An official website of the United States government

United States Department of Labor

United States Department of Labor

In 2016, despite a slowdown in employment growth compared with the previous 2 years, nonfarm employment continued an expansionary period that began in May 2014, when employment recovered from a record-breaking recession. Job gains across some industries slowed relative to the pace of job growth these industries set in 2015, notably in construction, temporary help services, social assistance, and food services and drinking places.

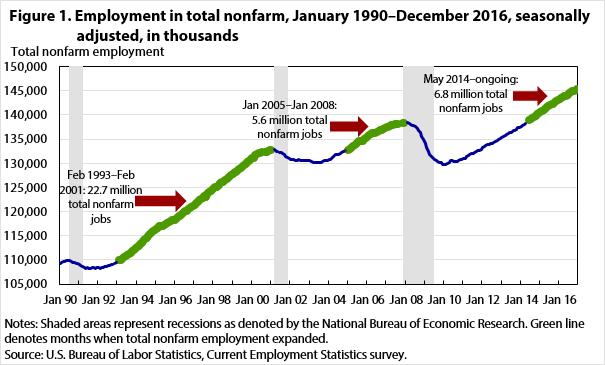

Nonfarm payroll employment in the United States grew by 2.2 million in 2016, marking 32 months of expansion,1 according to data from the Current Employment Statistics (CES) survey.2 (See figure 1.) This expansion has, so far, resulted in an additional 6.8 million nonfarm jobs. The previous expansion, which lasted for 36 months (from January 2005 to January 2008), resulted in just 5.6 million jobs. The longest employment expansion in CES history,3 which began in February 1993, lasted for 96 months and resulted in an additional 22.7 million jobs.

