An official website of the United States government

United States Department of Labor

United States Department of Labor

No prices are more visible to the public than gasoline prices. Even for people who don’t have to fill up a tank on a regular basis, gasoline prices are likely to be in their view, posted every day. In addition, no prices have more of an impact on short-run movements in the Consumer Price Index (CPI). Gasoline prices are so much more volatile than other CPI components that, even though gasoline makes up less than 6 percent of the CPI, it is often the main source of monthly price movements in the all items index. Moreover, because they are so visible and gasoline is purchased so frequently, gasoline prices have a major impact on the perception of prices. Constantly seeing prices at the pump creep ever higher will often create a perception of broader inflation—and, of course, higher gasoline prices are likely to eventually have an impact on other prices as transportation costs increase.

So, it is particularly important that gasoline price changes be measured accurately and reliably. Fortunately, gasoline is one of the few consumer goods for which there are many sources of price data. In fact, the ease of price collection makes it feasible for other government agencies and even private sources to create reliable measures. On the government side, the Energy Information Administration (EIA) publishes extensive gasoline price data. Among private sources are the American Automobile Association, the Oil Price Information Service, and the Lundberg Survey. Furthermore, gasoline is one of the few nonfood items for which the Bureau of Labor Statistics (BLS) publishes an average price series as well as an index; the fact that gasoline is a relatively homogenous product makes meaningful average price data possible.

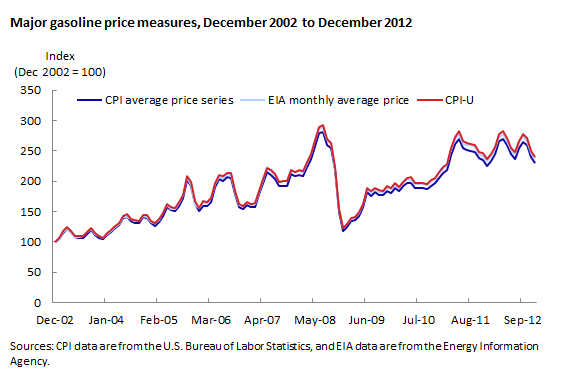

This article examines three measures of gasoline prices: the BLS Consumer Price Index for All Urban Consumers (CPI-U) U.S. city average for all types of gasoline, the BLS CPI average price series for all types of gasoline, and the EIA Weekly Retail Gasoline and Diesel Prices for all grades of gasoline. The purpose of the article is to identify how these measures have behaved over the 10-year period from December 2002 to December 2012.

A CPI component index, the gasoline index is a subcomponent of the transportation series, as well as the special energy aggregate. Data for the gasoline index are collected as part of the larger data collection process of the CPI; the process involves BLS economic assistants physically collecting prices at selected outlets in 87 metropolitan statistical areas across the country.

The CPI average price series for gasoline is one of a number of average price series produced by the CPI program in addition to the index series. Most average price series are for food products. Average price series in the CPI are based on the same data as index series, but because of various differences in computation procedures, average price series may not behave identically to the indexes of their respective categories.

The EIA retail gasoline series is based on a telephone survey of about 900 gasoline outlets. The data, collected each Monday and published each week, are part of a broad array of energy-related data published by EIA. A monthly average also is published.1

For all three measures discussed in this report, the price being sought is the pump price paid by the consumer, including all taxes. In addition, the definition of gasoline includes different grades, but excludes diesel and alternative fuels. So, to a large degree, the series being examined are all attempting to measure the same thing. The natural question that arises, then, is “Do these different measures agree?” A look at chart 1 reveals that they do indeed tell similar stories of gasoline price movement over the past 10 years.

