An official website of the United States government

United States Department of Labor

United States Department of Labor

From food stores to lumber yards, from courier services to water supply systems, the trade, transportation, and utilities industries make up a large portion of private sector employment in the United States. These industries employ 25.6 million workers: 14.9 million in retail trade, 5.6 million in wholesale trade, 4.4 million in transportation and warehousing, and 0.6 million in the utilities industries.1

Establishments involved in the trade, transportation, and utilities industries engage in a wide range of industrial activities. Retail trade establishments buy and sell end-use products and services, the final step in the distribution of merchandise to consumers; they may also sell repair and installation services to households, businesses, and institutions such as schools and hospitals. Wholesale trade establishments buy and sell merchandise to other businesses, such as retailers. Transportation establishments (comprised of both transportation and warehousing establishments) provide transportation services, such as delivering parcels, hauling bulk cargo, and transporting passengers by planes, trains, ships, trucks, and buses. Utilities establishments generate and transmit electric power, provide natural gas services, treat and distribute potable water, and treat and dispose of sewage.

This issue of BEYOND the NUMBERS takes a look at wages and employee benefits (nonwage compensation that supports the well-being of workers and their families) for workers in the trade, transportation, and utilities industries. The benefits reviewed in this issue are: paid leave (coverage of one or more of paid holidays, paid vacation, paid sick leave, and paid personal leave); insurance (healthcare, life, and disability), and retirement and savings (defined contribution and defined benefit). The data presented are the annual rate of change in total employer compensation costs (wages plus benefits); the employer costs per hour for total compensation; and the rate of employee access to paid leave, healthcare, and retirement benefits.

Employer cost estimates are from the Employment Cost Index (ECI), December 2012, available online at https://www.bls.gov/news.release/archives/eci_01312013.pdf, and Employer Costs for Employee Compensation (ECEC), December 2012, available online at https://www.bls.gov/news.release/archives/ecec_03122013.pdf. Estimates of benefits access rates are from the BLS publication, National Compensation Survey: Employee Benefits in the United States, March 2012, available online at www.bls.gov/ncs/ebs/benefits/2012.2

The ECI is a leading U.S. economic indicator used by the Federal Reserve Board for fiscal policy decisions, and by many private industry organizations for compensation escalation; it measures quarterly and annual percent changes in total compensation costs as well as the cost changes for the various components of total compensation.

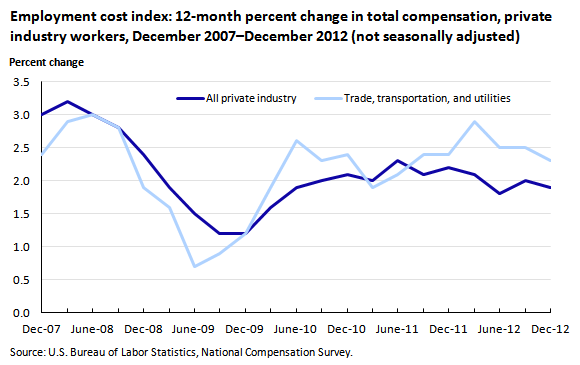

The ECI data indicates that the increase in total compensation in the 5 years ending in December 2012 for trade, transportation, and utilities industry workers was 10.6 percent, compared with an increase of 10.3 percent for all private industry workers.3 And in December 2012, total compensation costs increased at an annual rate of 2.3 percent for trade, transportation, and utilities workers, compared with the 1.9 percent annual rate for all private industry workers. (See chart 1.)

