An official website of the United States government

United States Department of Labor

United States Department of Labor

A tourist walking along Ocean Drive could be excused for thinking Miami residents spend a lot of money on lavish meals, sugary drinks, and alcohol when they see the flashy bars and restaurants along that stretch.1 However, the spending habits of residents vary greatly from what the presence of these establishments might lead one to think.2 Miami-area households spent $5,610 for food in 2013–14, the only area of 18 metropolitan areas tracked by the Bureau of Labor Statistics Consumer Expenditure Survey (CE) that spent significantly less than the nation in this category.3 In particular, spending was comparably lower than the South and United States for sugar and other sweets and nonalcoholic beverages, among others.4 (See table 1.) In contrast, Miami area residents spent more than the region and nation on chicken, fish and seafood, and rice.

This Beyond the Numbers article examines average annual food and beverage expenditures in 2-year increments from 2010 to 2014 in Miami compared with the South, United States, and other large metropolitan areas.5 Factors contributing to these consumption patterns such as household income, food prices, and demographics in the local area are analyzed as well.

Miami households spent an average of $5,610 on food in 2013–14, about 13 percent of the area’s total annual expenditures. Miami area households spent the least on food of the 18 metropolitan areas tracked—$665 less per year than Atlanta, the second lowest spender in the food category.6 Miami households in 2013–14 spent $3,480 and $2,131 for food at home and food away from home, respectively, both significantly less than the United States. When eating away from home, Miami consumers consistently spent less than Southern and U.S. consumers on lunch, but about the same on breakfast, brunch, and dinner.

| Food and beverage categories | Geographic area | Miami expenditure as a percentage of U.S. expenditure | Miami expenditures significantly different than the U.S., the South, or both | ||

|---|---|---|---|---|---|

| United States | South region | Miami | |||

| Significantly lower spending categories: | |||||

| Sugar and other sweets | $141 | $124 | $78 | 55.3 | Both |

| Nonalcoholic beverages | 379 | 378 | 274 | 72.3 | Both |

| Bakery products | 351 | 325 | 262 | 74.6 | Both |

| Fresh milk and cream | 149 | 138 | 113 | 75.8 | Both |

| Processed vegetables | 131 | 130 | 100 | 76.3 | Both |

| Fresh vegetables | 238 | 205 | 203 | 85.3 | U.S. |

| Significantly higher spending categories: | |||||

| Rice | $27 | $25 | $57 | 211.1 | Both |

| Fish and seafood | 126 | 116 | 226 | 179.4 | Both |

| Poultry | 171 | 168 | 250 | 146.2 | Both |

| Fresh fruits | 272 | 226 | 279 | 102.6 | South |

| Source: U.S. Bureau of Labor Statistics. | |||||

As a percentage of total spending, Miami household expenditures were significantly less than the Southern region and nation on cream, candy and chewing gum, peanut butter, and beer and ale at home. By the same measure, the percentage of total expenditures was larger for Miami consumers than the Southern region and nation for rice, chicken, fish and seafood, fresh fruits, fresh fruit juice, and canned and bottled fruit juice.

Income levels affect spending on food and beverages. Miami area households took home an average of $48,310 after taxes.7 Income after taxes averaged $53,566 in the South and $57,364 in the United States. Miami, Phoenix, and Cleveland were the only areas of the 18 whose households had an average after-tax income below the national average. Residents of the fourth lowest earning metropolitan area, Atlanta ($60,435), took home 25 percent more annually than Miami households. Other metropolitan areas at the lower end of the income spectrum, including Cleveland and Atlanta, were also at the lower end of average spending on food in dollars.

Over the 2013–14 period, Miami area households spent an average of $78 on sugar and other sweets, $35 less than Baltimore—the second lowest spending area. Conversely, Boston households spent the most on sugar and other sweets. Within the category, Miami consumers spent comparably less for candy and chewing gum, a pattern that continued from 2010 to 2014. Miami spending on artificial sweeteners declined over these years and was measurably lower than the South and nation during this period. Spending on sugar itself, much of which is produced in south Florida, was similar to patterns in both the South and United States.8

Miami expenditures on fats and oils averaged $97 over the 2013–14 period, similar to the South and United States. Within this category, Miami area residents consistently spent less on peanut butter than the Southern region and nation. Snacking was not as popular in Miami considering that spending on potato chips, nuts, and other snacks was consistently lower than the South and United States from 2010 to 2014.