| Date | CPI average price series | EIA monthly average price | CPI-U |

|---|---|---|---|

Dec 2002 | 100 | 100 | 100 |

Jan 2003 | 105.42 | 104.97 | 105.54 |

Feb 2003 | 114.15 | 115.82 | 117.30 |

Mar 2003 | 121.26 | 121.34 | 123.76 |

Apr 2003 | 115.37 | 114.28 | 117.46 |

May 2003 | 107.45 | 107.70 | 109.66 |

Jun 2003 | 105.48 | 107.28 | 108.73 |

Jul 2003 | 106.09 | 108.75 | 109.15 |

Aug 2003 | 113.13 | 116.24 | 116.20 |

Sep 2003 | 119.91 | 120.43 | 123.01 |

Oct 2003 | 111.44 | 112.39 | 114.19 |

Nov 2003 | 106.84 | 108.82 | 109.66 |

Dec 2003 | 104.13 | 106.51 | 106.80 |

Jan 2004 | 110.70 | 112.95 | 114.27 |

Feb 2004 | 116.11 | 118.26 | 119.65 |

Mar 2004 | 122.48 | 124.42 | 125.78 |

Apr 2004 | 126.95 | 128.69 | 130.39 |

May 2004 | 138.79 | 141.57 | 142.57 |

Jun 2004 | 141.03 | 140.87 | 145.00 |

Jul 2004 | 134.19 | 136.74 | 138.12 |

Aug 2004 | 131.42 | 134.36 | 135.35 |

Sep 2004 | 130.94 | 133.80 | 134.76 |

Oct 2004 | 140.28 | 142.90 | 144.58 |

Nov 2004 | 139.00 | 141.57 | 143.58 |

Dec 2004 | 130.40 | 132.05 | 134.68 |

Jan 2005 | 126.34 | 131.21 | 130.65 |

Feb 2005 | 132.70 | 136.67 | 137.20 |

Mar 2005 | 142.65 | 148.36 | 146.94 |

Apr 2005 | 157.41 | 159.90 | 161.96 |

May 2005 | 152.81 | 154.30 | 157.26 |

Jun 2005 | 150.17 | 153.81 | 155.00 |

Jul 2005 | 159.58 | 163.26 | 164.99 |

Aug 2005 | 172.51 | 176.98 | 177.75 |

Sep 2005 | 201.02 | 206.51 | 208.65 |

Oct 2005 | 191.60 | 193.49 | 198.07 |

Nov 2005 | 161.61 | 161.16 | 166.75 |

Dec 2005 | 150.98 | 155.98 | 156.34 |

Jan 2006 | 159.72 | 165.15 | 166.41 |

Feb 2006 | 159.38 | 162.77 | 165.41 |

Mar 2006 | 165.47 | 172.71 | 171.87 |

Apr 2006 | 189.64 | 195.03 | 196.81 |

May 2006 | 202.64 | 206.65 | 209.74 |

Jun 2006 | 200.61 | 205.04 | 207.64 |

Jul 2006 | 206.23 | 211.69 | 213.77 |

Aug 2006 | 205.35 | 209.87 | 212.59 |

Sep 2006 | 178.54 | 182.37 | 183.88 |

Oct 2006 | 157.01 | 160.46 | 161.80 |

Nov 2006 | 154.84 | 159.20 | 159.78 |

Dec 2006 | 161.14 | 165.08 | 166.33 |

Jan 2007 | 157.14 | 160.18 | 161.89 |

Feb 2007 | 157.96 | 162.56 | 163.13 |

Mar 2007 | 178.67 | 182.58 | 184.28 |

Apr 2007 | 196.95 | 202.31 | 203.10 |

May 2007 | 215.03 | 223.02 | 222.36 |

Jun 2007 | 209.88 | 217.07 | 218.04 |

Jul 2007 | 203.99 | 210.71 | 211.49 |

Aug 2007 | 191.81 | 198.32 | 199.08 |

Sep 2007 | 192.21 | 199.37 | 199.83 |

Oct 2007 | 192.48 | 199.65 | 199.68 |

Nov 2007 | 211.10 | 218.89 | 219.10 |

Dec 2007 | 207.79 | 214.84 | 215.61 |

Jan 2008 | 209.61 | 216.59 | 217.75 |

Feb 2008 | 208.73 | 215.40 | 216.49 |

Mar 2008 | 223.90 | 230.44 | 232.16 |

Apr 2008 | 236.36 | 245.42 | 245.10 |

May 2008 | 258.16 | 266.97 | 268.50 |

Jun 2008 | 278.61 | 287.26 | 289.66 |

Jul 2008 | 280.43 | 287.89 | 291.65 |

Aug 2008 | 259.85 | 268.23 | 269.95 |

Sep 2008 | 253.83 | 262.84 | 263.25 |

Oct 2008 | 218.35 | 217.77 | 223.66 |

Nov 2008 | 149.49 | 154.51 | 154.69 |

Dec 2008 | 117.94 | 122.11 | 122.67 |

Jan 2009 | 124.44 | 128.76 | 129.71 |

Feb 2009 | 133.99 | 138.21 | 139.48 |

Mar 2009 | 135.41 | 140.73 | 140.91 |

Apr 2009 | 142.65 | 147.10 | 148.37 |

May 2009 | 156.67 | 162.07 | 162.66 |

Jun 2009 | 181.52 | 187.61 | 189.36 |

Jul 2009 | 175.63 | 180.69 | 182.99 |

