An official website of the United States government

United States Department of Labor

United States Department of Labor

Using data from the Consumer Expenditure Interview Survey, this article examines travel expenditures—both in general and for specific expense categories—on domestic and international trips for the 2005–2013 period. It describes patterns of spending, along with trip characteristics (e.g., destination and length of stay), against the backdrop of the recent recession and subsequent recovery. Consistent with previous research, the analysis finds that the business cycle has an effect on travel patterns, but that this effect is more pronounced for international than for domestic trips.

The 2007–2009 recession affected domestic and international travel in similar ways, despite the higher costs of international travel.1 For each type of travel, the number of trips decreased during the recession and has remained below its 2007 level thereafter; however, spending per trip has increased. At the same time, for those who did travel internationally, neither the recession nor the recovery had a notable effect on trends in the choice of destination. For example, trips to Mexico and Canada generally declined from 2005 to 2013, despite both countries’ geographical proximity to the United States, and trips to Asia generally increased over the same period.

These findings are based on data from the quarterly Interview Survey, a component of the Consumer Expenditure Survey (CE). The survey asks participants detailed questions about travel that occurred in the last 3 months, capturing data on destination, length of stay, whether the travel included a package deal, and other information.2

This article compares patterns of spending—both in general and for specific items—on domestic and international trips for survey participants who were interviewed from 2005 to 2013.3 It examines levels of expenditures as well as expenditure shares (that is, the percent allocation among types of expenditures in the travel budget). It also includes analysis of trip characteristics, such as length of stay and, as noted, countries or areas visited for international trips. (See appendix A for details on trips data and appendix B for a list of travel expenditures collected.)

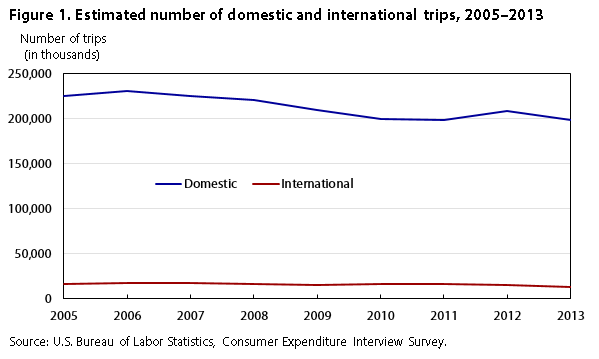

The smallest number of trips, either domestic (10,040) or international (691), was reported in 2013. (See table 1.) The largest number of trips of either type was reported in 2005 (14,269 domestic and 1,081 international). As shown in figure 1, when weighted to reflect the number of trips taken in the United States as a whole, the estimated number of trips ranges from almost 198 million (2011) to almost 230 million (2006) for domestic travel and from 14.9 million (2009) to 17.2 million (2007) for international travel.4

| Year | Domestic | International | ||

|---|---|---|---|---|

| Trips reported (actual) | Trips represented (estimated, in thousands) | Trips reported (actual) | Trips represented (estimated, in thousands) | |

| 2005 | 14,269 | 224,646 | 1,081 | 16,522 |

| 2006 | 13,718 | 229,962 | 1,046 | 16,762 |

| 2007 | 12,324 | 224,515 | 1,022 | 17,223 |

| 2008 | 12,359 | 220,056 | 947 | 16,576 |

| 2009 | 11,999 | 209,860 | 906 | 14,924 |

| 2010 | 11,396 | 199,492 | 967 | 15,854 |

| 2011 | 10,679 | 197,932 | 939 | 15,895 |

| 2012 | 10,864 | 208,499 | 901 | 15,438 |

| 2013 | 10,040 | 198,014 | 691 | 12,521 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||||

| Year | Domestic trips represented | International trips represented |

|---|---|---|

| 2005 | 224,646 | 16,522 |

| 2006 | 229,962 | 16,762 |

| 2007 | 224,515 | 17,223 |

| 2008 | 220,056 | 16,576 |

| 2009 | 209,860 | 14,924 |

| 2010 | 199,492 | 15,854 |

| 2011 | 197,932 | 15,895 |

| 2012 | 208,499 | 15,438 |

| 2013 | 198,014 | 12,521 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

Both domestic and international travel decreased during the recession, which officially lasted from December 2007 to June 2009.5 This decline continued during the recovery period, even though international trips experienced a temporary rebound in 2011 and domestic trips in 2012.

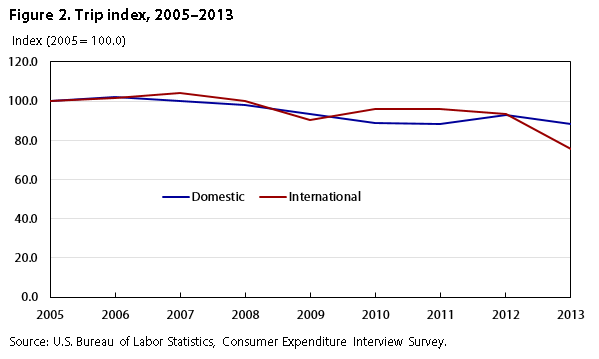

Figure 2 displays the number of trips reported, by type, indexed to equal 100.0 in 2005. The number of points higher or lower than 100.0 in a particular year equals the percent increase or decrease in the number of trips reported for that year relative to 2005. Here, the pattern for international trips is more easily seen.

