An official website of the United States government

United States Department of Labor

United States Department of Labor

Crossref 0

The Winners and Losers from Trade, Economic Commentary (Federal Reserve Bank of Cleveland), 2019.

The determinants of inflation volatility: a panel data analysis for US-product categories, Applied Economics, 2022.

Heterogeneity in the exchange rate pass-through to consumer prices: the Swiss franc appreciation of 2015, Swiss Journal of Economics and Statistics, 2022.

One-stop source: A global database of inflation, Journal of International Money and Finance, 2023.

On the Heterogeneous Welfare Gains and Losses from Trade, On the Heterogeneous Welfare Gains and Losses from Trade, 2019.

On the Heterogeneous Welfare Gains and Losses from Trade, On the Heterogeneous Welfare Gains and Losses from Trade, 2019.

Structural transformation and its implications for the Chinese economy, Pacific Economic Review, 2020.

The Rent-Price Index in U.S Housing Markets, SSRN Electronic Journal, 2009.

On the heterogeneous welfare gains and losses from trade, Journal of Monetary Economics, 2020.

Oil-supply news and dynamics of exchange rates in oil-exporting countries, Corporate and Business Strategy Review, 2023.

On the Heterogeneous Welfare Gains and Losses from Trade, On the Heterogeneous Welfare Gains and Losses from Trade, 2019.

Quantifying the trade costs of U.S. exporters in the service sector, Economic Modelling, 2026.

Tradable goods and services—goods and services that can be sold in a location, typically another country, different from where they were produced—are, theoretically, sold at the same price wherever they are sold. Tradable goods and services are characterized by lower inflation relative to nontradable goods and services—goods and services whose price depends on where they are sold. Almost universally, goods are tradable and services are nontradable, though there are exceptions. This article uses new tradable and nontradable indexes to confirm that the goods and services that make up the market basket upon which the U.S. Consumer Price Index is based follow the tradable-versus-nontradable pattern. In particular, tradable market basket items are found to have lower inflation than nontradable ones over the 6-year period examined.

Some economists suggest that, in analyzing inflation, it can be useful to differentiate between tradable goods and nontradable goods. A tradable good is a good that can be sold in another location, typically another country, from where it was produced—as opposed to a nontradable good, which cannot. Theoretically, tradable goods should follow the law of one price, which dictates that a good or service costs the same in every location where it is sold. This uniformity of price is expected to occur because any price differentiation could be exploited for arbitrage: goods and services could be bought in the location with the cheapest price and then resold for profit in locations with higher prices. The practice would continue until, through competition, profit seekers drive the price down so that it is the same in all locations and no arbitrage opportunities remain. In any given country, the cost for traded goods should not exceed the cheapest price globally. By contrast, nontraded goods compete only domestically and can therefore have different prices from country to country. If all this is true, then goods that are traded should have lower inflation than goods that are not.

That the initial price of goods would differ across countries reflects the principle of comparative advantage. Developed by David Ricardo in the 19th century, this principle asserts that certain countries have specific advantages that allow them to produce goods more cheaply than others. Therefore, it is preferable for each country to produce what it can most efficiently, then trade for other goods that other countries produce most efficiently. This practice is more productive than each country trying to produce every good. Ricardo’s classic example posits that it is better for the Portuguese to produce port wine and the English to produce wool cloth, and for them to trade, than for each to make both, given that Portugal has a climate conducive to the production of only the former and England a climate conducive to the production of only the latter.1 Building on this two-economy example, the law of one price says that cloth costs in England and Portugal should be the same and that wine costs in those two countries should be the same. If not, entrepreneurial merchants would exploit the price difference until it disappeared. Today, this law is particularly relevant in relation to globalization trends over the last few decades. Less developed countries with lower labor costs, fewer regulatory restrictions, and cheaper inputs can produce many goods at a substantially lower cost than the cost of production of the same goods in developed countries. The law of one price should have the effect of dampening price growth for affected items in more-developed countries, such as the United States.

The law, of course, does meet some practical limitations. Transportation, transaction, and regulatory costs add to the initial cost of the good one might buy to resell for a higher price elsewhere. So, if, for example, one wants to buy shoes in Malaysia and sell them in Switzerland, he or she faces some combination of shipping and distribution costs, foreign exchange and bargaining costs, and import tariff and tax costs. Still, after these costs are accounted for, there are opportunities for countries to export goods to markets where they are cheaper than domestic alternatives. According to the World Bank, there were about $19 trillion of global exports in 2014,2 some of which was surely driven by comparative advantages.

The goal of this article is to determine whether the goods and services in the market basket that goes into the construction of the U.S. Consumer Price Index (CPI) follow the tradable-versus-nontradable pattern: tradable goods and services have lower inflation, and nontradable ones have higher inflation. Confirming this hypothesis would add to the body of research on the issue and could serve as justification for the regular production of tradable and nontradable inflation indexes for policy analysis. The analysis that follows breaks CPI items into two categories: tradable and nontradable. Next, new indexes are created to see whether there is a discernible difference in inflation rates between the two categories. The results obtained are then compared with the CPI special aggregate goods index and services index. In theory, it should be easier for goods, such as cars and consumer electronics, to be traded than services, such as a carwash or dentistry. Although it is likely that there are exceptions to the tradable–nontradable pattern, the analysis presented here seeks to identify whether the differences between the goods and services indexes are meaningful or whether the two indexes are similar enough to use as proxies for them.

Statistics New Zealand, the statistical agency which produces that nation’s economic data, provides tradable and nontradable inflation indexes.3 The agency released a number of papers on the methodology it used in creating those indexes, the research that the methodology was based on, and the results that were obtained. Statistics New Zealand’s work built primarily on the academic research of Jacqueline Dwyer in 1992 and the 1997 work of Genevieve Knight and Leanne Johnson, who developed ideas put forward by Morris Goldstein, Mohsin Khan, and Lawrence Officer in 1980.4

Goldstein, Khan, and Officer had posited that there might be a difference in the inflation of tradable and nontradable goods.5 Dwyer responded to their conjecture by specifying a quantitative model to determine whether goods were in fact tradable or not. Not having a quantitative system had stymied previous attempts at researching this issue effectively. She pointed out that, although, theoretically, goods and services should be defined as tradable if they followed the law of one price, in practice that was not possible, partly because of issues such as the aforementioned transportation and transaction costs, which lead to price differences in similar goods and services around the world. Dwyer’s model assumed that goods could be classified as tradable or nontradable by comparing output data for a given industry with the amount of goods imported or exported by that industry. With this system, a threshold would be set as a proportion of output whereby, if the amount imported or exported was more than the threshold, goods or services in the industry in question would be classified as either export oriented, import competing, or both. Industries that are import competing or export oriented (or both) are then considered tradable. In other words, Dwyer calculated the proportion of an industry’s contribution to the economy (output) derived from imports and exports, and if either proportion was greater than the threshold, the industry was deemed tradable. Dwyer wanted a system to set the threshold objectively, but some subjectivity was unavoidable. Dwyer’s work related to Australia, and she set 10 percent as the threshold to define an industry as export oriented or import competing. In setting the threshold, one wants to maintain a level of stability among classifications. On the one hand, industries should not be changing from tradable to nontradable year after year, because that behavior would impede analysis. On the other hand, one does not want to set the threshold such that there would be no way for an industry to switch classifications if there were some consequential change in the industry. This behavioral tension creates a subjective balancing act, with stability as the goal, but with the potential for some flexibility.6

Knight and Johnson built on Dwyer’s work, also looking into Australian tradable and nontradable inflation indexes. They agreed with Dwyer’s 10-percent threshold for Australia and reiterated that stability of the tradability classification was an important goal. Their approach differed from Dwyer’s, however, in that they used the output of commodities instead of that of industries, because the former allowed for a lower level of disaggregation, producing a more detailed classification system. They also added a caveat about the problem with any classification that used thresholds, namely, that the amount actually traded is not the same as the amount that could be traded. In other words, the goods that are tradable are not necessarily traded. For example, milk may be a tradable good, in that many countries trade it and it does not have a large international price variance; yet, it could be classified as nontradable by Australia because that country produces a lot of milk, negating the need to import it, and shipping costs making it unprofitable to export it. Knight and Johnson referred to this impediment to a tradable good’s actually being traded as a lack of “profitability of trade.” Ideally, a good that could be traded at its domestic price would be included in determining whether the good is tradable or not, but they could not find an effective method for making such a determination.7

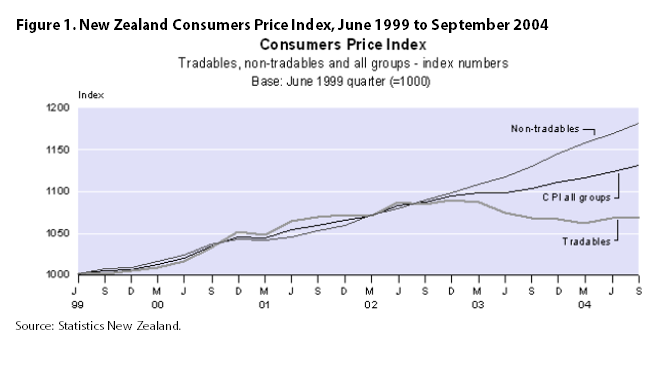

Analysts at Statistics New Zealand utilized all this research to create tradable and nontradable indexes. They used input–output (IO) tables to find the output of all goods and services that are tracked. They then looked at the proportions of items that were either imported or exported, to see whether the proportions exceeded the threshold. If they did, the items were categorized as either import competing or export oriented. The analysts then tested various thresholds for robustness, seeking to find the one that led to the most stability for commodities. They found that 15 percent was the best threshold:8 those goods and services which had imports or exports above 15 percent of the total amount of the good or service produced were designated tradable, and those which did not were considered nontradable. Inflation data for the goods and services that were designated tradable, and for those which were deemed nontradable, were then aggregated separately. The analysts then conducted research on the resulting two indexes from 1999 to 2004 and found that the tradable and nontradable indexes were relatively similar until 2002, after which they started to diverge substantially from 2003 to 2004. (See figure 1.)

