An official website of the United States government

United States Department of Labor

United States Department of Labor

Crossref 0

KESEHATAN KEUANGAN RUMAH TANGGA DI ASIA TENGGARA: TELAAH CAKUPAN TERHADAP LITERATUR, Jurnal Ilmu Keluarga dan Konsumen, 2023.

Enhancing Financial Well‐Being: Solution‐Focused Financial Therapy Intervention, International Social Science Journal, 2025.

Applying for and receiving unemployment insurance benefits during the coronavirus pandemic, Monthly Labor Review, 2021.

The impact of abortion restrictions on American mental health, Science Advances, 2024.

Factors Predicting Hotel Recommendations: A Comparison of Guest Feedback Before and After the Hotel Closures During the COVID-19 Pandemic, International Journal of Hospitality & Tourism Administration, 2024.

Sexual identity, poverty, and utilization of government services, Journal of Population Economics, 2024.

Zachowania konsumentów w czasie pandemii COVID-19, Przegląd Organizacji, 2021.

Utilization Impact of Cost-Sharing Elimination for Preventive Care Services: A Rapid Review, Medical Care Research and Review, 2022.

Determinants of Food Expenditure Patterns: Evidence from U.S. Consumers in the Context of the COVID-19 Price Shocks, Sustainability, 2022.

The onset of the coronavirus disease 2019 (COVID-19) pandemic led to considerable changes in consumer spending behavior in the United States. Using data from the Household Pulse Survey, this article examines the extent of pandemic-related behavioral changes reported in August 2020. The article also shows how these changes differed across generations and geography.

Dedication: We dedicate this article to the memory of our colleague, Jennifer Edgar, past Associate Commissioner in the Office of Survey Methods Research. Jennifer significantly contributed to the testing of questions asked in the Household Pulse Survey.

In early 2020, the coronavirus disease 2019 (COVID-19) pandemic brought unprecedented health, economic, and social upheaval throughout the world. For many people living in the United States, the pandemic began on January 31, 2020, when the U.S. Secretary of Health and Human Services declared a public health emergency in response to the outbreak. For others, the pandemic began months later, as the disease spread across the country. On the international stage, on March 11, 2020, the World Health Organization announced that COVID-19 could be characterized as a pandemic because of the high rates of infection in various countries around the globe. Shortly thereafter, on March 13, 2020, President Donald J. Trump declared that the coronavirus outbreak in the United States constituted a national emergency.1 On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed by Congress and signed into law by the President, providing an economic stimulus payment, extra unemployment benefits, additional funding for food and housing programs and activities, and other provisions.

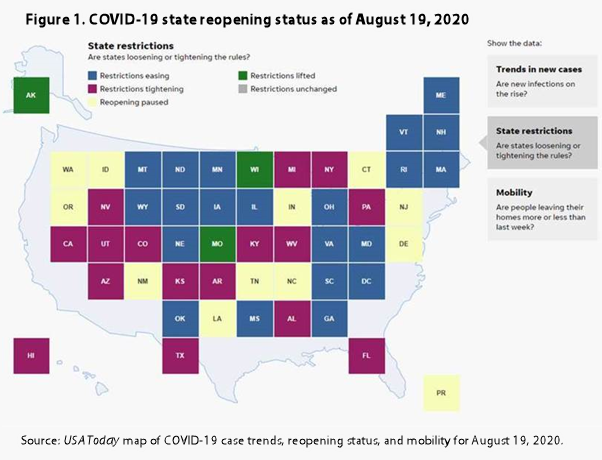

From that point forward, general health concerns and a number of measures, such as stay-at-home orders, gathering restrictions, and store closings, led to a significant shift in the daily lives of people. Travel declined, telework increased, and consumer spending behavior changed in significant ways. Attesting to how these measures affected many consumers, Raj Chetty et al. reported that, from January to April 2020, total consumer credit and debit card spending by all consumers decreased by $7.5 billion, about a 34-percent reduction.2 More recently, some states and local governments have relaxed restrictions and resumed business, at least partially.3 (See figure 1.) At the same time, as people have dealt with the consequences of the pandemic, they have experienced differential impacts in their financial well-being. Yet, regardless of where we are today—personally, financially, and health-wise—versus where we were before January 2020, all of our lives have been affected by the coronavirus pandemic.