| Month | All private industry | Trade, transportation, and utilities |

|---|---|---|

Dec 2007 | 3.0 | 2.4 |

Mar 2008 | 3.2 | 2.9 |

Jun 2008 | 3.0 | 3.0 |

Sep 2008 | 2.8 | 2.8 |

Dec 2008 | 2.4 | 1.9 |

Mar 2009 | 1.9 | 1.6 |

Jun 2009 | 1.5 | 0.7 |

Sep 2009 | 1.2 | 0.9 |

Dec 2009 | 1.2 | 1.2 |

Mar 2010 | 1.6 | 1.9 |

Jun 2010 | 1.9 | 2.6 |

Sep 2010 | 2.0 | 2.3 |

Dec 2010 | 2.1 | 2.4 |

Mar 2011 | 2.0 | 1.9 |

Jun 2011 | 2.3 | 2.1 |

Sep 2011 | 2.1 | 2.4 |

Dec 2011 | 2.2 | 2.4 |

Mar 2012 | 2.1 | 2.9 |

Jun 2012 | 1.8 | 2.5 |

Sep 2012 | 2.0 | 2.5 |

Dec 2012 | 1.9 | 2.3 |

The ECEC shows employer costs per hour worked quarterly for the various components of compensation, as well as the percent of total compensation that each component makes up. Private industry compensation costs for trade, transportation, and utilities workers averaged $24.31 per hour worked in December 2012. Wages and salaries averaged $17.12 per hour and benefits averaged $7.19. (See table 1.)

| Industry group | Total compensation cost (1) | Wages and salaries cost | Benefits cost | Paid leave (2) | Insurance (3) | Retirement and savings (4) | |||

|---|---|---|---|---|---|---|---|---|---|

| Cost | Percent | Cost | Percent | Cost | Percent | ||||

| All workers | $28.89 | $20.32 | $8.57 | $1.98 | 6.9 | $2.36 | 8.2 | $1.04 | 3.6 |

| Trade, transportation, and utilities | 24.31 | 17.12 | 7.19 | 1.45 | 6.0 | 2.18 | 9.0 | 0.86 | 3.5 |

| Retail trade | 17.64 | 13.22 | 4.42 | 0.79 | 4.5 | 1.38 | 7.8 | 0.37 | 2.1 |

| Wholesale trade | 31.45 | 22.13 | 9.31 | 2.19 | 7.0 | 2.64 | 8.4 | 0.97 | 3.1 |

| Transportation and warehousing | 35.06 | 22.64 | 12.41 | 2.45 | 7.0 | 4.04 | 11.5 | 1.73 | 4.9 |

| Utilities | 59.26 | 35.79 | 23.47 | 5.06 | 8.5 | 5.49 | 9.3 | 6.66 | 11.2 |

| Footnotes: | |||||||||

| Source: U.S. Bureau of Labor Statistics, National Compensation Survey. | |||||||||

Employer compensation costs for trade, transportation, and utilities workers vary by industry. Costs fluctuate for a number of reasons such as part-time and full-time status, job skills, and union representation. BLS data indicate that about 30 percent of wholesale and retail trade workers have part-time status, compared to 16 percent of transportation and utilities workers.4 In addition, jobs often found in retail trade industries generally require fewer skills and less training than jobs in utilities industries; and workers in retail trade industries are less likely than utilities industry employees to have union representation.5 In December 2012, total compensation costs per employee hour worked ranged from $17.64 for workers in retail trade industries to $59.26 for workers in utilities industries. The average cost for paid leave benefits in retail trade industries was $0.79 per employee hour worked, 4.5 percent of total compensation; for utilities industries the cost was $5.06 per hour, 8.5 percent of total compensation. In December 2012, the average cost for healthcare, life, and disability insurance in wholesale trade industries was $2.64 per employee hour worked, 8.4 percent of total compensation. The employer cost for insurance in transportation and warehousing industries was significantly higher at $4.04 per employee hour worked, 11.5 percent of total compensation. (See table 1.)

Employer retirement costs per hour worked varied significantly by industry. In December 2012, retirement and savings costs per hour worked were significantly higher for transportation and warehousing and utilities workers, compared with those costs for retail and wholesale trade workers.

Employee Benefits in the United States is an annual publication that provides information on the percent of workers with access to and participation in employer-provided employee benefits.

In March 2012, 68 percent of workers in retail trade industries, compared with 88 percent of workers in wholesale trade industries had access to paid vacations. Less than half of retail trade workers participated in healthcare plans, compared with 90 percent of utilities workers who participated in such plans. In that same period, 41 percent of all workers participated in employer-sponsored defined contribution retirement plans, and 17 percent participated in defined benefit plans. For transportation and warehousing industry workers, however, 37 percent participated in defined contribution plans and 32 percent participated in defined benefit plans. (See table 2.)