| Date | Total nonfarm |

|---|---|

| Jan 90 | 109,185 |

| Feb 90 | 109,433 |

| Mar 90 | 109,648 |

| Apr-90 | 109,687 |

| May-90 | 109,839 |

| Jun-90 | 109,861 |

| Jul-90 | 109,830 |

| Aug-90 | 109,614 |

| Sep- 90 | 109,524 |

| Oct-90 | 109,364 |

| Nov-90 | 109,215 |

| Dec 90 | 109,159 |

| Jan 91 | 109,042 |

| Feb 91 | 108,736 |

| Mar 91 | 108,578 |

| Apr 91 | 108,366 |

| May 91 | 108,243 |

| Jun 91 | 108,337 |

| Jul 91 | 108,298 |

| Aug 91 | 108,308 |

| Sep 91 | 108,340 |

| Oct 91 | 108,355 |

| Nov 91 | 108,298 |

| Dec 91 | 108,324 |

| Jan 92 | 108,375 |

| Feb 92 | 108,314 |

| Mar 92 | 108,369 |

| Apr 92 | 108,527 |

| May 92 | 108,654 |

| Jun 92 | 108,719 |

| Jul 92 | 108,792 |

| Aug 92 | 108,930 |

| Sep 92 | 108,966 |

| Oct 92 | 109,147 |

| Nov 92 | 109,283 |

| Dec 92 | 109,494 |

| Jan 93 | 109,804 |

| Feb 93 | 110,047 |

| Mar 93 | 109,998 |

| Apr 93 | 110,306 |

| May 93 | 110,573 |

| Jun 93 | 110,752 |

| Jul 93 | 111,054 |

| Aug 93 | 111,212 |

| Sep 93 | 111,453 |

| Oct 93 | 111,736 |

| Nov 93 | 111,999 |

| Dec 93 | 112,315 |

| Jan 94 | 112,587 |

| Feb 94 | 112,783 |

| Mar 94 | 113,247 |

| Apr 94 | 113,597 |

| May 94 | 113,931 |

| Jun 94 | 114,245 |

| Jul 94 | 114,619 |

| Aug 94 | 114,902 |

| Sep 94 | 115,256 |

| Oct 94 | 115,465 |

| Nov 94 | 115,886 |

| Dec 94 | 116,166 |

| Jan 95 | 116,492 |

| Feb 95 | 116,693 |

| Mar 95 | 116,912 |

| Apr 95 | 117,075 |

| May 95 | 117,059 |

| Jun 95 | 117,293 |

| Jul 95 | 117,389 |

| Aug 95 | 117,644 |

| Sep 95 | 117,888 |

| Oct 95 | 118,039 |

| Nov 95 | 118,188 |

| Dec 95 | 118,322 |

| Jan 96 | 118,307 |

| Feb 96 | 118,736 |

| Mar 96 | 119,001 |

| Apr 96 | 119,165 |

| May 96 | 119,488 |

| Jun 96 | 119,773 |

| Jul 96 | 120,023 |

| Aug 96 | 120,203 |

| Sep 96 | 120,427 |

| Oct 96 | 120,676 |

| Nov 96 | 120,975 |

| Dec 96 | 121,146 |

| Jan 97 | 121,379 |

| Feb 97 | 121,684 |

| Mar 97 | 121,999 |

| Apr 97 | 122,291 |

| May 97 | 122,552 |

| Jun 97 | 122,818 |

| Jul 97 | 123,124 |

| Aug 97 | 123,093 |

| Sep 97 | 123,604 |

| Oct 97 | 123,946 |

| Nov 97 | 124,250 |

| Dec 97 | 124,554 |

| Jan 98 | 124,828 |

| Feb 98 | 125,027 |

| Mar 98 | 125,176 |

| Apr 98 | 125,456 |

| May 98 | 125,860 |

| Jun 98 | 126,080 |

| Jul 98 | 126,209 |

| Aug 98 | 126,551 |

| Sep 98 | 126,773 |

| Oct 98 | 126,974 |

| Nov 98 | 127,254 |

| Dec 98 | 127,601 |

| Jan 99 | 127,727 |

| Feb 99 | 128,136 |

| Mar 99 | 128,244 |

| Apr 99 | 128,618 |

| May 99 | 128,830 |

| Jun 99 | 129,093 |

| Jul 99 | 129,414 |

| Aug 99 | 129,576 |

| Sep 99 | 129,792 |

| Oct 99 | 130,189 |

| Nov 99 | 130,482 |

| Dec 99 | 130,781 |

| Jan 00 | 131,009 |

| Feb 00 | 131,140 |

| Mar 00 | 131,608 |

| Apr 00 | 131,895 |

| May 00 | 132,121 |

| Jun 00 | 132,077 |

| Jul 00 | 132,253 |

| Aug 00 | 132,240 |

| Sep 00 | 132,375 |

| Oct 00 | 132,361 |

| Nov 00 | 132,589 |

| Dec 00 | 132,731 |

| Jan 01 | 132,706 |

| Feb 01 | 132,778 |

| Mar 01 | 132,751 |

| Apr 01 | 132,471 |

| May 01 | 132,432 |

| Jun 01 | 132,302 |

| Jul 01 | 132,191 |

| Aug 01 | 132,035 |

| Sep 01 | 131,794 |

| Oct 01 | 131,467 |

| Nov 01 | 131,176 |

| Dec 01 | 131,004 |

| Jan 02 | 130,869 |

| Feb 02 | 130,733 |

| Mar 02 | 130712 |

| Apr 02 | 130,634 |

| May 02 | 130,629 |

| Jun 02 | 130,685 |

| Jul 02 | 130,601 |

| Aug 02 | 130,587 |

| Sep 02 | 130,527 |

| Oct 02 | 130,649 |

| Nov 02 | 130,662 |

| Dec 02 | 130,504 |

| Jan 03 | 130,596 |

| Feb 03 | 130,447 |

| Mar 03 | 130,238 |

| Apr 03 | 130,194 |

| May 03 | 130,187 |

| Jun 03 | 130,197 |

| Jul 03 | 130,219 |

| Aug 03 | 130178 |

| Sep 03 | 130,282 |

| Oct 03 | 130,485 |

| Nov 03 | 130,496 |

| Dec 03 | 130,619 |

| Jan 04 | 130,778 |

| Feb 04 | 130,826 |

| Mar 04 | 131,157 |

| Apr 04 | 131,408 |

| May 04 | 131,715 |

| Jun 04 | 131,792 |

| Jul 04 | 131,837 |

| Aug 04 | 131,956 |

| Sep 04 | 132,118 |

| Oct 04 | 132,464 |

| Nov 04 | 132,530 |

| Dec 04 | 132,659 |

| Jan 05 | 132,795 |

| Feb 05 | 133,034 |

| Mar 05 | 133,169 |

| Apr 05 | 133,533 |

| May 05 | 133,710 |

| Jun 05 | 133,955 |

| Jul 05 | 134,329 |

| Aug 05 | 134,525 |

| Sep 05 | 134,592 |

| Oct 05 | 134,676 |

| Nov 05 | 135,017 |

| Dec 05 | 135,174 |

| Jan 06 | 135,452 |

| Feb 06 | 135,767 |

| Mar 06 | 136,049 |

| Apr 06 | 136,232 |

| May 06 | 136,257 |

| Jun 06 | 136,336 |

| Jul 06 | 136,542 |

| Aug 06 | 136,725 |

| Sep 06 | 136,878 |

| Oct 06 | 136,886 |

| Nov 06 | 137,095 |

| Dec 06 | 137,266 |

| Jan 07 | 137,506 |

| Feb 07 | 137,595 |

| Mar 07 | 137,785 |

| Apr 07 | 137,865 |

| May 07 | 138,008 |

| Jun 07 | 138,083 |

| Jul 07 | 138,049 |

| Aug 07 | 138,029 |

| Sep 07 | 138,117 |

| Oct 07 | 138,201 |

| Nov 07 | 138,315 |

| Dec 07 | 138,413 |

| Jan 08 | 138,430 |

| Feb 08 | 138,346 |

| Mar 08 | 138,268 |

| Apr 08 | 138,058 |

| May 08 | 137,872 |

| Jun 08 | 137,710 |

| Jul 08 | 137,497 |

| Aug 08 | 137,230 |

| Sep 08 | 136,780 |

| Oct 08 | 136,306 |

| Nov 08 | 135,540 |

| Dec 08 | 134,846 |

| Jan 09 | 134,053 |

| Feb 09 | 133,351 |

| Mar 09 | 132,528 |

| Apr 09 | 131,841 |

| May 09 | 131,492 |

| Jun 09 | 131,021 |

| Jul 09 | 130,692 |

| Aug 09 | 130,479 |

| Sep 09 | 130,259 |

| Oct 09 | 130,055 |

| Nov 09 | 130,053 |

| Dec 09 | 129,778 |

| Jan 10 | 129,801 |

| Feb 10 | 129,733 |

| Mar 10 | 129,897 |

| Apr 10 | 130,140 |

| May 10 | 130,664 |

| Jun 10 | 130,527 |

| Jul 10 | 130,459 |

| Aug 10 | 130423 |

| Sep 10 | 130,371 |

| Oct 10 | 130,633 |

| Nov 10 | 130,752 |

| Dec 10 | 130,839 |

| Jan 11 | 130,882 |

| Feb 11 | 131,071 |

| Mar 11 | 131,296 |

| Apr 11 | 131,642 |

| May 11 | 131,719 |

| Jun 11 | 131,944 |

| Jul 11 | 132013 |

| Aug 11 | 132,123 |

| Sep 11 | 132,371 |

| Oct 11 | 132,580 |

| Nov 11 | 132,721 |

| Dec 11 | 132,930 |

| Jan 12 | 133,288 |

| Feb 12 | 133,525 |

| Mar 12 | 133,758 |

| Apr 12 | 133,836 |

| May 12 | 133,951 |

| Jun 12 | 134,027 |

| Jul 12 | 134,170 |

| Aug 12 | 134,347 |

| Sep 12 | 134,550 |

| Oct 12 | 134,696 |

| Nov 12 | 134,828 |

| Dec 12 | 135,072 |

| Jan 13 | 135,283 |

| Feb 13 | 135,569 |

| Mar 13 | 135,699 |

| Apr 13 | 135,896 |

| May 13 | 136,122 |

| Jun 13 | 136,284 |

| Jul 13 | 136,406 |

| Aug 13 | 136,667 |

| Sep 13 | 136,857 |

| Oct 13 | 137,069 |

| Nov 13 | 137,327 |

| Dec 13 | 137,374 |

| Jan 14 | 137,564 |

| Feb 14 | 137,715 |

| Mar 14 | 137,987 |

| Apr 14 | 138,316 |

| May 14 | 138,562 |

| Jun 14 | 138,866 |

| Jul 14 | 139,068 |

| Aug 14 | 139,298 |

| Sep 14 | 139,578 |

| Oct 14 | 139,805 |

| Nov 14 | 140117 |

| Dec 14 | 140,372 |

| Jan 15 | 140,606 |

| Feb 15 | 140,844 |

| Mar 15 | 140,930 |

| Apr 15 | 141,192 |

| May 15 | 141,536 |

| Jun 15 | 141,742 |

| Jul 15 | 141,996 |

| Aug 15 | 142,153 |

| Sep 15 | 142,253 |

| Oct 15 | 142,574 |

| Nov 15 | 142,846 |

| Dec 15 | 143,085 |

| Jan 16 | 143,211 |

| Feb 16 | 143,448 |

| Mar 16 | 143673 |

| Apr 16 | 143,826 |

| May 16 | 143,869 |

| Jun 16 | 144,166 |

| Jul 16 | 144,457 |

| Aug 16 | 144,633 |

| Sep 16 | 144,882 |

| Oct 16 | 145,006 |

| Nov 16 | 145,170 |

| Dec 16 | 145,325 |

| Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | |

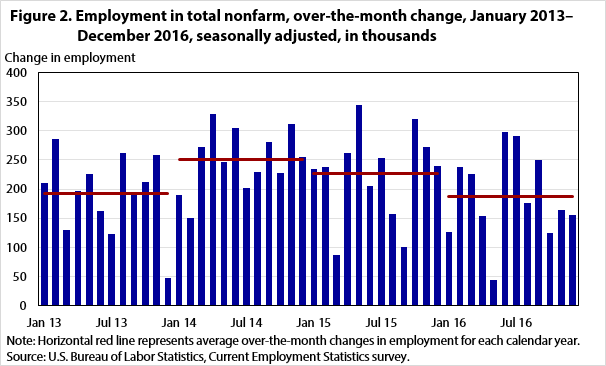

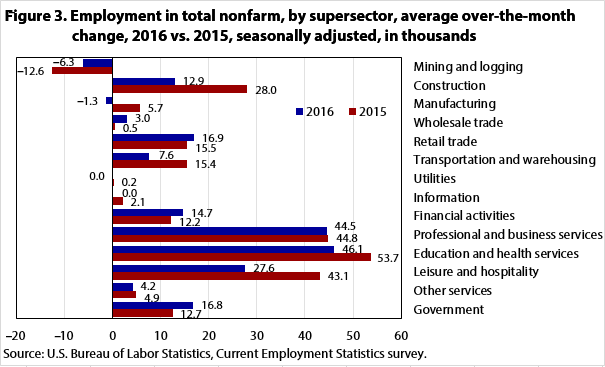

Total nonfarm employment grew by an average of 187,000 a month in 2016, down compared with 226,000 a month in 2015. (See figure 2.) Job gains in 2016 were mainly concentrated in education and health services and in professional and business services. Education and health services grew at a slower rate in 2016 compared with growth in 2015, while professional and business services matched the pace of job growth it set in 2015. Retail trade, government, and financial activities employment also grew, outpacing their growth in 2015. Mining employment experienced moderating losses compared with losses in 2015, and manufacturing employment stalled after experiencing a slight uptick in 2014. (See figure 3.)

