benefit plans for union workers ($2.00) is approximately 7 times higher than the cost for nonunion workers (26 cents).

Employers with 500 or more workers have defined benefit costs (99 cents) that are approximately four times higher than the defined benefit cost for employers that have 1 to 99 employees (23 cents).

These data are from the National Compensation Survey - Benefits program. To learn more, see "Retirement costs for defined benefit plans higher than for defined contribution plans" (HTML) (PDF), Beyond the Numbers, December 2012.

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Employer costs for defined benefit and defined contribution retirement plans at https://www.bls.gov/opub/ted/2012/ted_20121226.htm (visited March 04, 2026).

Recent editions of Spotlight on Statistics