In order to create tradable and nontradable inflation indexes, one needs to determine which goods and services fall into each category and then aggregate existing inflation data, by item, on the basis of their tradability classification. There are three main steps: setting a threshold for tradability, using IO tables to determine which goods and services meet that threshold, and then using those classifications to aggregate inflation data to create the indexes. Because the United States does not have a single, centralized statistical agency, the process for U.S. data is slightly more complicated, as the Bureau of Labor Statistics (BLS), which produces inflation data, and the Bureau of Economic Analysis (BEA), which produces IO data, use different item classification systems.

BEA produces IO tables with data on the United States. These data include the total amount of selected goods and services produced, as well as the amount of each imported or exported. It is worth noting that using export and import data may not be the best system for the United States, because many U.S. states are the size of other countries. (Indeed, California alone ranks as one of the largest economies in the world.) Thus, exports and imports, which measure international trade, are a flawed metric because numerous goods labeled nontradable on an international basis are likely heavily traded among states.9 As a result, future research should look into the feasibility of using interstate trade volumes to count toward the threshold for designating a good or service import competing or export oriented.

In considering output, two statistics are plausible as output measures: total final use and total commodity output. Total commodity output is used in this article because that statistic reflects the amount produced in the economy—in other words, the amount that a given good or service contributed to the economy. By contrast, total final use looks only at a good or service that is consumed in its final form.10 For example, total commodity output includes all the lumber purchased by the government, businesses, and consumers, as well as the amount imported and exported. Thus, total commodity output includes lumber bought by a furniture maker who uses it as an input. In contrast, total use looks only at lumber bought for consumption as a final product, such as lumber bought at a hardware store for home improvement purposes. In looking at the influence that imports and exports of goods and services have on prices, it is important to examine all market participants who are buying and selling, because they all help to determine the price and thus inflation. Furthermore, total commodity output matches the definition of output set forth in all of the literature that specifies a metric.

As Dwyer, Johnson, and Knight noted, setting the threshold is very difficult, and there is room for subjectivity. The best way to find a threshold would be to set different ones and check to see how many industries change tradability categories year after year. The threshold should then be set at the level that yielded the least movement of industries over time. Unfortunately, the BEA IO tables with import and export data have long multiyear intervals; therefore, creating an effective time series is impractical. To get sufficient data points would have required going back a substantial amount of time, during which there have been changes in both the BEA and the BLS methodology. Statistics New Zealand also faced trouble using time series, so it established an alternative. While the agency reiterates that time series are best, it believes that its alternative offers robust results and that the difference, in the final analysis, is marginal.11

The method by which Statistics New Zealand tested a number of thresholds to see which one led to the most stability was described briefly earlier. Specifically, the agency measured stability as the number of industries that changed tradability classifications owing to a 1-percentage-point increase or decrease from the threshold. For example, if the threshold in question was 15 percent, the stability measure was the number of industries that went from tradable to nontradable, and vice versa, as a result of moving the threshold to 14 percent or 16 percent. To find the most stable threshold, three tests were conducted: the first test examined how many industries switched because of either imports or exports, the second one how many industries switched because of imports alone, and the final one how many industries switched because of exports alone. All three tests confirmed that using 15 percent, with a 1-percentage-point deviation above or below that value, led to the least number of industries changing classification.12

Statistics New Zealand’s methodology was applied in this article in calculating the appropriate threshold for the United States. Thresholds from 1 percent to 15 percent were tested for their stability. Looking at imports and exports together indicated that the threshold should be 11 percent, with the next-best threshold 15 percent. A change in the threshold of 1 percentage point in either direction from 11 percent led to 13 industries changing classifications. Examining imports and exports individually yielded similar results: 11 percent was found to be the best threshold for exports, with 15 percent as second best; and 11 percent was found to be the best threshold for imports, with 7 percent and 10 percent tied for second best. Because all three tests found 11 percent to be the best threshold, that threshold was adopted.

With this 11-percent threshold and BEA data on output, imports, and exports, industrial classifications were evaluated to see if they were import competing or export oriented. Although the title of the data series examined is “IO industry,” the variables represent goods and services. For example, the apparel-manufacturing industry produces apparel, and the death care services industry provides death care services. Using IO table data afforded a lower level of disaggregation, similar to that used with the New Zealand methodology. Thus, commodities, as well as the industries that produce them that had imports or exports greater than 11 percent of total output, were classified as import competing and export oriented, respectively. The commodities that met the threshold were then classified as tradable, and the commodities that did not were labeled nontradable.

The tradability classification is composed of two parts. The first is a binary distinction: Is the item tradable or not, according to the aforementioned criteria? The second part involved determining how tradable the item was. An item’s “tradability” was determined by the percentage of total output represented by either exports or imports, whichever was higher. Thus, an item had to have a tradability greater than 11 percent in order to be deemed tradable. Apparel manufacturing, for example, has a tradability of 466 percent; that is, the amount of apparel the United States imports is 466 percent of domestic production. Put another way, the dollar value of U.S. imports of apparel is 4.66 times more than the contribution of U.S. apparel manufacturing to gross domestic product.

The next step was to aggregate BLS inflation data, using those CPI items which were classified as tradable or nontradable. Had BEA and BLS used the same classification system, the items that were classified by tradability by means of the BEA IO tables would have been the CPI items to aggregate. But BEA and BLS use different systems. Thus, the BEA industrial categories needed to be matched to BLS items. That way, the tradable and nontradable labels that were created with the use of IO data could be attached to the CPI items that needed to be aggregated. Meeting this objective meant creating a concordance, or translation, between the BEA IO industry classifications and the BLS CPI item classifications. Put another way, BLS tracks inflation data, and its items needed to be aggregated by their tradability classification by using BEA data, so the two systems had to be bridged. The process was unavoidably subjective, involving a comparison of the definitions of the items and establishing a “best fit.” Some cases were easier than others. For example, the CPI item “boys’ shirts” clearly falls within the IO industry “apparel manufacturing,” and the CPI item “funeral expenses” matches almost precisely with the IO industry “death care services.” Once the matches were made, each IO industry’s tradability classification was attached to its matching CPI item for aggregation later. Continuing the example, funeral expenses were labeled nontradable because death care services were nontradable, and because all the CPI apparel items fell under apparel manufacturing, they were classified as tradable, with a tradability of 466 percent.

Some pairings were not as straightforward. Several CPI items had two competing IO industries that looked like they could be reasonable fits; however, digging into the IO tables illuminated the ideal choice. The CPI item “chicken,” for example, had two chicken-related IO industries, one for poultry production and one for poultry processing. In this case, processing was used instead of production, because the IO table revealed that almost none of the output from production was consumed in that form. Instead, it was primarily an input for processing, and the output from processing was absorbed chiefly by personal consumption expenditures. This situation meant that the CPI item “chicken”—the chicken that people buy in stores or restaurants—was more accurately reflected by poultry processing than poultry production.

There were other classification challenges as well. Some goods and services, such as cosmetics, had no IO industries that related specifically to them; these goods and services were categorized into the IO group “all other miscellaneous manufacturing.” Some items were small components of larger IO categories that were too broad, while others straddled multiple IO categories. For example, the CPI has an item “coffee” and another item “other beverage materials including tea.” These match, roughly, with the respective IO industries “coffee and tea manufacturing” and “soft drink and ice manufacturing.” For the subsequent analysis, coffee was classified as tradable, given that that was the designation for coffee and tea manufacturing goods. Although coffee and tea are both likely to be tradable, had one been tradable and the other not, there would not have been a mechanism to make the proper distinction. Meanwhile, “other beverage materials including tea” was composed of two industries that had different classifications. Coffee and tea manufacturing items were tradable, while soft drink and ice manufacturing items were not. In cases like this, a weighted average was created. “Coffee and tea” had $4 billion in output and was 13.5 percent tradable. “Soft drink and ice manufacturing” had $38 billion dollars in output and was 5.1 percent tradable. A weighted average created a tradability of 5.9 percent, leading to a classification of nontradable for “other beverage materials including tea.”13

Once the CPI items had been divided into tradable and nontradable classifications, they were compared with the items’ classification among the indexes that could be their proxies: the CPI special aggregate goods index and services index. Table 1 presents an overview of how the items were divided between tradable and nontradable, compared with their breakdown into goods and services as defined by their respective CPI indexes. The overlap column represents the percentage of items in each category that met the pattern of goods being tradable and services being nontradable. A full list of CPI items by their tradability classification is given in the appendix.