| Year | Index for domestic trips | Index for international trips |

|---|---|---|

| 2005 | 100.0 | 100.0 |

| 2006 | 102.4 | 101.5 |

| 2007 | 99.9 | 104.2 |

| 2008 | 98.0 | 100.3 |

| 2009 | 93.4 | 90.3 |

| 2010 | 88.8 | 96.0 |

| 2011 | 88.1 | 96.2 |

| 2012 | 92.8 | 93.4 |

| 2013 | 88.1 | 75.8 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

Both types of travel exhibited similar patterns from 2005 through 2009, the year the recession ended. However, international trips experienced some recovery in 2010 and 2011, while domestic trips continued to decline. Nevertheless, both types of travel fell in 2013, and neither type reached or exceeded the 100.0 threshold after the recession ended.

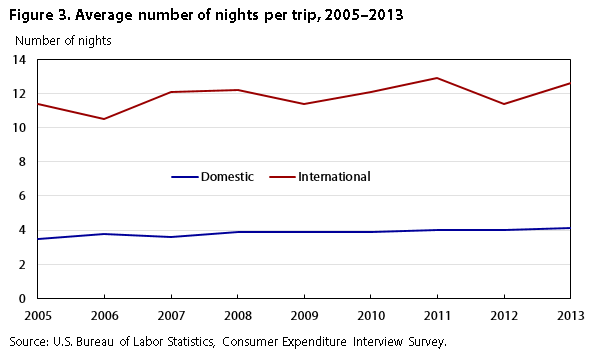

On average, international trips are longer than domestic trips—about three times longer, regardless of year, according to figure 3. But the figure points to a surprising observation: despite the recession, the average length of stay has increased for both domestic and international trips. While the increase is small for domestic trips (about a half night), it is more than a full night for international trips. However, these results should be interpreted with caution, as they may reflect random variation across samples, some of which include more respondents who took longer trips.

| Year | Number of nights on domestic trips | Number of nights on international trips |

|---|---|---|

| 2005 | 3.5 | 11.4 |

| 2006 | 3.8 | 10.5 |

| 2007 | 3.6 | 12.1 |

| 2008 | 3.9 | 12.2 |

| 2009 | 3.9 | 11.4 |

| 2010 | 3.9 | 12.1 |

| 2011 | 4.0 | 12.9 |

| 2012 | 4.0 | 11.4 |

| 2013 | 4.1 | 12.6 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

The CE collects extensive amount of detail on spending on trips. Basic expenditure categories include transportation (airfare; train fare; bus fare; ship fare; and driving expenses, such as tolls, gasoline, and parking), food (purchased at restaurants or prepared by the consumer unit6 on the trip), alcoholic beverages (from restaurants or stores), lodging, and other items. A detailed list of these categories is included in appendix B.

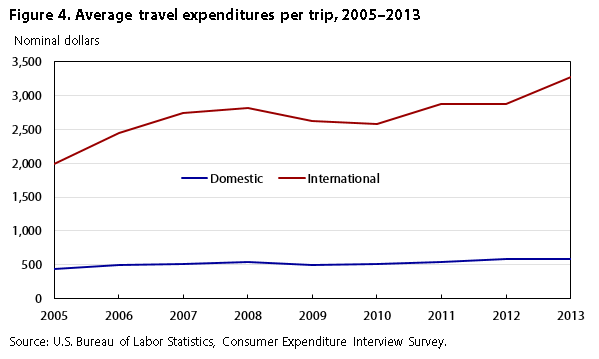

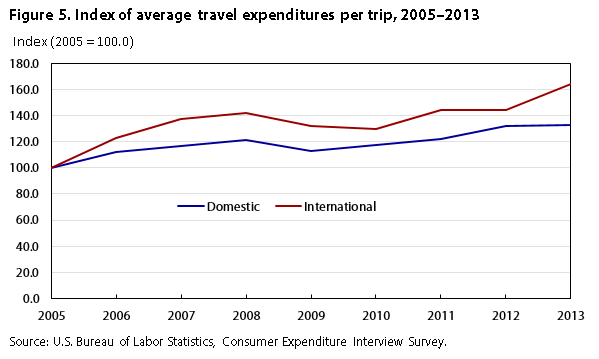

Not surprisingly, international trips are more expensive than domestic trips, regardless of year. (See figure 4.) Therefore, to demonstrate how expenditures change over time in percent terms, figure 5 shows expenditures indexed to values reported in 2005. It is clear that both domestic and international travel react in similar ways to changing economic conditions, but that expenditures for international travel increase or decrease at a faster rate in most years.