Among the first major pandemic-related behavioral changes in the daily lives of people were those related to work and shopping behaviors. In many areas across the United States, these changes affected the use of public services. For example, in March 2020, public transportation authorities in many U.S. cities reduced transit services in an effort to address ridership declines and protect the health and safety of employees and customers.4 Data from the U.S. Bureau of Labor Statistics (BLS) Current Population Survey indicate that, in May 2020, 35.4 percent of employed workers teleworked because of the coronavirus pandemic.5 In April 2020, an analysis of personal credit and debit card purchases of millions of people in the United States showed spikes in online purchases of groceries, meals from restaurants, and products ordinarily purchased in stores. At the same time, dramatic drops in credit and debit card spending were reported for businesses associated with entertainment, transportation, and travel.6

Against this backdrop, a question arises whether consumer behavioral changes continued through the summer as more states and counties began phased reopenings. In this article, we address this question by analyzing Household Pulse Survey (HPS) data collected in August 2020.7 Specifically, we examine the extent to which spending behaviors and financial well-being changed during August 2020 and show how these changes differed across generations and geography. The changes in consumer behavior and financial well-being presented here only reflect a snapshot in time, and future developments will depend on individual and state responses to changes in the incidence of COVID-19 cases.

The main findings of our analysis are as follows:

BLS, along with several other federal agencies, developed questions for the rapid-response HPS. The HPS, an online survey using a probability-based sample and email and text message invitations to elicit responses from participants, is a collaboration among the U.S. Census Bureau, BLS, the U.S. Department of Housing and Urban Development, the National Center for Education Statistics, the National Center for Health Statistics, and the Economic Research Service of the U.S. Department of Agriculture. The survey was developed for a quick release in the field, gathering data on the many ways in which the lives of people in the United States have been affected by the pandemic. The survey instruments include questions on respondent demographics, employment, food security, health, housing, education, financial well-being, and spending behaviors.8

The first phase of the survey was fielded from April 23 to July 21, 2020. The BLS Office of Prices and Living Conditions (OPLC) contributed questions related to the receipt and actual or expected use of Economic Impact Payments (also known as stimulus payments), as well as sources of income being used to meet spending needs during the pandemic. We recently published another article summarizing the results of the survey.9

The present analysis reports findings from the first week of the second phase of the survey. Fielded from August 19 to 31, 2020, OPLC questions shifted the focus from economic stimulus payments to potential long-term impacts of the coronavirus pandemic and related policies or changes in business practices that influence consumer buying behavior. (See appendix for a list of BLS questions in the HPS phase 2 questionnaire, including those contributed by the Office of Employment and Unemployment Statistics.10) The U.S. Census Bureau releases these data with person- and household-level weights. In our analysis of data for phase 2, we applied person-level weights, as we did in our analysis of data for phase 1. Thus, our results are shown for people as opposed to households, and the statistics are presented for weighted respondents. This distinction is important for readers who might wish to compare our results with those of researchers who use household sampling and weights in their analyses.

Readers examining our results should also note that the HPS questions about consumer behavioral changes reflect only a 7-day reference period. This question feature, discussed in greater detail in later sections, implies that although two respondents may have exhibited the same behavior during the pandemic (e.g., avoiding eating at restaurants), their responses to the same HPS question could differ. This difference would occur if one of the respondents made the change before the survey’s 7-day reference period and the other made the change during the reference period. Only the respondent who made the change during the reference period would be tabulated as such in the survey findings presented here.

This section discusses financial well-being with respect to reported consumer difficulties in meeting household expenses during the pandemic and identifies changes in spending behavior across generations and geography.

In response to the question, “In the last 7 days, how difficult has it been for your household to pay for usual household expenses, including but not limited to food, rent or mortgage, car payments, medical expenses, student loans, and so on?” 13.6 percent of respondents (weighted to represent the population) reported it being very difficult, and 18.3 percent reported it being somewhat difficult. In comparison, in response to an August 2020 RAND survey question, “In the past month, how difficult has it been for you to cover your expenses and pay all your bills?” 7.1 percent of respondents reported it being very difficult, and 26.6 percent reported it being somewhat difficult.11 Similarly, according to results from wave 4 (July 2–13, 2020) of the Consumer Finance Institute COVID-19 Survey of Consumers, 11.5 percent of respondents reported being very concerned about their ability to make ends meet over the next 3 months.12 In contrast, in answering a 2019 Federal Reserve Board survey question, “Overall, which one of the following best describes how well you are managing financially these days?” 6 percent of respondents reported finding it difficult to get by, while 18 percent reported just getting by.13 In an April 2020 supplemental survey questionnaire, these percentages had increased marginally, with 7 percent of respondents reporting finding it difficult to get by and 20 percent reporting just getting by.14

The findings about difficulty in paying for usual household expenses were more pronounced for younger respondents than for older respondents. While 64.7 percent of millennials reported at least some difficulty in paying for usual expenses, only 34.5 percent of the Silent Generation reported the same.15 (See figure 2.) Additionally, as expected, those in the lowest income category reported the most difficulty in paying for usual expenses. (See table 1.)