| Item | Tradable versus nontradable | Goods versus services | Overlap | ||

|---|---|---|---|---|---|

| Tradable | Nontradable | Goods | Services | ||

| All Items | 102 | 109 | 144 | 67 | 75.8 |

| Apparel | 20 | 0 | 20 | 0 | 100.0 |

| Education and communication | 3 | 13 | 5 | 11 | 100.0 |

| Food and beverages | 29 | 33 | 62 | 0 | 45.2 |

| Housing | 18 | 19 | 22 | 15 | 89.2 |

| Medical care | 3 | 12 | 4 | 11 | 93.3 |

| Other goods and services | 3 | 11 | 7 | 7 | 71.4 |

| Recreation | 14 | 12 | 17 | 9 | 80.8 |

| Transportation | 12 | 9 | 7 | 14 | 85.7 |

| Source: U.S. Bureau of Labor Statistics. | |||||

Looking at the number of items which overlap is useful and suggests that there are a lot of similarities between the tradable–nontradable and goods–services designations. A different way to look at the overlap would be to look by expenditures on the items, rather than the number of items. Because items are weighted by their expenditures to reflect the impact that spending on each item has on consumers, items with more weight that match the aforementioned tradable–nontradable pattern will bring the indexes closer together.14 This method provides a more accurate means of examining the similarity in the sets of indexes. Table 2 shows that, in terms of spending, some categories are more similar than the counts of items implies while others are farther apart. As a whole, though, the expenditure analysis shows that the goods and services categories overlap, respectively, with the tradable and nontradable categories for 86.4 percent of U.S. consumer expenditures.

| Item | Tradable versus nontradable | Goods versus services | Overlap | ||

|---|---|---|---|---|---|

| Tradable | Nontradable | Goods | Services | ||

| All Items | $1,512,525 | $3,959,839 | $2,140,998 | $3,331,366 | 86.4 |

| Apparel | 177,575 | 0 | 177,575 | 0 | 100.0 |

| Education and communication | 32,144 | 357,057 | 40,195 | 349,006 | 100.0 |

| Food and beverages | 236,365 | 562,938 | 799,303 | 0 | 29.6 |

| Housing | 145,186 | 2,092,530 | 202,572 | 2,035,143 | 97.4 |

| Medical care | 95,147 | 344,877 | 95,309 | 344,714 | 100.0 |

| Other goods and services | 50,168 | 119,236 | 84,247 | 85,157 | 79.9 |

| Recreation | 75,689 | 240,466 | 111,179 | 204,977 | 85.0 |

| Transportation | 697,263 | 245,723 | 630,618 | 312,368 | 95.5 |

| Source: U.S. Bureau of Labor Statistics. | |||||

Once the CPI items were classified as tradable or nontradable, they were aggregated as such into their respective indexes. These indexes were then compared with the BLS goods index and services index. The CPI data used were from January 2010 to December 2015.

The results were partially as expected: tradable goods and services exhibited less inflation than their nontradable counterparts over the 6-year period examined. In fact, tradable goods showed a deflation of 2.5 percent, while nontradable goods registered inflation of 13.5 percent. Goods themselves did not exhibit deflation, but their inflation was only a modest 2.5 percent. By contrast, services inflation was 13.4 percent over the same period. For context, the CPI all-items index posted inflation of 9.2 percent. These results can all be seen in the following tabulation as the change in the respective index values over the 6-year span examined.

| Index | January 2010 | December 2015 | Change, January 2010 to December 2015 |

| Tradable | 100 | 97.25 | 2.75 |

| Nontradable | 100 | 113.49 | 13.49 |

| Goods | 100 | 102.52 | 2.52 |

| Services | 100 | 113.38 | 13.38 |

| CPI, all items | 100 | 109.16 | 9.16 |

Over time, the hypothesis that tradable goods and services have lower inflation and nontradable ones have higher inflation holds, with goods and tradable items having lower inflation overall and lower average rates of inflation than services and nontradable items. The hypothesis does not, however, account for the intervening volatility, which requires further investigation.

The relationship between the series is better illustrated by looking at them over time. The nontradable and services indexes track each other very closely. The tradable and goods indexes track each other as well, although they start to diverge at the end of the period examined. One can also see the volatility in the tradable items and in goods. Both exhibited a bout of inflation at the beginning of the period and then sustained some volatility, before starting a deflationary trend, as seen in figure 2.

| Month and year | Tradable | Nontradable | Goods | Services | CPI, all items |

|---|---|---|---|---|---|

| Jan 2010 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Feb 2010 | 99.7 | 100.1 | 99.9 | 100.1 | 100.0 |

