An official website of the United States government

United States Department of Labor

United States Department of Labor

In 1988, when defined contribution retirement plans were a fairly new concept in the workplace, Bureau of Labor Statistics (BLS) Commissioner, Janet L. Norwood wrote, “It is unclear whether the more rapid growth in defined contribution plans compared to defined benefit plans is a movement towards variable rather than fixed payments. But some plan sponsors have adopted defined contribution plans as a way of gaining more control, or at least predictability, over costs.”1 Norwood further explained that the payments employers make to defined contribution plans often are tied to profitability and give employers flexibility to adapt to changing economic conditions. In today’s economy, defined contribution retirement plans are the most prevalent type of employer-sponsored retirement benefit plans in private industry in the United States. In 2016, 44 percent of private industry workers participated in these plans.2

This Beyond the Numbers article takes a look at five types of employer-sponsored defined contribution retirement plans in private industry. The article shows the overall employee participation rates, employee participation rates by type of plan, and overall employer costs and worker participation costs for all types of plans. All defined contribution plans described in this article have some form of employer cost. Plans are categorized by type on the basis of Internal Revenue Code requirements and variations in contribution methods. The data are from the BLS National Compensation Survey (NCS) and are presented by selected worker and establishment characteristics and geographic areas.3

Defined contribution retirement plans are an important component of employer-sponsored benefit packages. These plans accumulate tax-deferred savings in individual employee accounts established by the employer. The government provides tax and savings incentives to both employers and employees by making it legal to set aside money on a tax-deferred, salary reduction basis for retirement expenses. Businesses have incentives for contributing money to these accounts as deferred salary because it reduces their income and payroll tax liabilities. The portion of deferred salary that workers contribute also may be exempt from income taxes, as well as investment income tax liabilities until the funds are withdrawn at retirement. Generally, there are no minimum amounts that an employer or employee may contribute to an account; there are, however, annual maximum limits that are set by the Internal Revenue Code.

Defined contribution plans often provide workers with incentives to save for retirement through employer matching contributions, thereby encouraging workers to make active choices in their retirement planning. These plans aim to put investment decisions into the hands of workers and they provide options for investing retirement funds. However, the worker also bears an investment risk: the payout of defined contribution plans is determined by the amount of money contributed to the plan and the rate of return on the money invested over time.

Defined contribution retirement plans are portable—when workers move from one job to another job they can take their retirement savings with them. Upon reaching retirement age, the account balance becomes available to the employee to be used as retirement income. Savings set aside for retirement generally may not be withdrawn prior to retirement without paying a tax penalty, except in limited circumstances such as paying for college, first time homebuyer expenses, or unexpected personal hardships.4

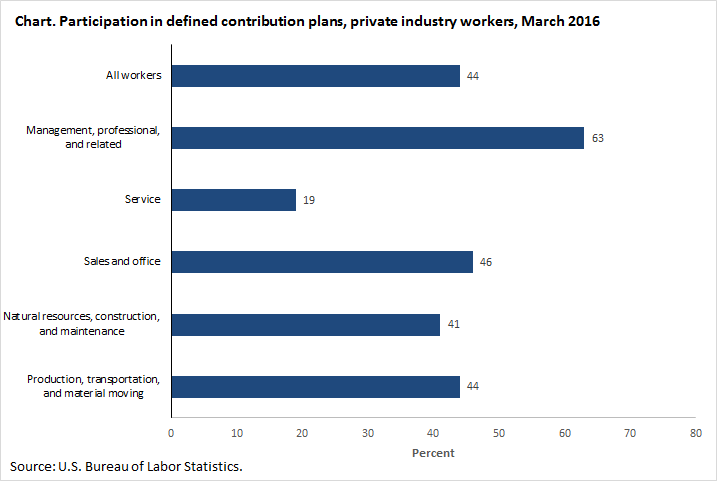

Overall employee participation rates for defined contribution plans vary significantly by some worker characteristics. This is because many employers do not offer the benefit or, for those employers that do offer the benefit, their employees may not want to contribute any of their salary in order to participate. Workers in high-paying jobs, for example, are more likely to participate in defined contribution plans than are workers in low-paying jobs. In 2016, 63 percent of management, professional, and related workers (relatively high-paying jobs) participated in defined contribution plans, compared with 19 percent of service workers (relatively low-paying jobs) who participated. (See chart 1.)

| Worker characteristics | Participation |

|---|---|

| Production, transportation, and material moving | 44 |

| Natural resources, construction, and maintenance | 41 |

| Sales and office | 46 |

| Service | 19 |

| Management, professional, and related | 63 |

| All workers | 44 |

| Source: U.S. Bureau of Labor Statistics. | |

The five types of defined contribution retirement plans reviewed in this article are: savings and thrift, deferred profit sharing, money purchase pension, employee stock ownership (ESOP), and savings incentive match plan (SIMPLE).