Aug 2009 | 181.25 | 186.84 | 189.07 |

Sep 2009 | 177.79 | 182.58 | 185.17 |

Oct 2009 | 176.91 | 182.30 | 183.61 |

Nov 2009 | 183.41 | 189.36 | 191.15 |

Dec 2009 | 180.84 | 186.35 | 188.30 |

Jan 2010 | 188.15 | 193.77 | 196.24 |

Feb 2010 | 183.41 | 188.87 | 190.76 |

Mar 2010 | 191.54 | 197.62 | 199.29 |

Apr 2010 | 196.75 | 202.94 | 205.16 |

May 2010 | 197.36 | 202.24 | 206.62 |

Jun 2010 | 188.42 | 194.89 | 196.65 |

Jul 2010 | 188.42 | 194.68 | 196.55 |

Aug 2010 | 189.23 | 194.75 | 197.41 |

Sep 2010 | 186.46 | 192.93 | 194.64 |

Oct 2010 | 192.48 | 199.65 | 201.11 |

Nov 2010 | 196.28 | 203.85 | 205.16 |

Dec 2010 | 205.21 | 213.30 | 214.37 |

Jan 2011 | 212.53 | 220.29 | 222.48 |

Feb 2011 | 217.67 | 228.41 | 227.39 |

Mar 2011 | 243.33 | 252.97 | 254.05 |

Apr 2011 | 261.54 | 269.56 | 273.12 |

May 2011 | 269.60 | 277.12 | 282.95 |

Jun 2011 | 254.10 | 261.37 | 266.62 |

Jul 2011 | 250.71 | 259.27 | 262.60 |

Aug 2011 | 249.15 | 258.64 | 261.35 |

Sep 2011 | 248.07 | 256.61 | 259.46 |

Oct 2011 | 238.39 | 245.35 | 248.43 |

Nov 2011 | 235.27 | 240.94 | 245.58 |

Dec 2011 | 225.39 | 232.75 | 235.70 |

Jan 2012 | 233.38 | 240.73 | 244.13 |

Feb 2012 | 245.23 | 254.72 | 256.15 |

Mar 2012 | 265.27 | 273.41 | 276.89 |

Apr 2012 | 269.19 | 276.98 | 281.90 |

May 2012 | 259.92 | 265.29 | 271.71 |

Jun 2012 | 243.87 | 251.64 | 255.04 |

Jul 2012 | 237.10 | 244.79 | 248.11 |

Aug 2012 | 254.50 | 264.52 | 266.04 |

Sep 2012 | 264.59 | 273.62 | 276.99 |

Oct 2012 | 259.92 | 266.76 | 271.15 |

Nov 2012 | 239.81 | 246.40 | 250.32 |

Dec 2012 | 229.25 | 236.60 | 239.80 |

The three curves displayed are normalized so that each series starts at the same place. Even so, the chart does obscure some slight differences. For example, the EIA measure shows gas prices rising from $1.429 in December 2002 to $3.381 in December 2012. The CPI average price measure winds up at nearly the same place ($3.386), but because it started at a higher price in December 2002, it shows a smaller total change over the period. (See table 1.)

| Measure | December 2002 | December 2012 | Total percent change | Annualized percent change, 2002–2012 | Annualized percent change, 2002–2007 | Annualized percent change, 2007–2012 |

|---|---|---|---|---|---|---|

| CPI average price | 1.477 | 3.386 | 129.25 | 8.65 | 15.75 | 1.99 |

| EIA monthly average price | 1.429 | 3.381 | 136.6 | 8.99 | 16.53 | 1.95 |

| CPI-U | 119.1 | 285.606 | 139.8 | 9.14 | 16.61 | 2.15 |

|

Note: CPI average price values and EIA monthly average price values are in dollars; The CPI-U has a base value of 1982–84 = 100. Source: U.S. Bureau of Labor Statistics.

| ||||||

Examination of the two average price series shows that the gap between them comes in the earlier part of the series; since December 2007, the CPI average price series has actually increased slightly faster than the EIA series. In addition, although the CPI-U rose about one-half of 1 percent more per year than the CPI average price series, this difference was greater in the earlier part of the period, nearly nine-tenths of a percent per year over the first 5 years. The differences are modest, but it’s worth considering some of the reasons these measures might differ.