| Mar 2010 | 101.0 | 100.2 | 100.7 | 100.3 | 100.4 |

| Apr 2010 | 101.5 | 100.3 | 101.0 | 100.4 | 100.6 |

| May 2010 | 101.5 | 100.4 | 101.0 | 100.5 | 100.7 |

| June 2010 | 100.2 | 100.7 | 100.1 | 100.9 | 100.6 |

| July 2010 | 99.8 | 100.9 | 99.9 | 101.1 | 100.6 |

| Aug 2010 | 100.0 | 101.1 | 100.2 | 101.2 | 100.7 |

| Sept 2010 | 100.1 | 101.1 | 100.4 | 101.1 | 100.8 |

| Oct 2010 | 100.8 | 101.0 | 100.9 | 101.0 | 100.9 |

| Nov 2010 | 101.0 | 101.0 | 101.0 | 101.0 | 101.0 |

| Dec 2010 | 101.6 | 101.0 | 101.4 | 101.0 | 101.2 |

| Jan 2011 | 102.6 | 101.3 | 102.2 | 101.3 | 101.6 |

| Feb 2011 | 103.7 | 101.6 | 103.0 | 101.6 | 102.1 |

| Mar 2011 | 106.8 | 101.8 | 105.2 | 101.8 | 103.1 |

| Apr 2011 | 108.8 | 102.0 | 106.7 | 101.9 | 103.8 |

| May 2011 | 109.9 | 102.2 | 107.6 | 102.1 | 104.3 |

| June 2011 | 108.5 | 102.6 | 106.7 | 102.5 | 104.2 |

| July 2011 | 108.0 | 102.9 | 106.5 | 102.8 | 104.3 |

| Aug 2011 | 108.3 | 103.2 | 106.9 | 103.1 | 104.5 |

| Sept 2011 | 108.4 | 103.4 | 107.1 | 103.1 | 104.7 |

| Oct 2011 | 107.7 | 103.4 | 106.7 | 103.1 | 104.5 |

| Nov 2011 | 107.2 | 103.4 | 106.4 | 103.1 | 104.4 |

| Dec 2011 | 105.8 | 103.5 | 105.6 | 103.2 | 104.1 |

| Jan 2012 | 106.6 | 103.9 | 106.3 | 103.5 | 104.6 |

| Feb 2012 | 108.0 | 104.0 | 107.3 | 103.6 | 105.1 |

| Mar 2012 | 110.4 | 104.2 | 109.0 | 103.8 | 105.9 |

| Apr 2012 | 111.3 | 104.3 | 109.5 | 104.0 | 106.2 |

| May 2012 | 110.3 | 104.5 | 108.8 | 104.2 | 106.1 |

| June 2012 | 108.5 | 104.9 | 107.7 | 104.7 | 105.9 |

| July 2012 | 107.4 | 105.1 | 107.0 | 104.8 | 105.7 |

| Aug 2012 | 109.0 | 105.3 | 108.2 | 105.0 | 106.3 |

| Sept 2012 | 110.4 | 105.4 | 109.2 | 105.2 | 106.8 |

| Oct 2012 | 110.1 | 105.5 | 109.0 | 105.2 | 106.8 |

| Nov 2012 | 107.9 | 105.6 | 107.6 | 105.3 | 106.2 |

| Dec 2012 | 106.5 | 105.7 | 106.7 | 105.4 | 106.0 |

| Jan 2013 | 106.7 | 106.0 | 106.9 | 105.8 | 106.3 |

| Feb 2013 | 109.2 | 106.3 | 108.6 | 106.1 | 107.1 |

| Mar 2013 | 109.8 | 106.5 | 109.0 | 106.3 | 107.4 |

| Apr 2013 | 109.0 | 106.6 | 108.6 | 106.4 | 107.3 |

| May 2013 | 109.1 | 106.9 | 108.5 | 106.8 | 107.5 |

| June 2013 | 109.0 | 107.2 | 108.5 | 107.2 | 107.8 |

| July 2013 | 108.5 | 107.5 | 108.3 | 107.4 | 107.8 |

| Aug 2013 | 108.4 | 107.7 | 108.4 | 107.5 | 107.9 |

| Sept 2013 | 108.4 | 107.9 | 108.4 | 107.7 | 108.1 |

| Oct 2013 | 107.5 | 107.8 | 107.8 | 107.7 | 107.8 |

| Nov 2013 | 106.6 | 107.9 | 107.1 | 107.8 | 107.6 |

| Dec 2013 | 106.1 | 108.0 | 106.9 | 107.9 | 107.6 |

| Jan 2014 | 106.3 | 108.5 | 107.2 | 108.4 | 108.0 |

| Feb 2014 | 106.9 | 108.8 | 107.7 | 108.7 | 108.4 |

| Mar 2014 | 108.3 | 109.3 | 108.8 | 109.2 | 109.0 |

| Apr 2014 | 109.4 | 109.4 | 109.5 | 109.3 | 109.4 |

| May 2014 | 109.7 | 109.8 | 109.7 | 109.8 | 109.8 |

| June 2014 | 109.5 | 110.1 | 109.6 | 110.2 | 110.0 |

| July 2014 | 108.6 | 110.4 | 109.2 | 110.4 | 110.0 |

| Aug 2014 | 107.5 | 110.6 | 108.8 | 110.4 | 109.8 |

| Sept 2014 | 107.4 | 110.7 | 108.9 | 110.5 | 109.9 |

| Oct 2014 | 106.4 | 110.7 | 108.1 | 110.5 | 109.6 |

| Nov 2014 | 104.0 | 110.8 | 106.5 | 110.5 | 109.0 |

| Dec 2014 | 101.1 | 111.0 | 104.8 | 110.7 | 108.4 |

| Jan 2015 | 98.2 | 111.4 | 102.8 | 111.1 | 107.9 |

| Feb 2015 | 99.4 | 111.6 | 103.7 | 111.3 | 108.3 |

| Mar 2015 | 101.3 | 111.8 | 105.0 | 111.5 | 109.0 |

| Apr 2015 | 101.6 | 111.9 | 105.1 | 111.8 | 109.2 |

| May 2015 | 103.3 | 112.1 | 106.1 | 112.1 | 109.7 |

| June 2015 | 103.4 | 112.6 | 106.3 | 112.6 | 110.1 |

| July 2015 | 102.7 | 112.9 | 106.0 | 112.8 | 110.1 |

| Aug 2015 | 101.6 | 113.1 | 105.5 | 112.9 | 110.0 |

| Sept 2015 | 100.3 | 113.3 | 104.7 | 113.1 | 109.8 |

| Oct 2015 | 99.9 | 113.4 | 104.4 | 113.2 | 109.8 |

| Nov 2015 | 98.9 | 113.4 | 103.6 | 113.3 | 109.5 |

| Dec 2015 | 97.3 | 113.5 | 102.5 | 113.4 | 109.2 |

| Source: U.S. Bureau of Labor Statistics. | |||||

Note that, although the tradable and goods indexes were higher than the nontradable and services ones for an extended amount of time, it does not mean that they had higher inflation during that period. For instance, rents in New York City may be high, but if they do not change from year to year, then they are not exhibiting inflation; they are simply expensive. To see whether there is inflation, one needs to look at the change in the index value, not the index level. Such inflation can be seen in figure 3, where, apart from the initial spike, services and nontradable goods sustained higher year-over-year price increases.

| Year and month | Tradable | Nontradable | Goods | Services | CPI, all items |

|---|---|---|---|---|---|

| Jan 2011 | 0.026 | 0.013 | 0.022 | 0.013 | 0.016 |

| Feb 2011 | .040 | .015 | .031 | .015 | .021 |

| Mar 2011 | .057 | .016 | .045 | .015 | .027 |

| Apr 2011 | .072 | .017 | .057 | .015 | .032 |

| May 2011 | .083 | .018 | .065 | .016 | .036 |

| June 2011 | .082 | .019 | .065 | .016 | .036 |

| July 2011 | .083 | .019 | .066 | .017 | .036 |

| Aug 2011 | .083 | .021 | .067 | .019 | .038 |

| Sept 2011 | .083 | .023 | .067 | .020 | .039 |

| Oct 2011 | .068 | .023 | .057 | .021 | .035 |

| Nov 2011 | .061 | .024 | .053 | .021 | .034 |

| Dec 2011 | .042 | .025 | .042 | .021 | .030 |

| Jan 2012 | .039 | .025 | .040 | .021 | .029 |

| Feb 2012 | .042 | .023 | .041 | .020 | .029 |

| Mar 2012 | .034 | .023 | .035 | .020 | .027 |

| Apr 2012 | .022 | .023 | .026 | .021 | .023 |

| May 2012 | .004 | .022 | .012 | .020 | .017 |

| June 2012 | .000 | .022 | .009 | .021 | .017 |

| July 2012 | -.006 | .021 | .005 | .019 | .014 |

| Aug 2012 | .007 | .020 | .013 | .019 | .017 |

| Sept 2012 | .018 | .020 | .019 | .019 | .020 |

| Oct 2012 | .022 | .021 | .022 | .020 | .022 |

| Nov 2012 | .007 | .021 | .011 | .021 | .018 |

| Dec 2012 | .006 | .021 | .010 | .021 | .017 |

| Jan 2013 | .001 | .021 | .005 | .022 | .016 |

| Feb 2013 | .011 | .023 | .012 | .024 | .020 |

| Mar 2013 | -.006 | .022 | .000 | .024 | .015 |

| Apr 2013 | -.020 | .022 | -.008 | .023 | .011 |

| May 2013 | -.011 | .023 | -.003 | .025 | .014 |

| June 2013 | .004 | .022 | .008 | .024 | .018 |

| July 2013 | .010 | .023 | .012 | .025 | .020 |

| Aug 2013 | -.005 | .023 | .001 | .024 | .015 |

| Sept 2013 | -.017 | .023 | -.007 | .024 | .012 |

| Oct 2013 | -.023 | .022 | -.011 | .024 | .010 |

| Nov 2013 | -.013 | .022 | -.005 | .024 | .012 |

| Dec 2013 | -.004 | .022 | .002 | .024 | .015 |

| Jan 2014 | -.004 | .023 | .003 | .024 | .016 |

| Feb 2014 | -.021 | .023 | -.008 | .024 | .011 |

| Mar 2014 | -.014 | .026 | -.002 | .027 | .015 |

| Apr 2014 | .003 | .026 | .009 | .027 | .020 |

| May 2014 | .006 | .027 | .011 | .028 | .021 |

| June 2014 | .005 | .027 | .010 | .028 | .021 |

| July 2014 | .001 | .027 | .009 | .028 | .020 |

| Aug 2014 | -.008 | .027 | .004 | .026 | .017 |

| Sept 2014 | -.009 | .027 | .004 | .025 | .017 |

| Oct 2014 | -.011 | .027 | .003 | .026 | .017 |

| Nov 2014 | -.024 | .027 | -.005 | .025 | .013 |

| Dec 2014 | -.047 | .028 | -.020 | .025 | .008 |

| Jan 2015 | -.076 | .026 | -.041 | .025 | -.001 |

| Feb 2015 | -.070 | .025 | -.038 | .024 | .000 |

| Mar 2015 | -.064 | .023 | -.035 | .021 | -.001 |

| Apr 2015 | -.071 | .023 | -.040 | .023 | -.002 |

| May 2015 | -.059 | .021 | -.033 | .021 | .000 |

| June 2015 | -.056 | .022 | -.030 | .022 | .001 |

| July 2015 | -.055 | .022 | -.030 | .022 | .002 |

| Aug 2015 | -.055 | .022 | -.030 | .023 | .002 |

| Sept 2015 | -.066 | .023 | -.038 | .024 | .000 |

| Oct 2015 | -.061 | .024 | -.034 | .024 | .002 |

| Nov 2015 | -.049 | .024 | -.028 | .025 | .005 |

| Dec 2015 | -.038 | .022 | -.021 | .025 | .007 |

| Source: U.S. Bureau of Labor Statistics. | |||||

The similarity, shown in figure 3, between goods and tradable items and between services and nontradable items, is not surprising, because the items that make up each pair overlap substantially: most items the CPI classifies as goods are tradable, and most items the CPI classifies as services are not. Of the 211 CPI items, only 51 do not follow this pairing pattern, and of those 51, about a tenth are items that are unsampled because expenditures on them are low, thus minimizing their impact on indexes. Two-thirds, 33 of the 51, are food items—a matter that is worth further investigation. Goods such as bread, milk, and meat products were labeled nontradable, but that is likely because the United States is a large producer of food for which there is a very large domestic market. Using the level of interstate trade as a proxy for international trade in these goods would likely switch their classification and bring the tradable–nontradable and goods–services indexes even closer together. Another food-related difference from the expected pattern was that the CPI classifies meals away from home as a good while the tradable–nontradable methodology classifies meals away from home as nontradable. This difference was a driving factor in the substantial gap in expenditures in the food and beverages group, in which only 32 percent of expenditures overlapped, the lowest of any category. Obviously, it would be difficult to import or export a meal eaten at a restaurant, so meals consumed away from home are nontradable. It is less obvious, however, why the CPI classifies food away from home as a good. One can understand the argument that it should be categorized as a service: the consumer is paying not only for the food, but for the service of its being prepared and presented. It could be that people pay the margins they do in restaurants for those services, not for the food. In addition, it could be that most restaurant expenses come from nonfood components, such as renting space and paying employees. Furthermore, other inflation item classification systems, such as the European Union’s “Classification of Individual Consumption according to Purpose” (COICOP), categorize meals away from home as a service rather than a good.15 By switching meals away from home to a service, the percentage of overlapping items for food and beverages increases from 45.2 percent to 54.8 percent, while overlapping food and beverage expenditures go from 29.6 percent to 69.9 percent. Given that meals away from home are some of the largest expenditure items in the CPI, switching them to a service greatly increases the total overlap between the tradable and nontradable indexes, on the one hand, and the goods and services indexes, on the other, and brings the overlap between the two systems for all U.S. expenditures from 86.4 percent to 92.3 percent.

