An official website of the United States government

United States Department of Labor

United States Department of Labor

Prepare tax returns for individuals or small businesses. Excludes “Accountants and Auditors” (13-2011).

Employment estimate and mean wage estimates for Tax Preparers:

| Employment (1) | Employment RSE (3) |

Mean hourly wage |

Mean annual wage (2) |

Wage RSE (3) |

|---|---|---|---|---|

| 82,370 | 3.3 % | $ 26.85 | $ 55,840 | 1.4 % |

Percentile wage estimates for Tax Preparers:

| Percentile | 10% | 25% | 50% (Median) |

75% | 90% |

|---|---|---|---|---|---|

| Hourly Wage | $ 13.31 | $ 16.52 | $ 23.20 | $ 35.82 | $ 46.45 |

| Annual Wage (2) | $ 27,680 | $ 34,350 | $ 48,250 | $ 74,500 | $ 96,610 |

Industries with the highest published employment and wages for Tax Preparers are provided. For a list of all industries with employment in Tax Preparers, see the Create Customized Tables function.

Industries with the highest levels of employment in Tax Preparers:

| Industry | Employment (1) | Percent of industry employment | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|

| Accounting, Tax Preparation, Bookkeeping, and Payroll Services | 78,340 | 7.43 | $ 26.61 | $ 55,360 |

| Management, Scientific, and Technical Consulting Services | 1,680 | 0.10 | $ 31.95 | $ 66,450 |

| Securities, Commodity Contracts, and Other Financial Investments and Related Activities | 720 | 0.07 | $ 38.92 | $ 80,950 |

| Credit Intermediation and Related Activities (5221 and 5223 only) | 250 | 0.01 | $ 26.96 | $ 56,080 |

| Computer Systems Design and Related Services | 160 | 0.01 | $ 23.22 | $ 48,300 |

Industries with the highest concentration of employment in Tax Preparers:

| Industry | Employment (1) | Percent of industry employment | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|

| Accounting, Tax Preparation, Bookkeeping, and Payroll Services | 78,340 | 7.43 | $ 26.61 | $ 55,360 |

| Management, Scientific, and Technical Consulting Services | 1,680 | 0.10 | $ 31.95 | $ 66,450 |

| Securities, Commodity Contracts, and Other Financial Investments and Related Activities | 720 | 0.07 | $ 38.92 | $ 80,950 |

| Credit Intermediation and Related Activities (5221 and 5223 only) | 250 | 0.01 | $ 26.96 | $ 56,080 |

| Computer Systems Design and Related Services | 160 | 0.01 | $ 23.22 | $ 48,300 |

Top paying industries for Tax Preparers:

| Industry | Employment (1) | Percent of industry employment | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|

| Securities, Commodity Contracts, and Other Financial Investments and Related Activities | 720 | 0.07 | $ 38.92 | $ 80,950 |

| Management of Companies and Enterprises | 70 | (7) | $ 32.38 | $ 67,350 |

| Management, Scientific, and Technical Consulting Services | 1,680 | 0.10 | $ 31.95 | $ 66,450 |

| Credit Intermediation and Related Activities (5221 and 5223 only) | 250 | 0.01 | $ 26.96 | $ 56,080 |

| Accounting, Tax Preparation, Bookkeeping, and Payroll Services | 78,340 | 7.43 | $ 26.61 | $ 55,360 |