Miami households spent an average of $274 annually on nonalcoholic beverages during 2013–14, the only area of the 18 metropolitan areas whose residents spent significantly less on this category than both their respective region and the nation.9 Miami average spending was $71 less than Atlanta—the second lowest spender for nonalcoholic beverages. In particular, the Miami area spent less on sports drinks, and other carbonated drinks. Local expenditures on cola were significantly lower than the South in the 2013–14 period even though they increased over the 5 years. Boston household spending on nonalcoholic beverages was among the highest of the 18 metropolitan areas.

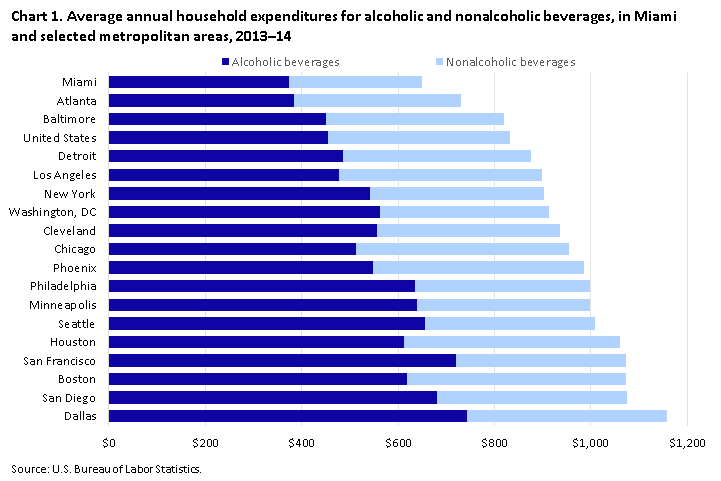

Spending on alcoholic beverages in Miami averaged $375 per household over 2013–14, compared with $362 in the South and $454 in the United States. Miami spending on alcohol away from home increased substantially from 2010 to 2014, growing faster than spending on alcohol at home. In particular, spending on wine away from home grew several fold from 2010 to 2014. In contrast, beer and ale at home expenditures were consistently lower in Miami than the South and United States. The highest expenditures for alcoholic beverages over the 2013–14 period were recorded in Dallas and San Francisco.