This difference in the food and beverage major group is likely the driver in the divergence between the tradable and goods indexes, seen in figure 2. Food and beverage items have exhibited considerable inflation over the period in question. Thus, the goods index, which includes all the food and beverage items, could be pushed higher than the tradable index, which includes just under half the food items. In figure 4, one can see the steady food and beverage inflation over the period.

| Year and month | Index |

|---|---|

| Jan 2010 | 100.0 |

| Feb 2010 | 100.0 |

| Mar 2010 | 100.1 |

| Apr 2010 | 100.1 |

| May 2010 | 100.2 |

| June 2010 | 100.2 |

| July 2010 | 100.1 |

| Aug 2010 | 100.3 |

| Sept 2010 | 100.6 |

| Oct 2010 | 100.8 |

| Nov 2010 | 100.8 |

| Dec 2010 | 100.9 |

| Jan 2011 | 101.8 |

| Feb 2011 | 102.2 |

| Mar 2011 | 102.9 |

| Apr 2011 | 103.2 |

| May 2011 | 103.6 |

| June 2011 | 103.8 |

| July 2011 | 104.2 |

| Aug 2011 | 104.7 |

| Sept 2011 | 105.1 |

| Oct 2011 | 105.3 |

| Nov 2011 | 105.2 |

| Dec 2011 | 105.4 |

| Jan 2012 | 106.1 |

| Feb 2012 | 106.0 |

| Mar 2012 | 106.2 |

| Apr 2012 | 106.3 |

| May 2012 | 106.4 |

| June 2012 | 106.5 |

| July 2012 | 106.5 |

| Aug 2012 | 106.7 |

| Sept 2012 | 106.8 |

| Oct 2012 | 107.1 |

| Nov 2012 | 107.1 |

| Dec 2012 | 107.3 |

| Jan 2013 | 107.7 |

| Feb 2013 | 107.8 |

| Mar 2013 | 107.8 |

| Apr 2013 | 108.0 |

| May 2013 | 107.9 |

| June 2013 | 108.0 |

| July 2013 | 108.1 |

| Aug 2013 | 108.3 |

| Sept 2013 | 108.3 |

| Oct 2013 | 108.5 |

| Nov 2013 | 108.4 |

| Dec 2013 | 108.5 |

| Jan 2014 | 108.9 |

| Feb 2014 | 109.2 |

| Mar 2014 | 109.6 |

| Apr 2014 | 110.0 |

| May 2014 | 110.4 |

| June 2014 | 110.4 |

| July 2014 | 110.7 |

| Aug 2014 | 111.1 |

| Sept 2014 | 111.4 |

| Oct 2014 | 111.7 |

| Nov 2014 | 111.7 |

| Dec 2014 | 112.0 |

| Jan 2015 | 112.3 |

| Feb 2015 | 112.3 |

| Mar 2015 | 112.1 |

| Apr 2015 | 112.1 |

| May 2015 | 112.1 |

| June 2015 | 112.3 |

| July 2015 | 112.5 |

| Aug 2015 | 112.8 |

| Sept 2015 | 113.2 |

| Oct 2015 | 113.4 |

| Nov 2015 | 113.1 |

| Dec 2015 | 112.9 |

| Source: U.S. Bureau of Labor Statistics. | |

In general, there was a lot of similarity between the tradable–nontradable and goods–services classifications. Figures 5 and 6 reveal their similarities. “Apparel” has an exact match between the two classifications, as does “education and communication,” while the rest vary to different degrees. It becomes clear how differently “food and beverages” is classified, because all food and beverage items are considered goods. Comparing figures 5 and 6, one can also see that the major groups with the most items do not necessarily correspond to the ones with the most expenditures. For example, the housing major group does not have the most items, but it has the most expenditures because rent and rental equivalents are the largest consumer expenditures.

| CPI item | Tradable | Nontradable | Goods | Services |

|---|---|---|---|---|

| Apparel | 20 | 0 | 20 | 0 |

| Education and communication | 5 | 11 | 5 | 11 |

| Food and beverages | 29 | 33 | 62 | 0 |

| Housing | 18 | 19 | 22 | 15 |

| Medical care | 3 | 12 | 4 | 11 |

| Goods and services | 3 | 11 | 7 | 7 |

| Recreation | 14 | 12 | 17 | 9 |

| Transportation | 10 | 11 | 7 | 14 |

| Source: U.S. Bureau of Labor Statistics. | ||||

| CPI item | Tradable | Nontradable | Goods | Services |

|---|---|---|---|---|

| Apparel | $177,575,210,065.12 | $0.00 | $177,575,210,065.12 | $0.00 |

| Education and communication | $40,194,879,234.06 | $349,006,157,222.86 | $40,194,879,234.06 | $349,006,157,222.86 |

| Food and beverages | $255,862,140,444.02 | $543,441,001,127.21 | $799,303,141,571.23 | $0.00 |

| Housing | $145,185,616,631.64 | $2,092,530,008,382.57 | $202,572,284,568.55 | $2,035,143,340,445.66 |

| Medical care | $95,146,623,071.01 | $344,876,634,791.20 | $95,308,910,164.17 | $344,714,347,698.04 |

| Goods and services | $50,167,654,800.85 | $119,235,770,431.38 | $84,246,794,155.59 | $85,156,631,076.64 |

| Recreation | $75,689,269,115.68 | $240,466,455,704.11 | $111,178,873,508.61 | $204,976,851,311.18 |

| Transportation | $672,703,130,120.10 | $270,283,333,118.52 | $630,618,039,203.34 | $312,368,424,035.28 |

| Source: U.S. Bureau of Labor Statistics. | ||||

Table 3 presents summary statistics for items that matched the expected pattern and for items that did not. The primacy of services and nontradable items within the CPI market basket can be seen in the breakdown in total expenditures by classification in figure 7: almost two-thirds of total spending is on nontradable items, as well as on those which the CPI classifies as services, while the remaining third is on tradable items, similar to what the CPI classifies as goods. It is worth noting that rent for one’s primary residence and the CPI approximation for a homeowner’s equivalent rent constitute roughly half of the spending on items classified as services and nontradable.

| Good or service | Tradable or nontradable | Number of items | Expenditures (trillions of dollars) | Matched expected pattern? |

|---|---|---|---|---|

| Total | … | 211 | 5.47 | … |

| Good | Tradable | 96 | 1.46 | Yes |

| Service | Nontradable | 61 | 3.26 | Yes |

| Good | Nontradable | 48 | .68 | No |

| Service | Tradable | 6 | .07 | No |

| Source: U.S. Bureau of Labor Statistics. | ||||

| Designation | Thousands of dollars spent |

|---|---|

| Tradable | $1,512,524,523.482 |

| Nontradable | 3,959,839,360.778 |

| Goods | 2,140,998,132.471 |

| Services | 3,331,365,751.790 |

| Source: U.S. Bureau of Labor Statistics. | |

Using the same graph as that in figure 7, figure 8 demonstrates how most of the difference between the tradable–nontradable and goods–services classifications is caused by how the category of food and beverages—especially food away from home—is classified. The figure shows the similarity in the classification of total expenditures that would obtain if the food and beverage items were all classified as tradable to match the CPI designation of all of them as goods.

| Designation | Thousands of dollars spent |

|---|---|

| Tradable | 1,256,662,859.556 |

| Food | 799,303,141.571 |

| Nontradable | 3,416,397,998.873 |

| Goods | 2,140,998,132.471 |

| Services | 3,331,365,751.790 |

| Source: U.S. Bureau of Labor Statistics. | |

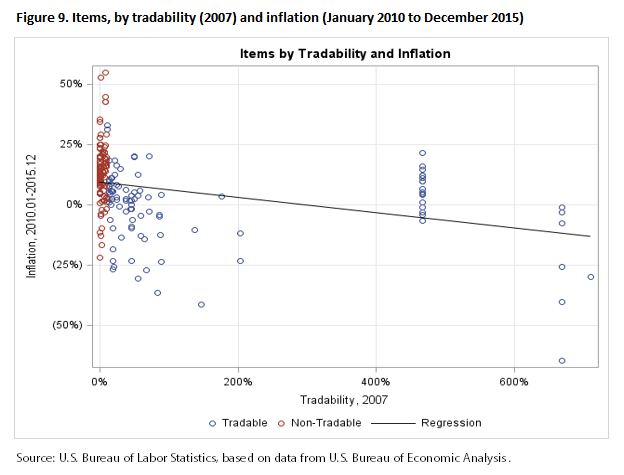

Looking at the time series graphs is one way of analyzing the impact that tradability has on inflation. The hypothesis posed toward the beginning of this article was that the index composed of tradable goods would exhibit lower inflation than the index composed of nontradable goods. One way to evaluate this hypothesis is to plot all the CPI items individually, rather than in aggregate. With the use of the tradability metric discussed earlier, all 211 items were plotted, with their tradability from the 2007 IO tables shown on one axis and their inflation from January 2010 to December 2015, the period in question, shown on the other. Figure 9 presents a scatter plot of the results.

The scatter plot indicates that the hypothesis holds. Most of the items that exhibited deflation are tradable. Because there are fewer tradable items than nontradable items, that the tradable ones are still the majority is notable. Furthermore, most of the items with high inflation are nontradable. The item that had the most deflation, televisions, was one of the most tradable, and the item with the second-most inflation, eggs, was one of the least tradable. The regression line reinforces the hypothesis, showing that an increase in tradability led to a decrease in inflation. The model the regression is based on suggests that tradability alone is not a sufficient determinant of inflation and that, therefore, other factors also influence inflation. Nonetheless, the results say that tradability is a statistically significant factor influencing inflation. In other words, tradability affects inflation, but so do many other factors.

That there are other factors contributing to inflation seems obvious and can help answer why the tradable and goods indexes were so volatile over the period examined. The attractiveness of importing or exporting goods is determined in part by factors such as transportation costs and transaction costs, as mentioned earlier. To find out whether those costs were affecting the inflation of tradable goods, two variables can be used as proxies for them: the price of oil and the strength of the dollar relative to a basket of currencies of U.S. trading partners. If the price of oil increases, the cost of imports will go up because of shipping costs. In turn, either people will continue buying the imports at higher prices, or they will begin buying U.S.-made alternatives. If the dollar weakens, buying imports becomes more expensive because the good is priced in foreign currency and each dollar buys less foreign currency. Thus, if the dollar index falls, the tradable index should increase as goods get more expensive or people switch to domestic alternatives. If the dollar strengthens, the tradable index should fall as foreign goods get relatively cheaper.