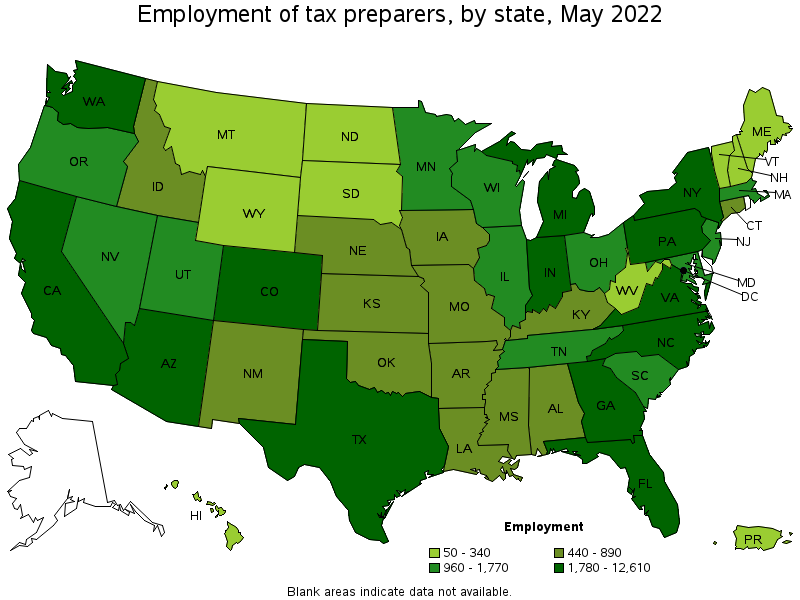

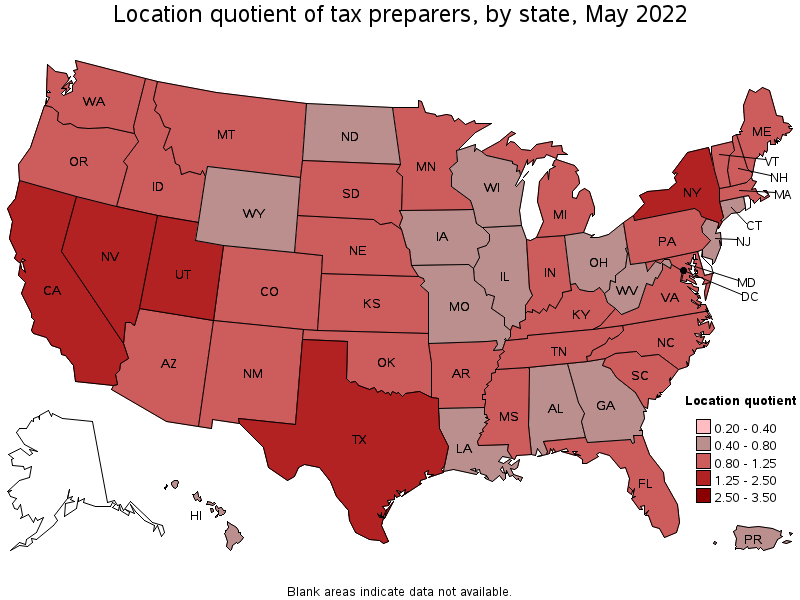

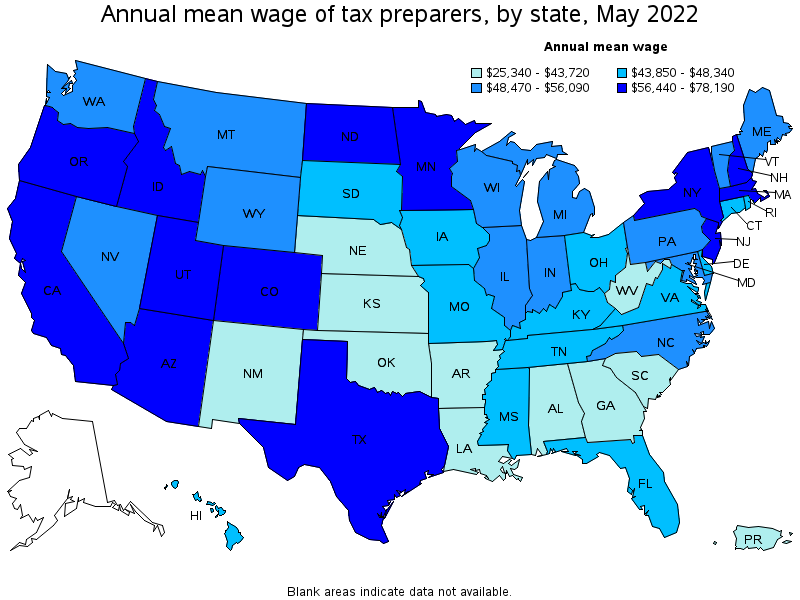

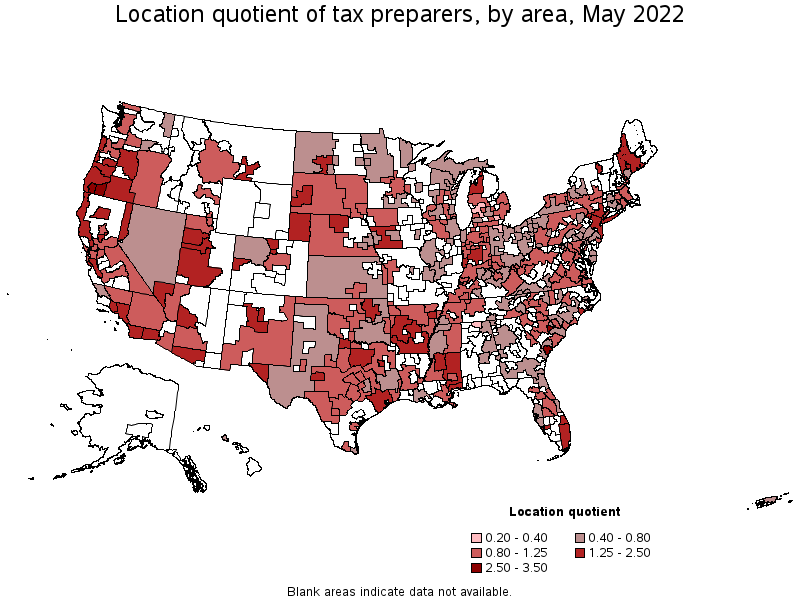

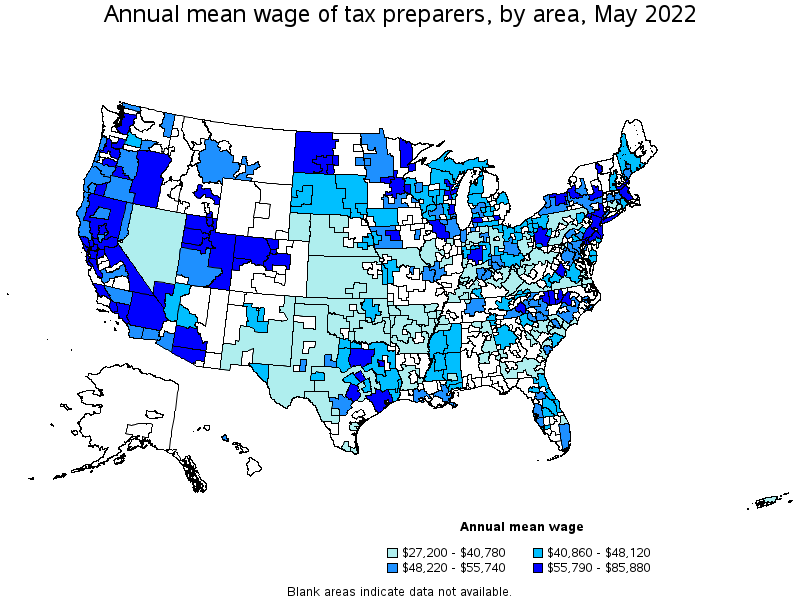

States and areas with the highest published employment, location quotients, and wages for Tax Preparers are provided. For a list of all areas with employment in Tax Preparers, see the Create Customized Tables function.

States with the highest employment level in Tax Preparers:

| State | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| California | 12,610 | 0.72 | 1.28 | $ 28.91 | $ 60,130 |

| Texas | 9,980 | 0.77 | 1.38 | $ 29.15 | $ 60,640 |

| New York | 7,590 | 0.83 | 1.50 | $ 33.70 | $ 70,090 |

| Florida | 5,030 | 0.55 | 0.98 | $ 22.50 | $ 46,810 |

| Pennsylvania | 2,590 | 0.45 | 0.80 | $ 26.73 | $ 55,600 |

States with the highest concentration of jobs and location quotients in Tax Preparers:

| State | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| Utah | 1,400 | 0.86 | 1.55 | $ 32.70 | $ 68,020 |

| New York | 7,590 | 0.83 | 1.50 | $ 33.70 | $ 70,090 |

| Nevada | 1,130 | 0.80 | 1.44 | $ 26.97 | $ 56,090 |

| Texas | 9,980 | 0.77 | 1.38 | $ 29.15 | $ 60,640 |

| California | 12,610 | 0.72 | 1.28 | $ 28.91 | $ 60,130 |

Top paying states for Tax Preparers:

| State | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| Colorado | 1,850 | 0.67 | 1.20 | $ 37.59 | $ 78,190 |

