An official website of the United States government

United States Department of Labor

United States Department of Labor

An official website of the United States government

United States Department of Labor

United States Department of Labor

The .gov means it's official.

Federal government websites often end in .gov or .mil. Before sharing sensitive information,

make sure you're on a federal government site.

The site is secure.

The

https:// ensures that you are connecting to the official website and that any

information you provide is encrypted and transmitted securely.

Capital stock measures the volume or quantity of a business’s assets, such as equipment, structures, land, and research and development.

Capital services measures the flow of productive benefits from these assets.

Capital input used in productivity measures is a measure of capital services, not stock.

Example: a construction company buys a crane today, and uses the crane to build apartments for many years.

Capital input is not measured by the initial purchase of the crane, but by the services, such as lifting and moving materials, that it provides to the construction company each year thereafter.

The flow of capital services from a building, machinery or a research idea changes over time, usually becoming less productive as it erodes, deteriorates, or becomes obsolete or incompatible with other equipment.

Businesses invest in units of new capital of many different types, such as hammers, trucks, computers, and buildings.

Agencies in the Department of Commerce collect information from U.S. businesses on capital exenditures (investments) on new and used structures and equipment each year, which is used to measure the capital stock. These investment data must be divided by producer price indexes to account for price changes.

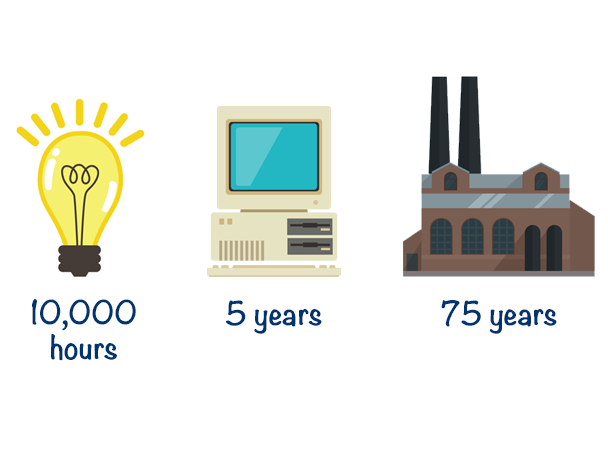

Each type of capital has its own expected life—how long it can be used in production before it is completely deteriorated or obsolete.

Each type of capital also reaches the end of that expected life (through deteriorating or becoming obsolete at its own rate).

A light bulb, for example, doesn’t deteriorate at all, giving the same light hour after hour, until it suddenly stops completely (on average 10,000 hours after first use).

By comparison, a laptop begins to deteriorate shortly after purchase, especially the battery. By the second year, the battery may need replacing. Additionally, new software will be incompatible with the laptop, making it obsolete.

Note that deterioration is not the same thing as depreciation. Deterioration is a loss of productive capacity, while depreciation is a loss of market value.

The stock of usable, or productive, capital changes over time as new investments are made and old investments deteriorate. The current year's productive capital stock is equal to last year's stock, less the deterioration of that stock, plus new investment. Note that last year’s stock includes the remaining productive stock from all previous years’ investments.

These different capital assets are combined into a single index of capital for each industry or sector.

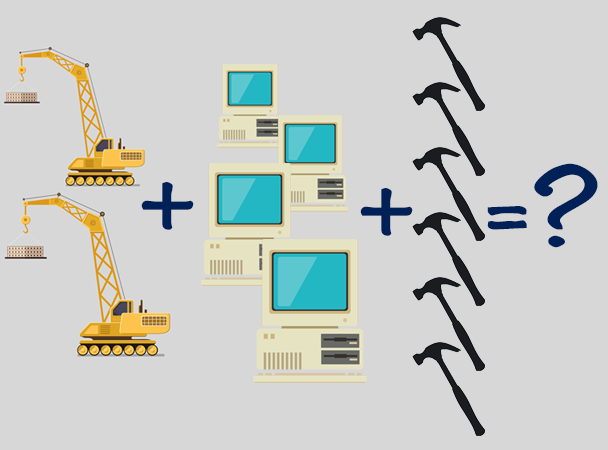

How do we combine, for example, the productive capacity from 2 cranes, 4 computers and 6 hammers?

The productive capital stocks of each asset are combined to form a single index, with greater weight given to those that are expected to yield larger service flows. Typically assets that would be costly to rent for a period are those that yield larger service flows.

For example, although there are more hammers than cranes in the example above, cranes would have a high rental price because they have high productive capacity—a single crane contributes far more to the construction of an office building than a single hammer, or even all ten hammers. So the two cranes would have greater weight in the total index of capital than the hammers.

Because businesses usually own, rather than rent, their assets, rental prices must be estimated. This requires some assumptions about productive capacity, rates of deterioration, obsolescence, and failure, based on historical data.

Productivity 101

Productivity 101