The tradable and goods indexes should fluctuate with these other variables. By contrast, the services and nontradable indexes are not influenced by similar outside factors. To investigate the fluctuation, the tradable index was plotted against the dollar index and the price of oil. The relationship among the latter three variables is seen clearly in figure 10.

| Month and year | Tradable index | Dollar index | West Texas Intermediate crude oil, dollars per barrel |

|---|---|---|---|

| Jan 2010 | 100.00 | 100.00 | $78.33 |

| Feb 2010 | 99.74 | 100.87 | $76.39 |

| Mar 2010 | 100.97 | 99.64 | $81.20 |

| Apr 2010 | 101.46 | 98.55 | $84.29 |

| May 2010 | 101.46 | 100.23 | $73.74 |

| Jun 2010 | 100.26 | 100.64 | $75.34 |

| Jul 2010 | 99.83 | 100.18 | $76.32 |

| Aug 2010 | 100.02 | 99.64 | $76.60 |

| Sep 2010 | 100.18 | 98.90 | $75.24 |

| Oct 2010 | 100.87 | 97.12 | $81.89 |

| Nov 2010 | 101.05 | 97.06 | $84.25 |

| Dec 2010 | 101.61 | 97.18 | $89.15 |

| Jan 2011 | 102.60 | 96.07 | $89.17 |

| Feb 2011 | 103.67 | 95.76 | $88.58 |

| Mar 2011 | 106.71 | 95.38 | $102.86 |

| Apr 2011 | 108.71 | 93.90 | $109.53 |

| May 2011 | 109.77 | 93.73 | $100.90 |

| Jun 2011 | 108.41 | 93.78 | $96.26 |

| Jul 2011 | 108.00 | 93.09 | $97.30 |

| Aug 2011 | 108.23 | 94.08 | $86.33 |

| Sep 2011 | 108.34 | 96.82 | $85.52 |

| Oct 2011 | 107.57 | 97.96 | $86.32 |

| Nov 2011 | 107.14 | 98.39 | $97.16 |

| Dec 2011 | 105.80 | 98.96 | $98.56 |

| Jan 2012 | 106.56 | 97.73 | $100.27 |

| Feb 2012 | 107.92 | 95.83 | $102.20 |

| Mar 2012 | 110.31 | 96.17 | $106.16 |

| Apr 2012 | 111.13 | 96.86 | $103.32 |

| May 2012 | 110.23 | 98.70 | $94.66 |

| Jun 2012 | 108.46 | 100.06 | $82.30 |

| Jul 2012 | 107.41 | 99.02 | $87.90 |

| Aug 2012 | 108.94 | 98.49 | $94.13 |

| Sep 2012 | 110.25 | 97.48 | $94.51 |

| Oct 2012 | 109.95 | 96.82 | $89.49 |

| Nov 2012 | 107.86 | 97.02 | $86.53 |

| Dec 2012 | 106.50 | 96.53 | $87.86 |

| Jan 2013 | 106.70 | 95.93 | $94.76 |

| Feb 2013 | 109.09 | 96.34 | $95.31 |

| Mar 2013 | 109.75 | 96.21 | $92.94 |

| Apr 2013 | 109.00 | 95.65 | $92.02 |

| May 2013 | 109.04 | 95.71 | $94.51 |

| Jun 2013 | 108.96 | 97.78 | $95.77 |

| Jul 2013 | 108.48 | 97.78 | $104.67 |

| Aug 2013 | 108.42 | 98.46 | $106.57 |

| Sep 2013 | 108.42 | 98.40 | $106.29 |

| Oct 2013 | 107.51 | 97.60 | $100.54 |

| Nov 2013 | 106.57 | 98.15 | $93.86 |

| Dec 2013 | 106.10 | 98.29 | $97.63 |

| Jan 2014 | 106.31 | 99.05 | $94.62 |

| Feb 2014 | 106.91 | 99.62 | $100.82 |

| Mar 2014 | 108.28 | 99.81 | $100.80 |

| Apr 2014 | 109.32 | 99.39 | $102.07 |

| May 2014 | 109.68 | 98.96 | $102.18 |

| Jun 2014 | 109.47 | 99.00 | $105.79 |

| Jul 2014 | 108.60 | 98.70 | $103.59 |

| Aug 2014 | 107.51 | 99.07 | $96.54 |

| Sep 2014 | 107.42 | 99.73 | $93.21 |

| Oct 2014 | 106.37 | 100.81 | $84.40 |

| Nov 2014 | 104.06 | 102.03 | $75.79 |

| Dec 2014 | 101.24 | 105.11 | $59.29 |

| Jan 2015 | 98.44 | 105.97 | $47.22 |

| Feb 2015 | 99.56 | 106.88 | $50.58 |

| Mar 2015 | 101.46 | 107.95 | $47.82 |

| Apr 2015 | 101.76 | 106.70 | $54.45 |

| May 2015 | 103.40 | 106.80 | $59.27 |

| Jun 2015 | 103.48 | 107.85 | $59.82 |

| Jul 2015 | 102.80 | 109.39 | $50.90 |

| Aug 2015 | 101.76 | 112.93 | $42.87 |

| Sep 2015 | 100.51 | 114.65 | $45.48 |

| Oct 2015 | 100.10 | 113.30 | $46.22 |

| Nov 2015 | 99.08 | 113.82 | $42.44 |

| Dec 2015 | 97.53 | 115.77 | $37.19 |

| Source: U.S. Bureau of Labor Statistics. | |||

To further test the results suggested by the graph in figure 10, a regression model looked at the impact of the dollar index and the price of oil on the tradable index. Both static levels of the price index, the dollar index, and the price of oil, along with the percent change of each of these factors from month to month, were examined. R-squared was equal to 0.635 in the static model, implying that the model was adequate. In the percent-change model, R-squared was equal to 0.988, implying that the model was robust. In both models, the price of oil was a statistically significant predictor of the level of tradability, at a 5-percent significance level. This finding should be taken with a grain of salt, however, as the CPI item “gasoline” is one of the larger components of the tradable index. In the static model, the dollar index was significant at the 10-percent significance level; it was significant at the 5-percent level in the percent-change model.16 These results suggest that tradable items’ inflation is determined not simply by the cost of goods abroad, but also by the transportation and transaction costs associated with importing and exporting those items.

The initial results presented in this article look promising: some of the findings corroborate what is set forth in the literature and suggest that further research into U.S. tradable and nontradable inflation might be valuable. A number of issues could be addressed.

One key area to investigate is the cause of the volatility in the tradable index. A number of factors could lead to the law of one price not working as well in practice as it does in theory. Finding variables to account for those factors and how they affect tradable inflation would be valuable. This research could involve finding a way to take free-trade agreements or tariffs into account. In this regard, there is existing research into how open countries are to trade and how their degree of openness relates to inflation rates, and valuable insights may be gained about factors that contribute to inflation.

Future research should look into further testing of the tradability threshold. The analysis conducted here examined plausible thresholds based on the literature, but an expanded range could be contemplated. The size of the U.S. economy suggests that whole percentage points for output may be too large; looking at half- or quarter-percent intervals for other thresholds could yield a more precise level.

Building on the analysis of thresholds, one could investigate the correlation between thresholds and inflation. In other words, one could look at the inflation among goods and services that were classified as tradable along a spectrum of thresholds. Using 10-percent, 15-percent, and 20-percent thresholds and comparing, say, the inflation of goods classified as tradable or not, one might see lower inflation for goods classified at the 20-percent level than at the 15-percent, 10-percent, or 5-percent level. This finding would be due to the stricter limit on classification, requiring higher volumes of trade for a good or service to be labeled tradable.

As mentioned earlier, an important area for research is an interstate trade quantification methodology. Interstate trade in the United States is similar to that in many international markets. Thus, goods that travel between states should be included in any analysis of those markets. One study points out that many U.S. states are the size of entire countries around the world in terms of both their economy and their population.17 Also, the United States has the world’s largest economy and is the fourth-largest country by area.18 Therefore, it is fair to consider goods traded between U.S. states as analogous to goods traded internationally. With a large proportion of U.S. consumption made up of domestically produced goods, many of which are shipped entirely within the confines of the nation, such a methodology could have a considerable impact on the results.

Another important consideration would be to conduct research over a longer timeframe. The research presented here examined only a 6-year period; the longer the period, the clearer the important patterns that appear may be.

Additional research opportunities arise in investigating the relationship between the tradable and nontradable indexes compared with the goods and services indexes. As discussed, there was substantial overlap between these categories, so they may serve as effective proxies for each other, thereby negating the need to establish new indexes. It is worth investigating further to see if the pattern holds over a longer period and, if it does, with what level of robustness. As was shown, simply by aligning the food and beverage items, the two classification systems become quite similar.