The rate of employee participation varies by type of plan, by worker and establishment characteristics and geographic areas. In 2015, 74 percent of all private industry workers participating in defined contribution plans participated in savings and thrift plans; also of note, in establishments with 1 to 99 workers, 66 percent of workers participated in savings and thrift plans. In establishments with 100 or more workers, 81 percent of workers participated in savings and thrift plans. (See table 1.) Note that table 1 shows the rate of participation in all types of plans adds up to more than 100 percent. This is because the design of a company’s defined contribution plans sometimes includes several different types of plans. For example, a savings and thrift plan may be combined with a profit-sharing plan that is aimed at fostering worker commitment to company goals.

| Characteristics | Savings and thrift | Deferred profit sharing | Money purchase pension | Employee stock ownership (ESOP) | Savings incentive match plan (SIMPLE) |

|---|---|---|---|---|---|

| All workers | 74 | 19 | 16 | 4 | 3 |

| Worker characteristic | |||||

| Management, professional, and related | 73 | 19 | 20 | 4 | 2 |

| Service | 79 | 13 | 13 | - | - |

| Sales and office | 79 | 18 | 11 | 6 | 3 |

| Natural resources, construction, and maintenance | 59 | 18 | 19 | - | - |

| Production, transportation, and material moving | 75 | 20 | 15 | - | - |

| Establishment characteristic | |||||

| Goods-producing industries | 70 | 21 | 18 | 6 | 3 |

| Service-providing industries | 76 | 18 | 15 | 4 | 3 |

| 1 to 99 workers | 66 | 21 | 14 | 4 | 7 |

| 100 or more workers | 81 | 17 | 17 | 4 | - |

| Geographic areas 2 | |||||

| Northeast | 65 | 22 | 26 | - | 3 |

| South | 82 | 14 | 12 | 5 | - |

| Midwest | 72 | 19 | 14 | - | - |

| West | 74 | 21 | 14 | - | - |

| 1 The sum of participation rates across each plan may be greater than 100 percent because multiple plans are available to some employees. 2 The geographic areas correspond to census regions. For information on the states and census divisions represented by the regions, see https://www.bls.gov/regions/home.htm. Note: (All workers participating in defined contribution plans = 100 percent). Dashes indicate that no data were reported or that data do not meet publication criteria. For definitions of major plans, key provisions, and related terms, see the "Glossary of Employee Benefit Terms" at https://www.bls.gov/ncs/ebs/glossary20152016.htm. Source: U.S. Bureau of Labor Statistics, National Compensation Survey. | |||||

Savings and thrift is the most prevalent type of plan. A savings and thrift plan requires an employee to contribute a predetermined amount of earnings into an individual account, all or part of which may be matched by the employer. Usually the employer matches a portion of the employee’s contribution up to a specified percent of the employee’s earnings. Both the employee and employer contributions can be either a flat amount or a percentage of the employee’s pay, although the latter is more prevalent. NCS data show that in 2015, 62 percent of savings and thrift plan participants were in plans in which the employer matched up to a specified percentage of employee earnings. Of those plans, one-half matched up to 6 percent of employee contributions (or earnings) and the remaining half matched lower contribution ceilings, typically 3 percent or 4 percent of earnings.5

Employees participating in savings and thrift plans often have two options for making contributions: they can make traditional 401(k) pre-tax contributions or Roth 401(k) post-tax contributions, or both, up to Internal Revenue Code annual limits. Traditional 401(k) pre-tax contributions, as well as any investment growth, are not subject to Federal or most State income taxes until funds are withdrawn at retirement. Roth 401(k) post-tax contributions are a feature that allows employees to make part or all of their retirement plan contributions on a post-tax basis. Upon distribution any portion of the balance that is based on pretax contributions plus earnings is taxed as regular income; and any post-tax contributions and their earnings are not subject to income tax. NCS data show that in 2015, 100 percent of savings and thrift plans had provisions that permitted employees to make pre-tax contributions, and 50 percent of plans permitted post-tax contributions.6

Deferred profit-sharing plans usually do not require an employee to contribute in order to participate. In these plans, employers usually contribute fixed or discretionary amounts to employee accounts, based on the amount of company profits. The contributions may be spread equally among all employees in the company or may be based on an employee’s salary. In 2015, 19 percent of all private industry workers participating in defined contribution plans participated in deferred profit-sharing plans; also of note, in establishments with 1 to 99 workers, 21 percent of workers participated in deferred profit-sharing plans. In establishments with 100 or more workers, 17 percent of workers participated in deferred profit-sharing plans.

