An official website of the United States government

United States Department of Labor

United States Department of Labor

With the passage of the Patient Protection and Affordable Care Act, the National Compensation Survey has worked to evaluate the potential effects on the cost, coverage, and provisions for the employer-sponsored health care data it currently publishes; and explore possibilities for future collection and publication efforts. The approach has included researching the details of the law and evolving regulations, listening to the suggestions and concerns of stakeholders, and testing collection of new data elements.

The National Compensation Survey (NCS1) is a program within the Bureau of Labor Statistics that provides comprehensive measures of employer costs for worker’s compensation based on an establishment survey. The survey also tracks the incidence and provisions2 of employer-provided benefits for workers. Following the passage of the Affordable Care Act (ACA3) in 2010, the NCS has researched and monitored the law to evaluate the potential effects in continuing to provide comprehensive health care cost and coverage measures, and to identify opportunities to provide additional health care related data. This article provides an overview of efforts to research the effects of the ACA on NCS cost, coverage, and provisions data, including obtaining expert feedback and testing selected elements for potential inclusion in future data collection.

The NCS produces both the quarterly Employment Cost Index (ECI) and the Employer Costs for Employee Compensation (ECEC). The ECI, a Principal Federal Economic Indicator, captures compensation cost changes in the United States; and the ECEC provides employer cost levels for employee wages and salaries and 18 individual benefits. In addition to the ECI and ECEC, the NCS collects and publishes extensive data on employer-provided benefits, with an emphasis on health care and retirement. For the September 2014 reference period, the NCS collected data from 10,200 establishments in the United States representing private industry, as well as state and local governments.

The employer-provided benefit with the largest average cost is health insurance. (See table 1.) In September 2014, health benefits accounted for 8.5 percent of total compensation paid to civilian workers and 27.3 percent of employer benefit costs overall.

| Compensation Component | Civilian Workers | Private Industry | State and Local Government |

|---|---|---|---|

| Wages and salaries | 68.7 | 69.8 | 64.0 |

| Benefits | 31.3 | 30.2 | 36.0 |

| Paid Leave(1) | 7.0 | 6.9 | 7.3 |

| Supplemental pay(2) | 2.4 | 2.8 | .8 |

| Insurance(3) | 9.0 | 8.3 | 12.0 |

| Health benefits | 8.5 | 7.8 | 11.7 |

| Retirement and savings | 5.2 | 4.1 | 10.0 |

| Defined benefit | 3.3 | 1.9 | 9.1 |

| Defined contribution | 1.9 | 2.1 | .8 |

| Legally required(4) | 7.7 | 8.1 | 5.9 |

| Notes: (2)Supplemental pay benefits include overtime and premium pay, shift differentials, and nonproduction bonuses. (3)Insurance benefits include health, life, and short-term and long-term disability. (4)Legally required benefits include Social Security, Medicare, federal and state unemployment insurance, and workers' compensation. Source: U.S. Bureau of Labor Statistics, Employer Costs for Employee Compensation. | |||

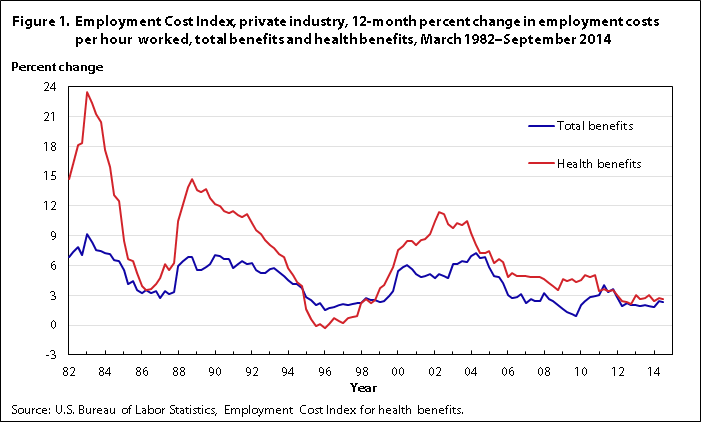

Since 1982, the NCS has documented the percent change in employer costs for health insurance in the ECI. The data show that employer health benefit costs have often outpaced average employer benefit cost increases from March 1982 to September 2014. In the 12-month period ending September 2014, employer costs for health benefits for private-industry workers increased 2.6 percent. (See figure 1.)