| Metropolitan area | Alcoholic beverages | Nonalcoholic beverages | Total |

|---|---|---|---|

| Miami | $375 | $274 | $649 |

| Atlanta | 385 | 345 | 730 |

| Baltimore | 450 | 369 | 819 |

| United States | 454 | 379 | 833 |

| Detroit | 485 | 391 | 876 |

| Los Angeles | 478 | 421 | 899 |

| New York | 541 | 361 | 902 |

| Washington, DC | 563 | 350 | 913 |

| Cleveland | 557 | 379 | 936 |

| Chicago | 513 | 441 | 954 |

| Phoenix | 549 | 436 | 985 |

| Philadelphia | 636 | 362 | 998 |

| Minneapolis | 639 | 359 | 998 |

| Seattle | 655 | 353 | 1008 |

| Houston | 612 | 448 | 1060 |

| San Francisco | 721 | 351 | 1072 |

| Boston | 619 | 454 | 1073 |

| San Diego | 681 | 393 | 1074 |

| Dallas | 744 | 413 | 1157 |

| Source: U.S. Bureau of Labor Statistics. | |||

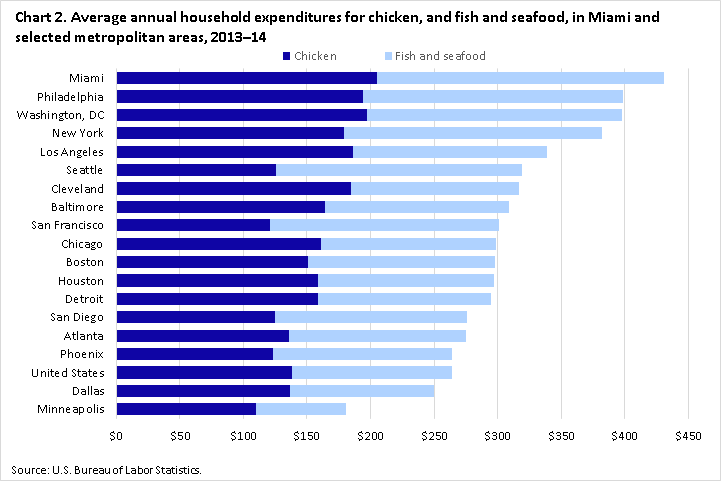

Although Miami consumers spent the least on total food, they spent significantly more on several items that are considered to be at the “heart” of a meal, such as chicken, and fish and seafood. During 2013–14, Miami households spent an average of $205 on chicken and $226 on fish and seafood, significantly higher than households in the South and United States, and among the highest expenditures of the 18 metropolitan areas. (See chart 2.) In contrast, Minneapolis expenditures were at the low end for chicken, and fish and seafood. The survey shows Miami area residents were among the lowest spenders of the 18 areas for ground beef and bacon. Miami expenditures on eggs were comparable to the South and the nation in the 2013–14 period.

| Metropolitan area | Chicken | Fish and seafood | Total |

|---|---|---|---|

| Miami | $205 | $226 | $431 |

| Philadelphia | 194 | 205 | 399 |

| Washington, DC | 197 | 201 | 398 |

| New York | 179 | 203 | 382 |

| Los Angeles | 186 | 153 | 339 |

| Seattle | 126 | 193 | 319 |

| Cleveland | 185 | 132 | 317 |

| Baltimore | 164 | 145 | 309 |

| San Francisco | 121 | 180 | 301 |

| Chicago | 161 | 138 | 299 |

| Boston | 151 | 147 | 298 |

| Houston | 159 | 138 | 297 |

| Detroit | 159 | 136 | 295 |

| San Diego | 125 | 151 | 276 |

| Atlanta | 136 | 139 | 275 |

| Phoenix | 123 | 141 | 264 |

| United States | 138 | 126 | 264 |

| Dallas | 137 | 113 | 250 |

| Minneapolis | 110 | 71 | 181 |

| Source: U.S. Bureau of Labor Statistics. | |||

Expenditure data from the CE for fruits and vegetables illustrate a Miami household preference for fresh foods. Miami households spent $279 for fresh fruits during the 2013–14 period, significantly more than Southern consumers. (See table 1.) Households in Miami spent $119 for processed fruits during this period. Spending in Miami on canned fruits was measurably below the South and nation and declined from 2010 to 2014. Miami expenditures for fresh fruit juice and canned and bottled fruit juice were both significantly above the spending on these items in the South. The average Miami family almost completely avoided frozen orange juice.10 San Francisco, Seattle, and Chicago consumers were among the highest spenders for combined fresh and processed fruits, each averaging above $500 over the 2013–14 period.

Miami households spent an average of $203 on fresh vegetables and $100 on processed vegetables. (See table 1.) Both of these expenditures were significantly below vegetable spending for the nation, while processed vegetable expenditures were also measurably below those for the South. In previous years, Miami average spending on vegetables was similar to both the South and United States.11 Seattle consumers were among the highest spenders on fresh vegetables while Boston area expenditures were among the highest for processed vegetables.

To get a better understanding of Miami food and beverage consumer expenditures, it can be useful to examine the places and employees selling those goods. According a different BLS program, the Quarterly Census of Employment and Wages (QCEW), there are 2,720 food and beverage stores with 48,200 employees serving the food-at-home market in the Miami area in 2014.12 (See table 2.) Grocery stores make up almost two-thirds of the food and beverage worksites and about 90 percent of the employment. For establishments serving the Miami food-away-from-home market, there were 9,060 food services and drinking places with 151,400 employees. Restaurants and other eating places accounted for 7 out of 8 food services and drinking places establishments and almost 90 percent of the jobs.