| Generation | Not difficult at all | A little difficult | Somewhat difficult | Very difficult |

|---|---|---|---|---|

| Millennials (born 1981–present) | 35.3 | 26.8 | 20.7 | 17.2 |

| Generation X (born 1965–80) | 41.3 | 23.5 | 19.1 | 16.0 |

| Baby boomers (born 1946–64) | 52.1 | 22.7 | 16.2 | 9.0 |

| Silent Generation (born 1928–45) | 65.5 | 18.0 | 11.2 | 5.3 |

| Source: U.S. Census Bureau, Household Pulse Survey. | ||||

| Household income | Percent distribution | |||

|---|---|---|---|---|

| Not difficult at all | A little difficult | Somewhat difficult | Very difficult | |

| Less than $25,000 | 18.0 | 22.9 | 26.4 | 32.7 |

| $25,000 to $34,999 | 26.3 | 25.4 | 26.5 | 21.8 |

| $35,000 to $49,999 | 33.3 | 26.9 | 21.4 | 18.4 |

| $50,000 to $74,999 | 44.1 | 25.3 | 18.8 | 11.8 |

| $75,000 to $99,999 | 51.0 | 25.3 | 15.8 | 7.9 |

| $100,000 to $149,999 | 63.5 | 21.2 | 10.8 | 4.5 |

| $150,000 to $199,999 | 70.4 | 18.2 | 8.1 | 3.2 |

| $200,000 and more | 80.6 | 11.9 | 4.8 | 2.7 |

| Did not report | 38.9 | 27.4 | 20.5 | 13.3 |

| Note: Values may not sum to 100 because of rounding. Source: U.S. Census Bureau, Household Pulse Survey. | ||||

Respondents were presented with a list of behavioral changes and asked to indicate how their shopping behavior had changed within the last 7 days. For the present analysis, we created categorical variables based on responses to the question’s check-all-that-apply response options. The consumer behavioral changes in the list were classified as “protective” or “relaxing” on the basis of their adherence to pandemic-avoidance behaviors. A “protective” behavioral change is one that conforms to pandemic-avoidance behaviors (e.g., increasing online shopping, avoiding eating at restaurants), whereas a “relaxing” behavioral change indicates a weaker adherence to pandemic-avoidance behaviors (e.g., increasing in-store shopping, resuming eating at restaurants).

As seen in figure 3, 46.8 percent of respondents reported exclusively protective changes in behavior, the most frequently reported category. In contrast, only 4.3 percent of respondents reported exclusively relaxing changes in behavior. A subset of respondents, 29.7 percent, reported at least one protective and one relaxing behavioral change. (A more detailed analysis of this group’s behavioral changes is provided later in this article.)

| Behavioral change | Percent |

|---|---|

| Protective | 46.8 |

| Relaxing | 4.3 |

| Both | 29.7 |

| No change | 18.5 |

| Note: Values do not sum to 100 because 0.7 percent of respondents did not report any answer to this question. Source: U.S. Census Bureau, Household Pulse Survey. | |

Focusing on individual behavioral changes reveals that 54.6 percent of respondents reported a change toward avoiding eating at restaurants, 48.5 percent reported a change toward making more online purchases, and 34.8 percent reported a change toward increasing their use of credit cards or mobile apps for purchases. These findings agree with recent global results reported in September 2020 by the Organisation for Economic Co-operation and Development, which show that the United States has had persistent pandemic-avoidance behaviors relative to nations such as France, Germany, Italy, and Great Britain, all of which saw a more pronounced relaxation of avoidance strategies.16 In our data, the most frequently reported relaxing change in U.S. spending behavior only ranked sixth among all reported consumer behavioral changes, and that change was for a necessity (20.4 percent of respondents reported changing spending to attend in-person medical or dental appointments) as opposed to discretionary spending (such as resuming eating at restaurants). A little over one-fifth of respondents (18.5 percent) reported no change in their spending or shopping behavior. (See figure 4.) A possible explanation for the high rate of “no change” responses could be the question’s reference period (last 7 days). As noted previously, respondents may have implemented some of the behavioral changes that the question asks about, but they may have done so more than 7 days ago.

| Category | Type of change | Percent |

|---|---|---|

| Avoided eating at restaurants | Protective | 54.6 |

| More online purchases | Protective | 48.5 |

| Increased use of credit card or smartphone apps | Protective | 34.8 |

| Canceled or postponed in-person medical or dental appointments | Protective | 28.7 |

| More curbside pickup | Protective | 25.9 |

| Attended in-person medical or dental appointments | Relaxing | 20.4 |

| More in-store purchases | Relaxing | 8.8 |

| Resumed eating at restaurants | Relaxing | 8.7 |

| Canceled or postponed housekeeping or caregiving services | Protective | 7.9 |

| Increased use of cash | Relaxing | 4.6 |

| Resumed or started new housekeeping or caregiving services | Protective | 2.6 |

| Did not change shopping behavior | — | 18.5 |

| Note: Percentages do not add to 100 because respondents were allowed to select more than one category when answering this question. Source: U.S. Census Bureau, Household Pulse Survey. | ||