| Date | Total benefits | Health benefits |

|---|---|---|

| 3/1/1982 | 6.9 | 14.7 |

| 6/1/1982 | 7.4 | 16.2 |

| 9/1/1982 | 7.9 | 18.1 |

| 12/1/1982 | 7.1 | 18.3 |

| 3/1/1983 | 9.2 | 23.5 |

| 6/1/1983 | 8.4 | 22.4 |

| 9/1/1983 | 7.6 | 21.3 |

| 12/1/1983 | 7.5 | 20.4 |

| 3/1/1984 | 7.3 | 17.6 |

| 6/1/1984 | 7.2 | 15.9 |

| 9/1/1984 | 6.6 | 13.1 |

| 12/1/1984 | 6.5 | 12.5 |

| 3/1/1985 | 5.5 | 8.5 |

| 6/1/1985 | 4.1 | 6.7 |

| 9/1/1985 | 4.4 | 6.5 |

| 12/1/1985 | 3.5 | 5.2 |

| 3/1/1986 | 3.2 | 3.9 |

| 6/1/1986 | 3.5 | 3.5 |

| 9/1/1986 | 3.2 | 3.6 |

| 12/1/1986 | 3.4 | 4.1 |

| 3/1/1987 | 2.7 | 4.7 |

| 6/1/1987 | 3.4 | 6.1 |

| 9/1/1987 | 3.1 | 5.5 |

| 12/1/1987 | 3.3 | 6.3 |

| 3/1/1988 | 5.9 | 10.5 |

| 6/1/1988 | 6.5 | 12.2 |

| 9/1/1988 | 6.9 | 13.9 |

| 12/1/1988 | 6.9 | 14.7 |

| 3/1/1989 | 5.5 | 13.6 |

| 6/1/1989 | 5.5 | 13.4 |

| 9/1/1989 | 5.8 | 13.7 |

| 12/1/1989 | 6.2 | 12.8 |

| 3/1/1990 | 7.1 | 12.2 |

| 6/1/1990 | 7.0 | 12.0 |

| 9/1/1990 | 6.7 | 11.5 |

| 12/1/1990 | 6.7 | 11.3 |

| 3/1/1991 | 5.7 | 11.5 |

| 6/1/1991 | 6.2 | 11.1 |

| 9/1/1991 | 6.5 | 10.9 |

| 12/1/1991 | 6.2 | 11.2 |

| 3/1/1992 | 6.3 | 10.3 |

| 6/1/1992 | 5.5 | 9.6 |

| 9/1/1992 | 5.2 | 9.2 |

| 12/1/1992 | 5.2 | 8.6 |

| 3/1/1993 | 5.6 | 8.1 |

| 6/1/1993 | 5.7 | 7.8 |

| 9/1/1993 | 5.3 | 7.2 |

| 12/1/1993 | 4.9 | 6.9 |

| 3/1/1994 | 4.5 | 5.7 |

| 6/1/1994 | 4.1 | 5.0 |

| 9/1/1994 | 4.1 | 4.3 |

| 12/1/1994 | 3.7 | 3.9 |

| 3/1/1995 | 2.8 | 1.6 |

| 6/1/1995 | 2.5 | 0.6 |

| 9/1/1995 | 2.0 | -0.1 |

| 12/1/1995 | 2.2 | 0.1 |

| 3/1/1996 | 1.5 | -0.3 |

| 6/1/1996 | 1.7 | 0.1 |

| 9/1/1996 | 1.8 | 0.7 |

| 12/1/1996 | 2.0 | 0.4 |

| 3/1/1997 | 2.1 | 0.2 |

| 6/1/1997 | 2.0 | 0.7 |

| 9/1/1997 | 2.1 | 0.8 |

| 12/1/1997 | 2.2 | 0.9 |

| 3/1/1998 | 2.2 | 2.2 |

| 6/1/1998 | 2.7 | 2.6 |

| 9/1/1998 | 2.5 | 2.2 |

| 12/1/1998 | 2.5 | 2.5 |

| 3/1/1999 | 2.3 | 3.7 |

| 6/1/1999 | 2.4 | 4.0 |

| 9/1/1999 | 2.9 | 5.0 |

| 12/1/1999 | 3.4 | 5.8 |

| 3/1/2000 | 5.4 | 7.6 |

| 6/1/2000 | 5.8 | 8.0 |

