An official website of the United States government

United States Department of Labor

United States Department of Labor

An official website of the United States government

United States Department of Labor

United States Department of Labor

The .gov means it's official.

Federal government websites often end in .gov or .mil. Before sharing sensitive information,

make sure you're on a federal government site.

The site is secure.

The

https:// ensures that you are connecting to the official website and that any

information you provide is encrypted and transmitted securely.

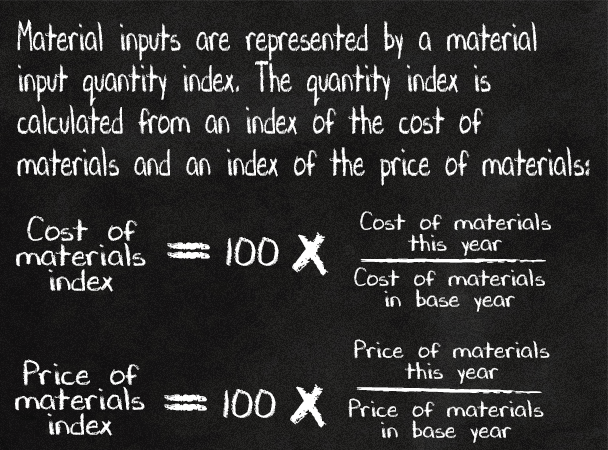

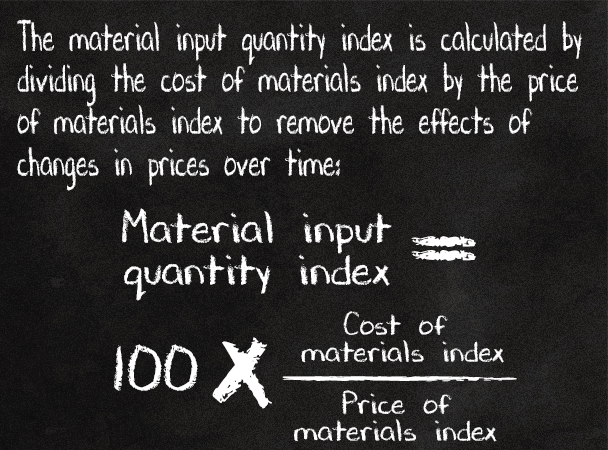

Material inputs are goods that are used to produce other goods and services. They include both raw materials and manufactured products.

Examples:

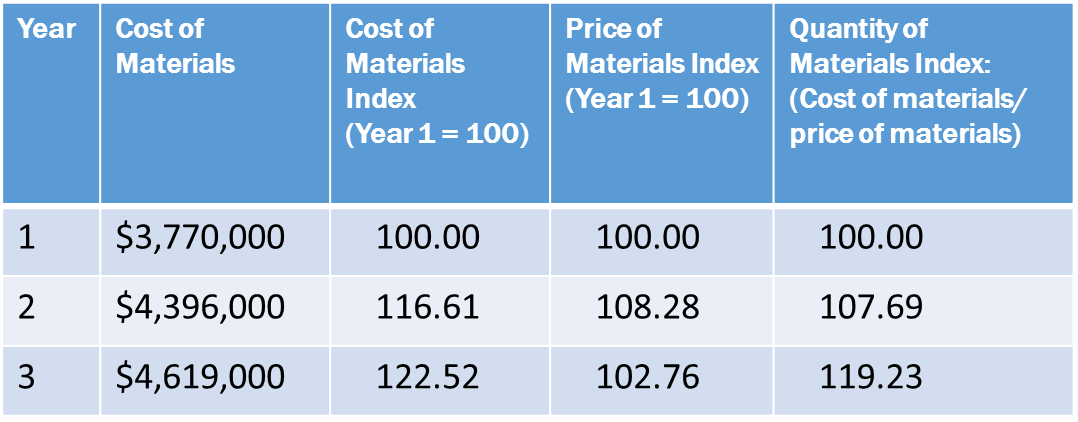

Example: An apparel manufacturer spends $3,770,000 on fabric one year, $4,396,000 the following year, and $4,619,000 the third year. The price of fabric rises 8.28 percent in the second year and then falls in the third year to a level that is 2.76 percent above its base year (year 1) level.