Figure 5 provides a more detailed look at those respondents who reported at least one protective behavioral change and at least one relaxing behavioral change. The darker red and darker blue bars in the figure show the percentage of respondents who reported both protective and relaxing behavioral changes and the corresponding change in spending behavior. For example, the top dark red bar shows that, among respondents who reported at least one protective and at least one relaxing behavioral change, 68.3 percent reported avoiding eating at restaurants within the past 7 days. Attending in-person medical or dental appointments was the most frequently reported relaxing behavioral change, with 65.4 percent of respondents within the “both” category reporting it, and the second most frequently reported change in behavior for this group.

| Category | Type of change | With attending medical only | Without attending medical only |

|---|---|---|---|

| Avoided eating at restaurants | Protective | 68.3 | 32.0 |

| Attended in-person medical or dental appointments | Relaxing | 65.4 | 23.6 |

| More online purchases | Protective | 65.3 | 33.5 |

| Increased use of credit card or smartphone apps | Protective | 49.3 | 26.4 |

| More curbside pickup | Protective | 34.4 | 16.8 |

| Canceled or postponed in-person medical or dental appointments | Protective | 28.4 | 19.1 |

| Resumed eating at restaurants | Relaxing | 24.6 | 24.6 |

| More in-store purchases | Relaxing | 23.3 | 23.3 |

| Increased use of cash | Relaxing | 13.3 | 13.3 |

| Canceled or postponed housekeeping or caregiving services | Protective | 9.2 | 5.2 |

| Resumed or started new housekeeping or caregiving services | Relaxing | 8.0 | 8.0 |

| Note: Percentages do not add to 100 because respondents were allowed to select more than one category when answering this question. Source: U.S. Census Bureau, Household Pulse Survey. | |||

Because attending in-person medical or dental appointments is viewed as a necessity, it may be the only relaxing behavior for many respondents who reported both protective and relaxing behaviors. To determine the effect of these respondents on the results reported in figure 5, we dropped them from the analysis. The results based on this exclusion are represented by the figure’s light red and light blue bars.

The difference between the dark blue and light blue bars corresponding to attending in-person medical or dental appointments represents the percentage of respondents whose only reported relaxing behavior was attending in-person medical or dental appointments (41.8 percent). The difference between the dark red and light red bars represents the percentage of respondents who reported a given protective behavior and whose only relaxing behavior was attending in-person medical or dental appointments. For example, among respondents who reported avoiding eating at restaurants, 36.3 percent (68.3 percent minus 32.0 percent) reported attending in-person medical or dental appointments as their only relaxing behavior.

Spending behavioral changes differed by generation. Older respondents were more likely to report avoiding eating at restaurants: 78.3 percent of respondents in the Silent Generation reported this protective behavioral change, compared with 62.7 percent of millennials. On the other hand, older respondents were more likely to resume attending in-person medical or dental appointments: 77.7 percent of respondents in the Silent Generation reported this relaxing behavioral change, compared with 58.3 percent of millennials.

Younger respondents were more likely to report a protective change only (53.6 percent of millennials versus 31.0 percent of respondents in the Silent Generation), whereas older respondents were more likely to report no change (28.3 percent of respondents in the Silent Generation versus 16.4 percent of millennials). (See figure 6.) This difference suggests that older respondents adopted a pandemic-avoidance strategy early and remained firm in that decision, while younger respondents were more prone to changing their behavior.

| Generation | No change | Both | Relaxing | Protective |

|---|---|---|---|---|

| Millennials (born 1981–present) | 16.4 | 26.6 | 3.4 | 53.6 |

| Generation X (born 1965–80) | 18.9 | 28.5 | 4.4 | 48.2 |

| Baby boomers (born 1946–64) | 21.0 | 33.0 | 5.0 | 40.9 |

| Silent Generation (born 1928–45) | 28.3 | 35.7 | 5.1 | 31.0 |

| Source: U.S. Census Bureau, Household Pulse Survey. | ||||

Younger respondents were more likely to make more purchases online: 70.4 percent of millennials reported this behavioral change, compared with 56.5 percent of respondents in the Silent Generation. Younger respondents were also more likely to opt for more curbside pickup: 43.5 percent of millennials reported doing so, compared with 27.0 percent of respondents in the Silent Generation. (See figure 7.)