For both CPI measures, data have been collected throughout the entire month since 2004. A specific amount of data must be collected in each of three pricing periods that encompass the month; within these periods, data collectors have discretion over when to collect prices. It is likely that more data are collected early in each period, meaning that there is some front loading of the data. Before 2004, CPI data collection usually ceased around the 23rd of the month. Consequently, up until 2004, CPI data likely represented a price or index skewed toward the earlier part of the month.

Data for the EIA measure are collected every Monday, with the price recorded as of Monday at 8 a.m. The monthly figure is an average of the four or five weekly figures.

Because gasoline prices can move substantially from week to week or even from day to day, timing issues can be important in short-run differences. If gasoline prices rise rapidly and stabilize in August, any front loading of data will cause a series to understate the increase for July and overstate it for August, compared with a series that uses data distributed evenly across the month.

Data used for both the CPI-U and the CPI average price series are collected in about 87 different metropolitan areas. Outlets in each area are selected on the basis of a telephone point-of-purchase survey. Currently, more than 4,000 gasoline quotes are collected per month in over 1,000 outlets.

The EIA collects data from a sample of 900 retail gasoline outlets. The outlets are drawn from a frame of 115,000 outlets across the country.

Although both CPI and EIA data are taken from locations across the country, the geographic distribution of the samples is not the same. Gasoline prices can vary substantially from state to state because of differing taxes and regulations, so even minor differences in the geographic distribution can cause the measures to differ.

The CPI-U is constructed in a two-stage process. Within a given location, a geometric means formula is used to create a basic index for each area. Then, all of the basic indexes are aggregated into the national index by means of a Laspeyres formula.

Both of the average price series are computed more simply than the CPI-U: each is a weighted arithmetic average of average prices.

Note that differences in formulas have the potential to account for slight differences between the CPI-U and the average price measures.

Price measures for gasoline as a whole are really aggregations or averages of measures for different grades of gasoline. The distribution of these grades, and changes in that distribution, will affect the series. The fact that the CPI-U has increased more rapidly than either of the average price series could indicate that, over time, there has been an increase in the proportion of quotes for regular gasoline, compared with quotes for higher grades. Such a trend would not affect the CPI-U, but would put downward pressure on average price series. Indeed, this seems the most likely explanation for the slightly faster increase in the CPI-U.

Despite slight differences in the samples, collection procedures, and formulas of the three gas price measures, the main conclusion to draw from this article is that similar results are produced. The similarities between the measures may increase readers’ confidence that the gasoline pricing data are generally accurate and reliable.

The U.S. all items Consumer Price Index for all Urban Consumers (CPI-U) increased 1.0 percent over the second quarter of 2013. The rise follows an increase of 2.1 percent in the first quarter of 2013. For the 12 months ended in June 2013, the all items CPI-U grew 1.8 percent. From June 2008 to June 2013, the 5-year annualized increase in this index was 1.3 percent.

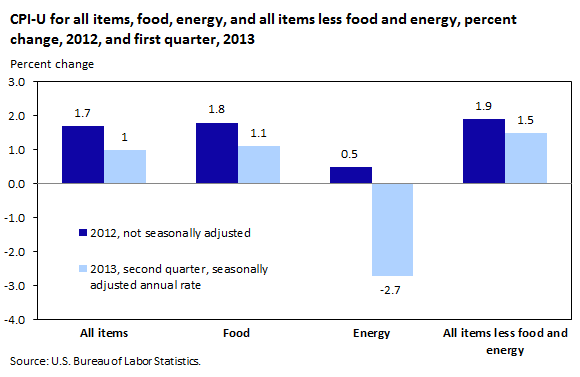

The index for all items excluding food and energy increased 1.5 percent in the second quarter of 2013; food prices rose 1.1 percent over the same period. In contrast, the energy index decreased 2.7 percent. (See chart 2.) Excluding food and energy, the U.S. CPI-U increased 2.5 percent in the second quarter of 2012.