Location quotients measure the employment concentration of an industry for different areas and show whether the employment share of an industry in the local economy is greater than, less than, or equal to the industry employment share in the United States as a whole. A location quotient below 1.0 indicates that industry employment is less concentrated in the local area than the United States; a location quotient above 1.0 indicates that industry employment is more concentrated in the local area than the nation; and a location quotient equaling 1.0 shows that the employment concentration in the local industry equals that for the United States. Employment concentrations in Miami were mostly comparable to concentrations in the United States for these industries.13 However, for places that sell alcoholic beverages, employment was more skewed toward servicing the market for drinking away from home than drinking at home, which is consistent with a tourist destination.

| Industry | Establishments | Employment | Location quotient |

|---|---|---|---|

| At home | |||

| Food and beverage stores | 2,720 | 48,200 | 1.2 |

| Grocery stores | 1,760 | 43,300 | 1.2 |

| Specialty food stores | 630 | 3,700 | 1.2 |

| Beer, wine, and liquor stores | 340 | 1,300 | 0.6 |

| Away from home | |||

| Food services and drinking places | 9,060 | 151,400 | 1.1 |

| Special food services | 660 | 10,300 | 1.2 |

| Drinking places, alcoholic beverages | 470 | 6,000 | 1.2 |

| Restaurants and other eating places | 7,930 | 135,100 | 1.0 |

| Source: U.S. Bureau of Labor Statistics. | |||

Tourist expenditures are usually not captured in the CE, but other sources can provide a more complete picture of the tourist segment in Miami. A record 14.5 million overnight guests visited the greater Miami area in 2014, up 2.4 percent from 2013.14 Approximately three-quarters of the people were repeat visitors, with about the same proportion traveling for leisure purposes. About half of the travelers were from foreign countries and the other half were from the United States. Each overnight visitor in Miami spent an average of $57 on all meals per day in 2014, with about 20 percent of their total trip expenditures going toward meals.

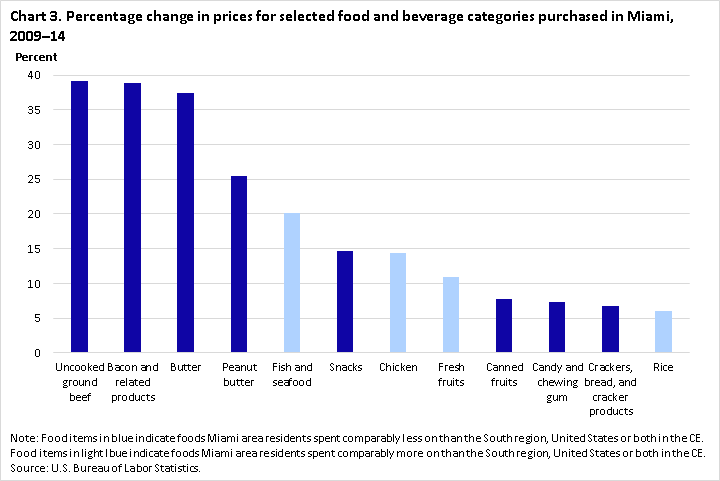

Prices help to determine which foods and how much of them consumers purchase.15 In this analysis, 12 specific foods were selected for which consumption in Miami is significantly different than that in the Southern region, nation, or both. Index numbers for these foods from the BLS U.S. Consumer Price Index for All Urban Consumers (CPI-U) were then used to calculate 5-year percent changes from 2009 to 2014. The index shows how national price changes relate to food expenditures for Miami households that spend comparably more or less on these 12 food items. (See chart 3.)