| Category | Type of change | Millennials (born | Generation X (born | Baby boomers (born | Silent Generation (born |

|---|---|---|---|---|---|

| Avoided eating at restaurants | Protective | 62.7 | 65.0 | 73.7 | 78.3 |

| Attended in-person medical or dental appointments | Relaxing | 58.3 | 63.7 | 70.5 | 77.7 |

| More online purchases | Protective | 70.4 | 67.5 | 60.8 | 56.5 |

| Increased use of credit card or smartphone apps | Protective | 55.6 | 49.5 | 44.4 | 43.5 |

| More curbside puckup | Protective | 43.5 | 35.7 | 26.6 | 27.0 |

| Canceled or postponed in-person medical or dental appointments | Protective | 26.8 | 29.2 | 29.2 | 29.0 |

| Resumed eating at restaurants | Relaxing | 30.1 | 27.0 | 19.6 | 16.4 |

| More in-store purchases | Relaxing | 23.9 | 22.1 | 23.4 | 23.5 |

| Increased use of cash | Relaxing | 11.8 | 13.2 | 15.6 | 9.1 |

| Canceled or postponed housekeeping or caregiving services | Protective | 9.3 | 10.1 | 7.8 | 12.4 |

| Resumed or started new housekeeping or caregiving services | Relaxing | 9.3 | 8.9 | 5.9 | 9.6 |

| Note: Percentages do not add to 100 because respondents were allowed to select more than one category when answering this question. Source: U.S. Census Bureau, Household Pulse Survey. | |||||

When asked the question, “In the last 7 days, for which of the following reasons have you or your household changed spending?” 48.8 percent of respondents reported concerns about being around public or crowded places or high-risk people, while 30.5 percent reported concerns about the economy.17 (See figure 8.) The top six reasons given by respondents for changing spending behavior were related to pandemic avoidance.

| Reason | Percent |

|---|---|

| Concerned about going to public or crowded places | 48.8 |

| Concerned about the economy | 30.5 |

| Places usually shopped were closed or had limited hours | 25.4 |

| Loss of income | 22.5 |

| Concerned about being laid off or having hours reduced | 15.0 |

| Working from home/teleworking | 12.9 |

| Places usually shopped reopened or increased hours | 6.5 |

| No longer concerned about going to public or crowded places | 5.1 |

| Resumed working at my workplace | 4.6 |

| Other | 3.7 |

| No longer concerned about being laid off or having hours reduced | 2.2 |

| No longer concerned about the economy | 1.5 |

| Increased income | 0.7 |

| Note: Percentages do not add to 100 because respondents were allowed to select more than one category when answering this question. Source: U.S. Census Bureau, Household Pulse Survey. | |

Besides being affected by usual sociodemographic characteristics such as age and income, decisions about protective or relaxing consumer behavioral changes are influenced by fluid pandemic conditions in each state and local jurisdiction. Media reporting, rates of infection, hospitalizations, deaths, and state- and local-level openings or closings may all affect the pandemic-avoidance tolerance thresholds and day-to-day activities of consumers. In this article, we focus on behavioral changes at the state level only. Protective behavioral changes appear to be more concentrated among certain states (e.g., California, Florida, Maryland, Massachusetts, New Jersey, Washington) and less so among other states (e.g., Arkansas, Iowa, Missouri, Montana, North Dakota, South Dakota, Wyoming). (See figure 9.)

| State | Percent | Population density (people per square mile) | Population density rank |