| Date | Employment change | Average over-the-month change |

|---|---|---|

| Jan 13 | 211 | 192 |

| Feb 13 | 286 | 192 |

| Mar 13 | 130 | 192 |

| Apr 13 | 197 | 192 |

| May 13 | 226 | 192 |

| Jun 13 | 162 | 192 |

| Jul 13 | 122 | 192 |

| Aug 13 | 261 | 192 |

| Sep 13 | 190 | 192 |

| Oct 13 | 212 | 192 |

| Nov 13 | 258 | 192 |

| Dec 13 | 47 | 192 |

| Jan 14 | 190 | 250 |

| Feb 14 | 151 | 250 |

| Mar 14 | 272 | 250 |

| Apr 14 | 329 | 250 |

| May 14 | 246 | 250 |

| Jun 14 | 304 | 250 |

| Jul 14 | 202 | 250 |

| Aug 14 | 230 | 250 |

| Sep 14 | 280 | 250 |

| Oct 14 | 227 | 250 |

| Nov 14 | 312 | 250 |

| Dec 14 | 255 | 250 |

| Jan 15 | 234 | 226 |

| Feb 15 | 238 | 226 |

| Mar 15 | 86 | 226 |

| Apr 15 | 262 | 226 |

| May 15 | 344 | 226 |

| Jun 15 | 206 | 226 |

| Jul 15 | 254 | 226 |

| Aug 15 | 157 | 226 |

| Sep 15 | 100 | 226 |

| Oct 15 | 321 | 226 |

| Nov 15 | 272 | 226 |

| Dec 15 | 239 | 226 |

| Jan 16 | 126 | 187 |

| Feb 16 | 237 | 187 |

| Mar 16 | 225 | 187 |

| Apr 16 | 153 | 187 |

| May 16 | 43 | 187 |

| Jun 16 | 297 | 187 |

| Jul 16 | 291 | 187 |

| Aug 16 | 176 | 187 |

| Sep 16 | 249 | 187 |

| Oct 16 | 124 | 187 |

| Nov 16 | 164 | 187 |

| Dec 16 | 155 | 187 |

| Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | ||

| Supersector | 2016 | 2015 |

|---|---|---|

| Mining and logging | –6.3 | –12.6 |

| Construction | 12.9 | 28.0 |

| Manufacturing | –1.3 | 5.7 |

| Wholesale trade | 3.0 | 0.5 |

| Retail trade | 16.9 | 15.5 |

| Transportation and warehousing | 7.6 | 15.4 |

| Utilities | 0.0 | 0.2 |

| Information | 0.0 | 2.1 |

| Financial activities | 14.7 | 12.2 |

| Professional and business services | 44.5 | 44.8 |

| Education and health services | 46.1 | 53.7 |

| Leisure and hospitality | 27.6 | 43.1 |

| Other services | 4.2 | 4.9 |

| Government | 16.8 | 12.7 |

| Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | ||

Average hourly earnings for all employees on private nonfarm payrolls increased by 2.9 percent in 2016, the largest annual percentage increase since 2008. Consumer prices, as measured by the Consumer Price Index for All Urban Consumers, increased 2.1 percent over the same period, indicating that earnings gains slightly outpaced price increases. The average workweek for all employees on private nonfarm payrolls declined in 2016 by 0.1 hour to 34.4 hours.

Trends in major economic indicators in 2016 largely reflected employment trends in related industries, such as mining and crude oil prices. (See table 1.) The U.S. dollar strengthened slightly in 2016 as U.S. exports fell 2.3 percent in 2016.4 A strong dollar increases the costs of U.S. goods and services to foreign customers, which can affect exports and employment in manufacturing and other export-related industries. Crude oil prices stabilized in 2016, which contributed to moderating job losses in mining and mining-related industries. Industrial production was flat over the year—reflecting weakness in manufacturing and mining employment. Historically low mortgage rates and rising home prices helped strengthen the housing market in 2016, sustaining employment in real estate and in residential construction, although overall construction spending was down compared with spending in 2015. Real gross domestic product grew by 1.6 percent in 2016, following gains of 2.6 percent in 2015 and 2.4 percent in 2014. This moderation indicates that the overall economy was still growing, albeit at a slower pace. Nonfarm employment growth mirrored this trend.

| Indicator | 12-month percent change | ||

|---|---|---|---|

| 2014 | 2015 | 2016 | |

| Real gross domestic product(1) | 2.4 | 2.6 | 1.6 |

| Real personal consumption expenditures(1) | 2.9 | 3.2 | 2.7 |

| Crude oil prices: West Texas Intermediate(1) | –4.9 | –47.8 | –11.0 |

| Trade-weighted U.S. dollar index (broad)(1) | 3.1 | 12.6 | 4.6 |

| Industrial Production Index(2) | 3.1 | –0.7 | –1.2 |

| Retail sales (excluding food services)(2) | 3.9 | 1.6 | 2.7 |

| 30-year fixed-rate mortgage average in United States(1) | 4.8 | –7.7 | –5.2 |

| Existing Home Sales Index(2) | –3.1 | 6.3 | 3.8 |

| Total construction spending(2) | 11.4 | 10.3 | 4.8 |

| Real personal health care expenditures(2) | 3.2 | 5.3 | 4.6 |

| Notes: (1) Annual, not seasonally adjusted. (2) Annual, seasonally adjusted. Sources: U.S. Bureau of Economic Analysis, Board of Governors of the Federal Reserve System, U.S. Energy Information Administration, U.S. Census Bureau, Federal Home Loan Mortgage Corporation (Freddie Mac), and National Association of Realtors. | |||

About a quarter of all nonfarm jobs added in 2016 were in education and health services. The majority of these gains were in health care, the largest component industry within education and health services. Health care added an average of 32,000 jobs per month in 2016, on par with the average monthly gain in 2015.

Employment growth in health care was widespread in 2016—mainly in ambulatory health care but also in hospitals and social assistance. Ambulatory health care services added the largest number of jobs gains (more than 239,000) in health care, with the growth mainly coming from offices of physicians, which added 66,000 jobs, and from offices of other health practitioners, which added 58,000 jobs over the year. Offices of other health practitioners include industries such as offices of chiropractors, offices of optometrists, and offices of physical therapists.

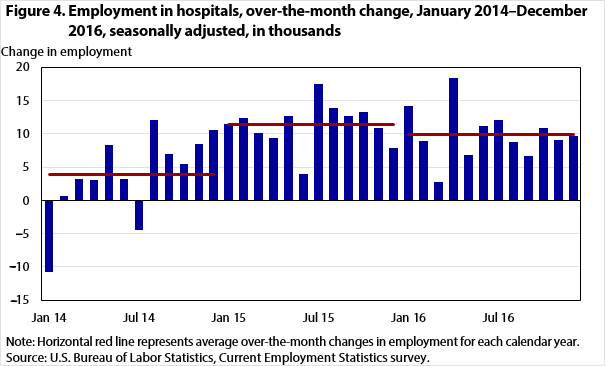

Since 1990, 2015 marked the strongest year of growth for the hospitals industry, adding 136,000 jobs, or an average of 11,000 a month. But 2016 was not far behind, with employment growth of 119,000, or an average of 10,000 a month. (See figure 4.) Decreasing hospital costs because of falling uncompensated care costs and continued merger activity have contributed to the surge in hospital employment in recent years.5

| Date | Employment change | Average over-the-month change |

|---|---|---|

| Jan 14 | –10.7 | 4 |

| Feb 14 | 0.7 | 4 |

| Mar 14 | 3.2 | 4 |

| Apr 14 | 3.1 | 4 |

| May 14 | 8.3 | 4 |

| Jun 14 | 3.2 | 4 |

| Jul 14 | –4.4 | 4 |

| Aug 14 | 12.0 | 4 |

| Sep 14 | 7.0 | 4 |

| Oct 14 | 5.5 | 4 |

| Nov 14 | 8.5 | 4 |

| Dec 14 | 10.5 | 4 |

| Jan 15 | 11.4 | 11 |

| Feb 15 | 12.4 | 11 |

| Mar 15 | 10.1 | 11 |

| Apr 15 | 9.4 | 11 |

| May 15 | 12.7 | 11 |

| Jun 15 | 4.0 | 11 |

| Jul 15 | 17.4 | 11 |

| Aug 15 | 13.8 | 11 |

| Sep 15 | 12.7 | 11 |

| Oct 15 | 13.3 | 11 |

| Nov 15 | 10.8 | 11 |

| Dec 15 | 7.9 | 11 |

| Jan 16 | 14.2 | 10 |

| Feb 16 | 8.9 | 10 |

| Mar 16 | 2.7 | 10 |

| Apr 16 | 18.4 | 10 |

| May 16 | 6.8 | 10 |

| Jun 16 | 11.2 | 10 |

| Jul 16 | 12.0 | 10 |

| Aug 16 | 8.7 | 10 |

| Sep 16 | 6.7 | 10 |

| Oct 16 | 10.8 | 10 |

| Nov 16 | 9.0 | 10 |

| Dec 16 | 9.7 | 10 |

| Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | ||

Although the health care industry showed similar employment growth in 2016 and 2015, social assistance experienced slower employment growth in 2016 compared with that in 2015. In 2016, social assistance added 88,000 jobs, down from an increase of 175,000 in 2015. Most of the employment growth occurred in the individual and family services industry, which added 67,000 jobs in 2016, down from an increase of 139,000 in 2015. This industry includes child and youth services and services for the elderly and persons with disabilities.