| Food item | Percent change |

|---|---|

| Uncooked ground beef | 39.1 |

| Bacon and related products | 38.8 |

| Butter | 37.5 |

| Peanut butter | 25.5 |

| Fish and seafood | 20.1 |

| Snacks | 14.6 |

| Chicken | 14.4 |

| Fresh fruits | 10.9 |

| Canned fruits | 7.8 |

| Candy and chewing gum | 7.3 |

| Crackers, bread, and cracker products | 6.7 |

| Rice | 6.0 |

| Source: U.S. Bureau of Labor Statistics. | |

Among the 12 foods, price increases were greatest over the 5 years for ground beef and bacon, as Miami residents spent significantly less on these meats than the Southern region and nation, up about 39 percent each. Price increases were less for fish and seafood (20.1 percent), and chicken (14.4 percent), foods Miami families spent significantly more on than those in the South and United States. In addition to price advances for meat, another protein, peanut butter, was also among the largest increases, up 25.5 percent. Snacks, and candy and chewing gum prices each increased less than 15 percent from 2009 to 2014 as Miami consumers spent comparably less for them over this period. Miami area residents spent more on fresh fruit than canned fruit and price increases were greater for the fresh variety (10.9 percent) than for canned (7.8 percent) over the 5 years. Prices for rice, a food Miami consumers spent significantly more on, remained relatively affordable, increasing only 6 percent from 2009 to 2014.

Miami had a unique demographic makeup during the 2009–13 period.16 A higher proportion of the population was of working age (25-54 years old), and residents were slightly older than those in the United States as a whole. The average age of the reference person from the CE in Miami was 50.1 years, similar to the South, United States, and several metropolitan areas. Miami demographics differed with the nation most in terms of race and ethnicity. A higher proportion of the population was Black and a lower proportion, White or Asian. The starkest difference between Miami and the United States was ethnicity, as Census data show Hispanics and Latinos made up nearly half of the population in Miami, compared with 16.6 percent nationwide. The majority of Hispanics in the Miami area were of Cuban descent (nearly a million). In fact, over half of all Cubans in the United States resided in Miami-Dade and Broward Counties during 2009–13. From the CE, 48 percent of reference people were Latino, the highest percentage of the 18 metropolitan areas.

Cuban culinary traditions certainly influenced the consumer expenditures in the area. Meat-based dishes of pork or chicken complemented with beans and rice are popular among Miami’s Cubans.17 Staples in Cuban cuisine that are less well known throughout the United States include bay leaf, mojo, sofrito, and mamey sapote. More well-known ingredients nationally include avocado, coconut, guava, papaya, and pineapple. Sugary desserts are popular and are often complemented with a very distinctive Cuban coffee. Census data also show that Miami was home to over a million other Hispanics or Latinos with ancestry in other countries in the Caribbean, Central and South America, reflecting their culinary preferences and food-spending patterns.

Miami is a tourist hotspot as well as a home to people with unique culinary habits. After all, not every place gets a nationally renowned weight-loss diet (South Beach Diet) named after it.18 Miami residents spent comparably less than the South and United States on sugary foods, beverages, snacks, ground beef, and lunch away from home. They spent comparably more than the Southern region and nation on chicken, fish and seafood, and rice. There are many factors that go into this behavior including income, consumer prices for foods, and area demographics. Miami households show a clear preference for cooked meals at home over snacking. Prices increased most for meats that Miami residents spend comparably less on, but rose at a slower pace for rice, a food that Miami residents consistently spent more on. Miami has a large Hispanic or Latino contingent, especially Cubans, whose cooking style influences consumer spending in the area. The mix of foods and beverages consumed by tourists in South Beach differ greatly from Miami resident expenditures. The latter are captured in the Consumer Expenditure Survey.

This Beyond the Numbers article was prepared by Matthew Dotson of the Bureau of Labor Statistics. Email: Dotson.Matthew@bls.gov, telephone: (310) 235-6865.

Upon request, the information in this article will be made available to individuals who are sensory impaired. Voice phone: (202) 691-5200. Federal Relay Service: 1-800-877-8339. This article is in the public domain and may be reproduced without permission.

Matthew Dotson, “Eating and drinking in Miami: consumer expenditures, 2010–14 ,” Beyond the Numbers: Regional Economies, vol. 5 / no. 11 (U.S. Bureau of Labor Statistics, August 2016), https://www.bls.gov/opub/btn/volume-5/eating-and-drinking-in-miami-consumer-expenditures-2010-14.htm

1 The Consumer Expenditure Survey (CE) defines Miami, Florida as consisting of two counties—Miami-Dade and Broward. To be consistent with this definition, all other Miami data in the article are also made up of only these two counties. Palm Beach County is not included.