|---|---|---|---|

| Alabama | 75.9 | 95 | 28 |

| Alaska | 70.0 | 1 | 51 |

| Arizona | 77.3 | 60 | 34 |

| Arkansas | 70.3 | 57 | 35 |

| California | 82.7 | 251 | 12 |

| Colorado | 73.3 | 52 | 38 |

| Connecticut | 78.5 | 741 | 5 |

| Delaware | 77.9 | 485 | 7 |

| District of Columbia | 87.7 | 11,011 | 1 |

| Florida | 78.8 | 378 | 9 |

| Georgia | 76.3 | 177 | 18 |

| Hawaii | 82.8 | 222 | 14 |

| Idaho | 70.7 | 20 | 45 |

| Illinois | 75.8 | 231 | 13 |

| Indiana | 68.8 | 184 | 17 |

| Iowa | 70.2 | 55 | 37 |

| Kansas | 71.3 | 36 | 41 |

| Kentucky | 72.7 | 112 | 23 |

| Louisiana | 75.1 | 108 | 24 |

| Maine | 77.6 | 43 | 39 |

| Maryland | 78.8 | 618 | 6 |

| Massachusetts | 80.7 | 871 | 4 |

| Michigan | 76.5 | 175 | 19 |

| Minnesota | 74.9 | 68 | 31 |

| Mississippi | 73.8 | 63 | 33 |

| Missouri | 69.3 | 88 | 29 |

| Montana | 62.4 | 7 | 49 |

| Nebraska | 71.9 | 24 | 44 |

| Nevada | 77.5 | 26 | 43 |

| New Hampshire | 76.3 | 148 | 22 |

| New Jersey | 80.7 | 1,218 | 2 |

| New Mexico | 76.1 | 17 | 46 |

| New York | 76.8 | 420 | 8 |

| North Carolina | 75.6 | 206 | 16 |

| North Dakota | 69.6 | 10 | 48 |

| Ohio | 71.2 | 284 | 11 |

| Oklahoma | 72.8 | 57 | 36 |

| Oregon | 75.3 | 41 | 40 |

| Pennsylvania | 73.7 | 286 | 10 |

| Rhode Island | 80.0 | 1,021 | 3 |

| South Carolina | 72.8 | 162 | 20 |

| South Dakota | 64.2 | 11 | 47 |

| Tennessee | 70.9 | 160 | 21 |

| Texas | 77.9 | 105 | 27 |

| Utah | 75.0 | 36 | 42 |

| Vermont | 74.4 | 67 | 32 |

| Virginia | 77.9 | 212 | 15 |

| Washington | 77.1 | 107 | 25 |

| West Virginia | 72.8 | 76 | 30 |

| Wisconsin | 74.4 | 106 | 26 |

| Wyoming | 63.3 | 6 | 50 |

| Source: U.S. Census Bureau, Household Pulse Survey. | |||

Notably, this trend is related to population density. States with more densely populated areas tend toward protective consumer behavioral changes. (See table 2.) Conversely, less densely populated states tend toward relaxing consumer behavioral changes. (See figure 9.) Although relaxing changes are less prevalent overall, when they do occur, they are more likely to be adopted (relative to protective changes) by less densely populated states than by more densely populated states. Note that, unlike figure 6, which shows mutually exclusive behavioral change categories, figures 9 and 10 display the proportion of the population reporting a protective or relaxing behavioral change, respectively, without excluding the possibility that both types of changes were reported. In other words, in figure 9, some of the respondents included in the proportion reporting a protective behavioral change reported both a protective and a relaxing change. The same is true for figure 10, which shows the proportion of respondents reporting a relaxing behavioral change. Figure 11 displays the proportion of respondents who reported both protective and relaxing behavioral changes.

| State | Population density (people per square mile) | Behavioral change (percent) | ||

|---|---|---|---|---|

| Protective | Relaxing | |||

| Most dense | District of Columbia | 11,011 | 87.7 | 37.0 |

| New Jersey | 1,218 | 80.7 | 35.8 | |

| Rhode Island | 1,021 | 80.0 | 37.1 | |

| Massachusetts | 871 | 80.7 | 37.0 | |

| Connecticut | 741 | 78.5 | 39.8 | |

| Least dense | South Dakota | 11 | 64.2 | 30.6 |

| North Dakota | 10 | 69.6 | 28.4 | |

| Montana | 7 | 62.4 | 29.4 | |

| Wyoming | 6 | 63.3 | 27.7 | |

| Alaska | 1 | 70.0 | 30.7 | |

| Source: U.S. Census Bureau, Household Pulse Survey and population density data. | ||||

| State | Percent | Population density (people per square mile) | Population density rank |

|---|---|---|---|

| Alabama | 32.6 | 95 | 28 |

| Alaska | 30.7 | 1 | 51 |

| Arizona | 34.3 | 60 | 34 |

| Arkansas | 31.2 | 57 | 35 |

| California | 32.6 | 251 | 12 |

| Colorado | 33.7 | 52 | 38 |

| Connecticut | 39.8 | 741 | 5 |

| Delaware | 36.8 | 485 | 7 |

| District of Columbia | 37.0 | 11,011 | 1 |

| Florida | 31.7 | 378 | 9 |

| Georgia | 34.2 | 177 | 18 |

| Hawaii | 34.4 | 222 | 14 |

| Idaho | 31.7 | 20 | 45 |

| Illinois | 34.9 | 231 | 13 |

| Indiana | 33.5 | 184 | 17 |

| Iowa | 32.9 | 55 | 37 |

| Kansas | 34.9 | 36 | 41 |

| Kentucky | 33.2 | 112 | 23 |

| Louisiana | 34.0 | 108 | 24 |

| Maine | 36.2 | 43 | 39 |

| Maryland | 34.3 | 618 | 6 |

| Massachusetts | 37.0 | 871 | 4 |

| Michigan | 37.5 | 175 | 19 |

| Minnesota | 33.8 | 68 | 31 |

| Mississippi | 32.2 | 63 | 33 |

| Missouri | 35.5 | 88 | 29 |

| Montana | 29.4 | 7 | 49 |

| Nebraska | 35.1 | 24 | 44 |

| Nevada | 36.6 | 26 | 43 |

| New Hampshire | 36.4 | 148 | 22 |

| New Jersey | 35.8 | 1,218 | 2 |

| New Mexico | 31.4 | 17 | 46 |

| New York | 34.8 | 420 | 8 |

| North Carolina | 35.8 | 206 | 16 |

| North Dakota | 28.4 | 10 | 48 |

| Ohio | 33.6 | 284 | 11 |

| Oklahoma | 32.6 | 57 | 36 |

| Oregon | 32.9 | 41 | 40 |

| Pennsylvania | 37.4 | 286 | 10 |

| Rhode Island | 37.1 | 1,021 | 3 |

| South Carolina | 36.0 | 162 | 20 |

| South Dakota | 30.6 | 11 | 47 |

| Tennessee | 32.4 | 160 | 21 |

| Texas | 30.1 | 105 | 27 |

| Utah | 39.0 | 36 | 42 |

| Vermont | 34.3 | 67 | 32 |

| Virginia | 35.0 | 212 | 15 |

| Washington | 35.9 | 107 | 25 |

| West Virginia | 30.9 | 76 | 30 |

| Wisconsin | 36.9 | 106 | 26 |

| Wyoming | 27.7 | 6 | 50 |

| Source: U.S. Census Bureau, Household Pulse Survey. | |||

| State | Percent | Population density (people per square mile) | Population density rank |