The following table shows the cost of materials and the cost, price, and quantity of materials indexes for the apparel manufacturer:

Data on the cost of materials used in production come from agencies in the Department of Commerce, which collect information from U.S. businesses on how much they spend on material inputs in each year.

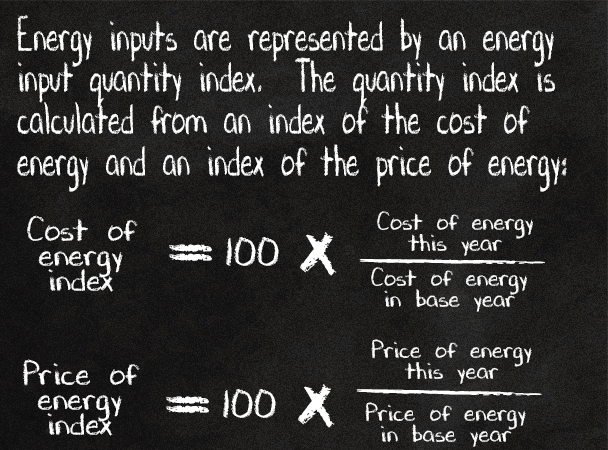

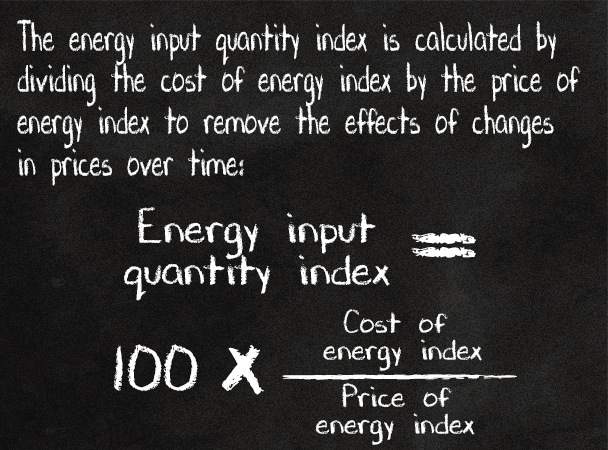

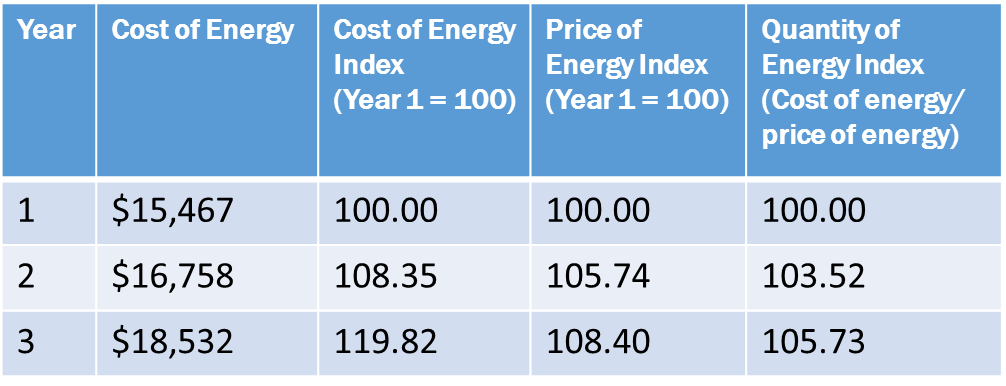

Energy inputs are the fuels and electricity used to produce goods and services.

Example: A hair salon uses electricity to power all its equipment. The salon’s electricity costs are $15,467 in one year, $16,758 the following year, and $18,532 the third year. The price of electricity rises by 5.74 percent in the second year and rises again in the third year to a level that is 8.40 percent above its base year level.

The following table shows the cost of energy and the cost, price, and quantity of energy indexes for the salon.