| 9/1/2000 | 6.0 | 8.5 |

| 12/1/2000 | 5.6 | 8.5 |

| 3/1/2001 | 5.1 | 8.1 |

| 6/1/2001 | 4.8 | 8.6 |

| 9/1/2001 | 4.9 | 8.7 |

| 12/1/2001 | 5.1 | 9.2 |

| 3/1/2002 | 4.7 | 10.5 |

| 6/1/2002 | 5.1 | 11.4 |

| 9/1/2002 | 4.9 | 11.2 |

| 12/1/2002 | 4.7 | 10.2 |

| 3/1/2003 | 6.1 | 9.8 |

| 6/1/2003 | 6.2 | 10.3 |

| 9/1/2003 | 6.5 | 10.1 |

| 12/1/2003 | 6.4 | 10.5 |

| 3/1/2004 | 7.0 | 9.3 |

| 6/1/2004 | 7.3 | 8.1 |

| 9/1/2004 | 6.8 | 7.3 |

| 12/1/2004 | 6.9 | 7.3 |

| 3/1/2005 | 5.8 | 7.5 |

| 6/1/2005 | 4.9 | 6.3 |

| 9/1/2005 | 4.8 | 6.7 |

| 12/1/2005 | 4.2 | 6.4 |

| 3/1/2006 | 3.0 | 4.8 |

| 6/1/2006 | 2.7 | 5.2 |

| 9/1/2006 | 2.8 | 4.9 |

| 12/1/2006 | 3.1 | 4.9 |

| 3/1/2007 | 2.2 | 4.9 |

| 6/1/2007 | 2.6 | 4.8 |

| 9/1/2007 | 2.4 | 4.8 |

| 12/1/2007 | 2.4 | 4.8 |

| 3/1/2008 | 3.2 | 4.6 |

| 6/1/2008 | 2.6 | 4.2 |

| 9/1/2008 | 2.4 | 3.9 |

| 12/1/2008 | 2.0 | 3.5 |

| 3/1/2009 | 1.6 | 4.6 |

| 6/1/2009 | 1.3 | 4.4 |

| 9/1/2009 | 1.1 | 4.6 |

| 12/1/2009 | 0.9 | 4.3 |

| 3/1/2010 | 2.0 | 4.5 |

| 6/1/2010 | 2.4 | 5.0 |

| 9/1/2010 | 2.8 | 4.8 |

| 12/1/2010 | 2.9 | 5.0 |

| 3/1/2011 | 3.0 | 3.4 |

| 6/1/2011 | 4.0 | 3.6 |

| 9/1/2011 | 3.3 | 3.4 |

| 12/1/2011 | 3.6 | 3.5 |

| 3/1/2012 | 2.8 | 3.0 |

| 6/1/2012 | 1.9 | 2.4 |

| 9/1/2012 | 2.2 | 2.3 |

| 12/1/2012 | 2.0 | 2.1 |

| 3/1/2013 | 2.0 | 3.0 |

| 6/1/2013 | 1.9 | 2.6 |

| 9/1/2013 | 2.0 | 2.7 |

| 12/1/2013 | 1.9 | 3.0 |

| 3/1/2014 | 1.8 | 2.4 |

| 6/1/2014 | 2.4 | 2.7 |

| 9/1/2014 | 2.3 | 2.6 |

In addition to employer costs data, the NCS also publishes detailed health provisions data on medical care, dental care, vision care, and outpatient prescription-drug coverage. For example, of the private-industry workers participating in medical plans in 2013, 80 percent had coverage for outpatient mental health care. For private-industry workers with outpatient prescription-drug coverage, 80 percent required a copayment for generic drugs. The median copayment for generic drug prescriptions was $10 per prescription.

