An official website of the United States government

United States Department of Labor

United States Department of Labor

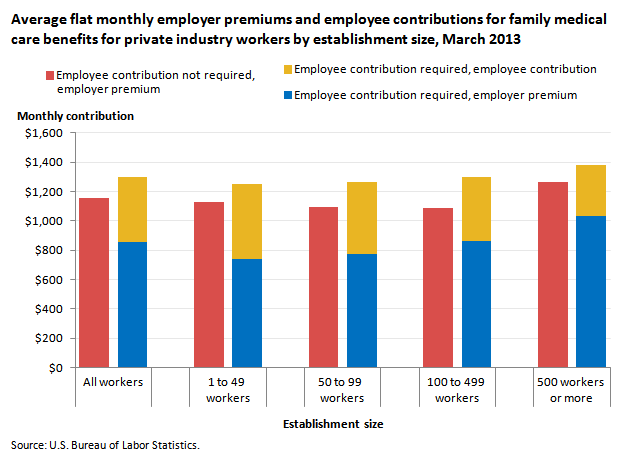

In March 2013, private industry employers who did not require their employees to contribute to family medical care benefits paid an average monthly premium of $1,152 per employee. Private industry employers who required employees to contribute to family medical care benefits paid an average monthly premium of $859, and the employee's average contribution was $442 per month.

Among employers not requiring employees to contribute to medical care benefit plans, business establishments with 50 to 99 workers paid about the same monthly premium per employee as establishments with 100 to 499 workers ($1,094 and $1,090, respectively). Large establishments with 500 workers or more paid the highest monthly premium at $1,266 per employee.

| Establishment size | Employee contribution not required, employer premium | Employee contribution required | |

|---|---|---|---|

| Employer premium | Employee contribution | ||

All workers | $1,152.38 | $858.75 | $442.26 |

1 to 49 workers | 1,127.80 | 740.85 | 507.99 |

50 to 99 workers | 1,093.87 | 771.36 | 490.50 |

100 to 499 workers | 1,090.00 | 862.98 | 435.01 |

500 workers or more | 1,266.40 | 1,029.68 | 353.57 |

Establishments with 1 to 49 workers required employees to contribute the most ($508) for family medical benefits, while the employer paid the lowest monthly premium ($741). In contrast, establishments with 500 workers or more required employees to contribute an average of $354 per month, while the establishment's monthly premium was $1,030.

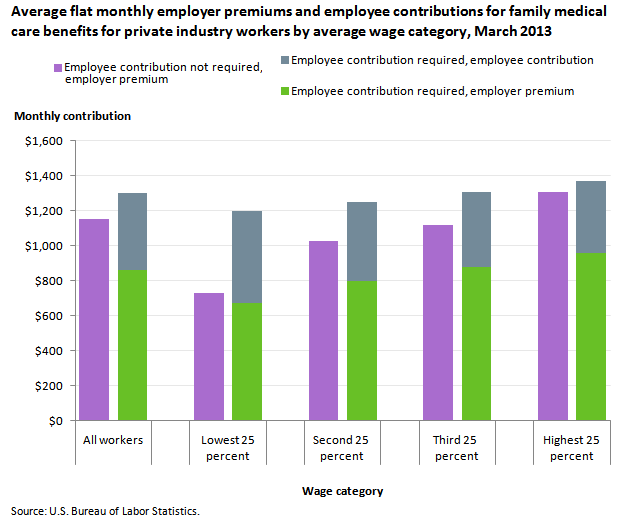

Employer premiums and employee contributions for family medical benefits differed among wage groups. Workers in the lowest 25-percent wage category contributed an average of $527 per month, while their employers paid a premium of $673. The gap between employer premiums and employee contributions widened as workers' wages increased. Workers in the highest 25-percent wage category contributed $415 per month for medical care benefits, and their employers paid a premium of $957.

| Establishment size | Employee contribution not required, employer premium | Employee contribution required | |

|---|---|---|---|

| Employer premium | Employee contribution | ||

All workers | $1,152.38 | $858.75 | $442.26 |

Lowest 25 percent | 730.98 | 672.57 | 527.49 |

Second 25 percent | 1,029.17 | 800.93 | 450.28 |

Third 25 percent | 1,118.62 | 876.96 | 431.60 |

Highest 25 percent | 1,308.10 | 957.16 | 414.66 |

Employers who did not require employees to contribute to family medical benefit plans paid far more for workers among the top 25 percent of wage earners ($1,308 per month) compared to the premium paid for workers in the bottom 25 percent ($731 per month).

These data are from the National Compensation Survey - Benefits program. For more information on employer and employee contribution for family medical care, see Table 13 (PDF) (HTML) from the Healthcare Benefits section of Employee Benefits in the United States, March 2013, Bulletin 2776.

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Employer premiums and employee contributions for family medical care benefits, March 2013 at https://www.bls.gov/opub/ted/2013/ted_20131017.htm (visited February 27, 2026).

Recent editions of Spotlight on Statistics