| Year | Expenditures on domestic trips | Expenditures on international trips |

|---|---|---|

| 2005 | $440 | $1,991 |

| 2006 | 492 | 2,449 |

| 2007 | 513 | 2,742 |

| 2008 | 535 | 2,826 |

| 2009 | 496 | 2,633 |

| 2010 | 517 | 2,583 |

| 2011 | 538 | 2,874 |

| 2012 | 580 | 2,872 |

| 2013 | 583 | 3,273 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

| Year | Index for domestic trips | Index for international trips |

|---|---|---|

| 2005 | 100.0 | 100.0 |

| 2006 | 111.9 | 123.0 |

| 2007 | 116.7 | 137.7 |

| 2008 | 121.6 | 142.0 |

| 2009 | 112.7 | 132.3 |

| 2010 | 117.6 | 129.8 |

| 2011 | 122.4 | 144.4 |

| 2012 | 132.0 | 144.3 |

| 2013 | 132.7 | 164.4 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

The difference in average travel expenditures is due to two key factors. As noted in the previous section, international trips last longer, on average, than do domestic trips. Furthermore, international trips may involve higher airfares or other costs. For these reasons, it is useful to examine components of travel expenditures, as well as daily costs for each type of trip. For simplicity, the analysis examines only major transportation expenses (airfare, other fares, and driving costs) per trip, along with daily trip costs for food (purchased at restaurants or prepared by consumers on trips) and lodging.

Table 2 reveals an interesting pattern: for all forms of major transportation, reported expenditures are higher, on average, for international than for domestic travel. For example, in each year, expenditures on airfares for international trips were two to three times those for domestic trips. This result is not surprising given that domestic travelers may be able to drive from home to their destination or take a bus or train. Thus, if airfares rise between certain domestic destinations, affected travelers have transportation alternatives, which may be of lower cost, to consider. By contrast, except for trips to Mexico or Canada, the use of these alternatives is not likely or even possible for most international trips. In addition, the greater distances involved in international travel undoubtedly add costs to airlines, which, in turn, presumably raise international airfares.

| Year | Airfare | Other fares(1) | Driving costs(2) | |||

|---|---|---|---|---|---|---|

| Domestic | International | Domestic | International | Domestic | International | |

| Percent of trips for which expenditures were reported | ||||||

| 2005 | 17.3 | 62.4 | 6.7 | 34.6 | 78.0 | 48.2 |

| 2006 | 19.4 | 74.9 | 7.2 | 38.7 | 76.0 | 41.1 |

| 2007 | 19.4 | 70.3 | 6.7 | 37.1 | 76.0 | 42.6 |

| 2008 | 18.3 | 70.3 | 6.9 | 36.5 | 75.6 | 40.5 |

| 2009 | 19.3 | 76.6 | 6.8 | 40.4 | 75.3 | 37.9 |

| 2010 | 19.9 | 76.0 | 6.6 | 39.6 | 74.3 | 38.9 |

| 2011 | 19.3 | 76.8 | 6.6 | 42.0 | 75.8 | 38.3 |

| 2012 | 19.0 | 72.0 | 7.0 | 39.1 | 76.1 | 34.5 |

| 2013 | 20.2 | 74.5 | 7.4 | 39.5 | 75.2 | 37.2 |

| Average expenditures for reporters only | ||||||

| 2005 | $452 | $1,095 | $221 | $621 | $87 | $180 |

| 2006 | 470 | 1,145 | 208 | 734 | 103 | 178 |

| 2007 | 494 | 1,476 | 266 | 747 | 104 | 233 |

| 2008 | 543 | 1,574 | 203 | 587 | 124 | 244 |

| 2009 | 458 | 1,275 | 192 | 770 | 100 | 206 |

| 2010 | 509 | 1,288 | 191 | 649 | 113 | 238 |

| 2011 | 486 | 1,530 | 142 | 504 | 127 | 200 |

| 2012 | 551 | 1,588 | 213 | 861 | 131 | 207 |

| 2013 | 545 | 1,646 | 226 | 941 | 127 | 249 |

| Notes: (1) Bus, train, and ship fares. (2) Car, truck, or moped rental; gasoline; parking; and tolls. Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||||||

Perhaps more interesting is that driving-related expenditures are much higher in other countries than in the United States. While no price information, domestic or international, is collected in the CE, it may be that prices for vehicle rentals or gasoline are higher overseas. If so, this would reasonably explain at least part of the difference. Expenditures may also be higher partly because average trip lengths are longer for international than for domestic trips, so rental or other driving costs may be incurred for more days. Whatever the reasons for the difference, only one-third to one-half of international travelers reported driving expenditures, compared with three-fourths of domestic travelers who did.

Among travel expenditures, airfares can be considered fixed costs—that is, the round-trip fare does not necessarily vary with the length of stay. However, food and lodging expenses clearly do. Therefore, it is useful to compare daily costs for these expenditures as well.