In March 2014, the average monthly employer premium paid for all civilian workers contributing to medical coverage was $377.84 for single coverage and $913.77 for family coverage. (See table 2.) Employers paid, on average, 81 percent of health insurance premiums for workers selecting single coverage and 69 percent of premiums for workers selecting family coverage.

| Contribution Requirement | Single Coverage | Family Coverage |

|---|---|---|

| Employer premium, no employee contribution | $505.75 | $1,262.15 |

| Employer premium, contribution required | 377.84 | 913.77 |

| Employee premium, contribution required | 113.24 | 449.04 |

| Source: U.S. Bureau of Labor Statistics, National Compensation Survey: Employee Benefits in the United States. | ||

The Affordable Care Act (ACA), signed into law in 2010 to help extend health insurance coverage to millions of Americans, mandates various requirements to employers providing health care benefit coverage to workers. While some agencies are focused on the implementation, regulation, and enforcement aspects of the ACA, the NCS is interested in identifying how the law will affect providing labor statistics for its economic measures. See Table 3 for ACA provisions discussed in this article.

Considering the relative importance of health benefits on employer costs for employee compensation, the NCS has closely examined the provisions of the ACA. In particular, the NCS is concerned with how the ACA will affect the data collection, accuracy, and analysis of employer provided health costs and provisions available through employer provided health insurance.

Using comprehensive NCS data on employment based health care benefits, the NCS provided research to help the Department of Health and Human Services identify essential health benefits.4 The NCS is conducting extensive research and listening activities on the ACA and the potential impact of the law on its current health insurance cost, coverage, and provision data measures. In addition, the NCS also investigated future collection of provisions affected by the ACA. In 2014, the NCS conducted a feasibility test on 200 establishments, focused on the availability and collectability of data on selected ACA provisions.5

The composition of compensation packages that employers offer can change over time. Such change may occur when a new product is either developed in the compensation marketplace or prompted by legislation. Typically, changes to worker compensation are automatically captured in the NCS. For example, in the last several decades employers have been shifting retirement benefits from defined benefit to defined contribution plans.6 Changes also may occur based on compensation decisions made by employers. For example, in an effort to shift some of the risk to workers, employers may decide to reduce the amount they contribute to health benefits or change the health plans offered.

To adjust for the constantly changing compensation landscape, the NCS regularly monitors news reports for market trends and legislative actions, attends professional association conferences, and conducts other information-gathering activities. These efforts allow the NCS to maintain the quality of data, and to identify potential areas where the program may collect new types of data.

Because of the monitoring of news and trends related to employer-provided benefits, NCS recognized early on that the ACA had the potential to significantly change many facets of the health care market. Given that the NCS is primarily concerned with capturing the costs, coverage, and provisions of employee compensation, research was narrowly focused on the legislation’s effect on employer-provided health benefits. The complexity and scope of the ACA required that the NCS review the impact of the law in a deliberate and formal way.

The first step was to study the ACA and interpret its provisions. Understanding the intricacies of the law involved using publicly available resources while also communicating with internal and external contacts. The NCS had to determine which aspects of the ACA were relevant to the goals of the survey, so that those issues could be studied more extensively. Table 3 shows the main ACA provisions identified and how they might potentially affect the NCS.

| ACA Provisions | Question for the NCS |

|---|---|

| • Penalties associated with the employer mandate | What should the NCS consider an employer cost? |

| • Different requirements based on the size of the employer | What are some potential challenges to the NCS in identifying which workers are offered health benefits? |

| • Essential Health Benefits | What additional details should the health-benefit provisions currently collected by the NCS include? |

| • Health insurance exchanges and the Small Business Health Options Program (SHOP) Marketplace | Are there opportunities to collect employer-provided health-benefits data differently? |

| Notes: Source: U.S. Bureau of Labor Statistics. | |

After distinguishing the main issues for study, the NCS considered the effect of these issues on both how employers provide health benefits and how the NCS collects these data. The fact that provisions related to the implementation and timing of various ACA requirements were changing made it more difficult to properly assess these issues.