Yet another approach would be to look into a few specific items to see how trade affected their inflation. To do so, one might look at total global trade for each of those items. For example, apparel has the highest tradability and also the greatest deflation. Is this confluence merely fortuitous, or has it occurred because apparel has become highly traded worldwide? Incorporating the tradable–nontradable and goods–services pattern, one could examine global price differences in services compared with global price differences in goods. For example, one could look at the prices for shirts and mechanics’ services in Vietnam compared with the prices for those same items in the United States to see if any arbitrage could take place and, if so, whether it would be more apparent in goods or in services. Some research has been conducted that looks into a country’s openness to trade and inflation,19 and there may be opportunities to tie that research to what is proposed here.

| CPI item code | Item | Good or service | Tradable or nontradable | Tradability index (percent) |

|---|---|---|---|---|

| AA01 | Men's suits, sport coats, and outerwear | Good | Tradable | 466.01 |

| AA02 | Men's furnishings | Good | Tradable | 466.01 |

| AA03 | Men's shirts and sweaters | Good | Tradable | 466.01 |

| AA04 | Men's pants and shorts | Good | Tradable | 466.01 |

| AA09 | Unsampled men's apparel | Good | Tradable | 466.01 |

| AB01 | Boys' apparel | Good | Tradable | 466.01 |

| AB09 | Unsampled boy's apparel | Good | Tradable | 466.01 |

| AC01 | Women's outerwear | Good | Tradable | 466.01 |

| AC02 | Women's dresses | Good | Tradable | 466.01 |

| AC03 | Women's suits and separates | Good | Tradable | 466.01 |

| AC04 | Women's underwear, nightwear, sportswear, and accessories | Good | Tradable | 466.01 |

| AC09 | Unsampled women's apparel | Good | Tradable | 466.01 |

| AD01 | Girls' apparel | Good | Tradable | 466.01 |

| AD09 | Unsampled girls' apparel | Good | Tradable | 466.01 |

| AE01 | Men's footwear | Good | Tradable | 466.01 |

| AE02 | Boys' and girls' footwear | Good | Tradable | 466.01 |

| AE03 | Women's footwear | Good | Tradable | 466.01 |

| AF01 | Infants' and toddlers' apparel | Good | Tradable | 466.01 |

| AG01 | Watches | Good | Tradable | 70.39 |

| AG02 | Jewelry | Good | Tradable | 176.54 |

| EA01 | Educational books and supplies | Good | Tradable | 11.55 |

| EA09 | Unsampled educational books and supplies | Good | Tradable | 11.55 |

| EB01 | College tuition and fees | Service | Nontradable | 0.67 |

| EB02 | Elementary and high school tuition and fees | Service | Nontradable | .00 |

| EB03 | Childcare and nursery school | Service | Nontradable | .00 |

| EB04 | Technical and business school tuition and fees | Service | Nontradable | .67 |

| EB09 | Unsampled tuition, other school fees, and childcare | Service | Nontradable | 1.36 |

| EC01 | Postage | Service | Nontradable | .61 |

| EC02 | Delivery services | Service | Nontradable | .61 |

| ED03 | Cellular telephone services | Service | Nontradable | .21 |

| ED04 | Landline telephone services | Service | Nontradable | 1.79 |

| EE01 | Personal computers and peripheral equipment | Good | Tradable | 146.38 |

| EE02 | Computer software and accessories | Good | Tradable | 20.76 |

| EE03 | Computer information processing services | Service | Nontradable | 2.39 |

| EE04 | Other information processing equipment | Good | Tradable | 83.55 |

| EE09 | Unsampled information and information processing | Service | Nontradable | 2.98 |

| FA01 | Flour and prepared flour mixes | Good | Nontradable | 10.19 |

| FA02 | Breakfast cereal | Good | Nontradable | 8.95 |

| FA03 | Rice, pasta, cornmeal | Good | Tradable | 13.11 |

| FB01 | Bread | Good | Nontradable | 5.21 |

| FB02 | Fresh biscuits, rolls, muffins | Good | Nontradable | 5.21 |

| FB03 | Cakes, cupcakes, and cookies | Good | Nontradable | 4.48 |

| FB04 | Other bakery products | Good | Nontradable | 5.21 |

| FC01 | Uncooked ground beef | Good | Nontradable | 7.94 |

| FC02 | Uncooked beef roasts | Good | Nontradable | 7.94 |

| FC03 | Uncooked beef steaks | Good | Nontradable | 7.94 |

| FC04 | Uncooked other beef and veal | Good | Nontradable | 7.94 |

| FD01 | Bacon, breakfast sausage, and related products | Good | Nontradable | 7.94 |

| FD02 | Ham | Good | Nontradable | 7.94 |

| FD03 | Pork chops | Good | Nontradable | 7.94 |

| FD04 | Other pork, including roasts and picnics | Good | Nontradable | 7.94 |

| FE01 | Other meats | Good | Nontradable | 7.94 |

| FF01 | Chicken | Good | Nontradable | 6.68 |

| FF02 | Other poultry, Including turkey | Good | Nontradable | 6.68 |

| FG01 | Fresh fish and seafood | Good | Tradable | 21.05 |

| FG02 | Processed fish and seafood | Good | Tradable | 21.05 |

| FH01 | Eggs | Good | Nontradable | 1.16 |

| FJ01 | Milk | Good | Nontradable | 1.07 |

| FJ02 | Cheese and related products | Good | Nontradable | 4.24 |

| FJ03 | Ice cream and related products | Good | Nontradable | 1.17 |

| FJ04 | Other dairy and related products | Good | Tradable | 13.15 |

| FK01 | Apples | Good | Tradable | 50.30 |

| FK02 | Bananas | Good | Tradable | 50.30 |

| FK03 | Citrus fruits | Good | Tradable | 50.30 |

| FK04 | Other fresh fruits | Good | Tradable | 37.50 |

| FL01 | Potatoes | Good | Tradable | 24.60 |

| FL02 | Lettuce | Good | Tradable | 24.60 |

| FL03 | Tomatoes | Good | Tradable | 24.60 |

| FL04 | Other fresh vegetables | Good | Tradable | 24.60 |

| FM01 | Canned fruits and vegetables | Good | Tradable | 14.73 |

| FM02 | Frozen fruits and vegetables | Good | Nontradable | 9.56 |

| FM03 | Other processed fruits and vegetables, including dried | Good | Tradable | 26.60 |

| FN01 | Carbonated drinks | Good | Nontradable | 5.14 |

| FN02 | Frozen noncarbonated juices and drinks | Good | Tradable | 13.15 |

| FN03 | Nonfrozen noncarbonated juices and drinks | Good | Tradable | 13.15 |

| FP01 | Coffee | Good | Tradable | 13.15 |

| FP02 | Other beverage materials, including tea | Good | Nontradable | 6.37 |

| FR01 | Sugar and artificial sweeteners | Good | Tradable | 16.80 |

| FR02 | Candy and chewing gum | Good | Tradable | 16.80 |

| FR03 | Other sweets | Good | Tradable | 16.80 |

| FS01 | Butter and margarine | Good | Nontradable | 1.07 |

| FS02 | Salad dressing | Good | Tradable | 13.15 |

| FS03 | Other fats and oils including, peanut butter | Good | Nontradable | 2.84 |

| FT01 | Soups | Good | Tradable | 13.15 |

| FT02 | Frozen and freeze-dried prepared foods | Good | Nontradable | 9.56 |

| FT03 | Snacks | Good | Nontradable | 10.05 |

| FT04 | Spices, seasonings, condiments, sauces | Good | Tradable | 13.15 |

| FT05 | Baby food | Good | Tradable | 13.15 |

| FT06 | Other miscellaneous foods | Good | Tradable | 13.15 |

| FV01 | Full-service meals and snacks | Good | Nontradable | .39 |

| FV02 | Limited-service meals and snacks | Good | Nontradable | .32 |

| FV03 | Food at employee sites and schools | Good | Nontradable | .34 |

| FV04 | Food from vending machines and mobile vendors | Good | Nontradable | .34 |

| FV05 | Other food away from home | Good | Nontradable | .34 |

| FW01 | Beer, ale, and other malt beverages at home | Good | Tradable | 15.92 |

| FW02 | Distilled spirits at home | Good | Tradable | 42.57 |

| FW03 | Wine at home | Good | Tradable | 44.76 |

| FX01 | Alcoholic beverages away from home | Good | Nontradable | 29.93 |

| GA01 | Cigarettes | Good | Nontradable | 4.04 |

| GA02 | Tobacco products other than cigarettes | Good | Nontradable | 4.04 |

| GA09 | Unsampled tobacco and smoking products | Good | Nontradable | 4.04 |

| GB01 | Hair, dental, shaving, and miscellaneous personal care products | Good | Tradable | 45.84 |

| GB02 | Cosmetics, perfume, bath, nail preparations and implements | Good | Tradable | 45.84 |

| GB09 | Unsampled personal care products | Good | Nontradable | .00 |

| GC01 | Haircuts and other personal care services | Service | Nontradable | .00 |

| GD01 | Legal services | Service | Nontradable | 3.42 |

| GD02 | Funeral expenses | Service | Nontradable | .00 |

| GD03 | Laundry and drycleaning services | Service | Nontradable | .00 |

| GD04 | Apparel services other than laundry and drycleaning | Service | Nontradable | .00 |

| GD05 | Financial services | Service | Nontradable | 4.18 |

| GD09 | Unsampled items | Service | Nontradable | .00 |

| GE01 | Miscellaneous personal goods | Good | Tradable | 45.84 |

| HA01 | Rent of primary residence | Service | Nontradable | .00 |

| HB01 | Housing at school, excluding board | Service | Nontradable | .00 |

| HB02 | Other lodging away from home, including hotels and motels | Service | Nontradable | .00 |

| HC01 | Owner's equivalent rent of primary residence | Service | Nontradable | .00 |

| HC09 | Unsampled owner's equivalent rent of secondary residence | Service | Nontradable | .00 |

| HD01 | Tenants' and household insurance | Service | Nontradable | 9.09 |

| HE01 | Fuel oil | Good | Tradable | 18.46 |

| HE02 | Other household fuels | Good | Tradable | 18.46 |

| HF01 | Electricity | Service | Nontradable | 1.01 |

| HF02 | Utility (piped) gas service | Service | Nontradable | .35 |

| HG01 | Water and sewerage maintenance | Service | Nontradable | .51 |

| HG02 | Garbage and trash collection | Service | Nontradable | .15 |

| HH01 | Floor coverings | Good | Tradable | 15.46 |

| HH02 | Window coverings | Good | Tradable | 203.09 |

| HH03 | Other linens | Good | Tradable | 203.09 |

| HJ01 | Bedroom furniture | Good | Tradable | 86.20 |

| HJ02 | Living room, kitchen, and dining room furniture | Good | Tradable | 47.77 |