2 The CE survey measures expenditures for consumer units. The terms consumers, households, and residents, are used interchangeably throughout the article for convenience. To get a better understanding about consumer units, reference people, and how the CE survey is conducted, please see the CE Frequently Asked Questions page for more information: https://www.bls.gov/cex/csxfaqs.htm.

3 These data are derived from the CE 2010–11, 2011–12, 2012–13, and 2013–14 current metropolitan statistical area 2-year tables, https://www.bls.gov/cex/tables.htm. Special tabulations on expenditures are based on research results by Sharon Krieger in the BLS Division of Price Statistical Methods for Expenditure Surveys. Statistically significant differences for annual average expenditures on foods and beverages in Miami compared to the South region and United States were identified using a 95-percent confidence interval. The differences were considered statistically significant if their 95-percent confidence intervals excluded the number zero. The terms significantly, comparably, and measurably are used interchangeably throughout this article to indicate statistically significant differences.

4 The CE defines the South as consisting of the following states and areas: Alabama, Arkansas, Delaware, District of Columbia, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia, and West Virginia.

5 From 2010–14, the CE produced 2-year consumer expenditure data at the metropolitan area level for 18 metropolitan areas: Atlanta; Baltimore; Boston; Chicago; Cleveland; Dallas-Fort Worth; Detroit; Houston; Los Angeles; Miami; Minneapolis-St. Paul; New York; Philadelphia; Phoenix; San Diego; San Francisco; Seattle; and Washington, D.C.

6 Several comparisons are made throughout the article between Miami and Atlanta due to their geographic proximity and similarities between the two areas.

8 “U.S. Sugar Production,” U.S. Department of Agriculture, Economic Research Service, http://www.ers.usda.gov/topics/crops/sugar-sweeteners/background.aspx#production.

9 Nonalcoholic beverages include cola, other carbonated drinks, tea, coffee, other noncarbonated fruit drinks, bottled water, sports drinks, and nonalcoholic beer. Several other beverages are not included in this category, including fresh milk, frozen orange juice, fresh fruit juice, canned and bottled fruit juice, or even tap water for consumption.

10 Miami consumer expenditures for frozen orange juice round down to zero for the closest dollar figure even though the actual figure would be slightly above zero.

11 The only exception to this statement was in 2012–13, when Miami consumers spent significantly less than the nation on processed vegetables.

12 Data for establishments, employment, and employment location quotients are derived from the BLS Quarterly Census of Employment and Wages (QCEW) program.

13 A location quotient is calculated by taking the local industry employment as a percentage of total local employment, divided by national employment for that industry as a percentage of total national employment. A location quotient above 1.0 indicates that industry employment is more concentrated in the local area than the United States, while a location quotient below 1.0 indicates industry employment is less concentrated in the local area. A location quotient equaling 1.0 means local industry employment makes up the same share of total local employment as that industry does for the nation.

14 Hannah Sampson, “2014 tourist tally: 14.5 million in Miami-Dade,” Miami Herald, February 26, 2015, http://www.miamiherald.com/news/business/article11258168.html.

15 Data in this section comes from the Consumer Price Index for All Urban Consumers (CPI-U), for selected food items. The CPI strictly measures changes in consumer prices over time and does not measure consumer expenditures nor quantities of goods and services purchased by consumers. The CE is used to derive cost weights for CPI indexes.

16 Demographics in this section come from the U.S. Census Bureau American Community Survey, 2009–13, which are 5-year estimates. Demographics for the reference person are from the CE survey.

17 Mandy Baca, “How Cuban food became Miami food,” The New Tropic, https://thenewtropic.com/cuban-food-history/.

18 “South Beach Diet,” Mayo Clinic, http://www.mayoclinic.org/healthy-lifestyle/weight-loss/in-depth/south-beach-diet/art-20048491.

Publish Date: Thursday, August 18, 2016