| Industry group | Paid holidays | Paid vacations | Paid sick leave | Paid personal leave | Healthcare (1) | Defined contribution retirement | Defined benefit retirement | |||

|---|---|---|---|---|---|---|---|---|---|---|

| Access | Access | Participation | Access | Participation | Access | Participation | ||||

| All workers | 77 | 77 | 61 | 37 | 70 | 55 | 59 | 41 | 19 | 17 |

| Trade, transportation, and utilities | 78 | 76 | 59 | 35 | 71 | 54 | 65 | 39 | 19 | 16 |

| Retail trade | 72 | 68 | 49 | 32 | 63 | 44 | 59 | 35 | 14 | 9 |

| Wholesale trade | 90 | 88 | 75 | 34 | 84 | 69 | 67 | 48 | 15 | 15 |

| Transportation and warehousing | 82 | 84 | 71 | 42 | 83 | 68 | 51 | 37 | 34 | 32 |

| Utilities | 98 | 98 | 93 | 61 | 97 | 90 | 92 | 79 | 84 | 81 |

| Footnotes: | ||||||||||

| Note: Workers that have access to paid leave benefits are considered to be participating in those benefits. | ||||||||||

This BEYOND the NUMBERS was prepared by Eli R. Stoltzfus, an economist, in the Office of Field Operations, Washington, DC. Email: NCSInfo@bls.gov. For more benefits information, see www.bls.gov/ebs. For additional assistance, contact one of our information offices: National-Washington, DC: (202) 691-6199, TDD (800) 877-8339; Atlanta (404) 893-4222; Boston: (617) 565-2327; Chicago: (312) 353-1880; Dallas: (972) 850-4800; Kansas City: (816) 285-7000; New York: (646) 264-3600; Philadelphia: (215) 597-3282; San Francisco: (415) 625-2270.

Information in this article will be made available to sensory-impaired individuals upon request. Voice phone: (202) 691-5200. Federal Relay Service: 1 (800) 877-8339. This article is in the public domain and may be reproduced without permission.

Eli R. Stoltzfus, “Compensation highlights in trade, transportation, and utilities industries ,” Beyond the Numbers: Pay & Benefits, vol. 2 / no. 15 (U.S. Bureau of Labor Statistics, May 2013), https://www.bls.gov/opub/btn/volume-2/compensation-highlights-in-trade-transportation-and-utilities-industries.htm

1 U.S. Bureau of Labor Statistics, Current Employment Statistics, Top Picks for employment levels in the trade, transportation, and utilities industries, seasonally adjusted, September 2012, https://www.bls.gov/ces/#data.

Industries are classified using the North American Industry Classification System (NAICS). NAICS is an industry classification system that groups establishments into industries based on the products or services produced by the establishments. Industries are classified into 20 two-digit sectors. Trade, transportation, and utilities industries include sectors 22, 42, 44, 45, 48, and 49. See North American Industry Classification, United States, 2012 (Executive Office of the President, Office of Management and Budget). The BLS NAICS page can be accessed at https://www.bls.gov/bls/naics.htm.

2 U.S. Bureau of Labor Statistics, National Compensation Survey, https://www.bls.gov/ncs/

3 U.S. Bureau of Labor Statistics, Employment Cost Index, Historical Listing–Volume 3, Table 5, https://www.bls.gov/web/eci/echistrynaics.pdf.

4 U.S. Bureau of Labor Statistics, Current Population Survey (CPS)–Labor force characteristics, hours of work, https://www.bls.gov/cps/cpsaat21.pdf. (Note: CPS hours of work estimates are not intended for comparison to other statistical series to measure employment trends or levels.)

Access. Employees are considered to have access to a benefit plan if it is available for their use. For example, if an employee is permitted to participate in a health plan offered by the employer, he or she is placed in a category with those having access to a health plan, regardless of whether the employee chooses to participate.

Participation. Participation is the percentage of employees who actually enroll in a benefit plan. A plan may be a contributory plan that requires employees to contribute to the plan’s cost in order to participate, or it may be a noncontributory plan for which the employer pays 100 percent of the cost of the benefit.

Defined benefit plan. A defined benefit retirement plan provides employees with guaranteed retirement benefits that are based on a benefit formula. A participant’s retirement age, length of service, and pre-retirement earnings may affect the benefit received.

Defined contribution plan. A defined contribution retirement plan specifies the level of employer contributions and places those contributions into individual employee accounts. Retirement benefits are based on the level of funds in the account at the time of retirement.

Publish Date: Thursday, May 16, 2013