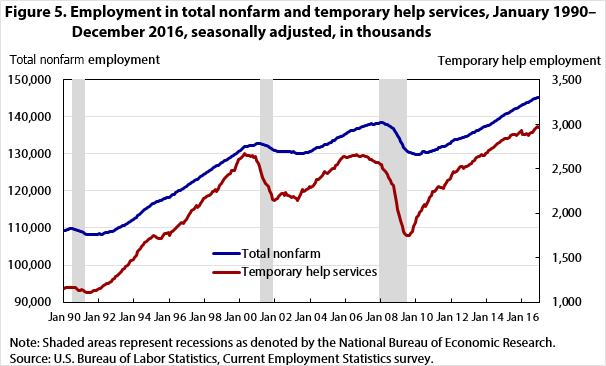

Professional and business services continued to expand in 2016, adding 534,000 jobs, a gain of 2.7 percent. However, this growth rate is the slowest since the end of the recession in 2009. Weakness in temporary help services employment was the primary cause of weaker growth within professional and business services. In marked contrast to recent years, temporary help services added just 32,000 jobs in 2016, down from 97,000 in 2015 and 162,000 in 2014. Historically, employment in temporary help services has been considered a leading indicator for total nonfarm employment. (See figure 5.)

| Date | Total nonfarm | Temporary help services |

|---|---|---|

| Jan 90 | 109,185 | 1,156.3 |

| Feb 90 | 109,433 | 1,163.1 |

| Mar 90 | 109,648 | 1,168.8 |

| Apr 90 | 109,687 | 1,162.4 |

| May 90 | 109,839 | 1,161.6 |

| Jun 90 | 109,861 | 1,163.5 |

| Jul 90 | 109,830 | 1,164.9 |

| Aug 90 | 109,614 | 1,158.9 |

| Sep 90 | 109,524 | 1,163.4 |

| Oct 90 | 109,364 | 1,141.3 |

| Nov 90 | 109,215 | 1,135.6 |

| Dec 90 | 109,159 | 1,128.6 |

| Jan 91 | 109,042 | 1,140.9 |

| Feb 91 | 108,736 | 1,125.0 |

| Mar 91 | 108,578 | 1,115.5 |

| Apr 91 | 108,366 | 1,111.8 |

| May 91 | 108,243 | 1,109.4 |

| Jun 91 | 108,337 | 1,112.9 |

| Jul 91 | 108,298 | 1,109.9 |

| Aug 91 | 108,308 | 1,120.8 |

| Sep 91 | 108,340 | 1,129.7 |

| Oct 91 | 108,355 | 1,132.8 |

| Nov 91 | 108,298 | 1,133.5 |

| Dec 91 | 108,324 | 1,141.7 |

| Jan 92 | 108,375 | 1,150.6 |

| Feb 92 | 108,314 | 1,157.3 |

| Mar 92 | 108,369 | 1,169.9 |

| Apr 92 | 108,527 | 1,183.1 |

| May 92 | 108,654 | 1,198.5 |

| Jun 92 | 108,719 | 1,207.7 |

| Jul 92 | 108,792 | 1,212.5 |

| Aug 92 | 108,930 | 1,222.8 |

| Sep 92 | 108,966 | 1,230.3 |

| Oct 92 | 109,147 | 1,248.9 |

| Nov 92 | 109,283 | 1,263.6 |

| Dec 92 | 109,494 | 1,285.4 |

| Jan 93 | 109,804 | 1,295.8 |

| Feb 93 | 110,047 | 1,304.7 |

| Mar 93 | 109,998 | 1,318.2 |

| Apr 93 | 110,306 | 1,341.7 |

| May 93 | 110,573 | 1,363.8 |

| Jun 93 | 110,752 | 1,378.7 |

| Jul 93 | 111,054 | 1,398.9 |

| Aug 93 | 111,212 | 1,411.6 |

| Sep 93 | 111,453 | 1,427.6 |

| Oct 93 | 111,736 | 1,463.2 |

| Nov 93 | 111,999 | 1,466.9 |

| Dec 93 | 112,315 | 1,483.2 |

| Jan 94 | 112,587 | 1,499.9 |

| Feb 94 | 112,783 | 1,527.8 |

| Mar 94 | 113,247 | 1,566.6 |

| Apr 94 | 113,597 | 1,594.1 |

| May 94 | 113,931 | 1,601.1 |

| Jun 94 | 114,245 | 1,628.7 |

| Jul 94 | 114,619 | 1,653.1 |

| Aug 94 | 114,902 | 1,664.5 |

| Sep 94 | 115,256 | 1,685.5 |

| Oct 94 | 115,465 | 1,696.2 |

| Nov 94 | 115,886 | 1,716.0 |

| Dec 94 | 116,166 | 1,719.6 |

| Jan 95 | 116,492 | 1,735.3 |

| Feb 95 | 116,693 | 1,743.9 |

| Mar 95 | 116,912 | 1,736.5 |

| Apr 95 | 117,075 | 1,728.3 |

| May 95 | 117,059 | 1,719.6 |

| Jun 95 | 117,293 | 1,716.9 |

| Jul 95 | 117,389 | 1,716.0 |

| Aug 95 | 117,644 | 1,739.7 |

| Sep 95 | 117,888 | 1,775.7 |

| Oct 95 | 118,039 | 1,773.1 |

| Nov 95 | 118,188 | 1,773.6 |

| Dec 95 | 118,322 | 1,778.6 |

| Jan 96 | 118,307 | 1,745.2 |

| Feb 96 | 118,736 | 1,790.0 |

| Mar 96 | 119,001 | 1,794.8 |

| Apr 96 | 119,165 | 1,811.4 |

| May 96 | 119,488 | 1,829.4 |

| Jun 96 | 119,773 | 1,849.6 |

| Jul 96 | 120,023 | 1,865.7 |

| Aug 96 | 120,203 | 1,884.3 |

| Sep 96 | 120,427 | 1,890.6 |

| Oct 96 | 120,676 | 1,878.6 |

| Nov 96 | 120,975 | 1,910.6 |

| Dec 96 | 121,146 | 1,927.8 |

| Jan 97 | 121,379 | 1,949.2 |

| Feb 97 | 121,684 | 1,974.2 |

| Mar 97 | 121,999 | 2,004.2 |

| Apr 97 | 122,291 | 2,026.3 |

| May 97 | 122,552 | 2,045.8 |

| Jun 97 | 122,818 | 2,057.1 |

| Jul 97 | 123,124 | 2,084.6 |

| Aug 97 | 123,093 | 2,066.4 |

| Sep 97 | 123,604 | 2,082.6 |

| Oct 97 | 123,946 | 2,106.6 |

| Nov 97 | 124,250 | 2,138.6 |

| Dec 97 | 124,554 | 2,165.0 |

| Jan 98 | 124,828 | 2,178.0 |

| Feb 98 | 125,027 | 2,191.2 |

| Mar 98 | 125,176 | 2,193.2 |

| Apr 98 | 125,456 | 2,202.8 |

| May 98 | 125,860 | 2,222.5 |

| Jun 98 | 126,080 | 2,248.4 |

| Jul 98 | 126,209 | 2,247.6 |

| Aug 98 | 126,551 | 2,266.2 |

| Sep 98 | 126,773 | 2,242.9 |

| Oct 98 | 126,974 | 2,280.6 |

| Nov 98 | 127,254 | 2,307.2 |

| Dec 98 | 127,601 | 2,334.8 |

| Jan 99 | 127,727 | 2,357.1 |

| Feb 99 | 128,136 | 2,387.4 |

| Mar 99 | 128,244 | 2,403.8 |

| Apr 99 | 128,618 | 2,422.8 |

| May 99 | 128,830 | 2,438.8 |

| Jun 99 | 129,093 | 2,450.7 |

| Jul 99 | 129,414 | 2,479.0 |

| Aug 99 | 129,576 | 2,481.3 |

| Sep 99 | 129,792 | 2,474.3 |

| Oct 99 | 130,189 | 2,550.2 |

| Nov 99 | 130,482 | 2,573.0 |

| Dec 99 | 130,781 | 2,605.4 |

| Jan 00 | 131,009 | 2,618.9 |

| Feb 00 | 131,140 | 2,623.1 |

| Mar 00 | 131,608 | 2,643.6 |

| Apr 00 | 131,895 | 2,675.9 |

| May 00 | 132,121 | 2,649.2 |

| Jun 00 | 132,077 | 2,647.7 |

| Jul 00 | 132,253 | 2,654.2 |

| Aug 00 | 132,240 | 2,639.7 |

| Sep 00 | 132,375 | 2,645.4 |

| Oct 00 | 132,361 | 2,629.6 |

| Nov 00 | 132,589 | 2,637.7 |

| Dec 00 | 132,731 | 2,587.8 |

| Jan 01 | 132,706 | 2,564.0 |

| Feb 01 | 132,778 | 2,527.4 |

| Mar 01 | 132,751 | 2,482.4 |

| Apr 01 | 132,471 | 2,397.6 |

| May 01 | 132,432 | 2,379.9 |

| Jun 01 | 132,302 | 2,337.0 |

| Jul 01 | 132,191 | 2,323.7 |

| Aug 01 | 132,035 | 2,296.8 |

| Sep 01 | 131,794 | 2,252.1 |

| Oct 01 | 131,467 | 2,214.9 |

| Nov 01 | 131,176 | 2,157.9 |

| Dec 01 | 131,004 | 2,144.9 |

| Jan 02 | 130,869 | 2,148.4 |

| Feb 02 | 130,733 | 2,161.0 |

| Mar 02 | 130,712 | 2,188.7 |

| Apr 02 | 130,634 | 2,212.7 |

| May 02 | 130,629 | 2,218.1 |

| Jun 02 | 130,685 | 2,220.9 |

| Jul 02 | 130,601 | 2,202.2 |

| Aug 02 | 130,587 | 2,232.2 |

| Sep 02 | 130,527 | 2,200.3 |

| Oct 02 | 130,649 | 2,196.4 |

| Nov 02 | 130,662 | 2,183.3 |

| Dec 02 | 130,504 | 2,173.9 |

| Jan 03 | 130,596 | 2,191.9 |

| Feb 03 | 130,447 | 2,177.5 |

| Mar 03 | 130,238 | 2,168.2 |

| Apr 03 | 130,194 | 2,140.0 |

| May 03 | 130,187 | 2,182.0 |

| Jun 03 | 130,197 | 2,211.5 |