The effects of different ACA provisions on what the NCS collects vary widely, with some confronting the core goals of the NCS. For example, the program had to examine how penalties (for employers that failed to comply with the employer mandate7), taxes on robust plans, (commonly referred to as Cadillac taxes), and subsidies (for some small businesses8) might impact employer costs for providing health benefits. Other complications arising from the ACA provisions included whether to collect the incidence of grandfathered plans9 and the availability of detailed information on variable premiums. It was important that the NCS response to these issues balance the program’s goal of providing detailed data with its concerns about both respondent burden and collection feasibility.

Some ACA provisions provide an opportunity for the NCS to improve the efficiency of collecting and publishing compensation data. Two examples of such provisions are the elimination of the lifetime maximums on health benefits and the creation of the Small Business Health Options Program (SHOP). Because insurers are prohibited from applying lifetime health-benefit maximums, the NCS removed this element from future publications. And the creation of SHOP marketplaces may provide the NCS with another avenue for collecting health plan documents. Currently, the NCS is investigating the use of the required Summary of Benefits and Coverage (SBC) forms as a supplement to Summary Plan Descriptions (SPDs).

Further, relevant ACA provisions were tested to determine their potential impact on current and future NCS health care cost and provision estimates. Potential changes to the NCS were recommended only if they improved the accuracy of the collected data or the collection process without overburdening survey respondents. For example, NCS will now capture the detail of whether a health care plan was grandfathered because this information offers an additional detail about the nature of employer-provided health benefits without adding any additional burden to respondents.10 The NCS continues to research ACA provisions that have yet to take effect, including employer penalties and the Cadillac tax, in order to anticipate future challenges or opportunities that these provisions may present. Moreover, efforts to continue tracking any legislative, executive, or judicial actions that may change or delay the effect of the law are ongoing.

As part of its research efforts on the ACA, the NCS identified potential implications for both data collection and estimation. Some of the ACA mandates that affect employers have not yet gone into effect, so how employers will respond is unknown. This led the NCS to pursue outreach opportunities, including attending meetings and hosting a conference, to gather more input on potential changes to employer-provided health care costs and coverage. These sessions brought together experts and survey stakeholders who provided feedback on how the ACA provisions could affect data collection.

Since 2012, the NCS has participated in meetings and events that included members from the BLS Technical Advisory Committee,11 the BLS Data Users Advisory Committee,12 the Federal Economic Statistics Advisory Committee;13 and staff from the following Departments or Federal agencies: Department of Labor Employee Benefits Security Administration, Bureau of Economic Analysis, HHS, and the Treasury Department. The NCS also provided internal presentations on the ACA and collected input from national and regional staff. At these sessions, the NCS shared information on its program activities, asked questions about possible ACA effects, learned of the efforts taken up by other departments and agencies, identified data elements of interest, and listened to the concerns of other interested parties. The combination of internal research and feedback from listening activities led to small-scale testing of how changes related to the ACA might affect data collection.

In September 2014, the NCS held a conference focused on the ACA. The conference, held in Washington, D.C., was designed to gain further stakeholder feedback on potential employer changes to health care coverage and increased costs attributable to the ACA. The conference included plenary sessions and workgroups, which gave participants an understanding of the scope and outputs of the NCS. More than 40 people attended from various government agencies, private consulting firms, think tanks, academia, and BLS national and regional offices. The goal of the conference was to explore the relationship between certain ACA provisions and NCS products, specifically the ECI.