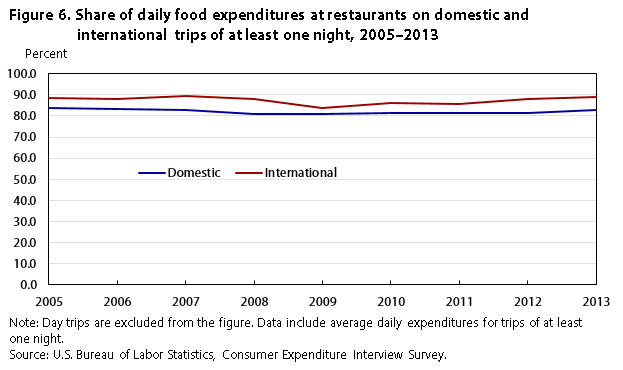

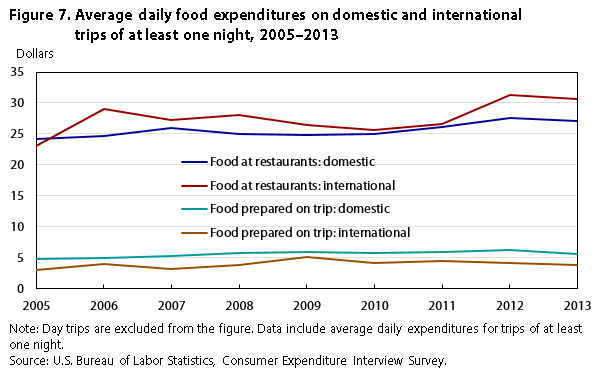

Figures 6 and 7 show that while the share of food at restaurants in the food budget is slightly larger on international than on domestic trips, the amount spent each day on both types of trips is about the same.

| Year | Share on domestic trips | Share on international trips |

|---|---|---|

| 2005 | 83.6 | 88.5 |

| 2006 | 83.2 | 87.9 |

| 2007 | 83.0 | 89.6 |

| 2008 | 81.1 | 88.1 |

| 2009 | 80.7 | 83.9 |

| 2010 | 81.3 | 86.3 |

| 2011 | 81.4 | 85.8 |

| 2012 | 81.5 | 88.1 |

| 2013 | 82.9 | 89.0 |

| Note: Day trips are excluded from the table. Data include average daily expenditures for trips of at least one night. Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

| Year | Food at restaurants | Food prepared on trip | ||

|---|---|---|---|---|

| Domestic | International | Domestic | International | |

| 2005 | $24.19 | $22.99 | $4.74 | $2.98 |

| 2006 | 24.62 | 29.08 | 4.97 | 4.01 |

| 2007 | 25.89 | 27.20 | 5.31 | 3.15 |

| 2008 | 24.96 | 28.11 | 5.83 | 3.81 |

| 2009 | 24.88 | 26.44 | 5.94 | 5.08 |

| 2010 | 24.98 | 25.59 | 5.73 | 4.07 |

| 2011 | 26.08 | 26.57 | 5.95 | 4.40 |

| 2012 | 27.52 | 31.23 | 6.25 | 4.21 |

| 2013 | 27.16 | 30.68 | 5.59 | 3.80 |

| Note: Day trips are excluded from the table. Data include average daily expenditures for trips of at least one night. Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||||

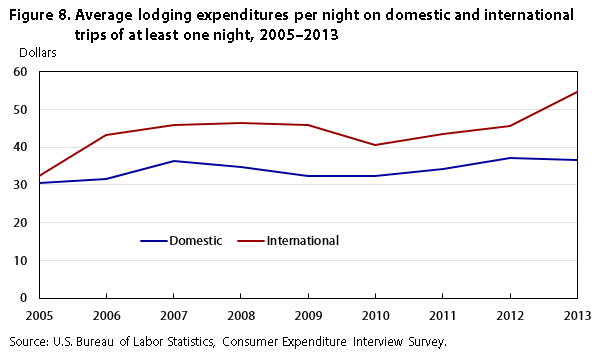

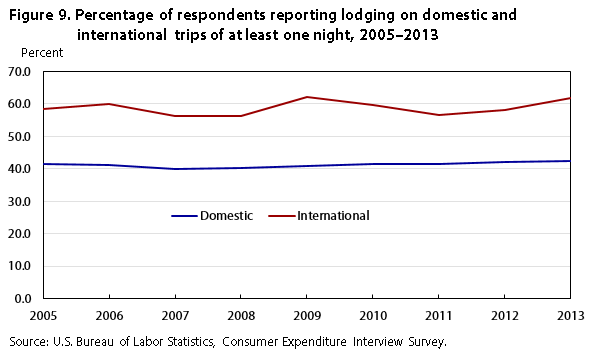

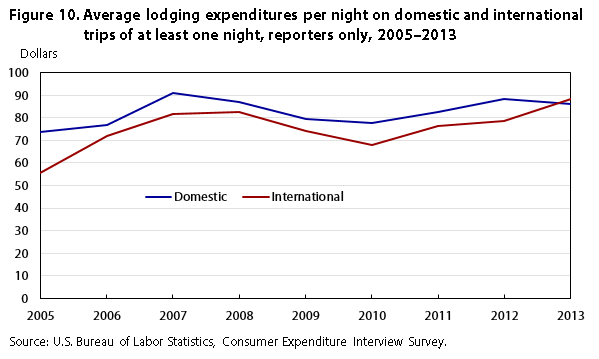

However, figure 8 shows that expenditures for lodging, unlike those for food, do differ between the two types of travel. In all years, lodging expenditures per night are larger outside than inside the United States. But these values are computed for all trips of at least one night, whether or not the respondent reported a lodging expenditure. It is possible that domestic travelers are more likely to stay with friends or relatives; indeed, as figure 9 shows, the percentage of respondents reporting overnight lodging is lower for domestic than for international trips. And when the difference in percent reporting is taken into account, the previous pattern actually reverses—spending per night for those who report lodging expenditures is higher, on average, for domestic than for international travel for all years except 2013, when the gap is just over $2. (See figure 10.)