| Jul 03 | 130,219 | 2,262.6 |

| Aug 03 | 130,178 | 2,248.5 |

| Sep 03 | 130,282 | 2,256.3 |

| Oct 03 | 130,485 | 2,266.1 |

| Nov 03 | 130,496 | 2,276.5 |

| Dec 03 | 130,619 | 2,299.6 |

| Jan 04 | 130,778 | 2,290.5 |

| Feb 04 | 130,826 | 2,302.6 |

| Mar 04 | 131,157 | 2,314.0 |

| Apr 04 | 131,408 | 2,346.2 |

| May 04 | 131,715 | 2,378.5 |

| Jun 04 | 131,792 | 2,376.7 |

| Jul 04 | 131,837 | 2,394.7 |

| Aug 04 | 131,956 | 2,408.8 |

| Sep 04 | 132,118 | 2,418.1 |

| Oct 04 | 132,464 | 2,473.5 |

| Nov 04 | 132,530 | 2,456.0 |

| Dec 04 | 132,659 | 2,445.1 |

| Jan 05 | 132,795 | 2,458.6 |

| Feb 05 | 133,034 | 2,479.5 |

| Mar 05 | 133,169 | 2,492.0 |

| Apr 05 | 133,533 | 2,506.9 |

| May 05 | 133,710 | 2,505.3 |

| Jun 05 | 133,955 | 2,530.6 |

| Jul 05 | 134,329 | 2,550.4 |

| Aug 05 | 134,525 | 2,567.3 |

| Sep 05 | 134,592 | 2,604.0 |

| Oct 05 | 134,676 | 2,612.2 |

| Nov 05 | 135,017 | 2,636.6 |

| Dec 05 | 135,174 | 2,634.0 |

| Jan 06 | 135,452 | 2,621.4 |

| Feb 06 | 135,767 | 2,631.0 |

| Mar 06 | 136,049 | 2,632.9 |

| Apr 06 | 136,232 | 2,634.2 |

| May 06 | 136,257 | 2,649.6 |

| Jun 06 | 136,336 | 2,648.7 |

| Jul 06 | 136,542 | 2,647.9 |

| Aug 06 | 136,725 | 2,657.4 |

| Sep 06 | 136,878 | 2,648.2 |

| Oct 06 | 136,886 | 2,638.8 |

| Nov 06 | 137,095 | 2,636.5 |

| Dec 06 | 137,266 | 2,643.1 |

| Jan 07 | 137,506 | 2,647.2 |

| Feb 07 | 137,595 | 2,641.9 |

| Mar 07 | 137,785 | 2,636.4 |

| Apr 07 | 137,865 | 2,627.7 |

| May 07 | 138,008 | 2,608.8 |

| Jun 07 | 138,083 | 2,605.4 |

| Jul 07 | 138,049 | 2,596.1 |

| Aug 07 | 138,029 | 2,586.0 |

| Sep 07 | 138,117 | 2,566.6 |

| Oct 07 | 138,201 | 2,573.1 |

| Nov 07 | 138,315 | 2,566.9 |

| Dec 07 | 138,413 | 2,552.5 |

| Jan 08 | 138,430 | 2,542.9 |

| Feb 08 | 138,346 | 2,505.3 |

| Mar 08 | 138,268 | 2,479.9 |

| Apr 08 | 138,058 | 2,466.0 |

| May 08 | 137,872 | 2,434.1 |

| Jun 08 | 137,710 | 2,402.5 |

| Jul 08 | 137,497 | 2,372.0 |

| Aug 08 | 137,230 | 2,338.0 |

| Sep 08 | 136,780 | 2,312.7 |

| Oct 08 | 136,306 | 2,239.1 |

| Nov 08 | 135,540 | 2,119.5 |

| Dec 08 | 134,846 | 2,045.5 |

| Jan 09 | 134,053 | 1,961.0 |

| Feb 09 | 133,351 | 1,913.8 |

| Mar 09 | 132,528 | 1,855.5 |

| Apr 09 | 131,841 | 1,795.8 |

| May 09 | 131,492 | 1,773.4 |

| Jun 09 | 131,021 | 1,751.7 |

| Jul 09 | 130,692 | 1,749.2 |

| Aug 09 | 130,479 | 1,747.4 |

| Sep 09 | 130,259 | 1,768.7 |

| Oct 09 | 130,055 | 1,791.5 |

| Nov 09 | 130,053 | 1,849.8 |

| Dec 09 | 129,778 | 1,894.2 |

| Jan 10 | 129,801 | 1,952.4 |

| Feb 10 | 129,733 | 1,974.9 |

| Mar 10 | 129,897 | 2,002.6 |

| Apr 10 | 130,140 | 2,031.9 |

| May 10 | 130,664 | 2,064.3 |

| Jun 10 | 130,527 | 2,092.5 |

| Jul 10 | 130,459 | 2,079.1 |

| Aug 10 | 130,423 | 2,117.6 |

| Sep 10 | 130,371 | 2,138.7 |

| Oct 10 | 130,633 | 2,175.5 |

| Nov 10 | 130,752 | 2,201.4 |

| Dec 10 | 130,839 | 2,247.2 |

| Jan 11 | 130,882 | 2,239.8 |

| Feb 11 | 131,071 | 2,260.2 |

| Mar 11 | 131,296 | 2,293.6 |

| Apr 11 | 131,642 | 2,299.2 |

| May 11 | 131,719 | 2,292.5 |

| Jun 11 | 131,944 | 2,285.4 |

| Jul 11 | 132,013 | 2,278.6 |

| Aug 11 | 132,123 | 2,316.2 |

| Sep 11 | 132,371 | 2,343.6 |

| Oct 11 | 132,580 | 2,365.6 |

| Nov 11 | 132,721 | 2,378.5 |

| Dec 11 | 132,930 | 2,390.9 |

| Jan 12 | 133,288 | 2,425.2 |

| Feb 12 | 133,525 | 2,464.8 |

| Mar 12 | 133,758 | 2,457.3 |

| Apr 12 | 133,836 | 2,466.8 |

| May 12 | 133,951 | 2,484.1 |

| Jun 12 | 134,027 | 2,508.7 |

| Jul 12 | 134,170 | 2,523.3 |

| Aug 12 | 134,347 | 2,523.5 |

| Sep 12 | 134,550 | 2,505.9 |

| Oct 12 | 134,696 | 2,522.0 |

| Nov 12 | 134,828 | 2,529.2 |

| Dec 12 | 135,072 | 2,532.5 |

| Jan 13 | 135,283 | 2,544.9 |

| Feb 13 | 135,569 | 2,563.0 |

| Mar 13 | 135,699 | 2,580.4 |

| Apr 13 | 135,896 | 2,596.0 |

| May 13 | 136,122 | 2,611.5 |

| Jun 13 | 136,284 | 2,623.4 |

| Jul 13 | 136,406 | 2,632.7 |

| Aug 13 | 136,667 | 2,640.8 |

| Sep 13 | 136,857 | 2,654.7 |

| Oct 13 | 137,069 | 2,647.9 |

| Nov 13 | 137,327 | 2,652.4 |

| Dec 13 | 137,374 | 2,671.5 |

| Jan 14 | 137,564 | 2,681.9 |

| Feb 14 | 137,715 | 2,702.7 |

| Mar 14 | 137,987 | 2,715.9 |

| Apr 14 | 138,316 | 2,726.1 |

| May 14 | 138,562 | 2,737.8 |

| Jun 14 | 138,866 | 2,751.4 |

| Jul 14 | 139,068 | 2,767.6 |

| Aug 14 | 139,298 | 2,787.4 |

| Sep 14 | 139,578 | 2,799.5 |

| Oct 14 | 139,805 | 2,808.4 |

| Nov 14 | 140,117 | 2,822.3 |

| Dec 14 | 140,372 | 2,833.5 |

| Jan 15 | 140,606 | 2,838.5 |

| Feb 15 | 140,844 | 2,834.7 |

| Mar 15 | 140,930 | 2,843.1 |

| Apr 15 | 141,192 | 2,853.6 |

| May 15 | 141,536 | 2,871.2 |

| Jun 15 | 141,742 | 2,886.3 |

| Jul 15 | 141,996 | 2,881.8 |

| Aug 15 | 142,153 | 2,887.4 |

| Sep 15 | 142,253 | 2,873.5 |

| Oct 15 | 142,574 | 2,900.8 |

| Nov 15 | 142,846 | 2,905.3 |

| Dec 15 | 143,085 | 2,930.1 |

| Jan 16 | 143,211 | 2,886.9 |

| Feb 16 | 143,448 | 2,880.2 |

| Mar 16 | 143,673 | 2,885.9 |

| Apr 16 | 143,826 | 2,892.9 |

| May 16 | 143,869 | 2,875.8 |

| Jun 16 | 144,166 | 2,894.0 |

| Jul 16 | 144,457 | 2,910.4 |

| Aug 16 | 144,633 | 2,911.4 |

| Sep 16 | 144,882 | 2,940.9 |

| Oct 16 | 145,006 | 2,953.5 |

| Nov 16 | 145,170 | 2,979.0 |

| Dec 16 | 145,325 | 2,961.6 |

| Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | ||

In 2016, professional and technical services outpaced job gains of recent years. This industry added 301,000 jobs in 2016, up from 252,000 in 2015 and 277,000 in 2014. Within professional and technical services, employment in computer systems design and related services and in management and technical consulting services continued to grow in 2016. Overall, the continued employment growth in professional and technical services counteracted some of the sluggishness in temporary help services.

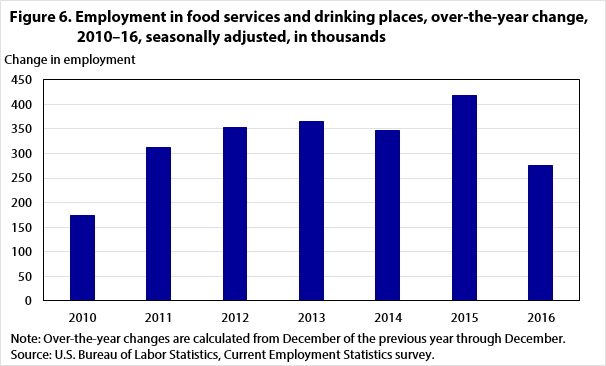

