An official website of the United States government

United States Department of Labor

United States Department of Labor

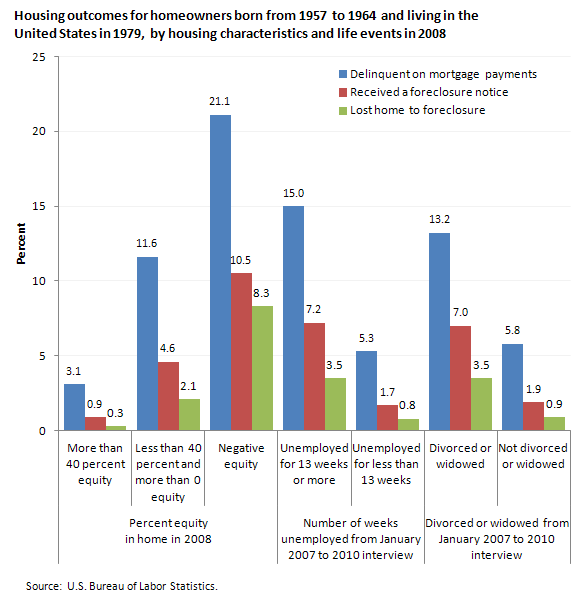

Among the youngest baby boomer—those born from 1957 to 1964—who owned a home in 2008, those who held negative equity in their home had delinquency and foreclosure rates that were several times higher than the rates for homeowners with equity in their homes.

| Characteristic/Life event | Probability of housing outcome (in percent) | ||

|---|---|---|---|

| Delinquent on mortgage payments | Received a foreclosure notice | Lost home to foreclosure | |

Percent equity in home in 2008 | |||

More than 40 percent equity | 3.1 | 0.9 | 0.3 |

Less than 40 percent and more than 0 equity | 11.6 | 4.6 | 2.1 |

Negative equity | 21.1 | 10.5 | 8.3 |

Divorced or widowed from January 2007 to 2010 interview | |||

Divorced or widowed | 13.2 | 7.0 | 3.5 |

Not divorced or widowed | 5.8 | 1.9 | 0.9 |

Number of weeks unemployed from January 2007 to 2010 interview | |||

Unemployed for 13 weeks or more | 15.0 | 7.2 | 3.5 |

Unemployed for less than 13 weeks | 5.3 | 1.7 | 0.8 |

Unemployment and divorce or widowhood are associated with a greater probability of adverse housing outcomes. Over the period from January 2007 to the 2010 interview, homeowners unemployed for 13 weeks or more had nearly three times the rate of delinquency and over four times the chance of receiving a foreclosure notice or losing one's home as homeowners unemployed fewer than 13 weeks. Similarly, those who became divorced or widowed were more likely than those who had not experienced such a change in their marital status to become delinquent in their mortgage, receive a foreclosure notice, or lose their home to foreclosure.

These data are from the National Longitudinal Surveys program. To learn more, see "Patterns of homeownership, delinquency, and foreclosure among youngest baby boomers" (HTML) (PDF), by Alison Aughinbaugh in Beyond the Numbers, volume 2, number 2, February 2013.

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Mortgage delinquency and foreclosure among youngest baby boomers at https://www.bls.gov/opub/ted/2013/ted_20130220.htm (visited February 22, 2026).