A money purchase pension plan provides fixed employer contributions, typically calculated as a percentage of employee earnings. The contributions are allocated to individual employee accounts each year. Some plans may allow employee contributions, but employees are not required to make contributions in order to participate.

An employee stock ownership plan (ESOP) is a type of plan under which the employer pays a designated amount into a fund that is typically invested in company-related stock. Upon retirement, the funds in the plan are distributed to employees according to a formula.

A savings incentive match plan (SIMPLE) is a plan designed to help small businesses set up individual accounts for their employees. The businesses usually have 100 or fewer employees and do not have any other qualified retirement plan. SIMPLE plans can be either part of a 401(k) plan or established as individual retirement accounts (IRAs).

Along with overall employee participation rates, and participation rates by type of plan, this article examines the overall employer costs and worker participation costs for all types of defined contribution retirement plans.

Employer costs for defined contribution plans are presented here in two ways:

Table 2 presents employer costs per employee participating in defined contribution retirement plans by type of job, type and size of establishment, and location of establishment.

| Characteristic | Wages and salaries 1 | Defined contribution plans | ||

|---|---|---|---|---|

| Employer costs 1 | Participation rate (in percent)2 | Worker participation costs 3 | ||

| All workers | $22.33 | $0.70 | 44 | $1.59 |

| Worker characteristic | ||||

| Management, professional, and related | 39.02 | 1.52 | 63 | 2.41 |

| Service | 11.39 | 0.15 | 19 | 0.79 |

| Sales and office | 17.23 | 0.46 | 46 | 1.00 |

| Natural resources, construction, and maintenance | 23.14 | 0.62 | 41 | 1.51 |

| Production, transportation, and material moving | 17.80 | 0.52 | 44 | 1.18 |

| Establishment characteristic | ||||

| Goods-producing industries | 25.45 | 0.94 | 53 | 1.77 |

| Service-providing industries | 21.70 | 0.65 | 42 | 1.55 |

| 1 to 99 workers | 19.64 | 0.45 | 34 | 1.32 |

| 100 or more workers | 25.59 | 1.01 | 57 | 1.77 |

| Geographic area 4 | ||||

| Northeast | 26.18 | 0.79 | 48 | 1.65 |

| South | 20.90 | 0.64 | 42 | 1.52 |

| Midwest | 20.40 | 0.71 | 48 | 1.48 |

| West | 23.43 | 0.70 | 40 | 1.75 |

| 1 Estimates from the Employer Costs for Employee Compensation March 2016 release, see https://www.bls.gov/news.release/archives/ecec_06092016.htm. 2 Estimates from the March 2016 benefits release, see https://www.bls.gov/ncs/ebs/benefits/2016/home.htm. 3 Worker participation cost is a derived cost that equals the employer costs per employee hour worked individual benefit cost (from Employer Costs for Employee Compensation) divided by the individual benefit participation rate. 4 The geographic areas correspond to census regions. For information on the states and census division represented by the regions, see https://www.bls.gov/regions/home.htm. Source: U.S. Bureau of Labor Statistics, National Compensation Survey. | ||||

Employer costs for employee compensation typically include wages and salaries plus benefit costs. The data presented here, the employer costs per hour worked for wages and salaries and the employer costs per hour worked for defined contribution plans, are published statistical estimates from the National Compensation Survey. The worker participation rates also are published statistical estimates.7

The worker participation costs per hour worked for defined contribution plans are not published statistical estimates. Worker participation costs are calculated by dividing the employer costs per hour for the benefit received by the participation rate of the benefit. The result is a derived number that represents the employer costs per hour worked for those workers participating in a plan.8 When the worker participation rate is factored in, the employer costs per hour worked are not as low as they first appear. This is because not all workers are participating in a defined contribution plan, and because not all employers offer the benefit to their workers. Thus, the actual employer costs per hour worked for those employers whose employees are participating in the benefit (worker participation costs) are higher than the overall employer costs per hour. And also, the actual differences in costs (cost ratios) between different worker groups are not as great as they first appear when considering only the overall employer costs.