| New York | 7,590 | 0.83 | 1.50 | $ 33.70 | $ 70,090 |

| Utah | 1,400 | 0.86 | 1.55 | $ 32.70 | $ 68,020 |

| Minnesota | 1,430 | 0.51 | 0.91 | $ 30.52 | $ 63,490 |

| Oregon | 1,230 | 0.65 | 1.16 | $ 29.53 | $ 61,420 |

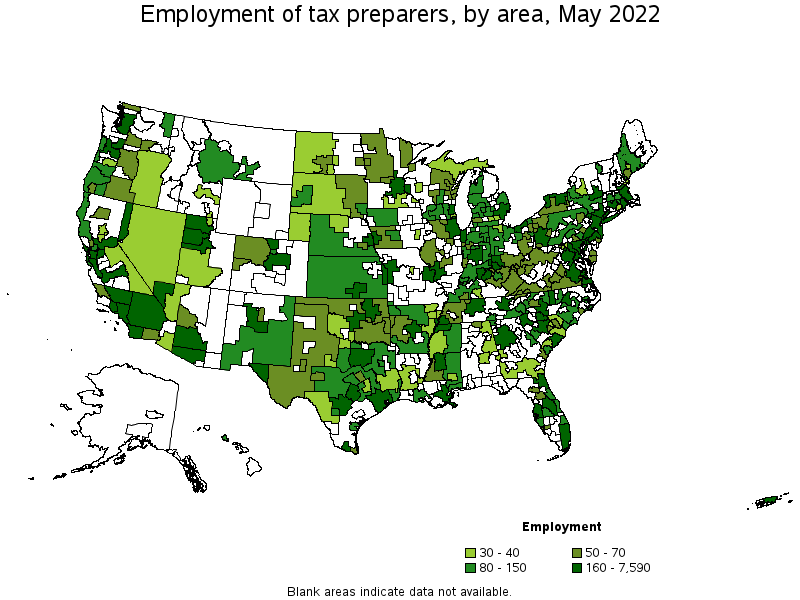

Metropolitan areas with the highest employment level in Tax Preparers:

| Metropolitan area | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| New York-Newark-Jersey City, NY-NJ-PA | 7,590 | 0.83 | 1.48 | $ 34.00 | $ 70,730 |

| Los Angeles-Long Beach-Anaheim, CA | 5,000 | 0.82 | 1.47 | $ 28.51 | $ 59,290 |

| Dallas-Fort Worth-Arlington, TX | 3,590 | 0.94 | 1.69 | $ 31.72 | $ 65,970 |

| Houston-The Woodlands-Sugar Land, TX | 3,120 | 1.02 | 1.83 | $ 31.73 | $ 66,000 |

| Miami-Fort Lauderdale-West Palm Beach, FL | 2,230 | 0.85 | 1.52 | $ 23.32 | $ 48,500 |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 1,930 | 0.64 | 1.14 | $ 26.07 | $ 54,220 |

| San Francisco-Oakland-Hayward, CA | 1,630 | 0.68 | 1.22 | $ 32.79 | $ 68,200 |

| Phoenix-Mesa-Scottsdale, AZ | 1,460 | 0.66 | 1.18 | $ 29.43 | $ 61,210 |

| Chicago-Naperville-Elgin, IL-IN-WI | 1,400 | 0.32 | 0.57 | $ 26.02 | $ 54,120 |

| Boston-Cambridge-Nashua, MA-NH | 1,360 | 0.50 | 0.90 | $ 29.62 | $ 61,620 |

Metropolitan areas with the highest concentration of jobs and location quotients in Tax Preparers:

| Metropolitan area | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| Grants Pass, OR | 50 | 1.73 | 3.10 | $ 24.38 | $ 50,700 |

| Sumter, SC | 60 | 1.56 | 2.81 | $ 13.96 | $ 29,030 |

| Hilton Head Island-Bluffton-Beaufort, SC | 120 | 1.54 | 2.77 | $ 26.46 | $ 55,050 |

| Medford, OR | 130 | 1.45 | 2.61 | $ 35.85 | $ 74,570 |

| Fort Collins, CO | 200 | 1.20 | 2.15 | $ 34.23 | $ 71,200 |

| Billings, MT | 100 | 1.14 | 2.04 | $ 23.64 | $ 49,160 |

| Salt Lake City, UT | 850 | 1.09 | 1.97 | $ 33.39 | $ 69,460 |

| Jacksonville, NC | 50 | 1.09 | 1.95 | (8) | (8) |

| Rapid City, SD | 80 | 1.08 | 1.93 | $ 21.82 | $ 45,380 |

| San Angelo, TX | 50 | 1.06 | 1.90 | $ 23.05 | $ 47,930 |

Top paying metropolitan areas for Tax Preparers:

| Metropolitan area | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| Denver-Aurora-Lakewood, CO | 950 | 0.61 | 1.09 | $ 41.29 | $ 85,880 |

| Ogden-Clearfield, UT | 170 | 0.60 | 1.07 | $ 39.05 | $ 81,220 |

| Bend-Redmond, OR | (8) | (8) | (8) | $ 37.43 | $ 77,850 |

| Medford, OR | 130 | 1.45 | 2.61 | $ 35.85 | $ 74,570 |

| Fort Collins, CO | 200 | 1.20 | 2.15 | $ 34.23 | $ 71,200 |

| San Jose-Sunnyvale-Santa Clara, CA | 970 | 0.86 | 1.55 | $ 34.14 | $ 71,010 |

| New York-Newark-Jersey City, NY-NJ-PA | 7,590 | 0.83 | 1.48 | $ 34.00 | $ 70,730 |