| Category | 2012, not seasonally adjusted | 2013, second quarter, seasonally adjusted annual rate |

|---|---|---|

All items | 1.7 | 1 |

Food | 1.8 | 1.1 |

Energy | 0.5 | -2.7 |

All items less food and energy | 1.9 | 1.5 |

Since the third quarter of 2011, the energy index has alternated between quarterly increases and quarterly declines. The pattern continued when energy prices for the second quarter of 2013 decreased by 2.7 percent, reversing much of the increase of 3.7 percent posted the previous quarter. Over the year, the energy index increased 3.2 percent from June 2012 to June 2013. Despite the over-the-year rise, the long-term trend for energy prices has been downward: the index decreased at a 1.8-percent annualized rate from June 2008 to June 2013, a cumulative loss of 8.6 percent.

Household energy prices rose 7.9 percent in the second quarter of 2013, while prices for motor fuel fell 9.6 percent. The index for fuel oil and other fuels fell 24.1 percent, but increases in natural gas and electricity prices outweighed the decrease. The motor fuel index dropped 9.6 percent, with prices for the different grades of gasoline declining from a low of 5.2 percent for unleaded midgrade to a high of 10.0 percent for unleaded regular; unleaded premium fell at a 7.7-percent rate. The index for other motor fuels exhibited an even greater quarterly decrease of 23.7 percent from March 2013 to June 2013.

The gasoline index continues to strongly influence the quarterly price trends of the energy index. As did the energy index, second-quarter gasoline prices reversed the previous quarterly trend by decreasing 8.8 percent. Since the last quarter of 2011, gasoline prices have shown no real trend on a quarter-by-quarter basis. A longer term look, however, reveals that gasoline prices declined at a 2.0-percent annualized rate from June 2008 until June 2013, falling a total of 9.5 percent. Still, the gasoline index has increased 2.8 percent since June 2012.

The natural gas index has risen for four consecutive quarters, culminating in a 28.4-percent increase in the second quarter of 2013. Natural gas prices have increased 11.7 percent since June 2012. Despite the recent increases, prices for natural gas decreased at an annualized rate of 7.9 percent for the 5 years ended June 2013; in total, the natural gas index lost 33.8 percent of its June 2008 value over the 5-year period. Electricity prices increased 6.2 percent in the second quarter of 2013 but have been considerably less volatile than natural gas prices over the long term. Prices for electricity have risen 1.9 percent over the last 12 months and have climbed at a 1.4-percent annualized rate over the last 5 years.

Retail food price inflation remained moderate through the second quarter of 2013, rising 1.1 percent from March to June. This increase followed a similar one of 0.8 percent during the first quarter of 2013. From June 2012 to June 2013, the food index grew 1.4 percent, approximately half as fast the 2.7-percent increase from June 2011 until June 2012. The 5-year annualized change in this index from June 2008 to June 2013 was 2.1 percent.

An increase in prices for food purchased for consumption away from home was the primary contributor to the quarterly increase in the aggregate food index. The index for food away from home rose 2.7 percent in the second quarter, whereas the index for food at home was flat over the same period. The index for food away from home has increased 2.2 percent since June 2012, while that for food at home rose a lesser 0.9 percent over the same timeframe. Since June 2008, prices for food away from home have increased at an annualized rate of 2.5 percent while prices for food at home have grown at a slower 1.8-percent rate.

Despite little over-the-quarter change in the broader food at home index, offsetting price movements in the subcategories of the index tell a slightly different story. Prices decreased 4.4 percent for fruits and vegetables, 3.7 percent for dairy and related products, and 2.5 percent for nonalcoholic beverages and beverage materials. In contrast, prices rose 3.4 percent for meats, poultry, fish, and eggs; 2.5 percent for cereals and bakery products; and 1.0 percent for nonalcoholic beverages and beverage materials, in the second quarter of 2013. Although the index for food at home was little changed from the previous quarter (a 0.1-percent increase), it increased a cumulative 9.5 percent between June 2008 and June 2013.

A few specific food indexes moved more sharply. During the second quarter, the lettuce index fell 41.4 percent after an increase of 108.4 percent in the first quarter of 2013. Finally, the eggs index increased 29.1 percent and the potatoes index rose 13.7 percent, while the index for pork chops dropped 17.6 percent and the index for coffee decreased 13.1 percent from March 2013 to June 2013.