The conference explored potential changes to the way the NCS collects and analyzes costs for health care benefits and provisions. Special attention was paid to the ACA provisions deemed most likely to influence employers’ decisions to offer health insurance, workers’ decisions to accept such insurance, and the terms under which such insurance is offered. Conference workgroups discussed provisions of the ACA that have the potential to affect the levels and trends of health care premiums, coverage, and provisions. Since the ACA contains provisions that impact employer cost-benefit measures—including penalties, tax credits for small employers, and Cadillac taxes—the NCS was primarily interested in determining how these provisions would change employer compensation costs and how any changes could be measured. Variable premiums based on age, smoking status, wellness, and other factors could be more prevalent. An additional concern explored was potential disruptions in the availability of coverage data, data that was widely available prior to the ACA, by plan and occupation.

The conference provided a wealth of information on changes to employer-provided health care likely to arise from the implementation of the ACA. In addition, conference participants acquired a greater understanding of the NCS and its extensive breadth of compensation data. The knowledge gained by conference attendees will increase awareness of the survey. The NCS continues to pursue opportunities to meet with external partners to learn more about what employers are doing to both comply with the ACA and manage costs for providing health insurance to their workers.

The NCS identified key ACA-related issues that would most affect data collection and publication. These issues were identified through both internal research and external feedback from users, experts, and other stakeholders. With this information, the NCS identified possible ways to adjust to ACA-related changes and incorporate new data elements.

The NCS conducted a nationwide feasibility test of these elements with 200 establishments in June and July 2014. The test yielded general concepts likely to be incorporated in future survey collection. Further, other concepts were introduced that, while less developed, may be included in the survey depending on the outcome of additional research.

Table 4 provides a list of ACA provisions that were investigated for possible inclusion in the NCS. In testing these elements, the NCS wanted to answer the following basic feasibility questions: Does the respondent have knowledge of or access to the requested information? Do the data elements make sense conceptually to the respondent? Would asking for this additional information pose an undue burden to the respondent?

| ACA Provison | Background |

|---|---|

| Grandfathered status | Plans that were in existence on March 23, 2010, are eligible for grandfathered status under the ACA, which exempts these plans from certain parts of the law. |

| Small Business Health Care Tax Credit | This credit is available to employers with fewer than 25 full-time equivalent employees that pay at least half of the cost of single coverage for their employees, have an average employee salary of $50,000 per year or less, and purchase insurance through the SHOP exchange. |

| Actuarial value | This value represents the share of health care expenses the plan covers for a typical group of enrollees. |

| Metal level | The ACA establishes four levels of coverage depending on the plan’s actuarial value: platinum, gold, silver, and bronze. |

| Small Business Health Options Program (SHOP) | SHOP exchanges provide a competitive health insurance marketplace for small businesses. They include state-run exchanges and the federal SHOP exchange for states that chose not to run their own exchange. |

| Variable Premiums | Under the ACA, insurers can only vary premiums based on tobacco use, age, geographic location, family size, and participation in a wellness program. Some states have additional restrictions. Even before the passage of the ACA, the NCS increasingly encountered premiums that varied by certain factors. The program sought to test different strategies to capture premium rates given this additional complexity. |

| Source: U.S. Bureau of Labor Statistics. | |

Because the test aimed to gauge collection feasibility, the sample was not designed to produce statistically valid, plan-specific data; accordingly, the results are not suitable for publication. However, the NCS did draw some conclusions that will help guide future collection. Foremost among them was the realization that most respondents could describe basic characteristics of the plans they offered, including the existence of a grandfathered plan among their plan offerings, factors by which their plan premiums varied, and eligibility for the small business tax credit.

Accurately responding to more detailed survey questions proved difficult for respondents. In an attempt to capture variable premium data, regional field economists attempted to collect data for specific cases, such as the premium rate for a 40-year-old male smoker. However, these specific cases caused problems for respondents, with few being able to provide the premium rates for particular types of individuals. Similarly, few survey respondents could give the actuarial value of their plans, and many were confused by the concept. These issues require further exploration.

In addition to collecting survey data, field economists reported their data-collection experiences, both in formal reports and informal group interviews. Since field economists directly interact with survey respondents, they can provide valuable feedback on the feasibility of accurately collecting data elements for survey production. These activities enabled the NCS to determine whether certain data-collection problems were related to the wording of the survey question or to confusion associated with a data element.