| Year | Expenditures on domestic trips | Expenditures on international trips |

|---|---|---|

| 2005 | $30.54 | $32.40 |

| 2006 | 31.66 | 43.31 |

| 2007 | 36.29 | 45.96 |

| 2008 | 34.83 | 46.32 |

| 2009 | 32.37 | 45.95 |

| 2010 | 32.23 | 40.46 |

| 2011 | 34.13 | 43.37 |

| 2012 | 37.01 | 45.60 |

| 2013 | 36.48 | 54.71 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

| Year | Percent reporting lodging | |

|---|---|---|

| Domestic | International | |

| 2005 | 41.5 | 58.3 |

| 2006 | 41.2 | 60.1 |

| 2007 | 39.9 | 56.3 |

| 2008 | 40.1 | 56.2 |

| 2009 | 40.8 | 62.1 |

| 2010 | 41.5 | 59.7 |

| 2011 | 41.4 | 56.7 |

| 2012 | 42.0 | 58.1 |

| 2013 | 42.4 | 61.9 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

| Year | Expenditures on domestic trips | Expenditures on international trips |

|---|---|---|

| 2005 | $73.65 | $55.62 |

| 2006 | 76.76 | 72.03 |

| 2007 | 90.93 | 81.58 |

| 2008 | 86.94 | 82.46 |

| 2009 | 79.41 | 74.05 |

| 2010 | 77.74 | 67.74 |

| 2011 | 82.53 | 76.52 |

| 2012 | 88.17 | 78.49 |

| 2013 | 85.93 | 88.37 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | ||

Regardless, even when average domestic lodging expenditures are higher than average international lodging expenditures, the difference in lodging costs for the two types of travel is not large for most years examined (see figure 10). For all years except 2005, in which reported lodging expenditures per night on domestic trips exceed those reported for international trips by $18, the gap ranges between over $4 (2008) and exactly $10 (2010). Furthermore, for both domestic and international trips, these expenditures follow similar patterns, generally rising before the recession, falling during the recession, and rising again thereafter.

As noted previously, the patterns observed for lodging expenditures may result from domestic travelers staying more frequently with family or friends. But even if they do, this does not explain the closeness of average expenditures on food across types of trips. (See figure 7.) For example, if those who stay with family or friends are less likely to purchase food at restaurants while on trips, food expenditures should be lower for domestic trips, all else being equal. However, all else may not be equal. Differences in prices or other factors faced by domestic and international travelers could explain the closeness of the means observed. Whatever the reason for that closeness, expenditures on food, both at restaurants and prepared by the consumer unit, follow similar patterns to lodging—rising before the recession, falling during the recession, and rising again in recovery.

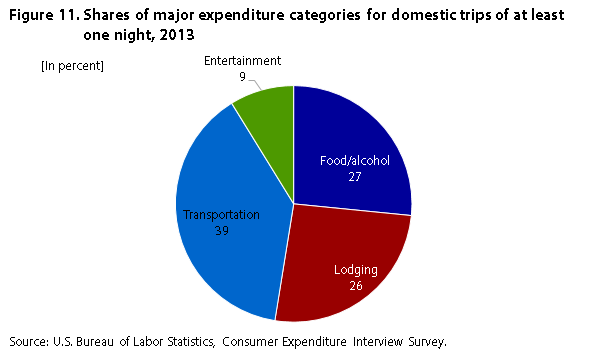

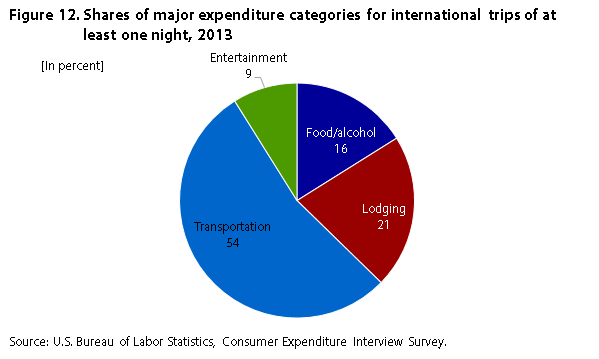

Another notable finding is that the shares of different expenditure categories for trips of at least one night are fairly stable over time for both domestic and international trips. For example, transportation, which is the largest major category in any year for domestic travel, accounts for between 36 and 39 percent of the travel budget each year. Given this small variation, the analysis compares expenditure shares for the two types of trips only for the most recent year under study (2013). (See figures 11 and 12.)

| Category | Share |

|---|---|

| Food/alcohol | 26.6 |

| Lodging | 26.0 |

| Transportation | 38.7 |

| Entertainment | 8.8 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | |

| Category | Share |

|---|---|

| Food/alcohol | 16.1 |

| Lodging | 21.2 |

| Transportation | 53.8 |

| Entertainment | 8.9 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | |

The shares of entertainment expenditures are identical for each type of trip. For transportation, however, the expenditure share for international travel is larger than that for domestic travel. The reverse is true for food (here including alcohol) and lodging: together, these two categories account for just over half of spending on domestic travel and less than two-fifths of spending on international travel. When considered individually, food and lodging each account for a little over one-fourth of the travel cost on domestic trips; for international trips, lodging is a little over one-fifth and food a little under one-sixth.