|---|---|---|---|

| Alabama | 29.6 | 95 | 28 |

| Alaska | 25.5 | 1 | 51 |

| Arizona | 30.5 | 60 | 34 |

| Arkansas | 26.7 | 57 | 35 |

| California | 29.4 | 251 | 12 |

| Colorado | 29.4 | 52 | 38 |

| Connecticut | 34.9 | 741 | 5 |

| Delaware | 30.9 | 485 | 7 |

| District of Columbia | 34.2 | 11,011 | 1 |

| Florida | 28.2 | 378 | 9 |

| Georgia | 28.7 | 177 | 18 |

| Hawaii | 31.7 | 222 | 14 |

| Idaho | 28.9 | 20 | 45 |

| Illinois | 31.1 | 231 | 13 |

| Indiana | 28.7 | 184 | 17 |

| Iowa | 27.9 | 55 | 37 |

| Kansas | 30.5 | 36 | 41 |

| Kentucky | 28.2 | 112 | 23 |

| Louisiana | 28.2 | 108 | 24 |

| Maine | 32.2 | 43 | 39 |

| Maryland | 29.6 | 618 | 6 |

| Massachusetts | 33.5 | 871 | 4 |

| Michigan | 32.6 | 175 | 19 |

| Minnesota | 28.5 | 68 | 31 |

| Mississippi | 27.8 | 63 | 33 |

| Missouri | 29.2 | 88 | 29 |

| Montana | 24.8 | 7 | 49 |

| Nebraska | 30.6 | 24 | 44 |

| Nevada | 31.8 | 26 | 43 |

| New Hampshire | 31.6 | 148 | 22 |

| New Jersey | 30.9 | 1,218 | 2 |

| New Mexico | 27.6 | 17 | 46 |

| New York | 30.1 | 420 | 8 |

| North Carolina | 29.9 | 206 | 16 |

| North Dakota | 24.9 | 10 | 48 |

| Ohio | 29.4 | 284 | 11 |

| Oklahoma | 27.0 | 57 | 36 |

| Oregon | 28.7 | 41 | 40 |

| Pennsylvania | 31.3 | 286 | 10 |

| Rhode Island | 33.7 | 1,021 | 3 |

| South Carolina | 31.4 | 162 | 20 |

| South Dakota | 25.4 | 11 | 47 |

| Tennessee | 28.6 | 160 | 21 |

| Texas | 26.5 | 105 | 27 |

| Utah | 35.2 | 36 | 42 |

| Vermont | 30.9 | 67 | 32 |

| Virginia | 32.2 | 212 | 15 |

| Washington | 31.7 | 107 | 25 |

| West Virginia | 26.9 | 76 | 30 |

| Wisconsin | 31.6 | 106 | 26 |

| Wyoming | 24.2 | 6 | 50 |

| Source: U.S. Census Bureau, Household Pulse Survey. | |||

The COVID-19 pandemic profoundly affected consumer spending patterns, both in the immediate aftermath of the national emergency declaration in March 2020 and into the summer months. This article suggests that concerns about disease spread and the economy are associated with consumer behavioral changes, and that many of the changes seen early in the pandemic have persisted and may continue for some time. Generational status and geographic location appear to be among the factors related to the likelihood of adopting consumer behavioral changes, although other factors may be revealed in more detailed multivariate analyses.

Q14a. Since March 13, 2020, have you applied for Unemployment Insurance (UI) benefits? Select only one answer.

Q14b. Since March 13, 2020, did you receive Unemployment Insurance (UI) benefits? Select only one answer.

Q14c. Including yourself, how many people in your household received Unemployment Insurance (UI) benefits since March 13, 2020? Please enter a number.

Q19a. In the last 7 days, how difficult has it been for your household to pay for usual household expenses, including but not limited to food, rent or mortgage, car payments, medical expenses, student loans, and so on? Select only one answer.

Q19b. In the last 7 days, which of the following changes have you or your household made to your spending or shopping? Select all that apply.

Q19c. In the last 7 days, for which of the following reasons have you or your household changed spending? Select all that apply.

Q20. Thinking about your experience in the last 7 days, which of the following did you or your household members use to meet your spending needs? Select all that apply.