In March 2016, the overall employer cost for providing defined contribution benefits was $0.70 per employee hour worked in private industry. Employer costs per hour worked for defined contribution plans vary significantly by some worker and establishment characteristics and by geographic areas. Often, the main factor determining the costs for the plans is the wage rate that an employer pays a worker for a particular job – the contribution that the employer makes to an employee’s account often is based on a percentage of the employee’s wages. For example, wages for management, professional and related workers usually are higher than are wages for service jobs. In March 2016, the average employer cost per hour worked for defined contribution plans was $1.52 per hour worked for management professional and related workers—approximately 10 times more than the $0.15 per hour worked for service workers.

Large establishments also, for example, pay a higher cost per hour worked for defined contribution plans than do small establishments in part because large establishments often pay higher wage rates than small establishments. In March 2016, the average employer cost per hour worked for defined contribution plans in establishments with 100 or more workers was $1.01 per hour worked, compared with $0.45 per hour worked in establishments with 1 to 99 workers.

Worker participation costs per hour worked also vary by worker and establishment characteristic and by geographic area, although proportionally they do not vary as much as the overall employer costs per hour worked. When using the worker participation rate to calculate the employer costs only for those workers participating in defined contribution plans, the difference in cost, or the cost ratio, between management, professional, and related workers, and service workers, is not as great because now the cost is averaged out across only those workers who are participating in a plan. For management, professional, and related workers, using the worker participation rate of 63 percent to calculate the worker participation cost shows that the employer cost is $2.41 per hour worked. For service workers, using the worker participation rate of 19 percent to calculate the worker participation cost shows that the cost is $0.79 per hour worked—an approximately threefold difference in the cost ratio compared to an approximately tenfold difference in the cost ratio seen in the overall employer cost per hour worked for these two groups of workers.

Likewise, worker participation costs per hour worked for defined contribution plans vary when comparing costs between large and small establishments. When factoring in that for establishments with 100 or more workers only 57 percent of workers participate in defined contribution plans, and for establishments with 1 to 99 workers only 34 percent of workers participate in defined contribution plans; the worker participation cost per hour worked for defined contribution plans for establishments with 100 or more workers is $1.77 per hour worked, only 1.3 times more than the $1.32 per hour worked for establishments with 1 to 99 workers.

By geographic area, worker participation costs vary from $1.48 per hour in the midwest census region to $1.75 per hour in the west census region.9

Defined contribution retirement plans are the most prevalent type of employer-sponsored retirement benefit in today’s economy. In 2016, 44 percent of private industry workers participated in these plans. Defined contribution plans provide tax and savings incentives to both employers and employees to set aside money for retirement purposes. Employers offer different types of defined contribution plans to their employees, including savings and thrift and deferred profit-sharing plans. The most prevalent type of plan is savings and thrift—a plan that requires an employee to make a contribution in order to receive an employer-matching contribution. To provide a further perspective, we examine employer costs for providing defined contribution retirement plans. In March 2016 the private industry overall employer cost for providing these benefits was $0.70 per employee hour worked.

This Beyond the Numbers article was prepared by Eli R. Stoltzfus, economist in the Office of Field Operations, Bureau of Labor Statistics, Email: NCSInfo@bls.gov, Telephone:(202) 691-6199.

Information in this article will be made available upon request to individuals with sensory impairments. Voice phone: (202) 691-5200. Federal Relay Service: 1-800-877-8339. This article is in the public domain and may be reproduced without permission.

Eli R. Stoltzfus, “Defined contribution retirement plans: Who has them and what do they cost? ,” Beyond the Numbers: Pay & Benefits, vol. 5 / no. 17 (U.S. Bureau of Labor Statistics, December 2016), https://www.bls.gov/opub/btn/volume-5/defined-contribution-retirement-plans-who-has-them-and-what-do-they-cost.htm

1 Janet L. Norwood, “Measuring the cost and incidence of employee benefits,” Monthly Labor Review, (August 1988), pp. 3–8, https://www.bls.gov/opub/mlr/1988/08/art1full.pdf. The declining incidence over the last few decades of defined benefit pension plans in private industry is well documented. See also, William J. Wiatrowski, “Changing landscape of employment-based retirement benefits,” Monthly Labor Review, (September 2011), https://www.bls.gov/opub/mlr/cwc/changing-landscape-of-employment-based-retirement-benefits.pdf and, “The last private industry pension plans: a visual essay,” Monthly Labor Review, (December 2012), pp. 3–18, https://www.bls.gov/opub/mlr/2012/12/art1full.pdf.

