An official website of the United States government

United States Department of Labor

United States Department of Labor

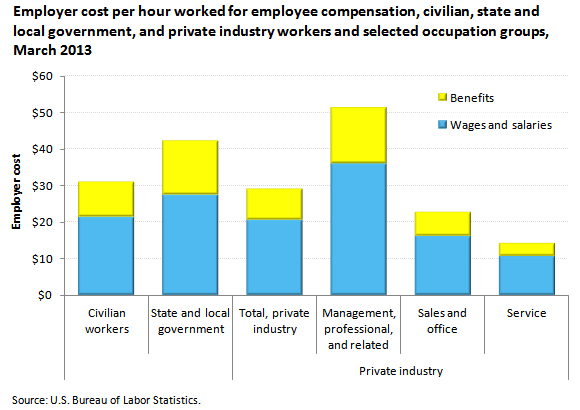

Employer costs for employee compensation averaged $31.09 per hour worked in March 2013. Wages and salaries averaged $21.50 per hour worked and accounted for 69.1 percent of these costs, while benefits averaged $9.59 and accounted for the remaining 30.9 percent.

| Compensation component | Civilian workers | |||||

|---|---|---|---|---|---|---|

| Total, civilian workers | State and local government | Private industry | ||||

| Total, private industry | Management, professional, and related | Sales and office | Service | |||

Total | $31.09 | $42.12 | $29.13 | $51.28 | $22.86 | $14.19 |

Benefits | 9.59 | 14.85 | 8.66 | 15.27 | 6.57 | 3.47 |

Wages and salaries | 21.5 | 27.27 | 20.47 | 36.02 | 16.29 | 10.71 |

Total employer compensation costs per hour worked averaged $42.12 for state and local government workers and $29.13 for private industry workers in March 2013. Among the occupation groups in private industry, management, professional, and related occupations had the highest total employer compensation costs at $51.28 per hour worked.

The total private industry benefit costs of $8.66 per hour worked included costs for paid leave that averaged $2.01 per hour worked (6.9 percent of total compensation); for supplemental pay, 81 cents (2.8 percent); for insurance benefits, $2.40 (8.2 percent); for retirement and savings, $1.06 (3.6 percent); and for legally required benefits, $2.39 (8.2 percent).

These data are from the Employment Cost Trends program. To learn more, see “Employer Costs for Employee Compensation — March 2013” (HTML) (PDF), news release USDL-13-1140.

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Total employer costs for employee compensation $31.09 per hour worked in March 2013 at https://www.bls.gov/opub/ted/2013/ted_20130613.htm (visited February 22, 2026).