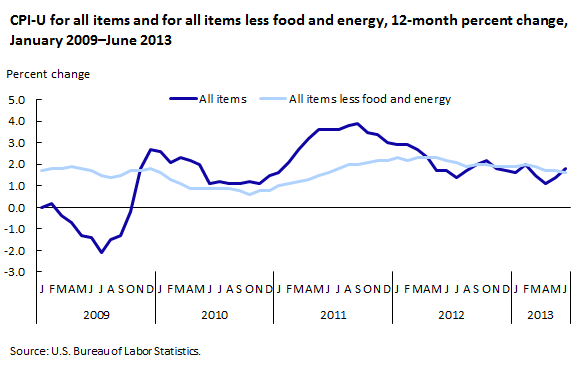

The CPI-U for all items excluding food and energy grew 1.5 percent over the second quarter of 2013, slightly less than the 2.1-percent increase seen in the first quarter. For the 12 months ended in June 2013, this index rose 1.6 percent (see chart 3), matching the annualized rate of 1.6 percent at which the index increased from June 2008 to June 2013.

| Month | All items | All items less food and energy |

|---|---|---|

Jan 2009 | 0.0 | 1.7 |

Feb 2009 | 0.2 | 1.8 |

Mar 2009 | -0.4 | 1.8 |

Apr 2009 | -0.7 | 1.9 |

May 2009 | -1.3 | 1.8 |

Jun 2009 | -1.4 | 1.7 |

Jul 2009 | -2.1 | 1.5 |

Aug 2009 | -1.5 | 1.4 |

Sep 2009 | -1.3 | 1.5 |

Oct 2009 | -0.2 | 1.7 |

Nov 2009 | 1.8 | 1.7 |

Dec 2009 | 2.7 | 1.8 |

Jan 2010 | 2.6 | 1.6 |

Feb 2010 | 2.1 | 1.3 |

Mar 2010 | 2.3 | 1.1 |

Apr 2010 | 2.2 | 0.9 |

May 2010 | 2.0 | 0.9 |

Jun 2010 | 1.1 | 0.9 |

Jul 2010 | 1.2 | 0.9 |

Aug 2010 | 1.1 | 0.9 |

Sep 2010 | 1.1 | 0.8 |

Oct 2010 | 1.2 | 0.6 |

Nov 2010 | 1.1 | 0.8 |

Dec 2010 | 1.5 | 0.8 |

Jan 2011 | 1.6 | 1.0 |

Feb 2011 | 2.1 | 1.1 |

Mar 2011 | 2.7 | 1.2 |

Apr 2011 | 3.2 | 1.3 |

May 2011 | 3.6 | 1.5 |

Jun 2011 | 3.6 | 1.6 |

Jul 2011 | 3.6 | 1.8 |

Aug 2011 | 3.8 | 2.0 |

Sep 2011 | 3.9 | 2.0 |

Oct 2011 | 3.5 | 2.1 |

Nov 2011 | 3.4 | 2.2 |

Dec 2011 | 3.0 | 2.2 |

Jan 2012 | 2.9 | 2.3 |

Feb 2012 | 2.9 | 2.2 |

Mar 2012 | 2.7 | 2.3 |

Apr 2012 | 2.3 | 2.3 |

May 2012 | 1.7 | 2.3 |

Jun 2012 | 1.7 | 2.2 |

Jul 2012 | 1.4 | 2.1 |

Aug 2012 | 1.7 | 1.9 |

Sep 2012 | 2.0 | 2.0 |

Oct 2012 | 2.2 | 2.0 |

Nov 2012 | 1.8 | 1.9 |

Dec 2012 | 1.7 | 1.9 |

Jan 2013 | 1.6 | 1.9 |

Feb 2013 | 2.0 | 2.0 |

Mar 2013 | 1.5 | 1.9 |

Apr 2013 | 1.1 | 1.7 |

May 2013 | 1.4 | 1.7 |

Jun 2013 | 1.8 | 1.6 |

The housing index increased 2.8 percent during the 3 months ended in June 2013, after a 2.1-percent rise in the 3 months ended in March. From June 2012 to June 2013, this index grew 2.2 percent, up from the 0.9-percent annualized rate of the June 2008–June 2013 period.