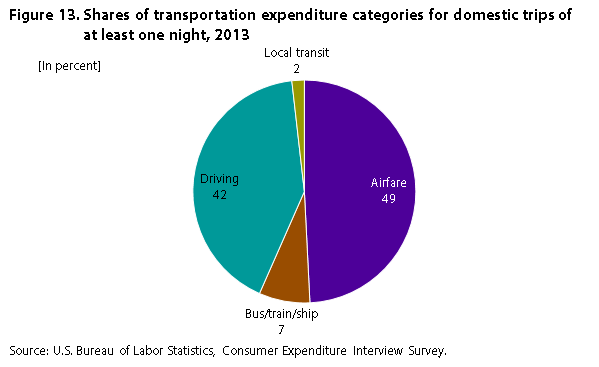

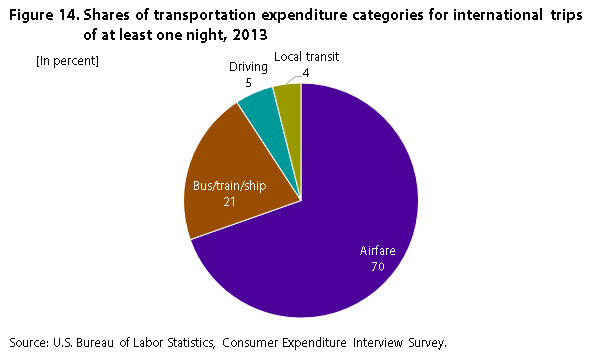

Also noteworthy is the breakdown of the transportation budget (see figures 13 and 14), which accounts for the largest share of any major category for either domestic or international travel for trips of at least one night. (Day trips are extremely unlikely to include airfare or other large transportation costs and are therefore excluded from this portion of the analysis.) Airfare constitutes the largest share in the transportation budget for either type of trip; however, while it accounts for only half of travel expenditures on domestic trips, it represents nearly three-quarters (70 percent) of international travel expenditures. Nevertheless, this result must be interpreted with caution, because the sample examined here is not limited to those who incurred an airfare expenditure, a condition that undoubtedly decreases the share for domestic travel more than it does for international travel.

| Category | Share |

|---|---|

| Airfare | 49.2 |

| Bus/train/ship | 7.4 |

| Driving | 41.6 |

| Local transit | 1.8 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | |

| Category | Share |

|---|---|

| Airfare | 69.6 |

| Bus/train/ship | 21.2 |

| Driving | 5.3 |

| Local transit | 3.9 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | |

So far, the analysis has revealed definite changes in expenditure levels, if not shares, during the recession and recovery, for both domestic and international travel. Might the recession have influenced the choice of destination visited and therefore, at least indirectly, the changes in expenditures?

In terms of domestic travel, the pattern for destinations involved in overnight trips is much like that for expenditure shares: that is, there is very little difference over time in places visited, to the extent this dynamic is tested. Overall, the four most visited states were California, Florida, Texas, and New York. When analyzed year by year, Texas and New York sometimes changed places for number of visits reported, but no other change was detected. In addition, the analysis did not check for a change in pattern for intra- and interstate visits. Thus, a trip to California is counted identically for an Angeleno who visits San Francisco and for a Nevadan who also visits San Francisco, or Los Angeles for that matter.

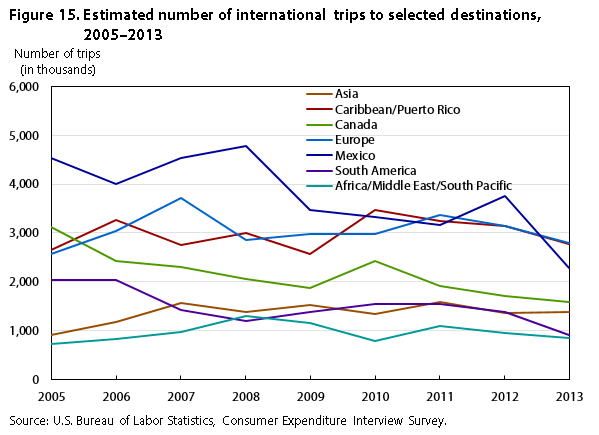

More intriguing are the patterns for international travel. Table 3 shows the total number of trips to destinations asked about in the survey instrument, after the reported numbers are weighted to reflect the total. Because of the small sample size, the analysis combines Africa, Middle East, and South Pacific destinations into one category.7 Also, travel to the Caribbean includes Puerto Rico as an international destination, even though Puerto Rico is a U.S. territory. (See appendix A for details.)