Based on test findings, the NCS determined that data on grandfathered plan status were available and collectible with little extra burden to respondents. As an initial step, which started March 2015, the NCS now collects the ACA grandfathered status of health plans. The staff is also investigating surveying other tested data elements, including additional criteria and costs related to variable health plan premiums. Further testing is also possible depending on the results of future research.

The NCS has taken a multifaceted approach to learn about the ACA as part of its ongoing survey improvement efforts. The NCS has extensively studied the ACA through research, listening, and testing activities. The NCS will continue its current publication of health cost, coverage, and provisions statistics, and will evaluate collection procedures and estimates as the impact of the ACA is better understood with regard to NCS processes. As previously noted, the lifetime maximum is an example of a now obsolete provision that NCS has stopped measuring due to the ACA. The NCS will keep abreast of changes and developments to the ACA.14

Starting in March 2015, the NCS initiated the collection of data on the ACA grandfathered status of health insurance plans. Other provisions are being considered for future NCS collection. The NCS is also evaluating provisions that are identified in the law but not fully implemented, such as the Cadillac tax. The NCS will continue to research, listen, and identify other opportunities to accommodate the changing health benefits landscape in line with the goal of answering customer’s questions about workers’ pay and benefits.

Jeffrey L. Schildkraut, Cathy A. Baker, Kenneth N. Cho, and Kevin L. Reuss, "The National Compensation Survey and the Affordable Care Act: preserving quality health care data," Monthly Labor Review, U.S. Bureau of Labor Statistics, April 2015, https://doi.org/10.21916/mlr.2015.9

ACKNOWLEDGMENTS: The authors would like to thank the following Bureau of Labor Statistics staff for their assistance with the article: Paul W. Carney, Emily M. Fasano, Thomas G. Moehrle, and Patricia D. Tam.

1 The use of NCS throughout the article references program, staff, processes, and data.

2 The term provisions throughout the article refers to NCS data elements related to a particular type of plan, service, condition, premium, or potential cost for health care.

3 For simplicity, we refer to the Patient Protection and Affordable Care Act and the companion Health Care Education Reconciliation Act as the Affordable Care Act.

4 For more information, see https://www.bls.gov/ncs/ebs/sp/selmedbensreport.pdf.

5 The ACA provisions discussed in this article are limited to those listed in Table 3 that may affect the NCS.

6 See Stephanie Costo, “Trends in retirement plan coverage over the last decade,” Monthly Labor Review, February 2006, https://www.bls.gov/opub/mlr/2006/02/art5full.pdfand “Retirement costs for defined benefit plans higher than for defined contribution plans,” Beyond the Numbers: Pay and Benefits, vol. 1, no. 21 (Bureau of Labor Statistics, December 2012),https://www.bls.gov/opub/btn/volume-1/pdf/retirement-costs-for-defined-benefit-plans-higher-than-for-defined-contribution-plans.pdf.

7 Details on the requirements for employers can be found at https://www.irs.gov/affordable-care-act/employers/questions-and-answers-on-employer-shared-responsibility-provisions-under-the-affordable-care-act.

8 Details on tax credits of small businesses can be found at http://www.irs.gov/uac/Small-Business-Health-Care-Tax-Credit-for-Small-Employers.

9 For more information on grandfathered plans, see https://www.healthcare.gov/health-care-law-protections/grandfathered-plans/.

10 Respondents (employers) should know if a health plan they offer is grandfathered or the information will be readily available on the Summary Plan Description (SPD).

11 For more information on the BLS Technical Advisory Committee, see https://www.bls.gov/advisory/tac.htm.

12 For more information on the BLS Data Users Advisory Committee, see https://www.bls.gov/advisory/duac.htm.

13 For more information on the Federal Economic Statistics Advisory Committee, see https://www.census.gov/fesac/.

14 For more information on changes to the ACA, see https://www.benefitnews.com/gallery/eba/42-changes-that-have-been-made-to-the-aca-2745281-1.html.