In 2016, leisure and hospitality employment grew at a slower pace than in 2015, adding 331,000 jobs in 2016, down from 517,000 in 2015. In fact, in 2016, the leisure and hospitality industry experienced the smallest over-the-year increase in employment since 2010.

Food services and drinking places, the largest component of leisure and hospitality, was the main cause of the employment slowdown because 2016 was the weakest year for food services and drinking places employment since 2010—immediately after the recession.6 (See figure 6.) The slowdown in employment in food services and drinking places coincides with a slowdown in restaurant openings. Food services firms are scaling back their business plans after overexpanding in previous years.7 Food services sales grew by just 2.5 percent in 2016 versus 7.5 percent in 2015 and 8.9 percent in 2014.8

| Date | Employment change |

|---|---|

| 2010 | 174.8 |

| 2011 | 311.9 |

| 2012 | 352.5 |

| 2013 | 365.0 |

| 2014 | 347.0 |

| 2015 | 416.9 |

| 2016 | 276.3 |

| Note: Over-the-year changes are calculated from December of the previous year through December. Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | |

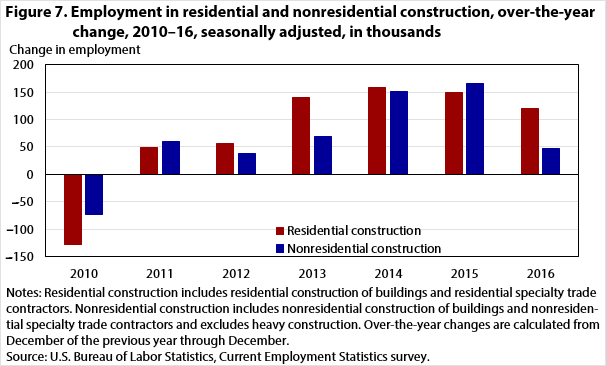

Construction employment growth was weaker in 2016 than in 2015, adding only 155,000 jobs, compared with 336,000 in 2015. Construction of buildings industries added 45,000 jobs in 2016 compared with 69,000 in 2015, its weakest annual growth since 2012. Specialty trade contractors also saw its weakest growth since 2012, adding 124,000 jobs in 2016 versus the previous year’s increase of 244,000.

| Date | Residential construction | Nonresidential construction |

|---|---|---|

| 2010 | –128 | –73 |

| 2011 | 49 | 60 |

| 2012 | 57 | 38 |

| 2013 | 141 | 69 |

| 2014 | 158 | 151 |

| 2015 | 149 | 165 |

| 2016 | 121 | 48 |

| Notes: Residential construction includes residential construction of buildings and residential specialty trade contractors. Nonresidential construction includes nonresidential construction of buildings and nonresidential specialty trade contractors and excludes heavy construction. Over-the-year changes are calculated from December of the previous year through December. Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | ||

Combining the residential construction and nonresidential construction employment series and comparing them can be helpful in analyzing trends in construction.9 Since 2012, job growth in construction has mostly been concentrated in residential construction industries. (See figure 7.) In residential construction, employment grew by 121,000 in 2016. In the prior 2 years, employment growth in residential construction had averaged 153,000 a year. In nonresidential construction, employment grew by 48,000 in 2016, compared with an average of 158,000 a year in the prior 2 years.

Retail trade employment grew by 203,000 in 2016, up from an increase of 186,000 in 2015. Several industries within retail trade experienced stronger employment gains than in 2015, including general merchandise stores, food and beverage stores, furniture and home furnishings stores, and building material and garden supply stores.

General merchandise stores (mainly other general merchandise stores) was the largest contributor to these job gains, adding 37,000 jobs. Strong employment gains also occurred in food and beverage stores, which added 37,000 jobs in 2016—exceeding the 10,000 in 2015.

Furniture and home furnishing stores, as well as building and garden supply stores, also had stronger job growth in 2016 versus 2015. The strengthening housing market may help explain the kind of strength that these two industries demonstrated throughout the year.10

Employment growth in motor vehicle and parts dealers decelerated in 2016, adding 41,000 jobs in 2016 versus 68,000 in 2015 and 69,000 in 2014. The recent slowing of employment gains in motor vehicle and parts dealers coincides with a slowdown in motor vehicle and parts manufacturing employment during 2016.

Clothing and clothing accessories stores have been experiencing weakness since 2013. Some retailers have been reluctant to increase hiring and are shutting down brick-and-mortar stores as growth in e-commerce continues.11 The nonstore retailers industry, which includes e-commerce, added 20,000 jobs during 2016, a growth rate of 3.8 percent, which is weaker than previous year’s growth rate of 5.3 percent. E-commerce sales grew 14.3 percent from the 4th quarter of 2015 to the 4th quarter of 2016. By the 4th quarter of 2016, e-commerce sales had grown to 8.3 percent of total retail sales.12

Financial activities added 176,000 jobs in 2016, compared with 146,000 in 2015, because of the strength in credit intermediation and related services, insurance carriers and related activities, and real estate.

Within credit intermediation, the industry of activities related to credit intermediation, which includes mortgage and nonmortgage loan brokers, was the standout performer. Employment in this industry was up 4.6 percent in 2016, marking its strongest year since 2012. Commercial banking, the largest industry within credit intermediation, flattened out over 2015 and 2016. Legal problems, regulation, flattened revenues, and the migration of mortgage business to nonbank financial entities have helped depress employment in commercial banking since the financial crisis of 2008.13

Real estate employment saw its best year of employment growth since before the 2007–09 recession, growing by 3.4 percent. Historically low mortgage rates in 2016 helped spur housing market activity, which may have supported stronger employment in real estate-related industries despite rising housing prices.14

Government added 201,000 jobs in 2016, up from an increase of 152,000 in 2015. This 2016 increase was mainly due to job gains in local government, which added 160,000 jobs, well above the 89,000 gain in 2015.