| Year | Asia | Caribbean/Puerto Rico | Canada | Europe | Mexico | South America | Africa/Middle East/South Pacific |

|---|---|---|---|---|---|---|---|

| 2005 | 901 | 2,639 | 3,127 | 2,574 | 4,532 | 2,025 | 724 |

| 2006 | 1,182 | 3,273 | 2,414 | 3,028 | 3,998 | 2,036 | 831 |

| 2007 | 1,557 | 2,744 | 2,309 | 3,705 | 4,526 | 1,422 | 959 |

| 2008 | 1,387 | 2,992 | 2,056 | 2,853 | 4,782 | 1,200 | 1,305 |

| 2009 | 1,517 | 2,573 | 1,861 | 2,972 | 3,474 | 1,374 | 1,153 |

| 2010 | 1,334 | 3,468 | 2,420 | 2,966 | 3,324 | 1,549 | 793 |

| 2011 | 1,590 | 3,244 | 1,910 | 3,360 | 3,160 | 1,532 | 1,099 |

| 2012 | 1,360 | 3,142 | 1,709 | 3,140 | 3,758 | 1,380 | 950 |

| 2013 | 1,372 | 2,761 | 1,583 | 2,784 | 2,271 | 898 | 852 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | |||||||

Figure 15 graphically represents the data from table 3. Although no single pattern describes all or most areas visited, a few observations stand out. In most years, the most frequently visited areas are Mexico, the Caribbean, and Europe. However, trips to Canada occur more frequently than do trips to Asia, South America, or other areas for which destination information is collected (Africa, Middle East, and South Pacific). This pattern persists even though trips to Canada generally decreased throughout the study period, while trips to Asia generally increased and trips to other areas were relatively stable.

| Year | Asia | Caribbean/Puerto Rico | Canada | Europe | Mexico | South America | Africa/Middle East/South Pacific |

|---|---|---|---|---|---|---|---|

| 2005 | 901 | 2,639 | 3,127 | 2,574 | 4,532 | 2,025 | 724 |

| 2006 | 1,182 | 3,273 | 2,414 | 3,028 | 3,998 | 2,036 | 831 |

| 2007 | 1,557 | 2,744 | 2,309 | 3,705 | 4,526 | 1,422 | 959 |

| 2008 | 1,387 | 2,992 | 2,056 | 2,853 | 4,782 | 1,200 | 1,305 |

| 2009 | 1,517 | 2,573 | 1,861 | 2,972 | 3,474 | 1,374 | 1,153 |

| 2010 | 1,334 | 3,468 | 2,420 | 2,966 | 3,324 | 1,549 | 793 |

| 2011 | 1,590 | 3,244 | 1,910 | 3,360 | 3,160 | 1,532 | 1,099 |

| 2012 | 1,360 | 3,142 | 1,709 | 3,140 | 3,758 | 1,380 | 950 |

| 2013 | 1,372 | 2,761 | 1,583 | 2,784 | 2,271 | 898 | 852 |

| Source: U.S. Bureau of Labor Statistics, Consumer Expenditure Interview Survey. | |||||||

Like trips to Canada, trips to Mexico generally fell during the period, particularly after 2008. Interestingly, these trips have a negative correlation with trips to South and Central America: in most years, when trips to Mexico decrease, trips to South and Central America increase.

Because of the aforementioned small sample size for some of the countries visited, the numbers in this section should be interpreted with caution. Differences in numbers of trips from year to year may not be statistically significant.

This article examined travel expenditures during the recent recession and recovery period. Consistent with previous work, the analysis revealed that economic conditions affected these expenditures, generally driving them down during recession and up during recovery. However, the pattern was more pronounced for international than for domestic trips.

In addition, expenditures for domestic and international travel differed not just in total (international trips cost more, on average), but also in allocation of the travel budget. For example, lodging expenditures per night were more responsive to economic conditions—and always higher on international than on domestic trips—even though they followed similar patterns regardless of trip type. In contrast, average daily expenditures for food were both similar and stable for each type of travel. At the same time, while the shares of expenditure items were unaffected by the recession or the recovery, the share of airfares in the travel budget was much larger for international than for domestic trips.

Overview. The CE Interview Survey is a quarterly, rotating-panel survey consisting of about 7,000 consumer units each quarter. During the interview, travelers are asked about several characteristics of the trip or trips they have taken during the last 3 months—characteristics including destination and length of stay. For domestic trips, the interviewer records the city (or other relevant identifier) and state that the traveler visited. For international trips, the interviewer records the city, country, or other destination information (e.g., “London,” “England,” or “United Kingdom”), as well as the larger area of the world the traveler visited. That is, the interviewer registers whether the traveler went to Africa, Asia, Australia, Canada, the Caribbean, Central America, Europe, Mexico, the Middle East, South America, or the South Pacific. This article combines trips to some of these destinations because of lack of sample (i.e., too few trips were reported to some destinations to ensure statistical reliability).

Moreover, as noted earlier, travel to Puerto Rico is included with other travel to the Caribbean, even though Puerto Rico is a U.S. territory, and therefore domestic. This is done because some interviewers included Puerto Rico within the Caribbean, while others identified it by state code (“PR”). Those who included it in the Caribbean identified the destination in many ways—for example, as the city visited (e.g., “San Juan”), the island itself (“Puerto Rico”), or just “Caribbean,” which may or may not include Puerto Rico. Furthermore, misspellings in the recorded interview responses make it impossible to identify all trips to Puerto Rico. Therefore, it is easier to add destinations coded “PR” to the Caribbean trips than to remove Puerto Rico from the Caribbean trips.