2 Employee Benefits in the United States, March 2016, Bulletin 2785, table 2 (U.S. Bureau of Labor Statistics, September 2016) https://www.bls.gov/ncs/ebs/benefits/2016/ownership/private/table02a.htm.

3 Health and Retirement Plan Provisions in Private Industry in the United States 2015, Bulletin 2784, table 54 (U.S. Bureau of Labor Statistics, April 2016) https://www.bls.gov/ncs/ebs/detailedprovisions/2015/ownership/private/table54a.pdf and, Employer Costs for Employee Compensation – March 2016, USDL-16-1150 (U.S. Bureau of Labor Statistics, June 9, 2016), https://www.bls.gov/news.release/archives/ecec_06092016.htm.

4 Retirement Topics - Exceptions to Tax on Early Distributions (Internal Revenue Service) https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions and www.irs.gov/taxtopics/tc558.html.

5 Health and Retirement Plan Provisions in Private Industry in the United States 2015, Bulletin 2784, table 60 (U.S. Bureau of Labor Statistics, April 2016) https://www.bls.gov/ncs/ebs/detailedprovisions/2015/ownership/private/table60a.pdf.

6 Ibid., table 57, https://www.bls.gov/ncs/ebs/detailedprovisions/2015/ownership/private/table57a.pdf.

7 Employer Costs for Employee Compensation – March 2016, USDL-16-1150 (U.S. Bureau of Labor Statistics, June 9, 2016) https://www.bls.gov/news.release/archives/ecec_06092016.pdf and, Employee Benefits in the United States, March 2016, Bulletin 2785 (U.S. Bureau of Labor Statistics, September 2016) https://www.bls.gov/ncs/ebs/benefits/2016/ebbl0059.pdf.

8 Thomas G. Moehrle, John L. Bishow, and Anthony J. Barkume, “Benefit cost concepts and the limitations of ECEC measurement,” Monthly Labor Review, (July 2012), https://www.bls.gov/opub/mlr/cwc/benefit-cost-concepts-and-the-limitations-of-ecec-measurement.pdf.

Note: Statistical comparison statements involving estimates of worker participation costs cannot be validated due to unavailable standard error estimates.

9 Geographic Terms and Concepts - Census Divisions and Census Regions, (Census Bureau), https://www2.census.gov/geo/pdfs/maps-data/maps/reference/us_regdiv.pdf

10 The Revenue Act of 1978, 26 U.S.C. § 401(k) (1978), Cash and Deferred Arrangements, http://www.law.cornell.edu/uscode/text/26/401.

401(k): The Revenue Act of 1978 included a provision that resulted in Internal Revenue Code Section 401(k) Cash and Deferred Arrangements.10 Section 401(k) created incentives for employers to provide their employees with tax deferred compensation to be saved for retirement purposes by setting aside money on a salary reduction basis. The payments that employers contribute to these plans are tax deductible. Employees also may contribute to these plans. For a traditional 401(k), the portion of income that employees elect to receive as deferred compensation up to legal limits set by the IRS, rather than as direct cash payments, is exempt from income taxes until the funds are withdrawn at retirement.

Defined benefit plan. A defined benefit retirement plan provides employees with guaranteed retirement benefits that are based on a benefit formula. A participant’s retirement age, length of service, and pre-retirement earnings may affect the benefit received. In the private sector, defined benefit plans are typically funded exclusively by employer contributions.

Defined contribution plan. A defined contribution retirement plan specifies the level of employer and employee contributions (retirement savings) and places those contributions into individual employee accounts. Retirement benefits are based on the level of contributions, plus earnings, that have accumulated in the account at the time of retirement.

Employer matching contribution. The employer matches a specified percentage of employee contributions. The matching percentage can vary by length of service, amount of employee contribution, or other factors.

Individual retirement accounts (IRAs). An IRA is a retirement savings plan. There are several types of IRAs: traditional IRAs, Roth IRAs, savings incentive match plans for employees (SIMPLE) IRAs, and simplified employee pension (SEP) IRAs. Traditional and Roth IRAs are established by individuals who are allowed to contribute earnings up to a set maximum dollar amount. SIMPLE and SEPs plans are retirement plans established by employers.

Participation. Participation is the percentage of employees who actually enroll in an employer-sponsored benefit plan, such as a health benefit plan or a retirement benefit plan. A plan may be a contributory plan, which requires employees to contribute to the plan’s cost, or a noncontributory plan, in which the employer pays 100 percent of the cost of the benefit.

Publish Date: Wednesday, December 07, 2016