Local government, excluding education, had a strong year in 2016, adding 90,000 jobs.15 Local government, excluding education, has driven job gains in government over the past few years. In 2016, it accounted for almost half the employment gains in government overall.

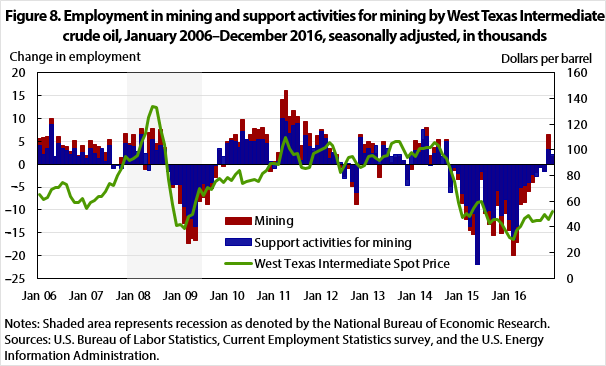

Employment losses in mining, the major component industry within mining and logging, continued through 2016, but at a slower pace than in 2015. Mining lost roughly 6,000 jobs a month in 2016 compared with 13,000 jobs a month in 2015. In both years, most job losses were located within support activities for mining.

The moderation of job losses in mining over the year can largely be explained by a stabilization of oil prices between $40 and $50 a barrel, which may have driven a slowdown in oil rig shutdowns during 2016.16 (See figure 8.) Employment losses in mining may have also curtailed orders for heavy mining equipment, negatively affecting employment in oil- and gas-related machinery manufacturing industries.

| Date | West Texas Intermediate Spot Price | Mining | Support activities for mining |