Among the information collected in the survey is the number of similar trips the traveler(s) within the consumer unit made to a particular location during the last 3 months. When the traveler has visited the same location more than once, expenditures are recorded as the sum of all similar trips. For example, if a respondent made four weekend visits to the same relative during the last 3 months and spent $20 for food each time, the number of similar trips is entered as four and the amount recorded for food is $80. The amount recorded would be the same if food expenditures were $10 on the first trip, $30 on the second, $15 on the third, and $25 on the fourth.

Aggregate number of trips. In the CE, each participating consumer unit represents a large number of similar consumer units across the country. This number is the consumer unit’s weight. Further, as already noted, each consumer unit reporting travel expenditures is asked about the number of similar trips taken during the last 3 months. To estimate the total number of trips that took place, the weight is multiplied by the number of similar trips reported. These weighted trip values are then added for the year in which the interview took place, and the results are reported in figure 1.

Note that respondents reported trips in the year indicated, but travelers may have taken at least some of these trips in the previous year. For example, in most years, a respondent interviewed in January would report information for trips that ended in either October, November, or December of the previous year. The exception is 2005, the first year for which data in this article are examined, because a sample redesign took effect in 2005 and respondents from the new sample were not interviewed for the first time until February 2005. Therefore, the first trips examined ended as early as November 2004. The last trips examined ended as late as November 2013, as participants interviewed in December 2013 reported trips that ended in September, October, or November of that year.

Caveats. In some cases, the number of similar trips is missing from the dataset. In these cases, the analysis retains the record but sets its value to one, because the consumer unit had to have taken at least one trip.

In a few cases, the destination of the trip was unknown. However, these cases represented only a small portion of trips reported—of the 116,238 trips reported in the 2005–2013 sample, only 90 were to unknown destinations. Although 86 of these “unknowns” were reported in 2013, they still accounted for less than 1 percent of all trips reported that year (10,040 domestic and 691 international). These cases are excluded from the analysis.

Finally, data collected about the trips (e.g., number of nights) are “as reported.” There is no editing done for consistency or correctness. This fact is particularly important for destinations visited. For example, a typographical error could result in the report of a trip to Manhattan, KY, even though “KY” should have been either “NY” or “KS.” Furthermore, counting trips to very specific destinations is difficult because of differences in nomenclature. For example, a trip to Manhattan, NY, might be listed as a trip to “New York,” “New York City,” “Manhattan,” “Midtown,” or any other number of names. Nomenclature differences, coupled with misspellings or typographical errors, make it impossible to compile statistics for geographic areas smaller than U.S. states or the foreign countries or areas described in this article.

Food and beverages:

Food away from home (i.e., purchased at restaurants, bars, or fast food places)

Food at home (i.e., purchased at grocery, convenience, or liquor stores)

Alcoholic beverages

Purchased at restaurants, bars, or fast food places

Purchased from grocery, convenience, or liquor stores

Lodging (hotels, etc.)

Transportation:

Driving expenses

Rental of cars or trucks

Gasoline and motor oil

Parking

Tolls

Rental of other vehicles

Motorcycles and mopeds

Airplanes

Airfare

Bus fare

Train fare

Ship fare

Local transportation (taxi, subway, etc.)

Entertainment:

Fees and admissions

Sporting events, museums, tours, etc.

Souvenirs, tourist booklets, etc.

Rental of recreational vehicles by type

Boat

Camper, trailer, RV

?pagebreak>?pagebreak>?pagebreak>?pagebreak>?pagebreak>?pagebreak>?pagebreak>Geoffrey D. Paulin, "Travel expenditures, 2005–2013: domestic and international patterns in recession and recovery," Monthly Labor Review, U.S. Bureau of Labor Statistics, March 2015, https://doi.org/10.21916/mlr.2015.6

1 Although previous work also found that the recession affected travel expenditures, it did not distinguish between international and domestic travel. See Geoffrey Paulin, “Travel expenditures 2005–2011: spending slows during recent recession,” Beyond the Numbers 1, no. 20, December 2012, https://www.bls.gov/opub/btn/volume-1/travel-expenditures-2005-2011-spending-slows-during-recent-recession.htm.

2 Readers can view specific questions of the survey on the CE website by selecting the questionnaire for the year of interest and opening the questions in section 18. (See https://www.bls.gov/cex/csxsurveyforms.htm.)

3 The trips reported ended as early as November 2004. For further details, see appendix A (Aggregate number of trips section).

4 Appendix A details the procedure for obtaining the weighted figures.

5 Beginning and ending dates of recessions are determined by the National Bureau of Economic Research; see http://www.nber.org/cycles.html.

6 A consumer unit consists of any of the following: (1) all members of a particular household who are related by blood, marriage, adoption, or some other legal arrangement; (2) a person living alone, sharing a household with others, living as a roomer in a private home or lodging house, or in permanent living quarters in a hotel or motel, but who is financially independent; (3) two or more persons living together who use their incomes to make joint expenditure decisions. Financial independence is determined by spending behavior with regard to the three major expense categories: housing, food, and other living expenses. To be considered financially independent, the respondent must provide at least two of the three major expenditure categories, either entirely or in part. The terms consumer unit, family, and household are often used interchangeably for convenience. However, the proper technical term for purposes of the Consumer Expenditure Survey is consumer unit.

7 Even after combining, the number of reported trips each year ranged from 49 to 78 for this category.