Thesia I. Garner, Adam Safir, and Jake Schild, "Changes in consumer behaviors and financial well-being during the coronavirus pandemic: results from the U.S. Household Pulse Survey," Monthly Labor Review, U.S. Bureau of Labor Statistics, December 2020, https://doi.org/10.21916/mlr.2020.26

1 See “Proclamation on declaring a national emergency concerning the novel coronavirus disease (COVID-19) outbreak” (The White House, March 13, 2020), https://trumpwhitehouse.archives.gov/presidential-actions/proclamation-declaring-national-emergency-concerning-novel-coronavirus-disease-covid-19-outbreak/.

2 Raj Chetty, John N. Friedman, Nathaniel Hendren, Michael Stepner, and the Opportunity Insights Team, “The economic impacts of COVID-19: evidence from a new public database built using private sector data,” working paper (Cambridge, MA: Opportunity Insights, November 2020), https://opportunityinsights.org/wp-content/uploads/2020/05/tracker_paper.pdf.

3 For updates on case trends, reopening status, and mobility, see “COVID-19 restrictions: map of COVID-19 case trends, restrictions, and mobility,” USA Today, https://www.usatoday.com/storytelling/coronavirus-reopening-america-map/#restrictions.

4 Kate Taylor, “No bus service. Crowded trains. Transit systems struggle with the virus.” The New York Times, March 17, 2020, https://www.nytimes.com/2020/03/17/us/coronavirus-buses-trains-detroit-boston.html.

5 “One-quarter of the employed teleworked in August 2020 because of COVID-19 pandemic,” The Economics Daily (U.S. Bureau of Labor Statistics, September 15, 2020), https://www.bls.gov/opub/ted/2020/one-quarter-of-the-employed-teleworked-in-august-2020-because-of-covid-19-pandemic.htm.

6 Lauren Leatherby and David Gelles, “How the virus transformed the way Americans spend their money,” The New York Times, April 11, 2020, https://www.nytimes.com/interactive/2020/04/11/business/economy/coronavirus-us-economy-spending.html.

7 “Household Pulse Survey: measuring social and economic impacts during the coronavirus pandemic” (U.S. Census Bureau), https://www.census.gov/programs-surveys/household-pulse-survey.html.

8 For more information about the Household Pulse Survey, see ibid.

9 Thesia I. Garner, Adam Safir, and Jake Schild, “Receipt and use of stimulus payments in the time of the Covid-19 pandemic,” Beyond the Numbers: Prices & Spending, vol. 9, no. 10 (U.S. Bureau of Labor Statistics, August 2020), https://www.bls.gov/opub/btn/volume-9/receipt-and-use-of-stimulus-payments-in-the-time-of-the-covid-19-pandemic.htm.

10 The full household questionnaire is available at https://www2.census.gov/programs-surveys/demo/technical-documentation/hhp/Phase_2_Questionnaire_09_09_2020_English.pdf.

11 Katherine Grace Carman and Shanthi Nataraj, “2020 American Life Panel survey on impacts of COVID-19: technical documentation” (Santa Monica, CA: RAND Corporation, 2020), https://www.rand.org/pubs/research_reports/RRA308-1.html.

12 Tom Akana, “CFI COVID-19 Survey of Consumers—wave 4 tracks how the vulnerable are affected more by job interruptions and income disruptions,” Consumer Finance Institute special report (Federal Reserve Bank of Philadelphia, September 2020), https://www.philadelphiafed.org/-/media/frbp/assets/consumer-finance/reports/cfi-covid-19-survey-of-consumers-wave-4-updates.pdf.

13 See appendix B, “Consumer responses to 2019 survey questions,” in Report on the economic well-being of U.S. households in 2019, featuring supplemental data from April 2020 (Board of Governors of the Federal Reserve System, May 2020), https://www.federalreserve.gov/publications/2020-supplemental-appendixes-2019-Appendix-B-Consumer-Responses-to-2019-Survey-Questions.htm.

14 See appendix D, “Consumer responses to April 2020 supplemental survey questions,” in Report on the economic well-being of U.S. households in 2019, featuring supplemental data from April 2020 (Board of Governors of the Federal Reserve System, May 2020), https://www.federalreserve.gov/publications/2020-supplemental-appendixes-2019-Appendix-D-Consumer-Responses-to-2019-Survey-Questions.htm.

15 Millennials are those born in 1981 or later, Generation X are those born between 1965 and 1980, baby boomers are those born between 1946 and 1964, and the Silent Generation are those born between 1928 and 1945.

16 See slide 10 in Laurence Boone, “Living with uncertainty,” OECD Economic Outlook presentation (Organisation for Economic Co-operation and Development, September 16, 2020), https://read.oecd-ilibrary.org/view/?ref=136_136495-20g6l69n4a.

17 The interpretation of “concerns about the economy” was left open to the respondent; for example, some respondents may have been concerned about the impact of the pandemic on the value of their retirement accounts, the stock market, or business closings, and these concerns may have resulted in either spending less or spending more.