|---|---|---|---|

| Jan 2006 | 65.49 | 5.7 | 4.0 |

| Feb 2006 | 61.63 | 5.8 | 2.2 |

| Mar 2006 | 62.69 | 6.1 | 3.5 |

| Apr 2006 | 69.44 | 10.0 | 8.6 |

| May 2006 | 70.84 | 1.4 | 1.7 |

| Jun 2006 | 70.95 | 6.0 | 4.5 |

| Jul 2006 | 74.41 | 4.2 | 3.5 |

| Aug 2006 | 73.04 | 3.8 | 2.9 |

| Sep 2006 | 63.80 | 2.7 | 2.1 |

| Oct 2006 | 58.89 | 5.2 | 3.5 |

| Nov 2006 | 59.08 | 1.9 | 1.7 |

| Dec 2006 | 61.96 | 4.1 | 2.6 |

| Jan 2007 | 54.51 | 1.9 | 1.3 |

| Feb 2007 | 59.28 | 5.1 | 3.4 |

| Mar 2007 | 60.44 | 4.4 | 2.3 |

| Apr 2007 | 63.98 | 3.8 | 1.3 |

| May 2007 | 63.46 | 3.3 | 3.4 |

| Jun 2007 | 67.49 | 2.6 | 0.6 |

| Jul 2007 | 74.12 | 5.5 | 4.1 |

| Aug 2007 | 72.36 | –0.7 | –0.9 |

| Sep 2007 | 79.92 | –0.2 | –0.1 |

| Oct 2007 | 85.80 | 1.5 | –1.0 |

| Nov 2007 | 94.77 | 6.8 | 4.6 |

| Dec 2007 | 91.69 | 4.6 | 4.1 |

| Jan 2008 | 92.97 | 6.5 | 3.8 |

| Feb 2008 | 95.39 | 2.0 | 2.7 |

| Mar 2008 | 105.45 | 7.8 | 6.4 |

| Apr 2008 | 112.58 | –1.1 | 2.3 |

| May 2008 | 125.40 | 6.9 | –1.3 |

| Jun 2008 | 133.88 | 7.8 | 5.5 |

| Jul 2008 | 133.37 | 4.5 | 3.1 |

| Aug 2008 | 116.67 | 7.7 | 4.1 |

| Sep 2008 | 104.11 | 3.6 | 3.2 |

| Oct 2008 | 76.61 | –1.1 | –1.7 |

| Nov 2008 | 57.31 | –5.0 | –4.4 |

| Dec 2008 | 41.12 | –4.5 | –4.4 |

| Jan 2009 | 41.71 | –8.5 | –4.5 |

| Feb 2009 | 39.09 | –13.0 | –9.2 |

| Mar 2009 | 47.94 | –17.4 | –11.3 |

| Apr 2009 | 49.65 | –16.2 | –11.8 |

| May 2009 | 59.03 | –16.8 | –13.6 |

| Jun 2009 | 69.64 | –8.1 | –5.4 |

| Jul 2009 | 64.15 | –7.4 | –4.2 |

| Aug 2009 | 71.05 | –8.9 | –5.4 |

| Sep 2009 | 69.41 | –5.3 | –4.0 |

| Oct 2009 | 75.72 | –2.9 | –0.2 |

| Nov–2009 | 77.99 | 3.1 | 3.4 |

| Dec 2009 | 74.47 | –0.4 | 1.6 |

| Jan 2010 | 78.33 | 5.0 | 4.6 |

| Feb 2010 | 76.39 | 5.7 | 5.1 |

| Mar 2010 | 81.20 | 6.4 | 4.9 |

| Apr 2010 | 84.29 | 4.7 | 3.6 |

| May 2010 | 73.74 | 9.8 | 7.1 |

| Jun 2010 | 75.34 | 5.2 | 5.3 |

| Jul 2010 | 76.32 | 6.6 | 4.9 |

| Aug 2010 | 76.6 | 7.9 | 4.9 |

| Sep 2010 | 75.24 | 7.7 | 5.4 |

| Oct 2010 | 81.89 | 8.0 | 5.5 |

| Nov 2010 | 84.25 | 6.4 | 4.6 |

| Dec 2010 | 89.15 | –1.7 | 0.7 |

| Jan 2011 | 89.17 | 0.7 | –1.0 |

| Feb 2011 | 88.58 | 2.5 | 0.6 |

| Mar 2011 | 102.86 | 14.2 | 9.9 |

| Apr 2011 | 109.53 | 16.2 | 9.3 |

| May 2011 | 100.90 | 10.5 | 6.7 |

| Jun 2011 | 96.26 | 11.8 | 8.5 |

| Jul 2011 | 97.30 | 10.5 | 8.9 |

| Aug 2011 | 86.33 | 4.0 | 0.9 |

| Sep 2011 | 85.52 | 9.3 | 6.3 |

| Oct 2011 | 86.32 | 6.8 | 3.8 |

| Nov 2011 | 97.16 | 2.8 | 3.5 |

| Dec 2011 | 98.56 | 6.3 | 4.1 |

| Jan 2012 | 100.27 | 7.7 | 7.1 |

| Feb 2012 | 102.20 | 6.4 | 5.6 |

| Mar 2012 | 106.16 | 3.5 | 1.2 |

| Apr 2012 | 103.32 | 2.5 | 2.6 |

| May 2012 | 94.66 | 2.2 | 1.5 |

| Jun 2012 | 82.30 | –0.7 | 0.3 |

| Jul 2012 | 87.90 | –2.8 | –3.1 |

| Aug 2012 | 94.13 | –1.0 | 0.1 |

| Sep 2012 | 94.51 | –4.8 | –3.8 |

| Oct 2012 | 89.49 | –8.9 | –6.1 |

| Nov 2012 | 86.53 | 6.6 | 5.8 |

| Dec 2012 | 87.86 | 4.3 | 2.4 |

| Jan 2013 | 94.76 | 5.0 | 3.4 |

| Feb 2013 | 95.31 | 4.5 | 2.4 |

| Mar 2013 | 92.94 | 2.4 | 4.0 |

| Apr 2013 | 92.02 | –2.9 | 1.0 |

| May 2013 | 94.51 | 4.9 | 4.2 |

| Jun 2013 | 95.77 | 2.2 | 3.5 |

| Jul 2013 | 104.67 | 0.3 | 1.7 |

| Aug 2013 | 106.57 | 1.5 | 2.1 |

| Sep 2013 | 106.29 | 1.7 | 2.1 |

| Oct 2013 | 100.54 | 0.9 | 0.9 |

| Nov 2013 | 93.86 | –3.3 | –4.7 |

| Dec 2013 | 97.63 | –1.2 | 2.1 |

| Jan 2014 | 94.62 | 5.2 | 3.1 |

| Feb 2014 | 100.82 | 4.5 | 2.6 |

| Mar 2014 | 100.80 | 5.3 | 7.6 |

| Apr 2014 | 102.07 | 8.0 | 6.0 |

| May 2014 | 102.18 | 1.8 | –0.1 |

| Jun 2014 | 105.79 | 3.7 | 2.3 |

| Jul 2014 | 103.59 | 5.5 | 3.6 |

| Aug 2014 | 96.54 | 0.0 | 1.6 |

| Sep 2014 | 93.21 | 5.4 | 5.0 |

| Oct 2014 | 84.40 | –4.8 | –6.2 |

| Nov 2014 | 75.79 | –1.4 | –0.8 |

| Dec 2014 | 59.29 | –3.4 | –2.0 |

| Jan 2015 | 47.22 | –8.7 | –6.4 |

| Feb 2015 | 50.58 | –12.2 | –9.1 |

| Mar 2015 | 47.82 | –14.5 | –13.7 |

| Apr 2015 | 54.45 | –15.5 | –10.8 |

| May 2015 | 59.27 | –21.9 | –21.9 |

| Jun 2015 | 59.82 | –3.4 | –1.7 |

| Jul 2015 | 50.90 | –10.9 | –10.4 |

| Aug 2015 | 42.87 | –13.2 | –10.2 |

| Sep 2015 | 45.48 | –15.6 | –12.0 |

| Oct 2015 | 46.22 | –9.1 | –5.7 |

| Nov 2015 | 42.44 | –15.1 | –11.3 |

| Dec 2015 | 37.19 | –10.7 | –7.7 |

| Jan 2016 | 31.68 | –14.5 | –12.2 |

| Feb 2016 | 30.32 | –20.0 | –16.5 |

| Mar 2016 | 37.55 | –17.1 | –13.6 |

| Apr 2016 | 40.75 | –8.8 | –5.2 |

| May 2016 | 46.71 | –8.4 | –4.7 |

| Jun 2016 | 48.76 | –6.0 | –4.0 |

| Jul 2016 | 44.65 | –4.0 | –2.2 |

| Aug 2016 | 44.72 | –1.8 | –2.6 |

| Sep 2016 | 45.18 | –0.6 | –0.7 |

| Oct 2016 | 49.78 | –1.6 | –1.7 |

| Nov 2016 | 45.66 | 6.5 | 3.2 |

| Dec 2016 | 51.97 | 1.7 | 2.2 |

| Sources: U.S. Bureau of Labor Statistics, Current Employment Statistics survey, and the U.S. Energy Information Administration. | |||

| Date | Manufacturing | Motor vehicles and parts manufacturing |

|---|---|---|

| 2010 | 120 | 39 |

| 2011 | 207 | 48 |

| 2012 | 158 | 56 |

| 2013 | 123 | 56 |

| 2014 | 208 | 40 |

| 2015 | 68 | 33 |

| 2016 | –16 | 17 |

| Note: Over-the-year changes are calculated from December of the previous year through December. Source: U.S. Bureau of Labor Statistics, Current Employment Statistics survey. | ||

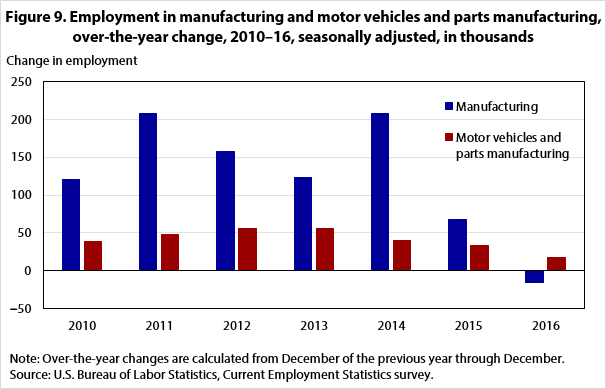

Employment in manufacturing, after increasing by 68,000 in 2015, was essentially flat over the year (–16,000), marking the weakest year for manufacturing employment since the Great Recession. (See figure 9.) Weakness in manufacturing employment occurred throughout the component industries, but the largest declines came in machinery, which lost 23,000 jobs, and in fabricated metal products, which lost 18,000. Employment losses in machinery, which includes mining and oil and gas field machinery, coincide with lower oil prices and the continued decline of mining employment.

Motor vehicles and parts manufacturing employment slowed in 2016, gaining only 17,000 jobs compared with a gain of 33,000 in 2015. Food manufacturing added the most jobs within manufacturing, adding 38,000 jobs over the year.

Despite decelerated employment growth across many industries, total nonfarm employment continued to expand in 2016—adding over 2.2 million jobs. Goods-producing industries continued to struggle, but service-providing industries, notably in education and health services and in professional and business services, continued to add jobs over the year. Smaller, but still substantial, job growth in several other industries, such as retail trade and leisure and hospitality, also contributed to make 2016 a positive one for job growth. Overall, 2016 was a year of decelerating but consistent job growth.

Michael Calvillo, "Employment expansion continues but at a slower pace," Monthly Labor Review, U.S. Bureau of Labor Statistics, April 2017, https://doi.org/10.21916/mlr.2017.12

1 For Current Employment Statistics (CES) program definitions of employment peak, trough, recovery, and expansion, see “CES peak–trough tables,” Current Employment Statistics—CES (national) (U.S. Bureau of Labor Statistics, December 10, 2012), https://www.bls.gov/ces/tables/peak-trough.htm.

2 The CES program, which provides detailed industry data on employment, hours, and earnings of workers on nonfarm payrolls, is a monthly survey of about 147,000 businesses and government agencies representing approximately 634,000 individual worksites. For more information on the program’s concepts and methodology, see “Technical notes for the Current Employment Statistics survey,” Current Employment Statistics—CES (national) (U.S. Bureau of Labor Statistics, February 8, 2016), https://www.bls.gov/web/empsit/cestn.htm. To access CES data, see https://www.bls.gov/ces/. The CES data are seasonally adjusted unless otherwise noted. Over-the-year changes are calculated from December of the previous year through December of the reference year.

3 The Current Employment Statistics program dates back to 1915, with total nonfarm employment data beginning in 1939. For more information on the history of the CES survey, see “One hundred years of Current Employment Statistics—an overview of survey advancements,” Monthly Labor Review, August 2016, https://www.bls.gov/opub/mlr/2016/article/one-hundred-years-of-current-employment-statistics-an-overview-of-survey- advancements.htm.

4 “Annual trade highlights,” Foreign Trade (U.S. Census Bureau, 2016 press highlights), https://www.census.gov/foreign-trade/statistics/highlights/annual.html.

5 For more information on increased hospital employment, see “American Hospital Association uncompensated hospital care cost fact sheet, American Hospital Association,” January 2016; and “Hospital merger and acquisition activity expands in first half of 2016, according to Kaufman Hall analysis,” Health IT Outcomes, July 25, 2016, http://www.healthitoutcomes.com/doc/hospital-merger-acquisition-activity-expands-according-kaufman-hall-analysis-0001.

6 The recession occurred from December 2007 to June 2009, as denoted by the National Bureau of Economic Research.

7 Julie Jargon and Lillian Rizzo, “Restaurant chains get burned by overexpansion, new rivals,” The Wall Street Journal, October 16, 2016.

8 “Monthly retail trade report,” Monthly & Annual Retail Trade (U.S. Census Bureau, December 2016), https://www.census.gov/retail/index.html.

9 Residential construction industry consists of the residential construction of buildings industry and residential specialty trade contractors industry. Nonresidential construction consists of residential construction of buildings industry and nonresidential specialty trade contractors industry.

10 Paul R. La Monica, “Layoffs in aisle 4! Retailers are big job killers,” CNN Money, June 8, 2016.

11 Miriam Gottfried, “Retailers need to close some doors to survive,” The Wall Street Journal, June 17, 2016.

12 “Latest quarterly e-commerce report,” Monthly & Annual Retail Trade (U.S. Census Bureau, February 17, 2017), https://www.census.gov/retail/index.html.

13 Ben McLannahan and Alistair Gray, “Big U.S. bank revenue growth is flat as a pancake,” Financial Times, January 20, 2016; Andrea Riquier, “Big banks are fleeing the mortgage market,” MarketWatch, February 12, 2016; and Michele Lerner, “The mortgage market is now dominated by non-bank lenders,” The Wall Street Journal, February 23, 2016.

14 “After housing’s best year in a decade, what’s next?” FreddieMac, December 21, 2016, http://www.freddiemac.com/finance/report/20161221_whats_next.html.

15 Local government, excluding education, includes noneducation administrative agencies of town, city, and county government.

16 Aikin Oyedele, “U.S. oil rig count rises for 9th straight week to the highest level in a year,” Business Insider, December 30, 2016.