| HJ03 | Other furniture | Good | Tradable | 87.12 |

| HJ09 | Unsampled furniture | Good | Tradable | 86.36 |

| HK01 | Major appliances | Good | Tradable | 64.09 |

| HK02 | Other appliances | Good | Tradable | 137.24 |

| HK09 | Unsampled appliances | Good | Tradable | 30.52 |

| HL01 | Clocks, lamps, and decorative items | Good | Tradable | 55.43 |

| HL02 | Indoor plants and flowers | Good | Nontradable | 10.81 |

| HL03 | Dishes and flatware | Good | Tradable | 88.85 |

| HL04 | Nonelectric cookware and tableware | Good | Tradable | 45.84 |

| HM01 | Tools, hardware, and supplies | Good | Tradable | 37.20 |

| HM02 | Outdoor equipment and supplies | Good | Nontradable | 1.43 |

| HM09 | Unsampled tools, hardware, outdoor equipment, and supplies | Good | Tradable | 37.20 |

| HN01 | Household cleaning products | Good | Nontradable | 9.72 |

| HN02 | Household paper products | Good | Nontradable | 4.73 |

| HN03 | Miscellaneous household products | Good | Tradable | 45.84 |

| HP01 | Domestic services | Service | Nontradable | .00 |

| HP02 | Gardening and lawn care services | Service | Nontradable | .00 |

| HP03 | Moving, storage, freight expense | Service | Nontradable | 4.85 |

| HP04 | Repair of household items | Service | Nontradable | 7.26 |

| HP09 | Unsampled household operations | Service | Nontradable | .00 |

| MC01 | Physicians' services | Service | Nontradable | .02 |

| MC02 | Dental services | Service | Nontradable | .00 |

| MC03 | Eyeglasses and eye care | Service | Nontradable | .00 |

| MC04 | Services by other medical professionals | Service | Nontradable | .00 |

| MD01 | Hospital services | Service | Nontradable | .28 |

| MD02 | Nursing homes and adult day services | Service | Nontradable | .00 |

| MD03 | Care of invalids and elderly at home | Service | Nontradable | .00 |

| ME01 | Commercial health insurance | Service | Nontradable | 9.09 |

| ME02 | Blue Cross/Blue Shield | Service | Nontradable | 9.09 |

| ME03 | Health maintenance organizations | Service | Nontradable | 9.09 |

| ME04 | Medicare and other health insurance | Service | Nontradable | 9.09 |

| MF01 | Prescription drugs | Good | Tradable | 71.47 |

| MF02 | Nonprescription drugs | Good | Tradable | 71.47 |

| MG01 | Medical equipment and supplies | Good | Tradable | 28.95 |

| MG09 | Unsampled rent or repair of medical equipment | Good | Nontradable | 2.98 |

| RA01 | Televisions | Good | Tradable | 668.59 |

| RA02 | Cable and satellite television and radio service | Service | Nontradable | .01 |

| RA03 | Other video equipment | Good | Tradable | 668.59 |

| RA04 | Video cassettes, discs, and other media including rental | Service | Tradable | 668.59 |

| RA05 | Audio equipment | Good | Tradable | 668.59 |

| RA06 | Audio discs, tapes, and other media | Good | Tradable | 668.59 |

| RA09 | Unsampled video and audio | Good | Tradable | 668.59 |

| RB01 | Pets and pet products | Good | Nontradable | 6.76 |

| RB02 | Pet services, including veterinary | Service | Nontradable | .00 |

| RC01 | Sports vehicles, including bicycles | Good | Tradable | 89.08 |

| RC02 | Sports equipment | Good | Tradable | 59.88 |

| RC09 | Unsampled sporting goods | Good | Tradable | 59.88 |

| RD01 | Photographic equipment and supplies | Good | Tradable | 66.81 |

| RD02 | Photographers and film processing | Service | Nontradable | .33 |

| RD09 | Unsampled photography | Service | Nontradable | 2.98 |

| RE01 | Toys | Good | Tradable | 709.81 |

| RE02 | Sewing machines, fabric, and supplies | Good | Tradable | 38.33 |

| RE03 | Music instruments and accessories | Good | Tradable | 45.84 |

| RE09 | Unsampled recreation commodities | Good | Tradable | 45.84 |

| RF01 | Club dues and fees for participant sports and group exercise | Service | Nontradable | .00 |

| RF02 | Admissions | Service | Nontradable | .47 |

| RF03 | Fees for lessons or instructions | Service | Nontradable | .00 |

| RF09 | Unsampled recreation services | Service | Nontradable | .00 |

| RG01 | Newspapers and magazines | Good | Nontradable | 7.31 |

| RG02 | Recreational books | Good | Nontradable | 7.43 |

| RG09 | Unsampled recreational reading materials | Good | Nontradable | 7.43 |

| TA01 | New vehicles | Good | Tradable | 57.70 |

| TA02 | Used cars and trucks | Good | Tradable | 18.09 |

| TA03 | Leased cars and trucks | Service | Nontradable | 1.38 |

| TA04 | Car and truck rental | Service | Nontradable | 1.38 |

| TA09 | Unsampled new and used motor vehicles | Good | Tradable | 49.30 |

| TB01 | Gasoline (all types) | Good | Tradable | 18.46 |

| TB02 | Other motor fuels | Good | Tradable | 18.46 |

| TC01 | Tires | Good | Tradable | 55.54 |

| TC02 | Vehicle accessories other than tires | Good | Tradable | 55.54 |

| TD01 | Motor vehicle body work | Service | Nontradable | .02 |

| TD02 | Motor vehicle maintenance and servicing | Service | Nontradable | .02 |

| TD03 | Motor vehicle repair | Service | Nontradable | .02 |

| TD09 | Unsampled service policy | Service | Nontradable | .00 |

| TE01 | Motor vehicle insurance | Service | Nontradable | 9.09 |

| TF01 | State and local registration and license | Service | Nontradable | .00 |

| TF03 | Parking and other fees | Service | Nontradable | .00 |

| TF09 | Unsampled motor vehicle fees | Service | Tradable | 17.51 |

| TG01 | Airline fare | Service | Tradable | 18.35 |

| TG02 | Other intercity transportation | Service | Nontradable | 6.99 |

| TG03 | Intracity transportation | Service | Nontradable | 6.99 |

| TG09 | Unsampled public transportation | Service | Tradable | 17.51 |

Noah N. Johnson, "Tradable and nontradable inflation indexes: replicating New Zealand’s tradable indexes with BLS CPI data," Monthly Labor Review, U.S. Bureau of Labor Statistics, May 2017, https://doi.org/10.21916/mlr.2017.14

1 Roy J. Ruffin, “David Ricardo’s discovery of comparative advantage,” History of Political Economy, Winter 2002, pp. 727–748, https://doi.org/10.1215/00182702-34-4-727.

2 “Trade: merchandise exports (current US$), 1962–2015” The World Bank, 2016, http://data.worldbank.org/topic/trade.

3 Hugh Dixon, Daniel Griffiths, and Lance Lawson, “Exploring tradable and non-tradable inflation in consumer prices,” paper presented at the annual meeting of the New Zealand Association of Economists, June 30–July 2, 2004.

4 Ibid.

5 Morris Goldstein, Mohsin S. Kahn, and Lawrence H. Officer, “Prices of tradable and nontradable goods in the demand for total imports,” The Review of Economics and Statistics, May 1980, pp. 190–199, https://doi.org/10.2307/1924744.

6 Jaqueline Dwyer, “The tradeable non-tradeable dichotomy: a practical approach,” Australian Economic Papers, December 1992, pp. 443–459, https://doi.org/10.1111/j.1467-8454.1992.tb00721.x.

7 Genevieve Knight and Leanne Johnson, “Tradables: developing output and price measures for Australia’s tradable and non-tradable sectors,” Working Paper 97/1 (Australian Bureau of Statistics, December 1997), http://www.abs.gov.au/websitedbs/D3110122.NSF/6ead87599a9a3b0bca256eaf00836eb9/7d0bf6c0811507fbca25656f0005ce10/$FILE/97-1.pdf.

8 According to Statistics New Zealand’s analysis of Knight and Johnson’s work, “the optimal threshold is given by the value that results in the smallest number of industries changing classification as [they] move away from a given threshold.” The agency’s analysts focused on a specific timeframe and graphed different thresholds to compare their stability. To do so, they charted a variety of thresholds and their respective stabilities. Stability was measured by how many industries would change classifications because of a 1-percent increase or decrease in the threshold. They determined that 15 percent was the most stable threshold, as a 1-percent increase or decrease resulted in a change of only one industry in each direction. A total of two industries changing was the most stable threshold of those tested, namely, each percentage point from 1 to 60. For more details, see Dixon, Griffiths, and Lawson, “Exploring tradable and nontradable inflation.”

9 In fact, many states need to compete internationally with the close-by countries of Canada and Mexico, with whom the United States has a free-trade agreement.

10 In this article, total final use is used for the CPI item “used cars” because there is no total commodity output value for its corresponding IO industry, “used and secondhand goods.”

11 Dixon, Griffiths, and Lawson, “Exploring tradable and nontradable inflation.”

12 It is worth noting that, by setting, say, a 50-percent threshold, one might achieve more stability. The reason is that, because that percentage is such a high bar to meet, few would even be able to come close. However, a 50-percent threshold is unrealistic and would not accurately reflect goods being tradable or not. That is why, for example, New Zealand tested thresholds between 10 percent and 20 percent and the United States thresholds between 1 percent and 15 percent. The issue goes back to the discussion of balancing stability with flexibility: on the one hand, a 50-percent threshold would likely be very stable but would be neither flexible nor indicative of tradability; on the other hand, a 15-percent threshold is less stable but, at least in New Zealand’s case, offers the best approximation of a tradability threshold. Furthermore, it allows industries the opportunity to change categories if there are shifts in the economy or in specific industries.