The shelter component of the housing index increased 2.4 percent during the second quarter of 2013, matching its first-quarter rise. The rent of primary residence component rose 2.7 percent in the second quarter of 2013, after a 2.9-percent increase in the first quarter. The index for owners’ equivalent rent of primary residence grew 2.3 percent over the second quarter, following an increase of 2.1 percent in the first quarter. The index for lodging away from home slowed substantially in the second quarter, increasing 2.9 percent, compared with a first-quarter rise of 8.1 percent.

The transportation index decreased by 2.9 percent during the second quarter of 2013, after a 3.2-percent increase in the first quarter. This change is explained largely by a drop in the various motor fuel indexes, as well as quarterly price declines in the leased cars and trucks index, the car and truck rental index, the tires index , the airline fare index, and the other intercity transportation index.

The medical care index increased 1.2 percent during the 3 months ended in June 2013, attributable in large part to a 1.0-percent decline in prices for prescription drugs in the second quarter. The medical care services component of the medical care index increased 1.6 percent over the second quarter, less than half of the 3.4-percent increase seen in the first quarter of 2013. The medical care commodities index fell 0.1 percent in the second quarter, the third quarterly decline in a row for this index. Year over year, the medical care index has increased 2.1 percent since June 2012, with the index for medical care services rising 2.8 percent and the index for medical care commodities edging up 0.1 percent.

The index for apparel increased 3.2 percent over the second quarter of 2013, after falling 1.3 percent in the first quarter. The men’s, boys’, and girls’ apparel indexes, the jewelry and watches index, and the footwear index all increased in the second quarter. In contrast, the, women’s and infants’ and toddlers’ apparel indexes decreased over the period. The girls’ apparel index has become quite volatile during the last two quarters, increasing 18.2 percent over the second quarter after falling 26.1 percent in the first quarter.

The recreation index edged up 0.1 percent in the second quarter of 2013, after increasing 1.8 percent over the first quarter. The televisions index continued to decline, falling 11.5 percent in the second quarter. The recreational books index continues to exhibit a downward trend from quarter to quarter. Since 2010, this index has decreased or remained unchanged on a quarterly basis for 11 of the 14 quarters that elapsed. Over the second quarter, 2013, the recreational books index decreased 2.0 percent.

In contrast to the movement of the recreation index, the index for educational books and supplies, a component of the education index, has been rising for some time. The index increased 5.7 percent and 5.1 percent over the first two quarters of 2013 and 6.4 percent for the 12 months ended June 2013. The education index itself also rose, increasing 3.7 percent, with all of its subcomponents rising, except for the index for technical and business school tuition and fees, which fell 2.0 percent.

In the aggregate, the education and communication category ticked up 0.1 percent over the second quarter of 2013. The communication index declined 3.2 percent in that quarter, undoing its entire 2.9-percent first-quarter increase. The delivery services index was the only component that increased in the second quarter, rising 0.4 percent.

The other goods and services index grew 1.5 percent for the 3 months ended in June 2013, after a 2.0-percent increase over the 3-month stretch ended in March. The tobacco and smoking products index, often volatile, rose modestly in both the first and second quarters of 2013—0.4 percent and 2.8 percent, respectively. The index has increased 2.4 percent over the past year.

In sum, retail price inflation in the United States remained modest during the second quarter of 2013. The increase of 1.0 percent in the all items index was the result of modest movements by most of its components. Of the major groups, only the apparel index, which rose 3.2 percent, increased more than 3.0 percent.

This Beyond the Numbers summary was prepared by Malik Crawford and Stephen B. Reed, economists in the Office of Prices and Living Conditions, U.S. Bureau of Labor Statistics. Email: crawford.malik@bls.gov. Telephone: (202) 691-5375 or email: reed.stephen@bls.gov. Telephone: (202) 691-5378.

Information in this article will be made available to sensory-impaired individuals upon request. Voice phone: (202) 691-5200. Federal Relay Service: 1-800-877-8339. This article is in the public domain and may be reproduced without permission.

Malik Crawford and Stephen B. Reed, “Measures of gasoline price change ,” Beyond the Numbers: Prices & Spending, vol. 2 / no. 23 (U.S. Bureau of Labor Statistics, September 2013), https://www.bls.gov/opub/btn/volume-2/measures-of-gasoline-price-change.htm

Publish Date: Friday, September 13, 2013