| Idaho Falls, ID | 40 | 0.52 | 0.94 | $ 33.98 | $ 70,670 |

| Boulder, CO | 130 | 0.70 | 1.25 | $ 33.95 | $ 70,620 |

| Albany, OR | 40 | 0.75 | 1.35 | $ 33.59 | $ 69,870 |

Nonmetropolitan areas with the highest employment in Tax Preparers:

| Nonmetropolitan area | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| Balance of Lower Peninsula of Michigan nonmetropolitan area | 150 | 0.57 | 1.03 | $ 21.40 | $ 44,520 |

| Southwest Maine nonmetropolitan area | 140 | 0.76 | 1.36 | $ 21.35 | $ 44,420 |

| Northern Indiana nonmetropolitan area | 140 | 0.66 | 1.18 | $ 19.08 | $ 39,680 |

| North Texas Region of Texas nonmetropolitan area | 140 | 0.50 | 0.90 | $ 22.32 | $ 46,420 |

| Kansas nonmetropolitan area | 130 | 0.34 | 0.61 | $ 13.91 | $ 28,930 |

Nonmetropolitan areas with the highest concentration of jobs and location quotients in Tax Preparers:

| Nonmetropolitan area | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| Northwest Nebraska nonmetropolitan area | 40 | 0.97 | 1.74 | $ 17.91 | $ 37,260 |

| Central Oregon nonmetropolitan area | 60 | 0.90 | 1.62 | $ 23.70 | $ 49,290 |

| South Arkansas nonmetropolitan area | 80 | 0.86 | 1.54 | $ 16.46 | $ 34,240 |

| Southwest Iowa nonmetropolitan area | 70 | 0.80 | 1.44 | $ 23.78 | $ 49,470 |

| North Coast Region of California nonmetropolitan area | 80 | 0.79 | 1.42 | $ 26.22 | $ 54,530 |

Top paying nonmetropolitan areas for Tax Preparers:

| Nonmetropolitan area | Employment (1) | Employment per thousand jobs | Location quotient (9) | Hourly mean wage | Annual mean wage (2) |

|---|---|---|---|---|---|

| Northwest Colorado nonmetropolitan area | 50 | 0.43 | 0.78 | $ 35.85 | $ 74,560 |

| Northwest Illinois nonmetropolitan area | 60 | 0.48 | 0.86 | $ 32.21 | $ 66,990 |

| West North Dakota nonmetropolitan area | 40 | 0.33 | 0.58 | $ 28.59 | $ 59,470 |

| Eastern Sierra-Mother Lode Region of California nonmetropolitan area | 40 | 0.65 | 1.16 | $ 27.68 | $ 57,570 |

| Eastern Utah nonmetropolitan area | (8) | (8) | (8) | $ 27.58 | $ 57,370 |

These estimates are calculated with data collected from employers in all industry sectors, all metropolitan and nonmetropolitan areas, and all states and the District of Columbia. The top employment and wage figures are provided above. The complete list is available in the downloadable XLS files.

The percentile wage estimate is the value of a wage below which a certain percent of workers fall. The median wage is the 50th percentile wage estimate—50 percent of workers earn less than the median and 50 percent of workers earn more than the median. More about percentile wages.

(1) Estimates for detailed occupations do not sum to the totals because the totals include occupations not shown separately. Estimates do not include self-employed workers.

(2) Annual wages have been calculated by multiplying the hourly mean wage by a "year-round, full-time" hours figure of 2,080 hours; for those occupations where there is not an hourly wage published, the annual wage has been directly calculated from the reported survey data.

(3) The relative standard error (RSE) is a measure of the reliability of a survey statistic. The smaller the relative standard error, the more precise the estimate.

(7) The value is less than .005 percent of industry employment.

(8) Estimate not released.

(9) The location quotient is the ratio of the area concentration of occupational employment to the national average concentration. A location quotient greater than one indicates the occupation has a higher share of employment than average, and a location quotient less than one indicates the occupation is less prevalent in the area than average.

Other OEWS estimates and related information:

May 2022 National Occupational Employment and Wage Estimates

May 2022 State Occupational Employment and Wage Estimates

May 2022 Metropolitan and Nonmetropolitan Area Occupational Employment and Wage Estimates

May 2022 National Industry-Specific Occupational Employment and Wage Estimates

Last Modified Date: April 25, 2023