Data on the cost of energy used come from agencies in the Department of Commerce, which collect information from U.S. businesses on how much they spend on energy inputs in each year.

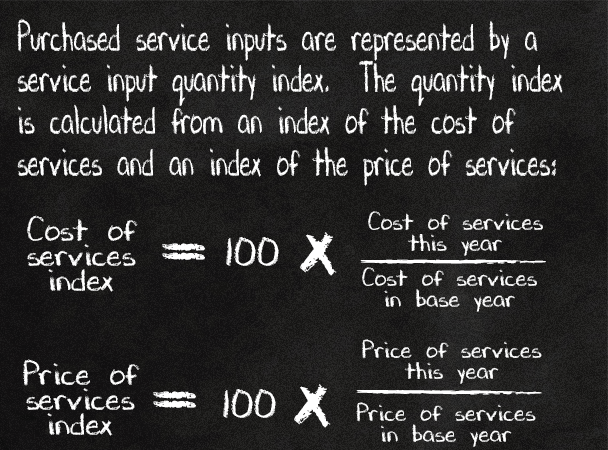

Purchased services inputs are services that a business pays other businesses to perform. These services are used to produce goods and services or to run the business.

Examples:

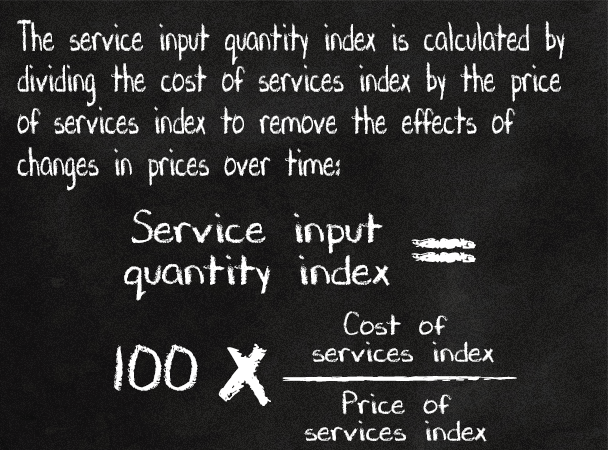

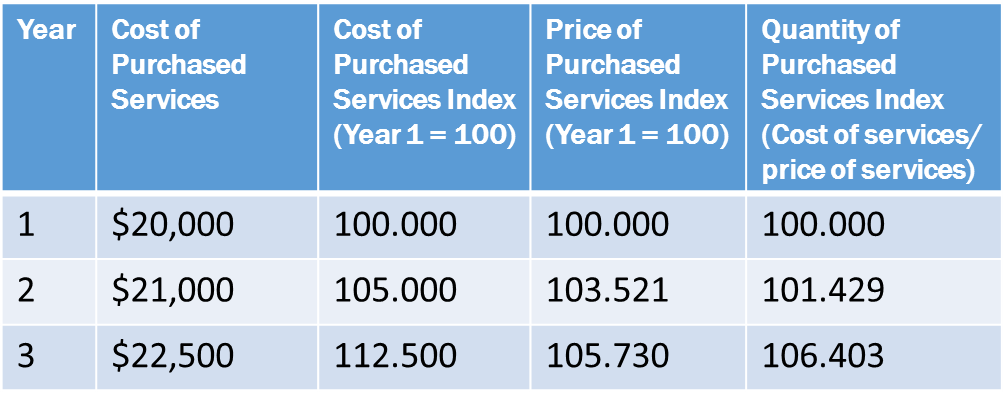

Example: A furniture manufacturing company has a contract with an accounting firm that provides payroll services. The furniture company pays the accounting firm $20,000 in one year, $21,000 the following year, and $22,500 the third year. The price of accounting services rises by 3.521 percent in the second year and rises again in the third year to a level that is 5.730 percent above its base year level.

The following table shows the cost of purchased services and the cost, price, and quantity of purchased services indexes for the furniture company:

Data on the cost of purchased services used come from agencies in the Department of Commerce, which periodically collect information from U.S. businesses on how much they spend on purchased service inputs.

Productivity 101

Productivity 101